US Dental Implants Market Size, Share, Trends, Industry Analysis Report: By Product Type, Procedure (Root Form and Plate Form), Material, Design, Age, and End-Use – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 114

- Format: PDF

- Report ID: PM4771

- Base Year: 2023

- Historical Data: 2019-2022

US Dental Implants Market Overview

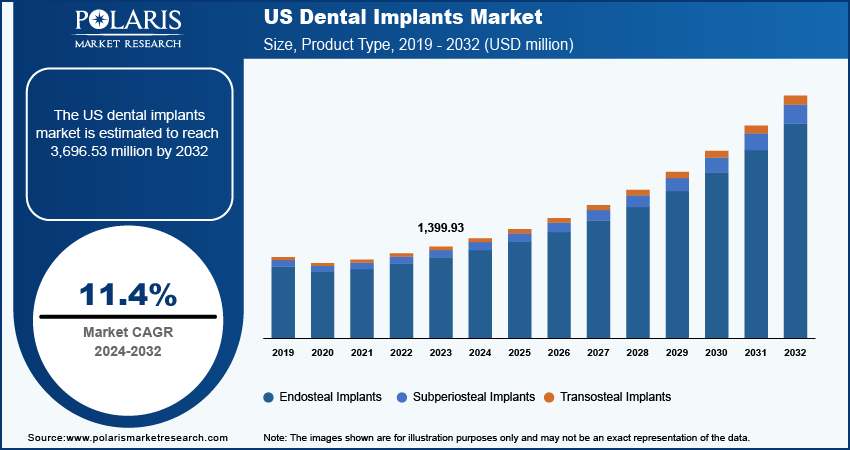

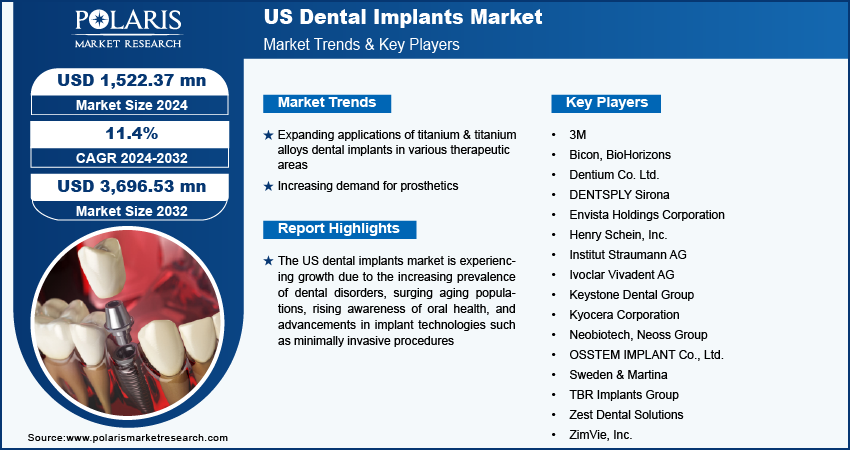

The US dental implants market size was valued at USD 1,399.93 million in 2023. The market is projected to grow from USD 1,522.37 million in 2024 to USD 3,696.53 million by 2032, exhibiting a CAGR of 11.4% during 2024–2032.

The US dental implant market growth is attributed to the aging edentulous population seeking solutions for tooth loss and the rising demand for dental implants. Enhanced consumer awareness regarding oral health underscores the importance of restorative procedures, while the growing popularity of preventive and cosmetic dental treatments fuels the demand for these procedures. Technological advancements in implant design, materials, and procedures have improved treatment outcomes, making dental implants more accessible and attractive to patients seeking long-term solutions.

Dental implants are commonly used in the US to replace missing teeth and support various dental prosthetics, including crowns and dentures. They offer a durable and effective solution that enhances oral function and aesthetics. Although the market faced challenges during the COVID-19 pandemic—leading to postponed procedures and stricter safety protocols—the increasing awareness among patients, technological improvements, and the growing aging population continue to drive demand for dental implants in the country.

To Understand More About this Research: Request a Free Sample Report

The rising prevalence of tooth loss due to periodontal diseases significantly affects a large segment of the population. As more individuals confront this issue, there is a growing willingness to invest in dental implant procedures as a viable long-term solution. The availability of high-quality services and advanced dental technologies boosts patient confidence and satisfaction, thereby increasing demand for implants.

The high costs associated with dental implants can deter potential patients, as these procedures often require a substantial financial commitment. Additionally, limited insurance reimbursement rates can complicate the affordability of essential treatments. Furthermore, a few risks associated with dental implant surgeries such as complications and the potential for further tooth loss may lead to hesitation among prospective candidates. Addressing these challenges effectively would present significant opportunities in the US dental implant market during the forecast period.

