U.S. Durable Medical Equipment Market Size, Share, Trends, Industry Analysis Report

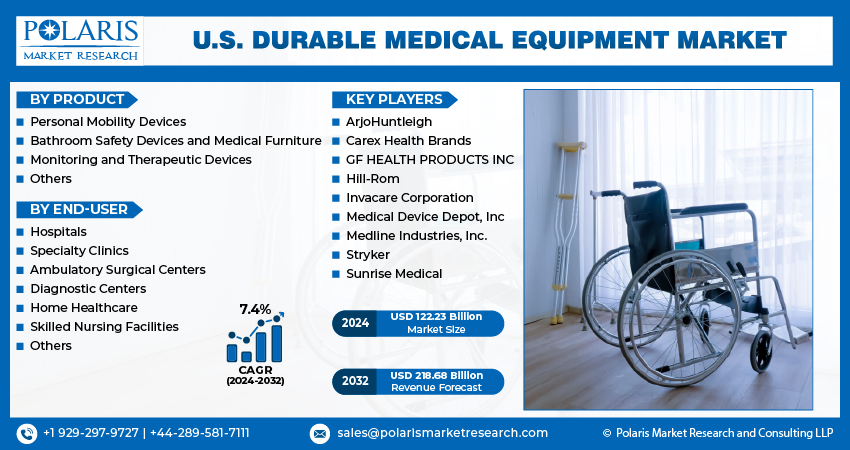

By Product (Personal Mobility Devices, Bathroom Safety Devices, Medical Furniture, Monitoring and Therapeutic Devices, Others), By End User – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM1693

- Base Year: 2024

- Historical Data: 2020-2023

Overview

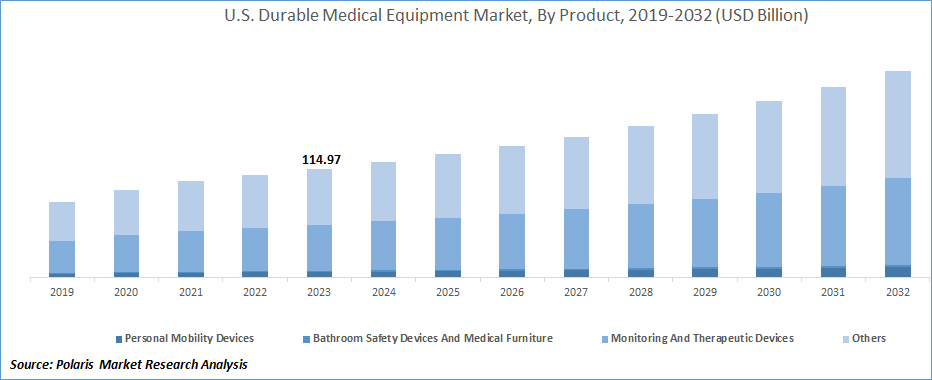

The U.S. durable medical equipment market size was valued at USD 122.23 billion in 2024, growing at a CAGR of 7.40% from 2025 to 2034. Key factors driving demand for durable medical equipment in the U.S. include increasing healthcare spending, a growing geriatric population, and an increasing incidence of chronic diseases.

Key Insight

- The personal mobility devices segment accounted for 4.95% of the U.S. durable medical equipment market share in 2024 due to the growing geriatric population.

- The hospitals segment accounted for 27.13% of revenue share in 2024 due to their high patient inflow.

Industry Dynamics

- The growing geriatric population is fueling the adoption of durable medical equipment in the U.S., as they usually develop mobility issues, chronic diseases, and other ailments.

- The increasing incidence of chronic diseases is propelling the U.S. durable medical equipment market growth by creating the need for glucose monitors, CPAP machines, home oxygen systems, and specialized mobility aids.

- The increasing number of product launches is creating a lucrative market opportunity.

- The high cost associated with some of the DME products hinders the market growth.

AI Impact on U.S. Durable Medical Equipment Market

- AI streamlines inventory management and supply chains, reducing costs and improving delivery times for durable medical equipment (DME).

- AI monitors equipment performance, predicting failures and reducing downtime, ensuring uninterrupted patient care.

- AI analyzes patient data to recommend tailored DME, improving outcomes for chronic conditions such as diabetes or mobility issues.

- AI identifies fraudulent claims and billing errors, saving costs for insurers and Medicare/Medicaid.

Market Statistics

- 2024 Market Size: USD 122.23 Billion

- 2034 Projected Market Size: USD 252.24 Billion

- CAGR (2025–2034): 7.40%

Durable medical equipment (DME) refers to medical devices and supplies designed for long-term use to help patients in managing medical conditions, illnesses, or disabilities. These products are typically prescribed by healthcare providers and are intended for repeated use rather than disposable or short-term applications. DME includes products such as wheelchairs, hospital beds, oxygen equipment, walkers, blood glucose monitoring devices, and CPAP machines. They are essential for improving patients’ quality of life, supporting mobility, facilitating recovery, and enabling at-home healthcare. DME must meet specific durability, functionality, and safety standards, ensuring they withstand prolonged use. These devices are usually covered by insurance or Medicare.

