U.S. Immunoassay Market Size, Share, Trends, Industry Analysis Report, By Product (Reagents & Kits, Analyzers/Instruments, Software & Services); By Technology; By Specimen; By Application; By End User; By Country, Segment Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 117

- Format: PDF

- Report ID: PM5006

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

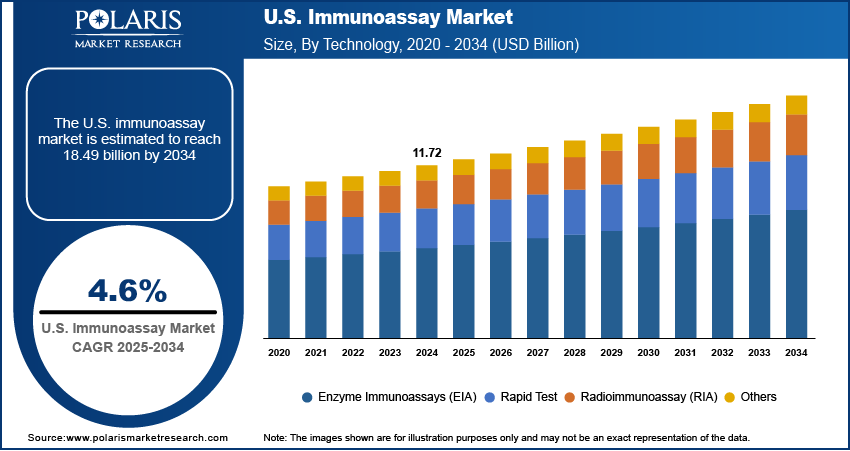

U.S. immunoassay market size was valued at USD 10.27 billion in 2023. The U.S. immunoassay industry is anticipated to grow from USD 10.44 billion in 2024 to USD 12.53 billion by 2032, exhibiting a CAGR of 2.3% during the forecast period.

U.S. Immunoassay Market Overview

Immunoassay refers to encompassing diagnostic techniques that utilize antibodies or antigens for detecting specific substances, including proteins, hormones, and drugs, in biological samples. It plays a crucial role in clinical diagnostics and pharmaceutical research, supporting disease diagnosis and monitoring. The growing old age population, emergence of chronic lifestyle diseases, and advancements in immunoassay techniques are prime factors propelling the U.S. immunoassay market forward. Furthermore, ongoing product innovations by the major companies are expected to stimulate the development of advanced and highly performing immunoassays in the United States. For instance, in July 2023, Siemens Healthineers, a healthcare company, introduced the Atellica CI Analyser for immunoassay testing and clinical chemistry after receiving approval from the US FDA.

To Understand More About this Research: Request a Free Sample Report

Moreover, the rising strategic planning by key market players to expand their product portfolio and fuel the manufacturing activities of new immunoassays is positively influencing the U.S. immunoassays market. For instance, in January 2024, Roche Holding acquired LumiraDx’s point of care (POC) technology for USD 295 million, along with the funding of USD 55 million within the deal closure duration (mid-2024). This is expected to expand Roche’s immunoassay development capacity, leading to the expansion of its product offering globally.

Growth Drivers

The Rising Prevalence of Chronic Health Conditions

The rising prevalence of neurological disorders, particularly Alzheimer's, in the U.S. is encouraging researchers to develop high-performing biomarkers to save millions of people through early detection and treatment options. As per a 2023 study published by the Alzheimer's Association, around 6.7 million people in the United States were living with Alzheimer's in 2023, and that number is expected to reach 13.8 million by 2060. The growing incidence of Alzheimer's is fostering investment from major players in the U.S. for the development of immunoassays. For instance, in June 2024, Roche Holding signed a license agreement with ALZpath, a California-based biotechnological firm, to utilize its antibody pTau217 for the development of blood tests to identify Alzheimer's disease.

Increasing Healthcare Expenditure in the United States

The growing working population, followed by increasing spending on health, is expected to create a favorable environment for the U.S. immunoassays market. According to the American Medical Association, U.S. healthcare expenditure grew by 4.1% in 2022 to USD 13,493 per capita. As per the national health projections published in Health Affairs in June 2023, yearly U.S. healthcare spending is projected to reach USD 7.2 trillion by 2031. This will certainly increase the affordability of diagnostic immunoassays, encouraging firms to expand their production capacity.

The growing demand for accurate, consistent, and reliable immunoassays, driven by rising measures taken by healthcare providers to utilize time and resources effectively, is expected to stimulate the market growth in the long run. For instance, in October 2023, Proteintech, an Illinois-based company, announced the launch of its new antibody, Multi-rAb Recombinant Secondary Antibodies, to provide target-oriented & reproducible immunoassays. These product innovations are expected to drive market expansion in the coming years.

Restraining Factors

High Costs of Investment are Likely to Impede Market Growth

The higher cost of investment in research and development activities and the limited availability of experienced professionals in immunoassays are likely to hamper market growth over the forecast period. The complex production procedures and stringent drug safety regulations are expected to restrict new entrants in the U.S. immunoassays market.