US Dental Implants Market Drivers and Trends

Expanding Applications of Titanium & Titanium Alloys Dental Implants in Various Therapeutic Areas

Titanium and titanium alloys dental implants in US serve as replacements for missing teeth and as essential support structures for dental prosthetics, including crowns, bridges, and dentures. With a rapidly growing elderly population, it is estimated that ∼27% of individuals aged 75 and above are edentulous (toothless), emphasizing the need for durable and biocompatible solutions such as titanium implants.

The rising incidence of dental injuries from road accidents and sports is contributing to the growing demand for effective therapeutic options. Titanium implants are especially valued for their unique ability to preserve and stimulate natural bone, making them an ideal long-term solution for dental restoration. Their aesthetic appeal and comfort surpass that of traditional removable dentures, enhancing patients' overall quality of life. According to the American Dental Association, around 5 million dental implant cases are placed annually in the US, underscoring their critical role in modern dental care and the expanding therapeutic applications within the dental implant market. Thus, the rising applications of titanium & titanium alloys drive the US dental implants market.

Increasing Demand for Prosthetics

Dental implants are becoming increasingly vital for oral rehabilitation, significantly aiding in restoring both oral function and facial aesthetics. According to the American Academy of Implant Dentistry, over 15 million people in the US have bridge and crown replacements for missing teeth annually, driving demand for dental implants.

The acceptance of dental implants is on the rise among patients and dental surgeons, primarily due to the limitations associated with removable prosthetics, which include discomfort, lack of a natural appearance, and ongoing maintenance requirements. Prosthetics mounted on dental implants do not interfere with soft tissues and enhance overall aesthetics. All these benefits are expected to propel the growth of the US dental implants market during the forecast period.

US Dental Implants Market – Segment Insights

US Dental Implants Market: Product Type-Based Insights

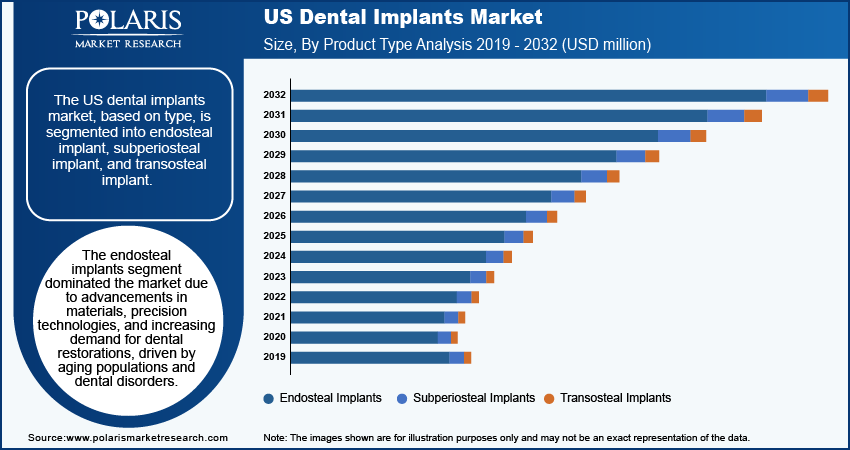

The US dental implants market, based on product type, is segmented into endosteal implant, subperiosteal implant, and transosteal implant. In 2023, the endosteal implants segment dominated the market, accounting for around 88% of market revenue (USD 1,235.9 million). Endosteal implants are widely used dental implants surgically placed directly into the jawbone, serving as artificial roots that anchor prosthetic teeth such as crowns or bridges. Typically made from biocompatible materials such as titanium, these implants promote osseointegration, where bone fuses with the implant for a stable foundation. The rising prevalence of dental disorders, such as tooth decay and periodontal disease, and the increasing aging global population have significantly propelled the demand for dental restorations.

Advancements in implant design and materials, including 3D imaging and computer-guided surgery, have enhanced the precision and predictability of outcomes. Patients increasingly prefer the aesthetic appeal of endosteal implants, which resemble natural teeth, as well as minimally invasive procedures that reduce recovery time and improve comfort. Overall, the growing awareness of oral health continues to drive the adoption of endosteal implants as a long-term dental solution.

US Dental Implants Market: Procedure-Based Insights

The US dental implants market, based on procedure, is bifurcated into root form and plate form. The plate form segment is expected to register a CAGR of 11.7% during the forecast period. A plate-form implant, also known as an endosteal implant, is employed in cases where the jawbone lacks the necessary width or length to accommodate a root-form implant. This implant type is flat and elongated, and it is placed directly on the top of the jawbone beneath the gum tissue. Over time, bone and soft tissue will naturally envelop and integrate with this implant, enhancing its stability and secure attachment.

