Urinalysis Market Size, Share, Trends, Industry Analysis Report

: By Product (Instrument and Consumables), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 116

- Format: PDF

- Report ID: PM3258

- Base Year: 2024

- Historical Data: 2020-2023

Urinalysis Market Overview

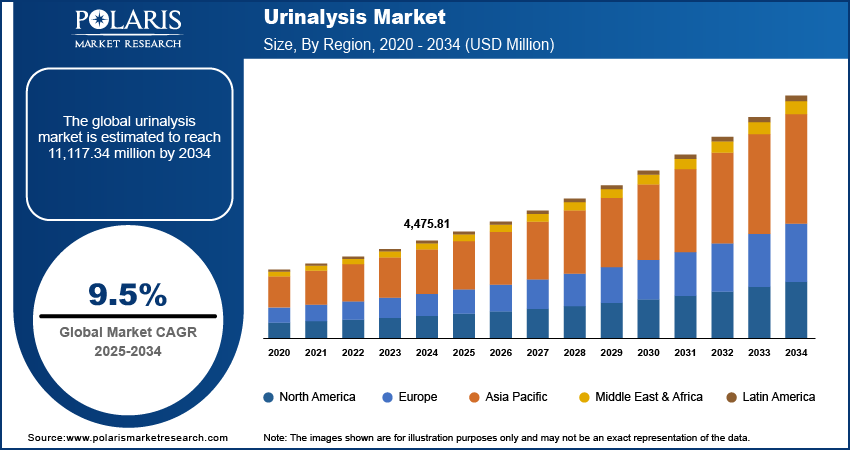

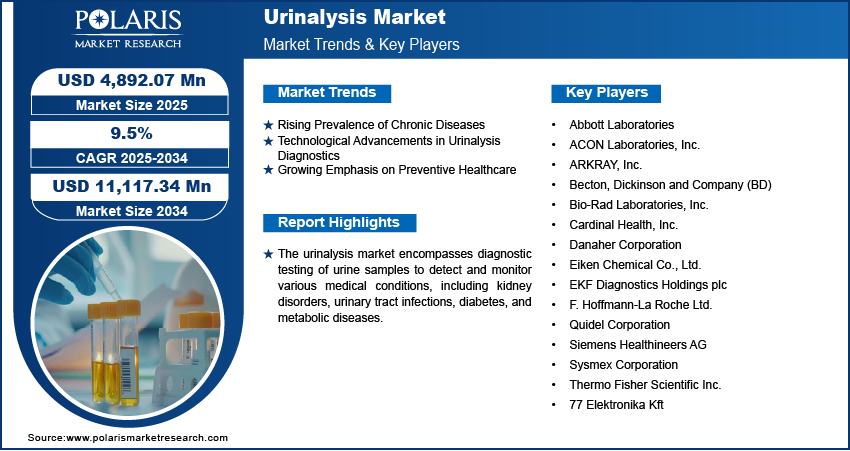

The urinalysis market size was valued at USD 4,475.81 million in 2024. The market is projected to grow from USD 4,892.07 million in 2025 to USD 11,117.34 million by 2034, exhibiting a CAGR of 9.5% during 2025–2034.

The urinalysis market refers to the global industry focused on the analysis of urine samples for diagnosing and monitoring medical conditions, including urinary tract infections, kidney diseases, and diabetes. The market is driven by the increasing prevalence of chronic diseases, the growing geriatric population, and the rising demand for point-of-care testing. Technological advancements, such as automated urine analyzers and digital urinalysis, are further supporting urinalysis market development. Additionally, increasing awareness about preventive healthcare and the expansion of diagnostic laboratories contribute to the market's expansion. Regulatory approvals and the integration of artificial intelligence in urinalysis testing are also influencing the industry's development.

To Understand More About this Research: Request a Free Sample Report

Urinalysis Market Dynamics

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases such as diabetes, kidney disorders, and urinary tract infections (UTIs) significantly propels the urinalysis market demand. For instance, the Centers for Disease Control and Prevention reported that in 2020, approximately 34.1 million adults in the US had diabetes, with a substantial number at risk for kidney-related complications. Urinalysis serves as a crucial, noninvasive diagnostic tool for early detection and management of these conditions, thereby driving its demand in clinical settings. The growing burden of these diseases necessitates regular monitoring, further amplifying the need for efficient urinalysis solutions.

Technological Advancements in Urinalysis Diagnostics

Advancements in diagnostic technologies have markedly enhanced the efficiency and accuracy of urinalysis. The development of automated urine analyzers and point-of-care testing devices has streamlined the diagnostic process, enabling rapid and reliable results. These innovations reduce manual intervention, minimize errors, and facilitate high-throughput analysis, making urinalysis more accessible across various healthcare settings. The integration of artificial intelligence and machine learning algorithms further refines diagnostic precision, supporting healthcare providers in making informed clinical decisions. Such technological progress improves patient outcomes and expands the application scope of urinalysis in preventive and personalized medicine. Hence, rising technological advancements in urinalysis diagnostics drive the urinalysis market demand.

