U.S. Hearing Aid Dispensers Market Share, Size, Trends, Industry Analysis Report, By Product (Hearing Devices, Hearing Implants); By Patient Type (Adult, Pediatric); By Ownership; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 114

- Format: PDF

- Report ID: PM4892

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

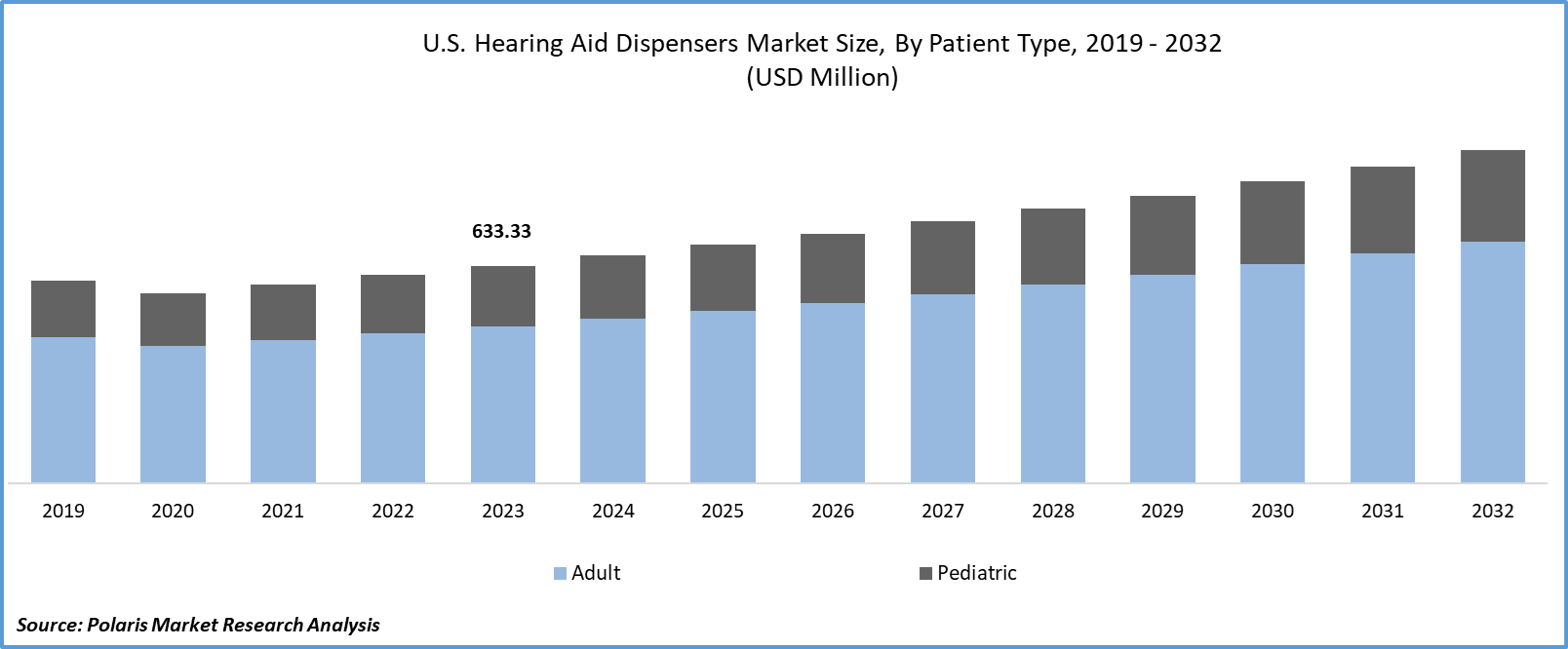

U.S. Hearing Aid Dispensers Market size was valued at USD 633.33 million in 2023. The market is anticipated to grow from USD 662.78 million in 2024 to USD 969.93 million by 2032, exhibiting the CAGR of 4.9% during the forecast period.

Market Overview

The increasing prevalence of the number of people witnessing hearing loss health conditions is creating a significant need for hearing aid tools in the United States. This is boosting the demand for hearing aid dispensers. The significant surge in job opportunities in the healthcare domain is likely to drive U.S. hearing aid dispensers market expansion in the long run. According to the Bureau of Labor Statistics, around 2.4 million jobs are expected to be created in the healthcare industry between 2019 and 2029.

The growing expansion activities of the major players are facilitating new growth potential for hearing aid dispensers in the region.

To Understand More About this Research:Request a Free Sample Report

- For instance, in May 2023, MLM Hearing, acquired 60 Belton Shops to expand its hearing aid offerings in the United States.

Moreover, as per the data published by the National Institute on Deafness and Other Communication Diseases, around 2- 3 children in the U.S. are suffering with hearing loss condition in 1 or both ears. Rising government policies to support hearing aid will also boost growth. For instance, in October 2022, the U.S. FDA approved the offering of hearing aids through OTC platforms to benefit around 30 Mn people across US.

Moreover, rising government policies to support hearing aid adoption will boost market growth. For instance, in October 2022, the U.S. Food and Drug Administration (FDA) approved the offering of hearing aids through over-the-counter platforms to benefit around 30 million people in the US.

