Urgent Care Apps Market Size, Share, Trends, Industry Analysis Report: By App Type, Clinical Area (Stroke, Cardiac Conditions, Trauma, and Other Clinical Areas), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM1730

- Base Year: 2024

- Historical Data: 2019-2022

Urgent Care Apps Market Overview

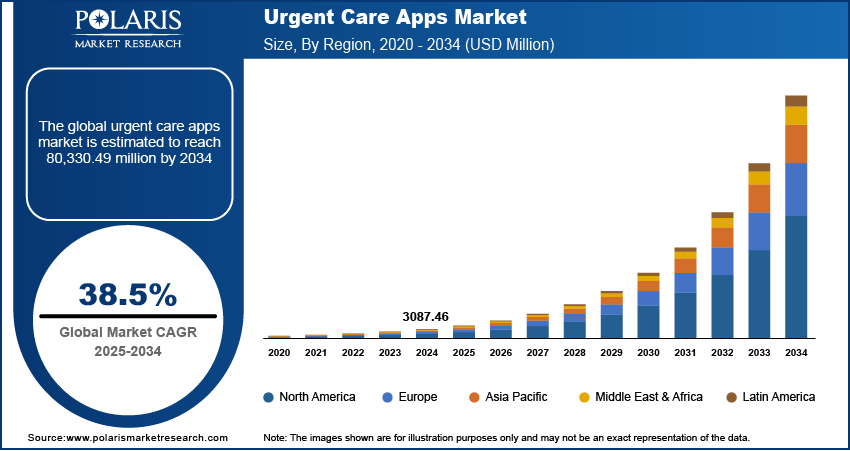

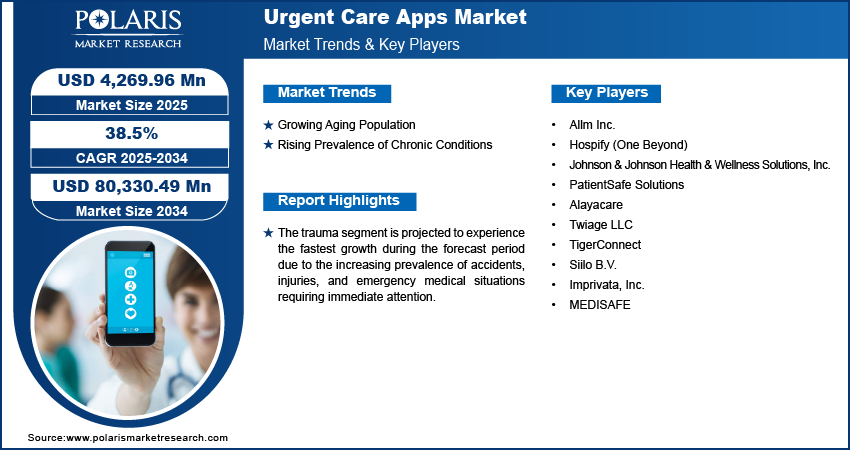

The global urgent care apps market size was valued at USD 3,087.46 million in 2024. The market is projected to grow from USD 4,269.96 million in 2025 to USD 80,330.49 million by 2034, exhibiting a CAGR of 38.5% from 2025 to 2034.

Urgent care apps are mobile or web-based applications designed to provide quick access to medical care and information for non-life-threatening conditions. These apps are often used to help users locate nearby urgent care centers, book appointments, consult with healthcare professionals, or seek medical advice.

The rising demand for convenient healthcare access is a significant driver of the urgent care apps market growth. Consumers increasingly prefer quick and accessible medical care that fits into their busy lifestyles, fueling the need for on-demand healthcare solutions. Urgent care apps help patients avoid long wait times at overcrowded emergency rooms (ERs), offering a more efficient and stress-free alternative for addressing urgent medical concerns.

The adoption of telemedicine has significantly contributed to the growth of the urgent care app market. The COVID-19 pandemic accelerated the use of telehealth services, making virtual consultations a mainstream option for addressing non-critical conditions. Moreover, increased familiarity with remote healthcare, combined with advancements in technology and patient preference for safe, accessible care, continues to drive the urgent care apps market expansion.

