Unsaturated Polyester Resins Market Size, Share, Trends, Industry Analysis Report: By Product, Form (Liquid Form and Powder Form), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM5367

- Base Year: 2024

- Historical Data: 2020-2023

Unsaturated Polyester Resins Market Overview

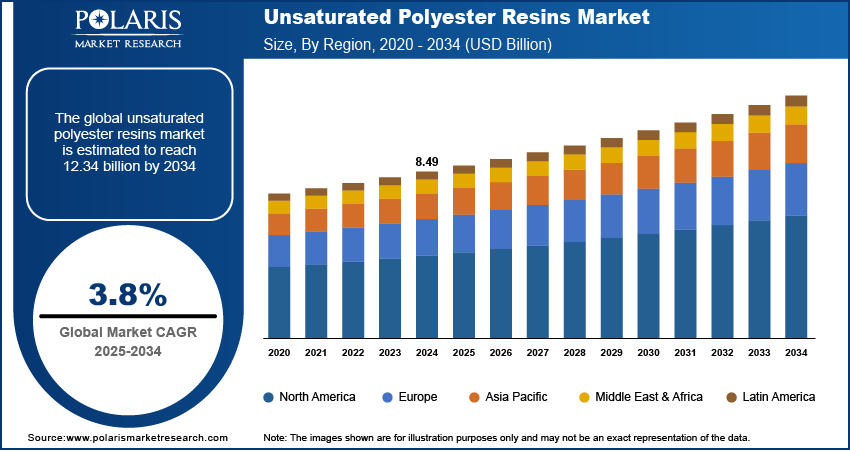

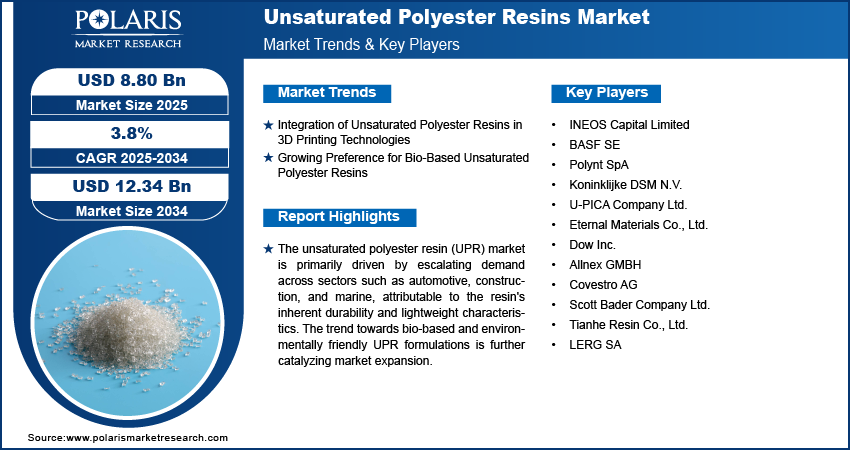

The global unsaturated polyester resins market size was valued at USD 8.49 billion in 2024. The market is projected to grow from USD 8.80 billion in 2025 to USD 12.34 billion by 2034, exhibiting a CAGR of 3.8% from 2025 to 2034.

Unsaturated polyester resins (UPRs) are a type of synthetic resin made by polymerizing unsaturated monomers with polyols. These resins are commonly used in the production of composite materials, coatings, and adhesives. They are valued for their versatility, durability, and ability to bond with a variety of reinforcing fibers like glass, making them ideal for automotive, construction, marine, and aerospace applications.

To Understand More About this Research: Request a Free Sample Report

The unsaturated polyester resins (UPR) market growth is being driven by the rising demand for lightweight and durable materials across various sectors, such as automotive, construction, marine, and aerospace. UPRs are preferred for their exceptional mechanical properties, corrosion resistance, and compatibility with composite applications. Recent advancements in the field include the development of eco-friendly formulations that minimize volatile organic compound (VOC) emissions. For instance, in May 2021, BASF launched UPR formulations with reduced volatile organic compound (VOC) emissions to meet evolving industry standards and address environmental concerns. Additionally, BASF expanded its product portfolio to cater to the increasing demand for lightweight and durable materials, particularly in automotive and construction applications.