Report Segmentation

The U.S. immunoassay market is primarily segmented based on product, technology, specimen, application, and end user.

|

By Product |

By Technology |

By Specimen |

By Application |

By End User |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Reagents & Kits Segment is Expected to Witness the Highest Growth During the Forecast Period

The reagents & kits segment will grow rapidly during the forecast period, owing to its high usage in healthcare settings. The growing demand for point-of-care testing and the rising accessibility of ready-to-use immunoassay kits is driving the segment growth in U.S. immunoassay market. Additionally, enzyme-linked immunosorbent assay reagents and kits are used to identify and quantify the antibody presence among the individuals, along with the estimation of the level of tumor markers. According to the National Survey on Drug Use, over 25% of people in the U.S. aged 12 or older admitted to use illicit drugs in 2022. This is largely attributable to the ability to detect drug-based chemical compounds, such as cocaine and amphetamine, among individuals, which requires the use of immunoassay techniques for detection.

By Technology Analysis

Enzyme Immunoassays (EIA) Segment Accounted for the Largest Market Share in 2023

Enzyme immunoassays (EIA) segment held the largest market share in 2023. This is due to its effectiveness in evaluating disease presence, assistance in treatment procedures, and its long-lasting shelf life. The affordability, the need for a smaller sample, and the ability to give results in a shorter span of time are projected to drive the adoption of enzyme immunoassay technology over the coming years. Additionally, enzyme immunoassays are widely recognized for analyzing disease outbreaks, mainly cholera, influenza, and HIV, by monitoring the presence of infectious antigens in body fluids.

By Specimen Analysis

Blood Segment Held a Significant Market Revenue Share in 2023

The blood segment held the largest market share in 2023, primarily due to the increased availability of blood-based specimens for several disease diagnoses. For instance, in December 2023, Savara announced the launch of a non-invasive immunoassay, aPAP ClearPath blood test, to detect autoimmune lung disease. It was developed in collaboration with the Trillium Health. A significant number of hospitals and laboratories are expected to adopt blood-based immunoassay tests, driven by a growing number of firms developing blood-based immunoassays due to their convenience and effectiveness in accurately detecting disease prevalence.

Regional Insights

California Registered the Largest Share of the Market in 2023

California held the dominant share of the market in 2023. This dominance is attributed to growing awareness of early diagnosis of diseases among its citizens, high medical insurance penetration, and state-sponsored medical insurance for the underserved population. According to the Summary Report 2024 published by the California Department of Public Health, ischemic heart disease caused the most deaths in California, accounting for 37,445 in 2022, while 29,819 were due to Alzheimer's disease. By 2040, around 1.6 million adults in California, which is a 127% rise, are projected to live with Alzheimer's disease.

Massachusetts is expected to be the fastest-growing state with a healthy CAGR during the projected period, owing to the rising prevalence of chronic health problems. For instance, according to the Massachusetts government, around 56% of the deaths in the region are attributable to chronic diseases, including cancer, stroke, diabetes, and cardiovascular diseases. This is driving the need for effective biomarkers in the region, making companies invest in immunoassay research activities.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The U.S. immunoassay market is moderately fragmented. Key players are increasing their investments in R&D activities, along with strategic expansion initiatives such as partnerships and acquisitions, to expand their manufacturing capacity and brand outreach. For instance, in April 2023, DYNEX Technologies joined forces with Tecan to promote the availability of ELISA immunoassays in the United States.

Some of the major players operating in the market include

- Abbott

- Agilent Technologies

- Becton, Dickinson, and Company

- Beckman Coulter

- Bio-Rad Laboratories, Inc.

- DiaSorin S.p.A.

- Ortho Clinical Diagnostics

- Quidel Corporation

- Sysmex America, Inc

- Thermo Fisher Scientific, Inc.

Recent Developments in the Industry

- In March 2024, Beckman Coulter, a California-based biotechnological company, announced the expansion of its partnership with Fujirebio to design neuro-degenerative disease diagnoses.

- In November 2023, Spear Bio, a Massachusetts-based biotechnology firm, announced that it had raised around USD 10 million with Seed Prime. The funding is expected to be used in designing cutting-edge ultra-sensitive proteomics & immuno-diagnostics platforms.

- In July 2023, Versea Ophthalmics announced the launch of its T-POC Total IgE Immunoassay Kit for the diagnosis of ocular surface health problems. This tear-based test has been designed & developed in partnership with the California-based company Axim Biotechnologies.

Report Coverage

The U.S. immunoassay market report emphasizes on key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, technology, specimen, application, end user, and their futuristic growth opportunities.

U.S. Immunoassay Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.44 billion |

|

Revenue Forecast in 2032 |

USD 12.53 billion |

|

CAGR |

2.3% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Competitive Landscape |

U.S. Immunoassay Market Share Analysis (2023) Company profiles/industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

FAQ's

The global U.S. immunoassay market size was valued at USD 10.27 billion in 2023 and is projected to grow to USD 12.53 billion by 2032.

The global market is projected to grow at a CAGR of 2.3% during the forecast period, 2024-2032.

California had the largest share of the global market

The key players in the market are Abbott (U.S.), Agilent Technologies (U.S.), Becton, Dickinson, and Company (U.S.), Beckman Coulter (U.S.), Bio-Rad Laboratories, Inc. (U.S.), DiaSorin S.p.A. (Italy), Ortho Clinical Diagnostics (U.S.), Quidel Corporation (U.S.), Sysmex America, Inc (U.S.), and Thermo Fisher Scientific, Inc. (U.S.).

The reagents & kits segment category held the highest share in the market in 2023.

The enzyme immunoassays (EIA) segment held the highest revenue share in the market in 2023.