Growing Emphasis on Preventive Healthcare

There is a heightened focus on preventive healthcare, with individuals and healthcare systems prioritizing early disease detection and regular health monitoring. Urinalysis plays a pivotal role in this paradigm by offering a simple yet effective means to screen for various health conditions. Routine urinalysis can detect asymptomatic issues, allowing for timely intervention and management. Government initiatives and public health campaigns further promote the importance of regular health check-ups, thereby increasing the adoption of urinalysis as a standard preventive measure. This proactive approach to health management contributes to the urinalysis market growth, as more individuals seek accessible and reliable diagnostic options.

Urinalysis Market Segment Insights

Urinalysis Market Evaluation by Product Outlook

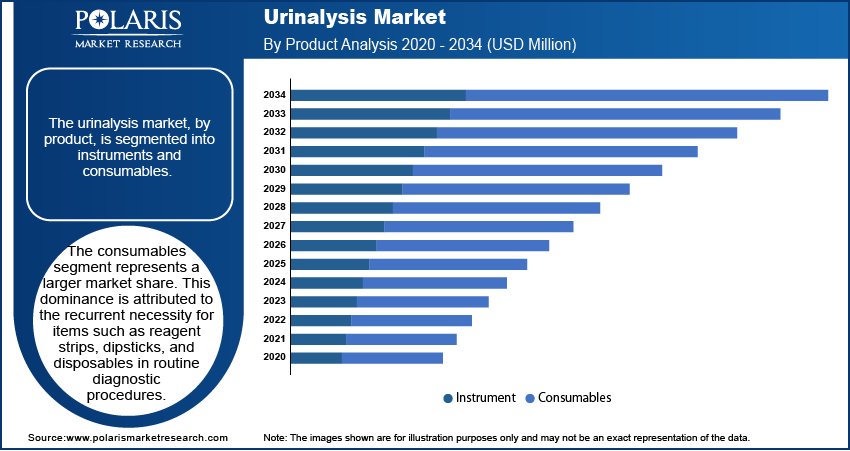

The urinalysis market, by product, is segmented into instruments and consumables. In 2024, the consumables segment accounted for a larger urinalysis market share. This dominance is attributed to the recurrent necessity for items such as reagent strips, dipsticks, and disposables in routine diagnostic procedures. Healthcare facilities, including hospitals and diagnostic laboratories, consistently require these consumables to conduct various urine tests, ensuring a steady and substantial demand. The continuous need for these products in daily medical operations underscores their significant share in the market.

The instruments segment is experiencing a higher growth rate. This surge is driven by technological advancements leading to the development of automated and semi-automated urine analyzers, as well as point-of-care devices. These innovations enhance diagnostic accuracy and efficiency, prompting healthcare providers to invest in modern instrumentation. The integration of advanced features, such as digital interfaces and connectivity, further propels the adoption of these instruments, contributing to their rapid market growth.

Urinalysis Market Assessment by Application Outlook

The urinalysis market, by application, is segmented into disease screening, fertility & pregnancy testing, and others. The disease screening segment held the largest market share in 2024. This prominence is attributed to the essential role urinalysis plays in diagnosing and monitoring various medical conditions, such as urinary tract infections, kidney diseases, and diabetes. The noninvasive nature and cost-effectiveness of urinalysis make it a preferred choice for routine health assessments in clinical settings. Additionally, the increasing prevalence of these diseases necessitates regular monitoring, further driving the demand for urinalysis in disease screening applications. Technological advancements have enhanced the accuracy and efficiency of urinalysis, reinforcing its widespread adoption for disease detection and management.

The pregnancy and fertility testing segment is expected to experience significant growth over the forecast period. The convenience and accessibility of urine-based tests for detecting pregnancy and assessing fertility have made them popular among consumers. Innovations in home-based testing solutions, including digital pregnancy tests and fertility monitoring kits, have empowered individuals to manage their reproductive health proactively. The rising awareness about reproductive health and the increasing availability of over-the-counter testing kits contribute to the expansion of this segment. As more individuals seek reliable and private means to monitor fertility and confirm pregnancies, the demand for urinalysis-based testing solutions continues to rise.

