US Medical Billing Outsourcing Market Size, Share, Trends, Industry Analysis Report: By Component, Services, and End Use (Hospitals, Physician Offices, and Others) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5505

- Base Year: 2024

- Historical Data: 2020-2023

US Medical Billing Outsourcing Market Overview

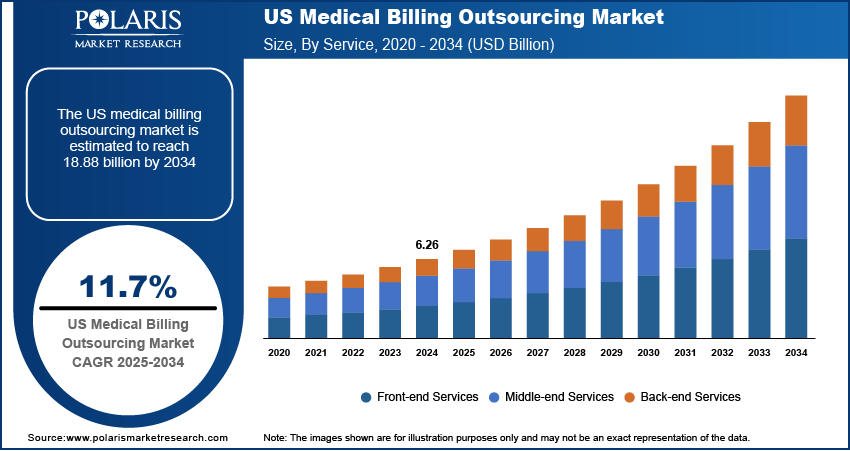

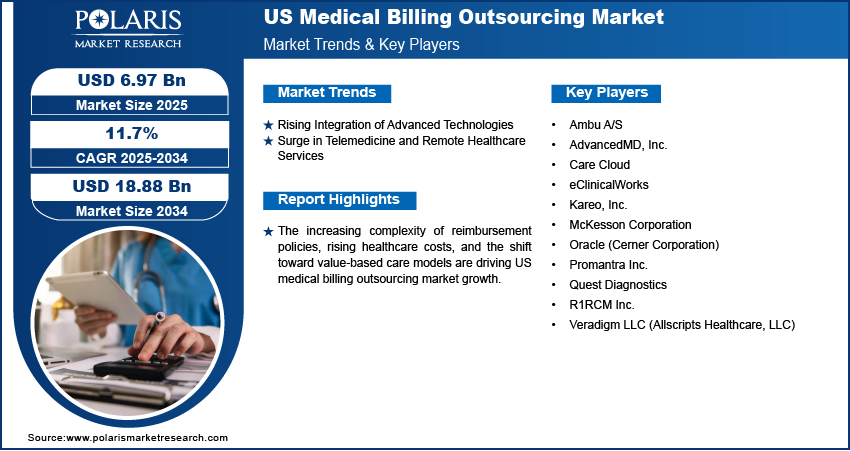

The US medical billing outsourcing market size was valued at USD 6.26 billion in 2024. The market is expected to grow from USD 6.97 billion in 2025 to USD 18.88 billion by 2034, exhibiting a CAGR of 11.7% during 2025–2034.

The US medical billing outsourcing market encompasses third-party services that manage healthcare providers' revenue cycle processes, including claims processing, coding, invoicing, and compliance management. Outsourcing medical billing services enables hospitals, clinics, and physician groups to enhance operational efficiency, reduce administrative burdens, and ensure regulatory compliance. The increasing complexity of reimbursement policies, rising healthcare costs, and the shift toward value-based care models are driving US medical billing outsourcing market growth.

To Understand More About this Research: Request a Free Sample Report

Stringent regulatory frameworks such as the Health Insurance Portability and Accountability Act (HIPAA) and the Affordable Care Act (ACA) are increasing US medical billing outsourcing market demand, compelling healthcare providers to adopt specialized outsourcing solutions to mitigate compliance risks. Moreover, the ongoing digital transformation in healthcare, alongside the rising adoption of electronic health records (EHRs) and cloud-based revenue cycle management (RCM) platforms, is creating substantial US medical billing outsourcing market opportunities for service providers offering end-to-end billing solutions.

US Medical Billing Outsourcing Market Dynamics

Rising Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI), robotic process automation (RPA), and cloud-based platforms is significantly transforming US medical billing outsourcing market dynamics. For instance, the Centers for Medicare & Medicaid Services (CMS) has been promoting the adoption of advanced technologies to improve healthcare operations, as highlighted in their guidelines on telemedicine and technology integration. AI-driven solutions enable real-time claims tracking and predictive analytics, enhancing revenue optimization and reducing claim denials. RPA automates repetitive tasks like data entry and coding, minimizing human errors and increasing operational efficiency. Cloud-based platforms facilitate seamless access to billing data, supporting scalability and interoperability among healthcare providers. These technological advancements are driving market growth by streamlining billing processes and improving financial outcomes for healthcare organizations.