The increasing utilization of composites in automotive components and the growing emphasis on energy-efficient materials are other key factors driving the unsaturated polyester resins market development. The market is witnessing robust expansion in emerging economies, driven by infrastructure development and a surge in automotive manufacturing activities.

Unsaturated Polyester Resins Market Dynamics

Integration of Unsaturated Polyester Resins in 3D Printing Technologies

Unsaturated polyester resins are known for their ability to fabricate components that exhibit high strength and durability, along with their capability to accommodate intricate geometrical configurations. For instance, in April 2023, Henkel launched Loctite 3D IND249, a high-temperature, high-strength photopolymer resin for industrial 3D printing. Designed for challenging geometries and fine feature resolution, the resin offers low viscosity and high green strength, enabling precise printing with ease of processing. Ideal for applications such as mold tooling and manufacturing aids, the resin is validated for use with printers from Nexa3D, Rapid Shape, and Stratasys. Additionally, UPRs are uniquely suited for additive manufacturing due to their superior mechanical attributes, which surround noteworthy impact resistance and flexibility. This shift towards the use of UPRs for additive manufacturing is particularly applicable to sectors such as automotive, aerospace, and construction, where there is a pressing demand for customized, lightweight components that meet rigorous performance standards. Thus, the adoption of UPRs within 3D printing technologies is driving the unsaturated polyester resins market expansion.

Growing Preference for Bio-Based Unsaturated Polyester Resins

Bio-based UPRs are recognized for their environmentally friendly nature and reduced reliance on petroleum-based materials. These resins offer the same high performance as traditional UPRs while lowering volatile organic compound (VOC) emissions and improving sustainability. As industries focus on eco-conscious solutions, bio-based UPRs are increasingly being adopted in sectors such as automotive, construction, and marine. Additionally, manufacturers are investing in developing bio-based polymer formulations to meet regulatory standards and consumer demand for greener products. For instance, in September 2024, Exel Composites partnered with INEOS to commercialize the use of bio-based ENVIREZ resins, reducing carbon emissions by 21% compared to traditional fossil-based resins. The resin contains 23% bio-based glycol and maintains the same performance as its fossil counterpart. It aims to reduce Scope 3 emissions and advance eco-friendly manufacturing in the composites industry. Thus, the growing preference for bio-based UPRs is boosting the unsaturated polyester resins market revenue.

Unsaturated Polyester Resins Market Segment Insights

Unsaturated Polyester Resins Market Assessment by Product Insights

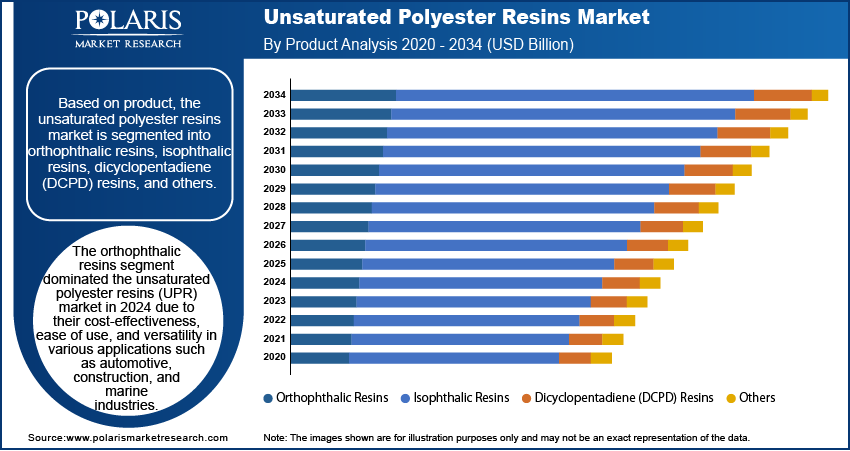

The global unsaturated polyester resins market segmentation, based on product, includes orthophthalic resins, isophthalic resins, dicyclopentadiene (DCPD) resins, and others. The orthophthalic resins segment dominated the unsaturated polyester resins (UPR) market in 2024 due to their cost-effectiveness, ease of use, and versatility in various applications, such as automotive, construction, and marine industries. These resins offer a balance of good mechanical properties, corrosion resistance, and durability, making them the preferred choice for standard applications. Additionally, orthophthalic resins are widely available and well-established in the market, which contributes to their dominance. Their ability to meet both functional and economic requirements positions them as the go-to resin for high volume production, driving their strong market presence.

