U.S. AI In Oncology Market Share, Size, Trends, Industry Analysis Report, By Component (Software Solutions, Hardware, Services); By Cancer Type; By Treatment Type; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM4773

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

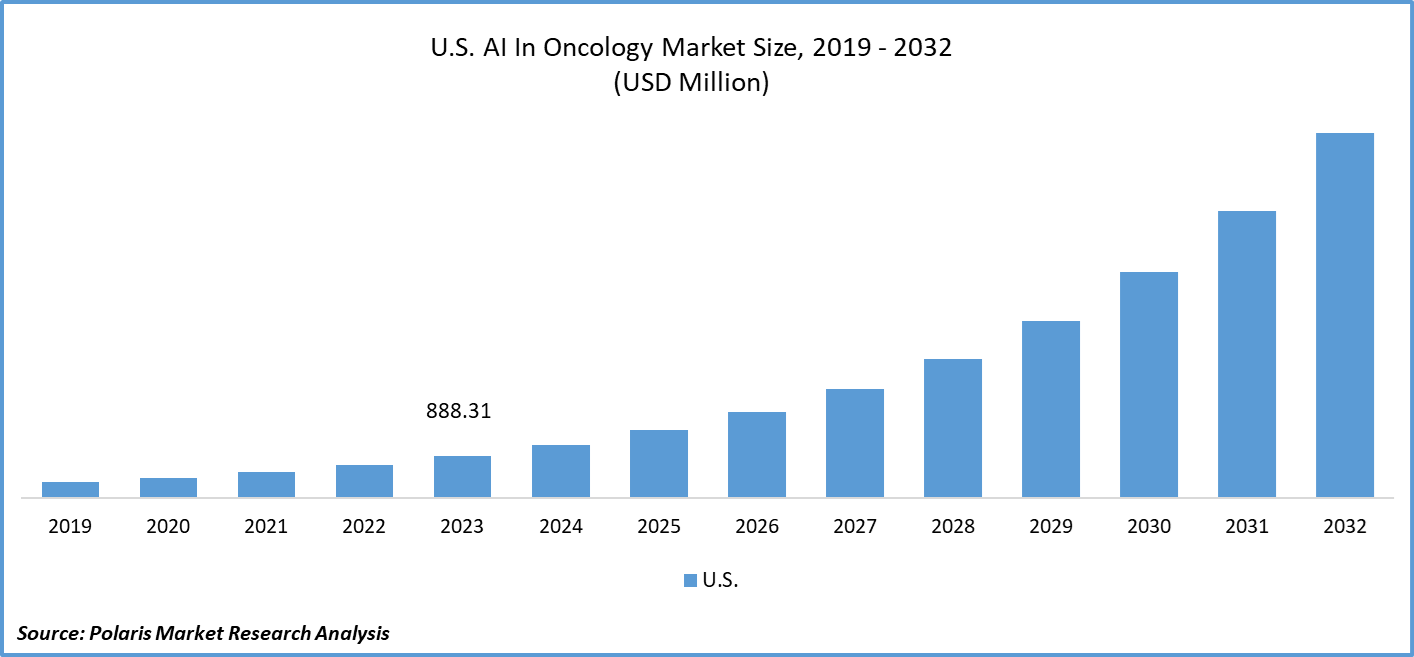

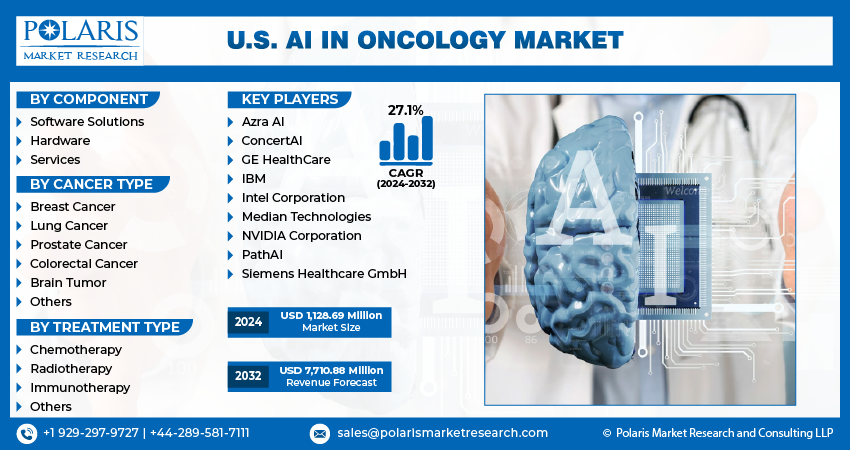

The U.S. ai in oncology market size was valued at USD 888.31 million in 2023. The market is anticipated to grow from USD 1,128.69 million in 2024 to USD 7,710.88 million by 2032, exhibiting a CAGR of 27.1% during the forecast period.