Urinalysis Market Regional Analysis

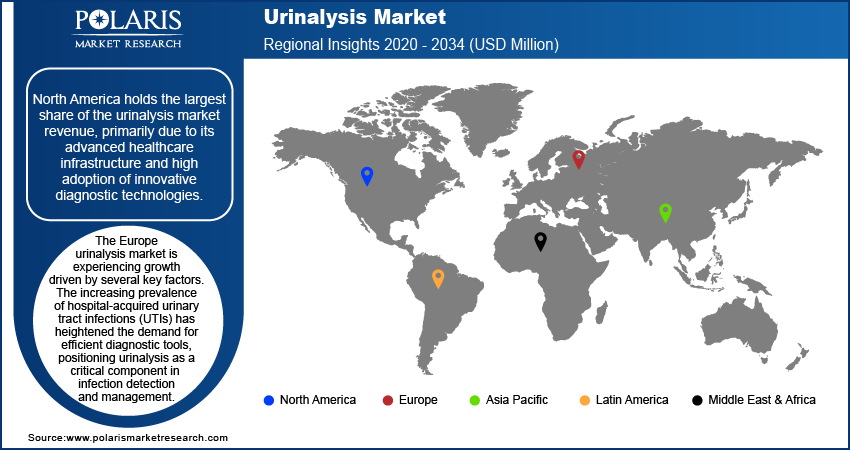

By region, the study provides urinalysis market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest urinalysis market revenue share in 2024, due to its advanced healthcare infrastructure and high adoption of innovative diagnostic technologies. The region's well-established medical facilities and significant healthcare expenditure facilitate the integration of sophisticated urinalysis equipment into routine clinical practice. Additionally, the increasing prevalence of chronic diseases, such as diabetes and kidney disorders, necessitates regular monitoring through urinalysis, further driving market demand. The presence of key industry players and ongoing research and development initiatives also contribute to the urinalysis market expansion in this region.

The Europe urinalysis market is experiencing growth driven by several key factors. The increasing prevalence of hospital-acquired urinary tract infections (UTIs) has heightened the demand for efficient diagnostic tools, positioning urinalysis as a critical component in infection detection and management. Technological advancements have led to the development of highly automated instruments, enhancing diagnostic accuracy and efficiency. The adoption of point-of-care urinalysis has expanded, enabling immediate testing and facilitating prompt clinical decisions. Government initiatives and stringent guidelines from organizations such as the European Confederation of Laboratory Medicine (ECLM) have standardized urinalysis procedures, further bolstering market growth. Germany stands out within the region, holding the largest market share, attributed to its advanced healthcare infrastructure and proactive approach to integrating innovative diagnostic technologies.

The Asia Pacific urinalysis market is poised for significant expansion in the coming years. This growth is primarily driven by the rising incidence of chronic diseases, including diabetes and kidney disorders, which necessitate regular monitoring through urinalysis. Strategic developments by key market players, such as product launches and technological innovations, have enhanced the availability and accessibility of advanced urinalysis solutions. The region's expanding geriatric population further contributes to market demand, as older adults are more susceptible to conditions requiring urinalysis for diagnosis and management. Additionally, the proliferation of diagnostic laboratories and improved healthcare facilities have facilitated the adoption of sophisticated urinalysis equipment. China emerges as a dominant force in the region, holding the largest market share, supported by its substantial population base and continuous advancements in healthcare infrastructure.

Urinalysis Market – Key Players and Competitive Insights

The competitive landscape of the urinalysis market is shaped by technological advancements, strategic partnerships, and a growing focus on automation. Companies are increasingly investing in research and development to introduce innovative solutions, such as automated urinalysis systems integrated with artificial intelligence and machine learning, for enhanced accuracy and efficiency. The market is characterized by the adoption of compact and portable analyzers, enabling decentralized testing in point-of-care settings. Strategic consolidations, such as mergers and acquisitions, are common as companies aim to expand their product portfolios and geographical reach. High entry barriers due to regulatory requirements and significant capital investments further define the market dynamics. Additionally, the integration of urinalysis systems with laboratory information systems (LIS) and electronic health records (EHR) is becoming a key trend, driven by the demand for seamless data management and connectivity across healthcare facilities. Regional players also maintain strong positions by offering specialized products tailored to local needs.

Siemens Healthineers AG is engaged in the urinalysis market, offering a comprehensive range of diagnostic solutions. Their portfolio includes advanced urine analyzers and reagent strips designed to enhance diagnostic accuracy and efficiency across various healthcare settings. Notably, Siemens Healthineers has developed the Atellica UAS 60 Analyzer, a compact system that automates urine sediment analysis, providing high-resolution digital imaging to closely replicate manual microscopy. This innovation aims to reduce human error and streamline laboratory workflows.

F. Hoffmann-La Roche Ltd., commonly known as Roche, is another key player in the urinalysis market. With over five decades of experience, Roche has continually advanced its urinalysis solutions to meet evolving clinical needs. Their product lineup features the cobas u 601 urine analyzer, a fully automated system that utilizes Chemstrip technology to deliver reliable and efficient urine testing. This analyzer is designed to minimize operator intervention, thereby enhancing laboratory productivity and ensuring consistent, high-quality results.