To Understand More About this Research: Request a Free Sample Report

Urgent Care Apps Market Dynamics

Growing Aging Population Worldwide

The growing aging population is driving the urgent care apps market development, as older adults often require frequent medical consultations for managing chronic conditions, routine check-ups, and unexpected health concerns. For instance, the Population Reference Bureau predicts that the number of Americans aged 65 and older will rise from 58 million in 2022 to 82 million by 2050, representing a 47% increase. This trend has significant implications for healthcare, policy, and economic structures. Mobility issues and the need for regular care make these apps very helpful for seniors. Urgent care apps allow elderly individuals to consult doctors, schedule appointments, and access healthcare services without leaving their homes, making care more convenient and reducing their effort. Additionally, these apps integrate features such as medication reminders and health monitoring, making them an essential tool for addressing the unique healthcare needs of an aging demographic.

Rising Prevalence of Chronic Conditions

The rising prevalence of chronic conditions is driving the urgent care apps market demand, as patients with long-term illnesses increasingly seek non-emergency consultations for routine management. For instance, according to the US Department of Health and Human Services, approximately 129 million individuals in the US are affected by at least one major chronic disease, such as cardiovascular disease, malignancies, diabetes mellitus, obesity, or hypertension. Urgent care apps provide a convenient platform for regular check-ins, medication refills, and follow-up care, reducing the need for frequent in-person visits to healthcare facilities. These apps include features such as appointment scheduling, virtual consultations, and integration with health records, empowering patients to better manage their conditions while saving time and effort.

Urgent Care Apps Market Segment Insights

Urgent Care Apps Market Assessment Based on App Type

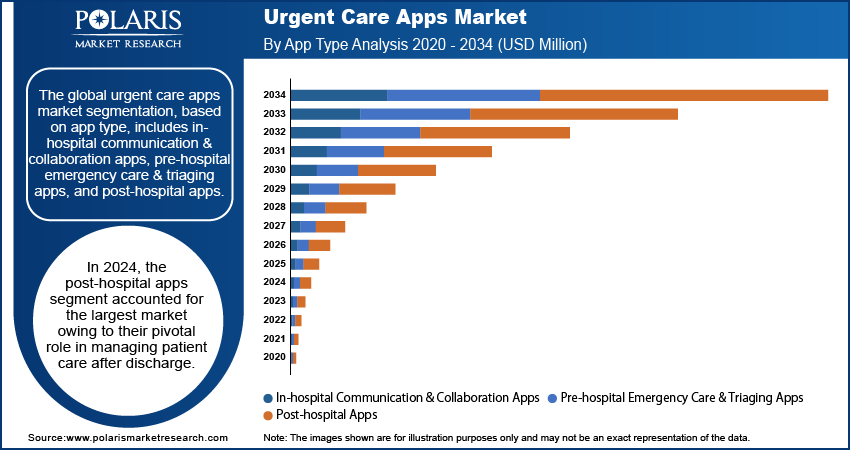

The global urgent care apps market segmentation, based on app type, includes in-hospital communication & collaboration apps, pre-hospital emergency care & triaging apps, and post-hospital apps. In 2024, the post-hospital apps segment accounted for the largest urgent care apps market share due to their pivotal role in managing patient care after discharge. These apps offer seamless transitions from hospital care to home-based recovery by enabling patients to schedule follow-up appointments, track recovery progress, and receive ongoing medical guidance. Additionally, they empower healthcare providers with real-time data, improving communication and collaboration between patients and their medical teams. With a growing focus on patient-centric care, post-hospital apps have become essential tools for maintaining long-term health outcomes, contributing to their significant market dominance.

Urgent Care Apps Market Evaluation Based on Clinical Area

The global urgent care apps market segmentation, based on clinical area, includes stroke, cardiac conditions, trauma, and other clinical areas. The trauma segment is projected to experience the fastest growth from 2025 to 2034 due to the increasing prevalence of accidents, injuries, and emergency medical situations requiring immediate attention. Trauma cases, ranging from fractures to severe injuries, have driven an increasing demand for rapid, dependable, and easily accessible medical care. Urgent care apps provide a critical solution by offering timely advice, real-time triaging, and the ability to connect with emergency services rapidly. These apps enhance the speed of response, making it easier for patients and first responders to access essential care. Furthermore, trauma patients often require ongoing care and monitoring, which urgent care apps facilitate, boosting their relevance in the broader healthcare landscape. Thus, with the growing emphasis on timely medical intervention, the trauma segment is expected to be a major driver of market growth in the coming years.

