U.S. Data Center Cooling Market Share, Size, Trends, Industry Analysis Report, By Component (Solution, Services); By Solution; By Services; By Type; By Containment; By Structure; By Application; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4523

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

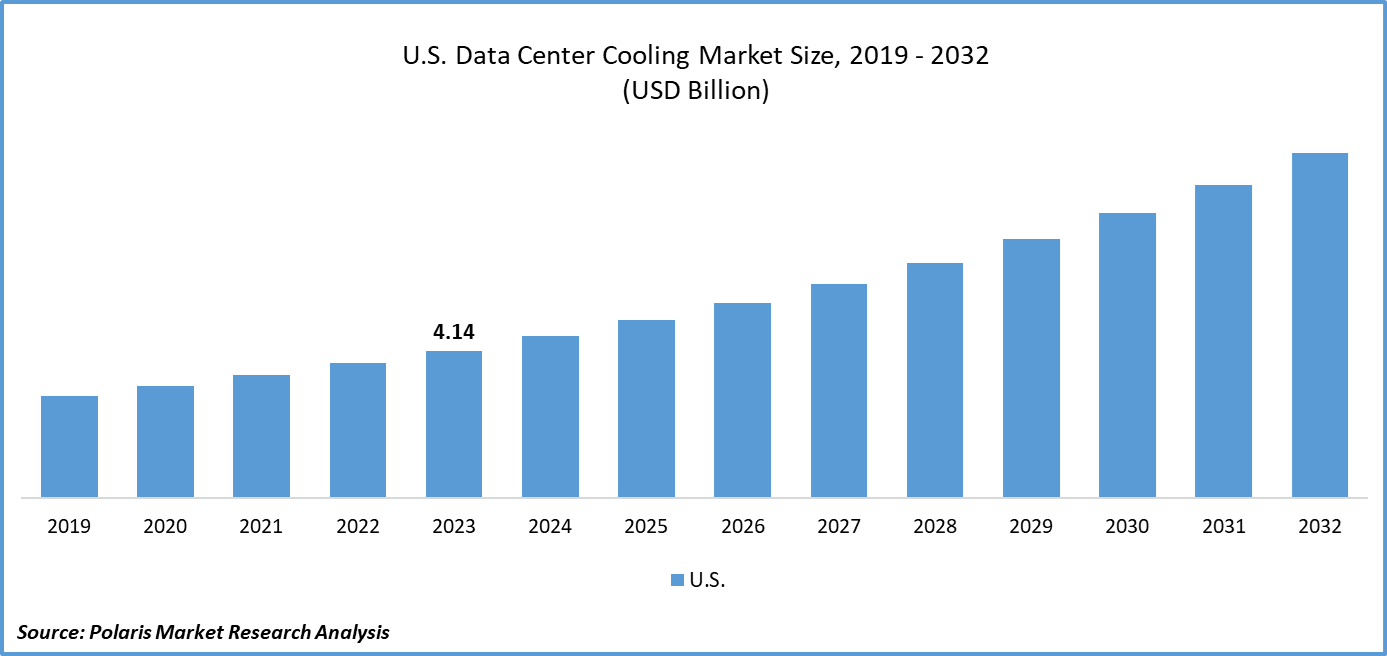

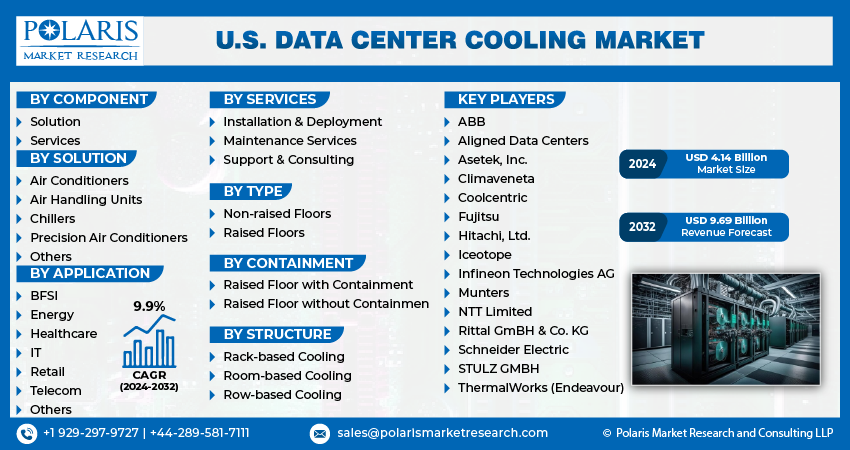

U.S. Data Center Cooling Market size was valued at USD 4.14 billion in 2023. The market is anticipated to grow from USD 4.54 billion in 2024 to USD 9.69 billion by 2032, exhibiting a CAGR of 9.9% during the forecast period

Industry Trends

The U.S. data center market outlook growth is attributed to the increase in data generation and the need to cater to the demand for big data analytics. As Industry 4.0 standards continue to evolve and the number of connected devices increases, IT organizations must improve their operational efficiency while ensuring data security. However, in-house data management can be time-consuming and complex, which has led many IT organizations to opt for data centers.