List of Key Companies in Urinalysis Market

- Abbott Laboratories

- ACON Laboratories, Inc.

- ARKRAY, Inc.

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc.

- Cardinal Health, Inc.

- Danaher Corporation

- Eiken Chemical Co., Ltd.

- EKF Diagnostics Holdings plc

- F. Hoffmann-La Roche Ltd.

- Quidel Corporation

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- 77 Elektronika Kft.

Urinalysis Industry Developments

- In December 2024, Copan Diagnostics received FDA approval for its urine collection and transport device, UriSponge, which features an innovative preservative formulation to enhance specimen stability.

- In August 2024, Alpha Laboratories Ltd. partnered with Clinical Design Technologies Ltd. to support the marketing and distribution of the world's first digital closed urine testing system.

- In June 2024, Community Health Center (CHC) Marwah launched a digital urine and blood analyzer, aiming to transform diagnostic capabilities.

Urinalysis Market Segmentation

By Product Outlook (Revenue USD Million, 2020–2034)

- Instrument

- Consumables

By Application Outlook (Revenue USD Million, 2020–2034)

- Disease Screening

- Fertility & Pregnancy Testing

- Others

By End Use Outlook (Revenue USD Million, 2020–2034)

- Hospitals

- Clinical Laboratories

- Home Care

- Research and Academics

- Others

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Urinalysis Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4,475.81 million |

|

Market Size Value in 2025 |

USD 4,892.07 million |

|

Revenue Forecast by 2034 |

USD 11,117.34 million |

|

CAGR |

9.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The urinalysis market has been segmented into detailed segments of product, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the urinalysis market focus on product innovation, strategic partnerships, and geographic expansion to strengthen their market presence. Advancements in automation and digital urinalysis systems are driving adoption in clinical laboratories and point-of-care settings. Strategic collaborations with healthcare providers and research institutions help enhance product development and market reach. Expanding distribution networks in emerging markets supports increased accessibility to urinalysis solutions. Additionally, investments in AI-driven diagnostics and cloud-based data management improve test accuracy and efficiency, further supporting urinalysis market opportunities.

FAQ's

The urinalysis market size was valued at USD 4,475.81 million in 2024 and is projected to grow to USD 11,117.34 million by 2034.

The market is projected to register a CAGR of 9.5% during the forecast period.

North America held the largest share of the market in 2024.

Abbott Laboratories; ACON Laboratories, Inc.; ARKRAY, Inc.; Becton, Dickinson and Company (BD); Bio-Rad Laboratories, Inc.; Cardinal Health, Inc.; Danaher Corporation; Eiken Chemical Co., Ltd.; EKF Diagnostics Holdings plc; F. Hoffmann-La Roche Ltd.; Quidel Corporation; Siemens Healthineers AG; Sysmex Corporation; Thermo Fisher Scientific Inc.; and 77 Elektronika Kft.

The consumables segment accounted for a larger share of the market in 2024.

The disease screening segment accounted for the largest share of the market in 2024.

Urinalysis is a diagnostic test that examines urine samples to detect and monitor various medical conditions, including infections, kidney diseases, diabetes, and other metabolic disorders. It involves physical, chemical, and microscopic analysis to assess factors such as urine color, pH levels, protein, glucose, and the presence of bacteria or blood cells. Urinalysis is commonly used in routine health check-ups, disease screening, and monitoring treatment effectiveness. The test is widely performed in hospitals, diagnostic laboratories, and point-of-care settings due to its noninvasive nature and ability to provide valuable clinical insights.

A few key trends in the market are described below: Adoption of Automated Urinalysis Systems – Increased demand for high-throughput, automated analyzers to improve diagnostic accuracy and efficiency. Integration of Artificial Intelligence (AI) and Machine Learning (ML) – AI-driven image analysis and data interpretation enhance result accuracy and workflow automation. Rising Demand for Point-of-Care Testing (POCT) – Growth in portable and handheld urinalysis devices for rapid diagnostics in homecare and outpatient settings. Advancements in Digital Urinalysis and Cloud-Based Data Management – Enhanced data storage, remote monitoring, and integration with electronic health records (EHR).

A new company entering the urinalysis market must focus on advanced technologies such as AI-powered urinalysis systems and biomarker-based diagnostics to enhance accuracy and early disease detection. Developing cost-effective, portable point-of-care testing (POCT) devices can improve accessibility in remote and home healthcare settings. Integration of cloud-based data management and electronic health records (EHR) connectivity can offer seamless digital solutions for laboratories and clinics. Expanding into emerging markets with affordable and user-friendly products can drive adoption. Additionally, strategic partnerships with healthcare providers and research institutions can accelerate innovation and market penetration.

Companies manufacturing, distributing, or purchasing urinalysis-related products and other consulting firms must buy the report.