Industry Trend

A.I. technologies have the potential to revolutionize various aspects of cancer care, from early detection to treatment selection, monitoring, and personalized medicine. AI-powered algorithms can analyze medical imaging data, such as mammograms, C.T. scans, and MRIs, to identify suspicious lesions or tumors at an early stage. These tools help radiologists and oncologists detect cancer more accurately and efficiently, due to timely intervention and improved patient outcomes.

The significant strides in technology within the realm of cancer diagnostics have been pivotal. Innovations such as advanced imaging techniques, molecular diagnostics, and genomic profiling have revolutionized the way cancer is detected and managed. These technological advancements not only enable earlier detection but also facilitate more precise and personalized treatment strategies, thereby enhancing patient outcomes.

To Understand More About this Research: Request a Free Sample Report

Furthermore, the continuous improvement and expansion of healthcare infrastructure In the U.S. have played a crucial role in driving market growth. Increased investment in healthcare facilities, coupled with initiatives to enhance access to diagnostic services, has bolstered the demand for cancer diagnostic tools and services. Additionally, there is a growing awareness among individuals about the importance of early detection in improving cancer prognosis. This heightened awareness, coupled with advancements in screening programs and campaigns, has led to a surge in the demand for early and accurate cancer diagnosis. As a result, the U.S. A.I. in oncology market size is estimated to increase during the forecast period.

The company has embarked on a significant collaborative effort, marking a bold step towards innovation in its operations. By embracing a comprehensive strategy geared towards broadening market reach, engaging with new demographics, and fostering sustainable growth in a dynamic business landscape, the company is primed for success. Leveraging the synergies of investment, technology, innovation, and strategic planning, it stands well-equipped to uphold its competitive edge and emerge as a frontrunner in its sector. Consequently, the U.S. A.I. in oncology market share is anticipated to witness substantial growth during the forecast period.

- For instance, in January 2024, NVIDIA Corporation collaborated with Deepcell to expedite the integration of generative A.I. into single-cell research, focusing on areas such as stem cells, cancer, and cell therapies.

A.I. technologies are being increasingly utilized in cancer research to analyze large datasets, identify biomarkers, and uncover new insights into the molecular mechanisms underlying cancer. This includes the development of A.I. algorithms for genomic analysis, drug discovery, and predictive modeling of cancer progression and response to therapy. Hence, the U.S. A.I. in oncology market share is estimated to increase during the forecast period.

Key Takeaway

- By cancer type category, breast cancer segment accounted for the largest market share in 2023.

- By treatment type category, the chemotherapy segment accounted for the largest market share in 2023.

What are the market drivers driving the demand for the U.S. AI in oncology market?

Increasing prevalence of cancer patients is projected to spur market demand.

The market's growth is attributed to the increasing prevalence of cancer, technological advancements in cancer diagnostics and healthcare infrastructure, and an increasing demand for early and accurate diagnosis of cancer. Significant strides in technology within the realm of cancer diagnostics have been pivotal. Innovations such as advanced imaging techniques, molecular diagnostics, and genomic profiling have revolutionized the way cancer is detected and managed. These technological advancements not only enable earlier detection but also facilitate more precise and personalized treatment strategies, thereby enhancing patient outcomes.

Furthermore, the continuous improvement and expansion of healthcare infrastructure have played a crucial role in driving market growth. Increased investment in healthcare facilities, coupled with initiatives to enhance access to diagnostic services, has bolstered the demand for cancer diagnostic tools and services. Additionally, there is a growing awareness among individuals about the importance of early detection in improving cancer prognosis. This heightened awareness, coupled with advancements in screening programs and campaigns, has led to a surge in the demand for early and accurate cancer diagnosis.

Which factor is restraining the demand for U.S. AI in oncology?