The increase in data center numbers and sizes requires the use of efficient power and cooling equipment to guarantee a smooth and continuous data center operation. Data centers consume a large amount of power and generate significant heat, necessitating efficient cooling systems. As a result, several vendors have designed liquid cooling systems specifically for data center use.

The complexity of data center cooling architectures poses a challenge for designers and engineers to predict the power requirements of each cooling cabinet, resulting in high investment and overbuilding of cooling facilities to accommodate future power requirements. However, intelligent power distribution units, power management software, and overhead busways are innovative power supply systems that ensure seamless power distribution in data centers. These systems account for growth and scalability, reducing the total cost of ownership. With customers' increasing computing demands, data center cooling managers must deploy such intelligent power supply systems to ensure peak operating efficiency and drive growth in the US data center cooling market.

To Understand More About this Research: Request a Free Sample Report

In the United States, the adoption of public and private cloud platforms by data centers is rapidly increasing. This shift to the cloud offers a range of advantages, including reduced capital expenditure, improved scalability, elasticity, and better operational cost efficiency. Additionally, the growing volume of data traffic and the emergence of big data have heightened the need for more secure data centers.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces U.S. Data Center Cooling Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Key Takeaways

- By component category, the solution segment accounted for the largest U.S. data center cooling market share in 2023

- By solution category, the air conditioners segment held the dominating U.S. data center cooling market share in 2023

- By service category, the maintenance & service segment is expected to grow with a significant CAGR over the market forecast period

- By structure category, the row-based cooling segment is expected to grow with a significant CAGR over the market forecast period

- By application category, the IT segment showcased the lucrative CAGR over the forecast period

What are the Market Drivers Driving the Demand for the U.S. Data Center Cooling Market?

The Increasing Adoption of Cloud Computing and Big Data Analytics is Driving the Demand for the U.S. Data Center Cooling Industry Growth

The growing adoption of cloud computing and big data analytics is significantly contributing to the increased demand for data centers, which in turn is driving the U.S. data center cooling industry growth. As more businesses move their operations to the cloud and generate vast amounts of data, they require powerful data centers to store, process, and analyze this information. These data centers generate heat, and effective cooling systems are essential to maintain optimal operating temperatures, prevent overheating, and ensure the reliable functioning of the equipment. The need for efficient and scalable cooling solutions has become critical, leading to an increase in demand for data center cooling services in the United States. Also, with the rise of edge computing, there is a growing U.S. data center cooling market trend toward building smaller, distributed data centers closer to end-users, further accelerating the demand for innovative and cost-effective cooling technologies.

Which Factor Is Restraining the Demand for U.S. Data Center Cooling?

The High Upfront Cost of Implementing Energy-Efficient Cooling Systems Hinders U.S. Data Center Cooling Industry Growth

The high upfront cost of implementing energy-efficient cooling systems is a significant restraint for the growth in the U.S. data center cooling market. Many data center operators are deterred by the initial investment required for energy-efficient solutions, such as air-side and water-side economization, which can be substantially higher than traditional cooling methods. Also, the cost of installing and maintaining these systems is quite expensive, especially for small-scale data centers. This has resulted in a slower adoption rate of energy-efficient cooling technologies despite their long-term benefits, including reduced energy consumption and lower operating costs. As a result, the market for energy-efficient data center cooling solutions needs to grow at its full potential and lower operational expenses.

Report Segmentation

The market is primarily segmented based on component, solution, services, type, containment, structure, and application.

|

By Component |

By Solution |

By Services |

By Type |

By Containment |

By Structure |

By Application |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Solution Insights

Based on solution analysis, the market is segmented on the basis of air conditioners, air handling units, chillers, precision air conditioners, and others. The air conditioners segment accounted for the largest share of the total U.S. data center cooling market revenue due to their widespread adoption and reliance on regular cooling methods. Air conditioners are widely used in data centers as they provide an effective way to remove heat generated by IT equipment, such as servers, storage systems, and networking devices. They work by circulating cold air through the data center, which helps to maintain a consistent temperature and humidity level, ensuring that the equipment operates within its recommended specifications.