Growth Drivers

Rising noise-induced hearing loss cases

Rising cases of hearing problems will facilitate a huge demand for the hearing aids, as this is posing a risk of hearing loss issues in the younger generation. As per the American Academy of Audiology, around 40 Mn adults in the U.S. are estimated to suffer with hearing loss due to the loud noise exposure. This will boost demand and the production of the hearing aid dispensers in the next few years.

Moreover, awareness about hearing aid instruments & branding initiatives will facilitate new growth opportunities. For instance, in November 2023, a hearing aid manufacturer, GN, and a US-based hearing wellness promoter, Soundly, announced the introduction of a new digital art campaign to enhance knowledge about hearing loss and health among the public.

Increasing research activities to provide effective hearing aids

The growing investments in research and development activities by the companies with a view to design adaptable and user-friendly hearing aid dispensers are fueling the availability of hearing aid tools in the United States. For instance, in August 2023, Akoio, a US-based company, announced the introduction of a newly patented hearing aid battery dispenser to its product offering.

Moreover, a 2023 study published in Lancet unveiled the potential of hearing aids in reducing the risk of attaining dementia by 50% among the hearing loss of untreated elderly adults. As more researchers work on the health benefits of having hearing aids, there will be a huge demand for hearing aid dispensers.

Restraining Factors

Lower number of insurance companies providing hearing aid tools

The limited knowledge about the hearing aid instruments functionality and benefits are significantly restricting their use in the region, consequently lowers the need for hearing aid dispensers. Additionally, the lower accessibility to the elderly population, driven by a lesser number of government and private insurance plans offering treatment coverage to the hearing tools, is expected to hamper the hearing aid dispensers’ market in the United States.

Report Segmentation

The market is primarily segmented based on product, patient type, ownership

|

By Product |

By Patient Type |

By Ownership |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

Hearing aid devices segment is expected to witness the highest growth during the forecast period

The hearing aid devices segment is projected to grow at a CAGR during the study period. This is attributable to the increasing demand for non-invasive treatment options among the population. The ease of use and affordability associated with the hearing devices application compared to the hearing implants are some of the significant factors contributing to their higher rate of adoption.

The hearing implants segment led the market with a substantial revenue share in 2023. This is driven by its potential to offer convenience by lowering the need for additional tests, visits, and hearing aid instruments for the patients. The significant rise in the number of people opting for permanent treatment options will further boost the hearing aid implants in the United States.

By Patient Type Analysis

Adult segment accounted for the largest market share in 2023

The adult segment accounted for the largest share. The rising cases of noise-induced hearing problems are positively impacting the demand for hearing aid dispensers in the marketplace. Furthermore, with the higher risk of hearing aid problems among the older adults, there will be a significant demand for hearing aid dispensers among adults.

By Ownership Analysis

Retail chains segment held the significant market revenue share in 2023

The retail chains segment held substantial share, due to the continuous rise in the efforts taken by the retail channels to enhance their coverage of a wider population base. For instance, in November 2023, InnerScope Hearing Technologies introduced iHEAR Matrix OTC in the 4218 Walmart stores. These developments are likely to drive market growth during the forecast period.

By Distribution Channel Analysis

Over-the-counter segment is anticipated to witness significant growth

The over-the-counter segment is likely to register significant growth in the study period. This is driven by the increasing number of companies offering over-the-counter options with government approval. The increase in accessibility to healthcare products, specifically hearing aid tools, is fueling the adoption of hearing aids along with the hearing aid dispensers in the United States.

Key Market Players & Competitive Insights

Product innovations to drive the competition

The U.S. hearing aid dispensers market is a mix of fragmentation and consolidation. The increasing concerns about designing new hearing aid tools and market expansion initiatives, mainly partnerships, collaborations, and acquisitions, are contributing to the hearing aid dispensers market consolidation in the United States. For instance, in December 2023, HearUSA launched a new hearing center in Huntington Beach, California.

Some of the major players operating in the global market include:

- Audio Hearing Aid Service, LLC (US)

- Costco Wholesale Corporation (US)

- Echo Hearing Center (US)

- Elite Hearing Centers of America (US)

- Family Hearing Center (US)

- Hearing Unlimited (US)

- HearUSA (US)

- Independent Hearing Services (US)

- LUCID HEARING HOLDING COMPANY, LLC (US)

- Miracle-Ear (US)

- SoundPoint Hearing Centers (US)

Recent Developments in the Industry

- In December 2023, Advanced Bionics announced the expansion of its cochlear implant technology portfolio with a sound processor, Marvel CI, after receiving approval from the FDA.

Report Coverage

The U.S. hearing aid dispensers market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, patient type, ownership, distribution channel, and their futuristic growth opportunities.

U.S. Hearing Aid Dispensers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 662.78 million |

|

Revenue forecast in 2032 |

USD 969.93 million |

|

CAGR |

4.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to segmentation. |

FAQ's

The global U.S. hearing aid dispensers market size is expected to reach USD 969.93 million by 2032

Key players in the market are Audio Hearing Aid Service, LLC, Costco Wholesale Corporation

U.S. Hearing Aid Dispensers Market exhibiting the CAGR of 4.9% during the forecast period.

The U.S. Hearing Aid Dispensers Market report covering key segments are product, patient type, ownership