Urgent Care Apps Market Regional Analysis

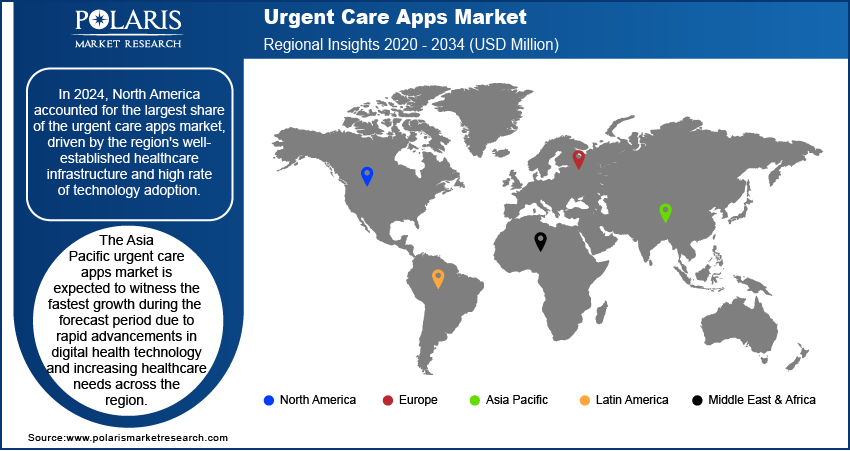

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the urgent care apps market, driven by the region's well-established healthcare infrastructure and high rate of technology adoption. The US, in particular, has witnessed a surge in the use of digital health solutions, with urgent care apps offering a convenient and cost-effective alternative to traditional in-person visits. For instance, in November 2024, the "Digital Health" event, organized by the Office of Research Development, facilitated innovation in the urgent care apps market by connecting healthcare and technology experts. This event has accelerated the development of effective solutions, enhancing the growth of urgent care apps. The preference for accessible, on-demand healthcare services among the population has fueled the widespread use of urgent care apps for everything from consultations to follow-up care. Moreover, North American healthcare systems, which are increasingly focused on improving patient experience and reducing healthcare costs, are embracing telemedicine and urgent care apps as vital tools to achieve these goals. The region’s robust investment in health tech innovations, coupled with favorable regulatory policies, further solidifies its dominance in the global market.

The US urgent care apps holds the largest revenue share due to various factors, including the country's advanced healthcare infrastructure, widespread adoption of smartphones, and high demand for accessible and efficient healthcare solutions. The US has a well-established telemedicine ecosystem, where urgent care apps play a critical role in offering quick, convenient medical consultations for non-emergency conditions, reducing the strain on emergency rooms and primary care facilities.

The Asia Pacific urgent care apps market is expected to witness the fastest growth during the forecast period due to rapid advancements in digital health technology and increasing healthcare needs across the region. Several countries in Asia Pacific are investing heavily in improving their healthcare systems, resulting in a significant rise in the adoption of mobile health solutions, including urgent care apps. For instance, in May 2024, the World Bank Group reported that the World Bank is enhancing Indonesia's healthcare through a USD 4.3 billion initiative, the Indonesia Health Systems Strengthening Project, approved in December 2023. Co-financed by the Asian Infrastructure Investment Bank, Asian Development Bank, and Islamic Development Bank, the project aims to improve the availability of functional medical equipment in public health facilities and increase the utilization of public health services nationwide. Urgent care apps cater to the growing demand for accessible healthcare in both urban and rural areas, especially as populations become more technologically proficient and reliant on smartphones. Additionally, government initiatives aimed at digitizing healthcare and expanding telemedicine access contribute to the growth of the market in Asia Pacific, making it one of the fastest-growing regions for urgent care apps globally.

China is expected to witness the fastest growth during the forecast period, driven by the country's large and rapidly growing population, which has increased the demand for accessible and affordable healthcare solutions. The widespread adoption of smartphones and mobile internet in China has enabled greater access to health apps, including urgent care platforms, marking a significant push towards digitalization.

Urgent Care Apps Market – Key Players and Competitive Insights

The competitive landscape of the urgent care apps market is characterized by a diverse mix of established healthcare providers, tech startups, and digital health companies, all competing for market share by offering innovative solutions and services. Key players include companies that specialize in telemedicine, healthcare platforms, and mobile health technologies. These players provide a range of services, such as virtual consultations, appointment scheduling, symptom checkers, and health record integration. Some major competitors in the market are well-known brands such as Teladoc Health, Zocdoc, Solv, and Amwell, which have established platforms that provide urgent care needs, offering features such as online consultations, prescription services, and real-time appointment booking. These companies benefit from their strong brand recognition, large user bases, and partnerships with health insurers and healthcare providers.