The U.S. durable medical equipment (DME) market encompasses the production, distribution, and sale of long-lasting medical devices used in hospitals, clinics, and home healthcare. The market is driven by factors such as an aging population, increasing prevalence of chronic diseases, and advancements in medical technology. Rising healthcare expenditure and expanding insurance coverage for DME further boost demand. The U.S. regulatory framework, led by the FDA and CMS, ensures product quality, safety, and reimbursement compliance. Additionally, the growing trend of home-based care and telehealth integration is fueling market growth, as patients seek cost-effective, convenient, and personalized healthcare solutions outside traditional hospital settings.

The U.S. durable medical equipment market demand is driven by the increasing healthcare spending. American Medical Association, in its article, stated that health spending in the U.S. increased by 7.5% in 2023 to $4.9 trillion from 2022. This drove hospitals, clinics, and patients to invest in essential equipment such as wheelchairs, hospital beds, and oxygen concentrators. Higher spending also enabled insurance providers to cover a wider range of DME, reducing costs for patients and encouraging more people to seek these devices. Additionally, rising healthcare spending is fueling key companies to invest in advancing technology in DME, such as smart prosthetics or portable dialysis machines, further attracting hospitals, clinics, and patients.

Drivers & Opportunities

Growing Geriatric Population: Older adults usually develop mobility issues, chronic diseases, and other ailments that are increasing their reliance on devices such as wheelchairs, walkers, and hospital beds. Elderly individuals also frequently need home healthcare solutions, such as oxygen concentrators, patient lifts, and adjustable mattresses, to maintain independence and safety. Additionally, Medicare and other insurance programs are expanding their coverage for DME to meet the needs of aging populations, further driving demand. According to the Population Reference Bureau, the number of Americans ages 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050. Therefore, as the geriatric population in the country expands, manufacturers and suppliers witness sustained growth in the DME market.

Increasing Incidence of Chronic Diseases: Chronic conditions such as diabetes, COPD, heart disease, and arthritis are necessitating continuous monitoring and treatment, driving the need for glucose monitors, CPAP machines, home oxygen systems, and specialized mobility aids. Hospitals and home healthcare providers are investing more in DME to support patients who need ongoing therapy, reducing hospital readmissions and improving quality of life. Insurance companies are also expanding coverage for these devices as chronic disease management becomes a priority, making DME more accessible. Additionally, technological advancements in portable and user-friendly medical equipment encourage adoption among patients who require daily use. Hence, as chronic illnesses rise globally, the DME market grows to meet the escalating demand for reliable, long-term medical solutions.

Segmental Insights

Product Analysis

Based on product, the segmentation includes personal mobility devices, bathroom safety devices, medical furniture, monitoring and therapeutic devices, and others. The personal mobility devices segment accounted for 4.95% of the U.S. durable medical equipment market share in 2024. It is attributed to the rising prevalence of mobility impairments, the growing geriatric population, and the increasing incidence of chronic conditions such as arthritis and osteoporosis. Consumers preferred devices such as wheelchairs, mobility scooters, and walkers as they enhanced independence and improved quality of life. The availability of technologically advanced mobility aids with features such as lightweight frames, adjustable seating, and powered propulsion systems further drove adoption. Supportive insurance coverage and Medicare reimbursement for essential mobility equipment also strengthened sales in the segment.

The monitoring and therapeutic devices segment is projected to register a CAGR of 7.23% from 2025 to 2034, owing to the rising incidence of chronic obstructive pulmonary disease (COPD) and other respiratory disorders, coupled with an aging population. Manufacturers are focusing on developing lightweight, energy-efficient, and user-friendly models to support patient mobility and comfort. The increasing shift toward portable and home-based oxygen therapy solutions is ensuring that this segment maintains its growth during the forecast period.

End User Analysis

In terms of end user, the segmentation includes hospitals, specialty clinics, ambulatory surgical centers, diagnostic centers, home healthcare, skilled nursing facilities, and others. The hospitals segment accounted for 27.13% of revenue share in 2024 due to their high patient inflow, advanced infrastructure, and extensive utilization of durable medical devices across diverse medical specialties. These facilities required a broad range of equipment, including patient monitoring systems, therapeutic devices, mobility aids, and medical furniture, to deliver effective acute and long-term care. The growing prevalence of chronic diseases and the rising number of surgical procedures have increased the demand for hospital-based equipment. Investments in upgrading healthcare facilities, coupled with strong procurement budgets and favorable reimbursement policies, further boosted adoption in hospitals.