Regulatory Challenges are likely to impede the market growth.

The introduction of AI technologies in healthcare, including oncology, is subject to regulatory oversight by agencies such as the Food and Drug Administration (FDA) in the United States. Obtaining regulatory approval for AI-based medical devices and software can be a lengthy and complex process, involving rigorous testing and validation to ensure safety, efficacy, and accuracy. Delays in regulatory approval can hinder the adoption of AI solutions by healthcare providers, limiting their availability and accessibility to patients. Hence, the U.S. AI in the oncology market is likely to impede the growth.

Report Segmentation

The market is primarily segmented based on component, cancer type, treatment type.

|

By Component |

By Cancer Type |

By Treatment Type |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Cancer Type Insights

Based on cancer type analysis, the market is segmented into breast cancer, lung cancer, prostate cancer, colorectal cancer, brain tumor, and others. Breast cancer accounted for the largest market share in 2023. This dominance is primarily driven by the escalating prevalence of breast cancer within the population.

According to the Centers for Disease Control and Prevention (CDC), while deaths from breast cancer have decreased over time, it still ranks as the second due to cause of cancer-related deaths among women overall and the primary cause among Hispanic women. Annually, in the United States, breast cancer is diagnosed in women, with around 240,000 cases and approximately 2,100 in men. The disease claims the lives of about 500 men and 42,000 women in the U.S. each year.

Consequently, there's a growing necessity for the introduction of innovative solutions to aid in the detection, diagnosis, and treatment of breast cancer. This trend towards advanced technology adoption is a key driver propelling the overall growth of the U.S. A.I. in the oncology market.

By Treatment Type Analysis

Based on treatment type analysis, the market is segmented into chemotherapy, radiotherapy, immunotherapy, and others. The chemotherapy segment accounted for the largest market share in 2023. Chemotherapy involves the administration of drugs to destroy cancer cells or inhibit their growth and is often a cornerstone of cancer treatment regimens.

With the integration of artificial intelligence (A.I.) technologies, such as machine learning algorithms and predictive analytics, healthcare providers can optimize chemotherapy treatment protocols, personalize dosing regimens, and predict patient responses more accurately. This enhances treatment outcomes, minimizes adverse effects, and improves overall patient care, contributing to the dominance of the chemotherapy segment within the A.I. in the Oncology market in the U.S.

Chemotherapy is a widely utilized cancer treatment, with an estimated 60% of Stage 4 bladder cancer patients undergoing this procedure, as reported by the American Cancer Society. The integration of A.I. into chemotherapy treatment helps healthcare professionals create personalized digital profiles for patients, allowing the customization of dosage during treatment.

Competitive Landscape

In the U.S. AI in oncology market, competition is evident through fragmentation, with numerous players vying for market share. Leading service providers in this field consistently upgrade their technologies to stay ahead, prioritizing efficiency, reliability, and safety. To secure a strong foothold in the market, these entities stress the importance of strategic partnerships, continual product improvements, and collaborative initiatives to outpace their industry peers.

Some of the major players operating in the US market include:

- Azra AI

- ConcertAI

- GE HealthCare

- IBM

- Intel Corporation

- Median Technologies

- NVIDIA Corporation

- PathAI

- Siemens Healthcare GmbH

Recent Developments

- In January 2024, PathAI introduced an expansion of six additional oncology indications for PathExplore, an AI-driven pathology panel utilized for the spatial analysis of the tumor microenvironment (TME).

- In November 2023, GE Healthcare introduced the MyBreastAI suite, a comprehensive platform amalgamating three AI applications sourced from software developed by iCAD. This innovative suite aims to enhance breast cancer detection capabilities and streamline associated workflows.

Report Coverage

The U.S. AI in oncology market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, cancer type, treatment type, and their futuristic growth opportunities.

U.S. AI In Oncology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,128.69 million |

|

Revenue forecast in 2032 |

USD 7,710.88 million |

|

CAGR |

27.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Cancer Type, By Treatment Type, |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The U.S. AI In Oncology Market report covering key segments are component, cancer type, treatment type.

U.S. AI In Oncology Market Size Worth $7,710.88 Million By 2032

U.S. AI in oncology market exhibiting a CAGR of 27.1% % during the forecast period.

key driving factors in U.S. AI In Oncology Market are increasing prevalence of cancer patient