Additionally, smaller startups and innovative tech companies are entering the market, developing niche solutions to cater to specific needs, such as AI-powered symptom checkers or mental health-focused urgent care services. These new entrants bring fresh ideas and technology-driven solutions, adding to the competitive dynamics. Key players in the market include Allm Inc.; Hospify (One Beyond); Johnson & Johnson Health & Wellness Solutions, Inc.; PatientSafe Solutions; Alayacare; Twiage LLC; TigerConnect; Siilo B.V.; Imprivata, Inc.; and MEDISAFE.

Imprivata Inc., founded in 2004, is a major digital identity security company based in Waltham, Massachusetts, primarily serving the healthcare sector. The company specializes in identity and access management (IAM) solutions that enhance security while streamlining workflows for healthcare professionals. Imprivata Inc. solutions include Access Management, featuring enterprise Single Sign-On (SSO), passwordless multi-factor authentication (MFA), NHS Spine Access, and rapid access to shared medical devices and patient data through touchless facial and palm vein recognition. Imprivata also specializes in Identity Governance and Administration, providing day-one role-based access to ensure security and operational readiness. The company’s Mobile Access Management optimizes shared mobile devices with SSO and risk analytics for secure workflows.

Johnson & Johnson Health and Wellness Solutions, Inc. is engaged in transforming healthcare by providing innovative, cost-effective, and scalable solutions aimed at improving health outcomes for individuals and populations. The company specializes in population health, energy management, health risk assessments, health and fitness applications, and digital health coaching. Their approach combines behavior science, consumer insights, healthcare analytics, human-centered design thinking, and clinical expertise to create comprehensive solutions that drive sustainable, positive change in healthcare.

List of Key Companies in Urgent Care Apps Market

- Allm Inc.

- Hospify (One Beyond)

- Johnson & Johnson Health & Wellness Solutions, Inc.

- PatientSafe Solutions

- Alayacare

- Twiage LLC

- TigerConnect

- Siilo B.V.

- Imprivata, Inc.

- MEDISAFE

Urgent Care Apps Industry Developments

In June 2024, AlayaCare, a technology platform for home and community-based care, launched AlayaCare Apps. The company stated that the solution enables home care providers to customize their software to fit specific workflows and operational needs, enhancing efficiency while reducing time and costs.

In February 2022, Allm Inc. announced that "Join," a communication app for healthcare professionals, has been implemented in 1,000 medical institutions across 30 counties.

Urgent Care Apps Market Segmentation

By App Type Outlook (Revenue – USD Million, 2020–2034)

- In-Hospital Communication & Collaboration Apps

- Pre-Hospital Emergency Care & Triaging Apps

- Post-Hospital Apps

- Rehabilitation Apps

- Care Provider Communication & Collaboration Apps

- Medication Management Apps

By Clinical Area Outlook (Revenue – USD Million, 2020–2034)

- Stroke

- Cardiac Conditions

- Trauma

- Other Clinical Areas

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Urgent Care Apps Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,087.46 million |

|

Market Size Value in 2025 |

USD 4,269.96 million |

|

Revenue Forecast by 2034 |

USD 80,330.49 million |

|

CAGR |

38.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global urgent care apps market size was valued at USD 3,087.46 million in 2024 and is projected to grow to USD 80,330.49 million by 2034.

The global market is projected to register a CAGR of 38.5% from 2025 to 2034.

In 2024, North America accounted for the largest share of the urgent care apps market, driven by the region's well-established healthcare infrastructure and high rate of technology adoption.

A few of the key players in the market are Allm Inc.; Hospify (One Beyond); Johnson & Johnson Health & Wellness Solutions, Inc.; PatientSafe Solutions; Alayacare; Twiage LLC; TigerConnect; Siilo B.V.; Imprivata, Inc.; and MEDISAFE.

In 2024, the post-hospital apps segment accounted for the largest market share due to their pivotal role in managing patient care after discharge.

• The trauma segment is projected to experience the fastest growth during the forecast period due to the increasing prevalence of accidents, injuries, and emergency medical situations requiring immediate attention.