The home healthcare segment is expected to register a CAGR of 8.65% from 2025 to 2034. Rising demand for home-based management of chronic conditions such as diabetes, COPD, and cardiovascular disorders is fueling the use of monitoring devices, therapeutic equipment, and mobility aids in this setting. Technological advancements, including remote patient monitoring and telehealth integration, have further enhanced the feasibility of home-based care. Additionally, the aging population, combined with a shift in healthcare policy toward reducing inpatient admissions, is projected to sustain the segment’s strong growth.

Key Players & Competitive Analysis

The U.S. medical durable equipment (MDE) market is highly competitive, dominated by major players like Medtronic, Philips, and ResMed, who leverage strong R&D capabilities and extensive distribution networks. The market is characterized by rapid technological advancements, with companies investing heavily in connected health solutions and AI-driven devices to enhance patient outcomes. Consolidation remains a key trend, as larger firms acquire niche players to expand product portfolios and geographic reach. Cost pressures and stringent FDA regulations create high entry barriers, though startups focusing on innovative, patient-centric solutions are gaining traction. Competitive pricing, reimbursement strategies, and partnerships with healthcare providers are critical for market share. Rising demand for home healthcare equipment, driven by an aging population and chronic disease prevalence, further intensifies competition, pushing firms to prioritize affordability and accessibility.

A few major companies operating in the U.S. durable medical equipment market include Becton, Dickinson and Company; Cardinal Health; Carex Health Brands, Inc.; Compass Health Brands; Drive DeVilbiss Healthcare; GE Healthcare; GF Health Products, Inc.; Invacare Corporation; Koninklijke Philips NV; Medline Industries, Inc.; Medtronic PLC; Nihon Kohden Corporation; Pride Mobility; and Sunrise Medical.

Key Companies

- Abbott

- Becton, Dickinson and Company

- Cardinal Health

- Carex Health Brands, Inc.

- Compass Health Brands

- Drive DeVilbiss Healthcare

- GE Healthcare

- GF Health Products, Inc.

- Invacare Corporation

- Koninklijke Philips NV

- Medline Industries, Inc.

- Medtronic PLC

- Nihon Kohden Corporation

- Optum Insight

- Pride Mobility

- Sunrise Medical

U.S. Durable Medical Equipment Industry Developments

In June 2025: Cardinal Health introduced its multi-parameter monitoring cable and lead wire system, Kendall DL Multi System in the U.S. According to Cardinal Health, the new system is designed for the continuous monitoring of blood oxygen level, cardiac activity, and temperature with a single connection point.

In July 2025, Invacare announced that it raised $24,096 for Free Wheelchair Mission.

In June 2024, Optum Insight launched DME Navigator, an end-to-end solution for durable medical equipment (DME) benefits management that will streamline the delivery of durable medical equipment to patients.

In June 2024, Abbott announced U.S. Food and Drug Administration (FDA) clearance for two new over-the-counter continuous glucose monitoring (CGM) systems, Lingo and Libre Rio.

U.S. Durable Medical Equipment Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Personal Mobility Devices

- Wheelchairs

- Scooters

- Walker and Rollators

- Canes and Crutches

- Door Openers

- Others

- Bathroom Safety Devices and Medical Furniture

- Commodes and Toilets

- Mattress & Bedding Devices

- Monitoring and Therapeutic Devices

- Blood Sugar Monitors

- Continuous Passive Motion (CPM)

- Infusion Pumps Market

- Nebulizers

- Oxygen Equipment

- Continuous Positive Airway Pressure (CPAP)

- Suction Pumps

- Traction Equipment

- Others

- Others

- Insulin Pumps

- Ostomy Bags & Accessories

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

- Home Healthcare

- Skilled Nursing Facilities

- Others

U.S. Durable Medical Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 122.23 Billion |

|

Market Size in 2025 |

USD 130.28 Billion |

|

Revenue Forecast by 2034 |

USD 252.24 Billion |

|

CAGR |

7.40% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 122.23 billion in 2024 and is projected to grow to USD 252.24 billion by 2034.

The market is projected to register a CAGR of 7.40% during the forecast period.

A few of the key players in the market are Becton, Dickinson and Company; Cardinal Health; Carex Health Brands, Inc.; Compass Health Brands; Drive DeVilbiss Healthcare; GE Healthcare; GF Health Products, Inc.; Invacare Corporation; Koninklijke Philips NV; Medline Industries, Inc.; Medtronic PLC; Nihon Kohden Corporation; Pride Mobility; and Sunrise Medical.

The hospitals segment dominated the market share in 2024.

The home healthcare segment is expected to witness the fastest growth during the forecast period.