Unsaturated Polyester Resins Market Evaluation by Form Insights

The global unsaturated polyester resins market segmentation, based on form, includes liquid form and powder form. The powder form of unsaturated polyester resins is expected to grow from 2025 to 2034 due to its ease of handling, reduced wastage, and improved storage stability. Powder resins offer better control over application thickness, leading to a more uniform and consistent finish. The increasing demand for energy efficient and environmentally friendly solutions is driving the adoption of powder coatings, as they generate fewer emissions compared to liquid forms. Additionally, the growing use of powder resins in the automotive and construction industries for durable and high-performance coatings contributes to the growth of the segment.

Unsaturated Polyester Resins Market Regional Analysis

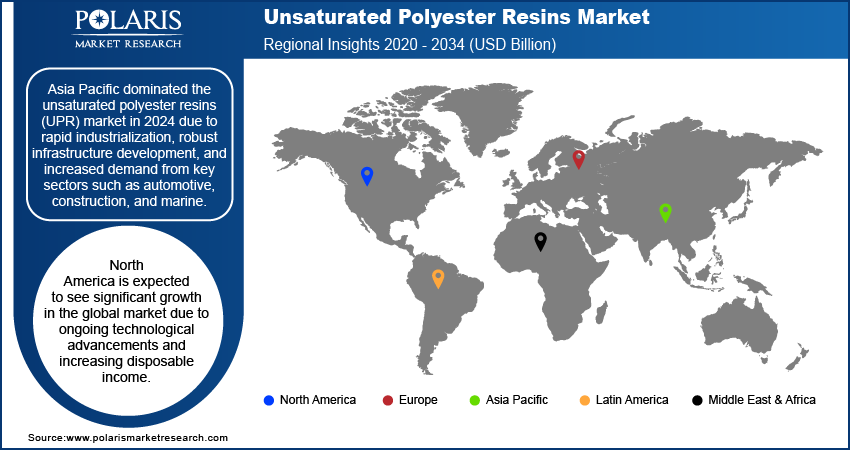

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the unsaturated polyester resins (UPR) market in 2024 due to rapid industrialization, robust infrastructure development, and increased market demand from key sectors such as automotive, construction, and marine. The region's manufacturing capabilities, along with the growing adoption of UPR in various applications, contribute to its market leadership. For instance, in April 2024, BASF's coatings division launched a new generation of clear coats and undercoats for the Asia Pacific refinish market that offers higher quality and increased productivity and contributes to a significant reduction in CO2 emissions. Additionally, countries like China and India are experiencing significant growth in the production of composite materials and coatings, supported by favorable regulatory policies and investments in sustainable technologies. As a result, Asia Pacific has become a major hub for UPR consumption, further driving its dominance in the global market.

North America is expected to see significant growth in the unsaturated polyester resins (UPR) market due to ongoing technological advancements and increasing disposable income. A shift towards sustainable and high performance composite materials further fuels the region’s robust market demand from key industries such as automotive and construction. Additionally, North America’s focus on eco-friendly technologies and innovation in UPR applications, especially in electric vehicle production and lightweight construction materials, is driving growth. Increasing consumer purchasing power is also expected to enhance the market demand for durable, high-performance materials, supporting market expansion in the region.

Unsaturated Polyester Resins Market – Key Players and Competitive Insights

The competitive landscape of the unsaturated polyester resins (UPR) market is characterized by a mix of global leaders and regional players vying for market share through innovation, strategic collaborations, and geographic expansion. Major players in the market, such as BASF SE, Polynt SpA, Koninklijke DSM N.V., and others, leverage their strong research and development capabilities, extensive distribution networks, and technical expertise to provide advanced UPR solutions for applications across diverse sectors, including automotive, construction, marine, and aerospace. These leading companies focus on product innovation, enhancing properties such as durability, corrosion resistance, and sustainability to meet the growing market demand for high-performance materials. Meanwhile, smaller regional companies are developing niche UPR products designed for specific local markets, offering tailored solutions to meet unique market needs. Competitive strategies in this market include mergers and acquisitions, partnerships with material suppliers, and expanding product portfolios to increase market reach in key regions. A few key major players are INEOS Capital Limited., BASF SE; Polynt SpA; Koninklijke DSM N.V.; U-PICA Company. Ltd.; Eternal Materials Co., Ltd.; Dow Inc.; Allnex GMBH; Covestro AG; Scott Bader Company Ltd.; Tianhe Resin Co., Ltd.; and LERG SA.