In addition, air conditioners can be easily installed and integrated into existing data center infrastructure, making them a popular choice for many organizations. Also, advancements in air conditioner technology have led to more energy-efficient models, which has increased their utilization by data center operators looking to reduce their energy consumption and costs. All these factors contributed to the dominance of the air conditioners segment in the U.S. data center cooling market.

By Services Insights

Based on services analysis, the market has been segmented on the basis of installation & deployment, maintenance services, and support & consulting. The Installation and Deployment segment dominated the US data center cooling market in 2023 due to the increasing number of data centers being built across the country, which has led to a growing demand for installation services. Also, many existing data centers are upgrading their cooling systems to more efficient and cost-effective solutions, which also drives the demand for deployment services. Further, the complexity of modern data center cooling systems requires specialized expertise and customized solutions, leading to increased revenue generation for installation and deployment services. Also, the growth of hyperscale data centers, which require large-scale cooling solutions, has further contributed to the dominance of this segment in the market.

By Application Insights

Based on application analysis, the market has been segmented on the basis of BFSI, energy, healthcare, IT, retail, telecom, and others. The IT applications segment, which includes servers, storage systems, and networking equipment, is expected to grow with a significant industry growth rate over the market forecast period in the U.S. data center cooling market. As more businesses move their operations online and generate increasing amounts of data, the demand for powerful and efficient computing infrastructure continues to rise. This has led to an expansion of data centers across the country, driving up the need for advanced cooling solutions that can effectively manage heat loads while minimizing energy consumption and costs.

In parallel, advancements in technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are also contributing to the rising demand for data center cooling solutions. Altogether, the growth of the IT applications segment is expected to have a positive impact on the U.S. data center cooling market, creating opportunities for manufacturers and service providers to offer cutting-edge solutions that meet the evolving needs of this industry.

Competitive Landscape

The U.S. data center cooling market is highly competitive and diverse, with several key market players competing for market share. Some of the key players include industry giants such as Schneider Electric and Johnson Controls, which offer a wide range of cooling solutions, including air conditioning, evaporative cooling, and economization systems. These players focus on offering customized solutions that cater to the specific needs of their clients, ensuring maximum efficiency and minimal environmental impact.

Some of the major players operating in the U.S. market include:

- ABB

- Aligned Data Centers

- Asetek, Inc.

- Climaveneta

- Coolcentric

- Fujitsu

- Hitachi, Ltd.

- Iceotope

- Infineon Technologies AG

- Munters

- NTT Limited

- Rittal GmBH & Co. KG

- Schneider Electric

- STULZ GMBH

- ThermalWorks (Endeavour)

Recent Developments

- In October 2023, ExxonMobil launched data center immersion cooling fluids, including EM DC 3152/3150/315, 3220, 3235 Super, 3250, 1150, and 1210 (AP) at the Open Compute Project (OCP) Global Summit in San Jose, United States.

- In November 2023, Vertiva, a global provider of critical digital infrastructure and continuity solutions, launched Vertiv SmartMod Max CW, a prefabricated modular data center designed to address the growing demand for rapid deployment of computing.

- In October 2023, ThermalWorks, a subsidiary of Endeavour, announced the global launch of its state-of-the-art, waterless cooling system built for the fast-changing data center industry.

- In January 2024, Aligned Data Centers, a technology infrastructure company offering innovative and adaptive Scale Data Centers and Build-to-Scale solutions for global hyper-scale and enterprise customers, announced the launch of its DeltaFlow liquid cooling technology.

Report Coverage

The Data Center Cooling market research report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, components, solutions, services, type, containment, structure, application, and futuristic growth opportunities.

U.S. Data Center Cooling Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.14 billion |

|

Revenue Forecast in 2032 |

USD 9.69 billion |

|

CAGR |

9.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Solution, By Services, By Type, By Containment, By Structure, By Application |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Get in Touch Whenever You Need Us

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the U.S. Data Center Cooling Market report with a phone call or email, as and when needed.

Browse Our Top Selling Reports

Drug Discovery Services Market Size, Share 2024 Research Report

Feed Acidulants Market Size, Share 2024 Research Report

Artificial Intelligence in Agriculture Market Size, Share 2024 Research Report

Mass Flow Controller Market Size, Share 2024 Research Report