Plate-form implants have a proven history of success. These implants distribute the force of chewing over a wider area of the jaw compared to screw-type implants, which makes them particularly suitable for individuals having weaker jaw structures. They can help certain patients circumvent the need for bone grafting, which is typically necessary to strengthen the jaw to support screw-type implants. Once the implant anchor is in place, the pontic or artificial tooth typically be securely attached to these implants. These advantages have led to a growing demand for plate form implantation, driving the US dental implants market revenue growth for this segment.

US Dental Implants Market: Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the US dental implants market grow in the coming years. Market participants are also undertaking a variety of strategic initiatives, including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaborations with other organizations, to expand their footprint across the region. To expand and survive in a more competitive and rising market climate, the US dental implants industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the US dental implants market to benefit clients and boost business growth. In recent years, the market has offered some technological advancements. Major players in the US dental implants market are Ivoclar Vivadent AG; Keystone Dental Group; Dentium Co. Ltd.; Neobiotech; OSSTEM IMPLANT Co., Ltd.; Institut Straumann AG; Sweden & Martina; TBR Implants Group; Zest Dental Solutions; ZimVie, Inc.; 3M; Kyocera Corporation; Neoss Group; Bicon; BioHorizons; Envista Holdings Corporation; DENTSPLY Sirona; and Henry Schein, Inc.

Osstem Implant Co., Ltd., a South Korean healthcare company, manufactures dental implant solutions and provides education programs. It operates globally in over 70 countries, with 21 subsidiaries and 70 sales networks. In May 2022, Osstem stated that its KS implant system offers robust stability and convenience for patients and dentists, featuring a hexagonal connection, 15-degree Morse taper, and improved stress dispersion for durability while streamlining prosthetic planning and inventory management.

Neobiotech, founded in 2000, offers a wide range of dental implant, restorative, and digital dentistry solutions, including SINUS and GBR kits. Their products and educational services span nearly 70 global locations. In August 2023, Neobiotech introduced the 'Tick-Tock Implant,' a revolutionary prosthesis system that simplifies attachment, enhances aesthetics, shortens surgery time, and prevents inflammation compared to traditional screw-connected dental implants.

List of Key Companies in US Dental Implants Market

- 3M

- Bicon

- BioHorizons

- Dentium Co. Ltd.

- DENTSPLY Sirona

- Envista Holdings Corporation

- Henry Schein, Inc.

- Institut Straumann AG

- Ivoclar Vivadent AG

- Keystone Dental Group

- Kyocera Corporation

- Neobiotech

- Neoss Group

- OSSTEM IMPLANT Co., Ltd.

- Sweden & Martina

- TBR Implants Group

- Zest Dental Solutions

- ZimVie, Inc.

US Dental Implants Industry Developments

In October 2023, Dentsply Sirona launched SureSmile Simulator, an AI-driven application in DS Core, offering 3D visualizations for confident SureSmile Aligner treatment decisions.

In November 2022, 3M unveiled the 3M Filtek Matrix, an innovative therapeutic solution designed to enhance the predictability of composite placement for dentists while offering a more cost-effective option for their patients.

In June 2022, Ivoclar introduced VivaScan, a compact and user-friendly intraoral scanner, offering dentists efficient digital impression-taking for improved patient experiences and streamlined workflows. Its lightweight design and high-speed performance enhance comfort and accuracy.

US Dental Implants Market Segmentation

By Product Type Outlook

- Endosteal Implants

- Subperiosteal Implants

- Transosteal Implants

By Procedure Outlook

- Root Form

- Plate Form

By Material Outlook

- Titanium

- Zirconia

- Ceramic

- Others

By Design Outlook

- Tapered

- Parallel

By Age Outlook

- Geriatric

- Middle Age

- Adults

- Others

By End-Use Outlook

- Dental Clinics

- Hospital

- Dental Academics & Research Institute

- Dental Laboratories

US Dental Implants Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,399.93 million |

|

Market Size Value in 2024 |

USD 1,522.37 million |

|

Revenue Forecast by 2032 |

USD 3,696.53 million |

|

CAGR |

11.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The US dental implants market size was valued at USD 1,399.93 million in 2023 and is projected to grow to USD 3,696.53 million by 2032.

The market is projected to register a CAGR of 11.4% during the forecast period.

Ivoclar Vivadent AG; Keystone Dental Group; Dentium Co. Ltd.; Neobiotech; OSSTEM IMPLANT Co., Ltd.; Institut Straumann AG; Sweden & Martina; TBR Implants Group; Zest Dental Solutions; ZimVie, Inc.; 3M; Kyocera Corporation; Neoss Group; Bicon; BioHorizons; Envista Holdings Corporation; DENTSPLY Sirona; and Henry Schein, Inc. are a few key market players.

The endosteal implants segment dominated the market in 2023.

The root form segment held a larger share of the US market in 2023.