BASF SE specializes in the production of unsaturated polyester resins, offering versatile solutions for coatings, adhesives, and composite materials across multiple industries. BASF’s notable products in this category include LAROMER UP 35 D, a medium-reactive resin tailored for wood coatings that offers high scratch resistance, strong adhesion, and low curing stress. It boosts production efficiency, cuts energy use, and supports translucent extenders like barium sulfate, ideal for primers and sealers in wood finishes. BASF’s LAROMER UP 9118 is a durable, radiation-curable resin for furniture and flooring finishes. It supports easy matting and various gloss levels and reduces VOC emissions for enhanced sustainability. Additionally, BASF's BASONOL HPE 1170 B, a hyperbranched co-binder for high-solid acrylics, enhances hardness and chemical resistance while remaining cost-effective and eco-compliant, exemplifying BASF’s commitment to sustainable, high-performance solutions.

Dow Inc. is a materials science company based in Midland, Michigan, USA, operating primarily through its subsidiary, The Dow Chemical Company (TDCC). The company has diverse product offerings, such as plastics, performance materials, coatings, silicones, and industrial intermediates. Its product portfolio includes packaging, infrastructure, mobility, and consumer care. Key applications of Dow’s products span home and personal care, durable goods, adhesives, sealants, coatings, and food packaging. The company operates through three main business segments, which include packaging & specialty plastics for packaging solutions. Industrial Intermediates, which provide essential materials for manufacturing across multiple industries and Performance Materials & Coatings. Also, the company offers a range of unsaturated polyester resins (UPR) designed for applications in construction, automotive, and marine industries. These resins provide excellent durability, corrosion resistance, and enhanced performance for composite materials. Dow's region of operation includes North America, Latin America, Europe, the Middle East, Africa, and Asia Pacific.

List of Key Companies in Unsaturated Polyester Resins Market

- INEOS Capital Limited

- BASF SE

- Polynt SpA

- Koninklijke DSM N.V.

- U-PICA Company Ltd.

- Eternal Materials Co., Ltd.

- Dow Inc.

- Allnex GMBH

- Covestro AG

- Scott Bader Company Ltd.

- Tianhe Resin Co., Ltd.

- LERG SA

Unsaturated Polyester Resins Industry Developments

In January 2024, Scott Bader launched a USD15.25 Billion manufacturing facility in North Carolina to produce structural adhesives and gelcoats, enhancing its service to North American markets such as marine, renewables, and e-mobility. This expansion, alongside recent investments in its Canadian facility, aims to address global supply chain challenges, increase production capacity.

In April 2023, AOC and BÜFA expanded their existing collaboration for distributing products in Southeast Europe, allowing customers access to a broad range of Vinyl Ester and unsaturated polyester formulations through BÜFA Composites Austria for multiple countries.

Unsaturated Polyester Resins Market Segmentation

By Product Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Orthophthalic Resins

- Isophthalic Resins

- Dicyclopentadiene (DCPD) Resins

- Others

By Form Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Liquid Form

- Powder Form

By End Use Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Building & Construction

- Tanks & Pipes

- Electrical

- Marine

- Transport

- Artificial Stones

- Others

By Regional Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Unsaturated Polyester Resins Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.49 billion |

|

Market Size Value in 2025 |

USD 8.80 billion |

|

Revenue Forecast by 2034 |

USD 12.34 billion |

|

CAGR |

3.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global unsaturated polyester resins market size was valued at USD 8.49 billion in 2024 and is projected to grow to USD 12.34 billion by 2034.

The global market is projected to register a CAGR of 3.8% from 2025 to 2034.

Asia Pacific dominated the global market in 2024 due to rapid industrialization and robust infrastructure development in the region.

A few of the key players in the market are INEOS Capital Limited., BASF SE; Polynt SpA; Koninklijke DSM N.V.; U-PICA Company. Ltd.; Eternal Materials Co., Ltd.; Dow Inc.; Allnex GMBH; Covestro AG; Scott Bader Company Ltd.; Tianhe Resin Co., Ltd.; and LERG SA.

The orthophthalic resins segment dominated the UPR market in 2024.

The powder form of unsaturated polyester resins is expected to grow during the forecast period.