Surge in Telemedicine and Remote Healthcare Services

The surge in telemedicine and remote healthcare services is reshaping US medical billing outsourcing market landscape, creating a demand for specialized billing solutions for virtual consultations. For instance, according to the Centers for Disease Control and Prevention, 37.0% of adults used telemedicine in the past 12 months in 2021. The COVID-19 pandemic accelerated the adoption of telehealth, leading to increased demand for billing services that accommodate remote care models. Healthcare providers are seeking scalable and cost-effective billing solutions to manage the complexities associated with telemedicine reimbursement. This shift is boosting market growth as outsourcing firms adapt to the evolving needs of virtual healthcare delivery.

US Medical Billing Outsourcing Market Segment Insights

US Medical Billing Outsourcing Market Assessment by Component Outlook

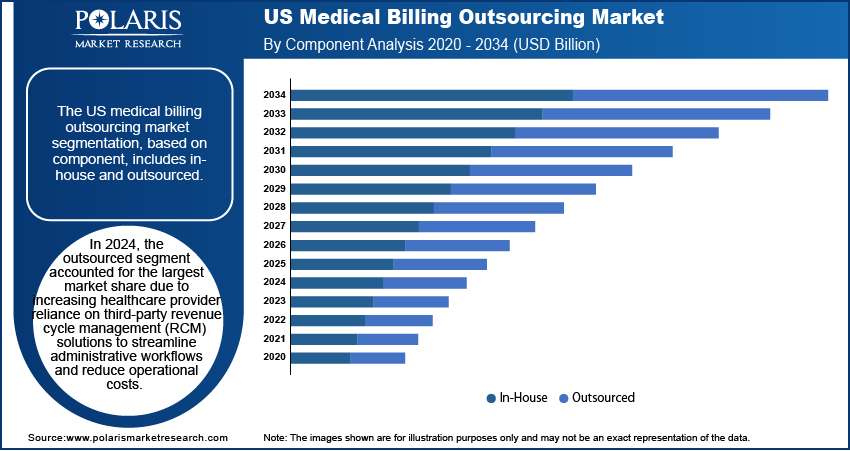

The US medical billing outsourcing market segmentation, based on component, includes in-house and outsourced. In 2024, the outsourced segment accounted for the largest market share due to the increasing reliance of healthcare providers on third-party revenue cycle management (RCM) solutions to streamline administrative workflows and reduce operational costs. Growing complexities in medical coding, insurance verification, and regulatory compliance are fueling demand for outsourced services, as providers seek expertise in handling evolving reimbursement models and minimizing claim denials. Technological advancements, such as AI-driven automation, cloud-based RCM platforms, and predictive analytics, further contribute to the segment’s leading position by enabling improved efficiency, real-time claims tracking, and enhanced financial performance across healthcare organizations.

US Medical Billing Outsourcing Market Evaluation by Services Outlook

The US medical billing outsourcing market segmentation, based on services, includes front-end services, middle-end services, and back-end services. In 2024, the front-end services segment accounted for the largest market share due to the increasing focus on patient registration, insurance verification, and pre-authorization processes to minimize claim denials. In addition, strategic alliances between companies are placing growing emphasis on front-end services in medical billing outsourcing to address critical challenges in prior authorization and revenue cycle management. By integrating advanced automation and data-driven solutions, these collaborations enhance claims processing efficiency, reduce administrative burdens, and accelerate reimbursement timelines. For instance, in February 2025, Careviso and XiFin formed a strategic partnership to enhance prior authorization and optimize revenue cycle management. This collaboration aims to expedite reimbursement processes and improve patient access by leveraging technology and data analytics to streamline workflows and reduce administrative burdens. The automation of eligibility verification and digital patient engagement tools are further contributing to the segment’s leading position by improving patient financial interactions and reducing administrative burdens. The emphasis on real-time claims processing and proactive revenue cycle management is boosting demand for front-end services, positioning them as a critical component in the medical billing ecosystem.

US Medical Billing Outsourcing Market Evaluation by End Use Outlook

The US medical billing outsourcing market segmentation, based on end use, includes hospitals, physician offices, and others. In 2024, the hospitals segment accounted for the largest market share due to the increasing complexity of billing procedures, high patient volumes, and regulatory compliance requirements. Large healthcare institutions are outsourcing billing operations to optimize revenue cycles, reduce administrative burdens, and ensure accurate claims processing. The adoption of AI-driven revenue cycle management platforms and cloud-based billing solutions enhances financial performance and operational efficiency. The rising need for end-to-end billing solutions, including coding, claims management, and denial resolution, is reinforcing the segment’s dominance and driving continued investment in outsourced hospital billing services.

US Medical Billing Outsourcing Market – Key Players and Competitive Insights

The competitive landscape features leaders and regional players competing for US medical billing outsourcing market share through technological innovation, strategic partnerships, and regional expansion. The players leverage advanced R&D capabilities, AI-driven automation, and regulatory compliance to deliver high-performance medical billing solutions, meeting the growing market demand for cloud-based platforms, predictive analytics, and end-to-end revenue cycle management. Market trends indicate a surge in AI-powered claim processing, robotic process automation (RPA), and blockchain-driven security frameworks driven by the increasing complexity of reimbursement models, value-based care adoption, and stringent compliance requirements. Strategic investments, mergers and acquisitions, and joint ventures remain crucial for market expansion, enabling firms to enhance competitive positioning and broaden service offerings. Post-merger integration and partnership ecosystems are key to unlocking market opportunities and addressing evolving healthcare financial management needs.

Regional companies focus on cost-effective and HIPAA-compliant billing solutions, leveraging localized healthcare policies and increasing adoption of outsourced revenue cycle management to cater to industry-specific demands. Competitive benchmarking involves market entry strategies, technological advancements, and regulatory landscape assessments to align with the evolving US healthcare ecosystem. The market is witnessing technological advancements such as AI-integrated denial management, cloud-based interoperability, and real-time analytics-driven billing workflows, reshaping healthcare financial operations and reimbursement efficiency. Companies are investing in automation-driven billing processes, cybersecurity enhancements, and scalable IT infrastructure to align with market growth, industry trends, and evolving payer-provider relationships. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying scalability opportunities and long-term profitability.

Oracle Corporation provides products and services that address enterprise information technology environments globally. Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain, as well as manufacturing management, enterprise resource planning (ERP), Oracle Advertising, NetSuite applications suite, Oracle Fusion cloud human capital management, and Oracle Fusion Sales, Service, and Marketing, are few of the cloud software programs included in the company's Oracle software as a service. It also provides licensed cloud-based business infrastructure solutions, middleware (which contains tools for development and other purposes), and enterprise databases like Oracle and Java. Also, the company provides Generative AI powered by state-of-the-art LLMs from Cohere, ensuring unparalleled data security, trusted performance, and versatile deployment options for text generation. Oracle's four main business divisions – cloud, license, hardware, and services – provide its database management systems and cloud-engineering services and solutions. In addition, the company also offers cloud-based industrial solutions for numerous industries, support services for Oracle licenses, and licenses for Oracle application software. Oracle offers cloud-based medical billing outsourcing solutions with AI-driven automation, revenue cycle management, compliance, and analytics for healthcare providers.

Quest Diagnostics company is a specialty genetics and bioinformatics company focused on providing genetic testing for inherited diseases. The company is based in Helsinki and Seattle, with a customer base spanning over 70 countries. Quest Diagnostics offers advanced technology and comprehensive support across 14 medical specialties. As a diagnostic services provider, the company is actively engaged in medical billing outsourcing to enhance revenue cycle efficiency and streamline claims management. By leveraging advanced billing solutions and automation, Quest Diagnostics optimizes reimbursement processes, reduces denials, and strengthens financial performance.

List of Key Companies in US Medical Billing Outsourcing Market

- AdvancedMD, Inc.

- Care Cloud

- eClinicalWorks

- Kareo, Inc.

- McKesson Corporation

- Oracle (Cerner Corporation)

- Promantra Inc.

- Quest Diagnostics

- R1RCM Inc.

- Veradigm LLC (Allscripts Healthcare, LLC)

US Medical Billing Outsourcing Industry Developments

In February 2025, Athelas, in collaboration with Commure, partnered with Resilient Healthcare Corp to launch a pilot program aimed at transforming outpatient care and streamlining hospital billing processes.

In May 2024, SmarterDx raised USD 50 million in Series B funding led by Transformation Capital, with continued support from Bessemer Venture Partners, Flare Capital Partners, and Floodgate Fund. This funding, totaling USD 71 million to date, is aimed at driving product innovation and supporting the company's expansion efforts.

In March 2022, Connecticut Children’s became the first pediatric hospital in the state to utilize Nym’s automated coding technology for medical billing. This initiative aims to enhance patient care workflows and improve the overall patient experience by streamlining billing processes, reducing administrative burdens, and increasing coding accuracy.

US Medical Billing Outsourcing Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- In-House

- Outsourced

By Services Outlook (Revenue, USD Billion, 2020–2034)

- Front-End Services

- Middle-End Services

- Back-End Services

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Physician Offices

- Others

US Medical Billing Outsourcing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.26 billion |

|

Market Size Value in 2025 |

USD 6.97 billion |

|

Revenue Forecast by 2034 |

USD 18.88 billion |

|

CAGR |

11.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The US medical billing outsourcing market size was valued at USD 6.26 billion in 2024 and is projected to grow to USD 18.88 billion by 2034.

The market is projected to register a CAGR of 11.7% during the forecast period.

Some of the key players in the market are AdvancedMD, Inc.; Care Cloud; eClinicalWorks; Kareo, Inc.; McKesson Corporation; Oracle (Cerner Corporation); Promantra Inc.; Quest Diagnostics; R1RCM Inc.; and Veradigm LLC (Allscripts Healthcare, LLC).

In 2024, the outsourced segment accounted for the largest market share due to increasing healthcare provider reliance on third-party revenue cycle management (RCM) solutions to streamline administrative workflows and reduce operational costs.

In 2024, the front-end services segment accounted for the largest market share due to the increasing focus on patient registration, insurance verification, and pre-authorization processes to minimize claim denials.