Unmanned Surface Vehicle Market Share, Size, Trends, Industry Analysis Report, By Size (Extra-Large USV, Large USV, Medium USV, Small USV); By Mode of operation; By Component; By Hull Type; By Endurance; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3886

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

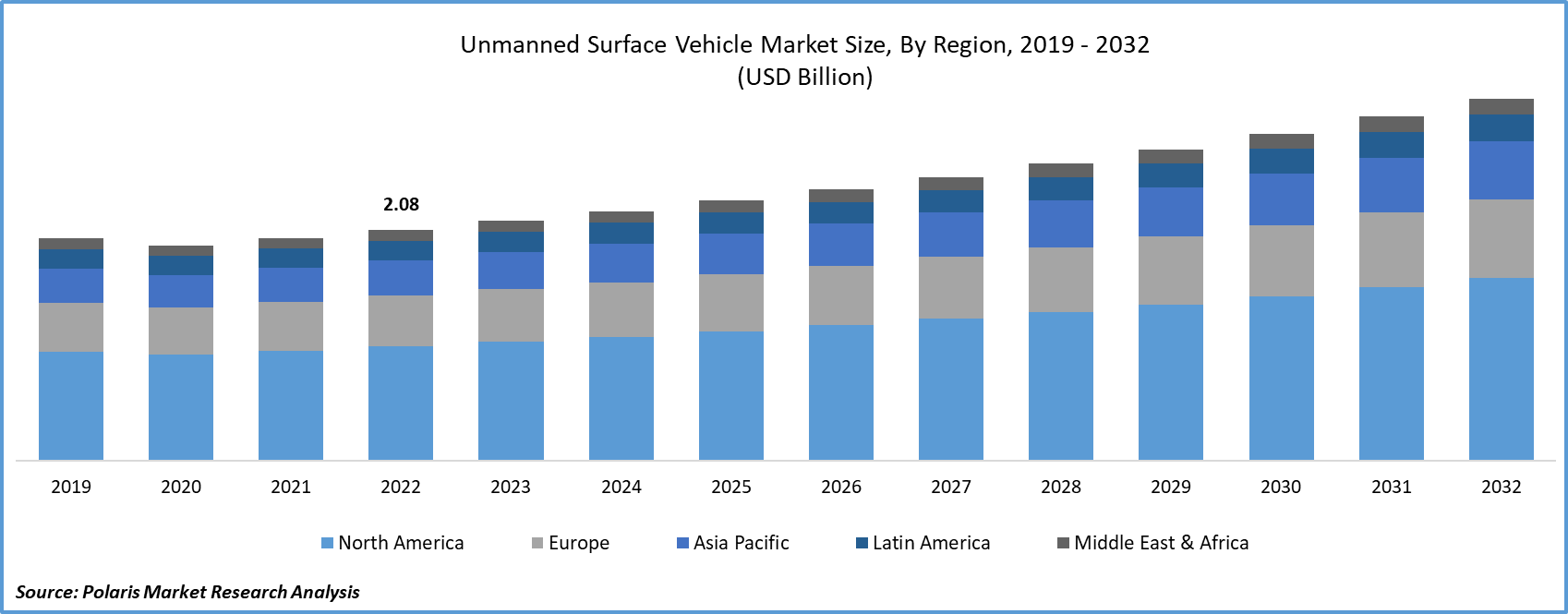

The global unmanned surface vehicle market size and share was valued at USD 2.16 billion in 2023 and is expected to grow at a CAGR of 4.80% during the forecast period.

Unmanned surface vehicles (USVs) are watercraft that function on the surface without human crew members aboard, equipped with diverse sensors and setups for remote control by operators on land or other vessels. USVs serve numerous purposes in commerce, research, and the military, offering a cost-efficient means for hydrographic surveys and oceanographic research compared to traditional research vessels. Additionally, they play a pivotal role in military operations by acting as an initial line of defense, thereby minimizing risks to military personnel.

Unmanned surface vehicles (USVs) have varying levels of autonomy. They can either be remote-controlled by a human pilot or have semi-autonomous obstacle avoidance. Besides, some USVs can autonomously navigate a route from the start to the end. With technological advances, some Unmanned surface vehicles market key players offer all three levels of autonomy in their USVs. During autonomous operation, most USVs can have their path updated and changed from a remote location.

Depending on the environment in which they are being operated, USVs necessitate different types of communication. If the USV operates on a river or lake, a radio frequency (RF) or cellular network may be employed. If the USV is far out in the sea or ocean, satellite communications will be needed. Owing to their compact design and cost-effective nature, unmanned surface vehicles are suitable for a wide range of applications. They’re primarily used in naval & homeland security, anti-submarine warfare, and intelligence, surveillance & reconnaissance. Furthermore, these vehicles find applications in hydrography & oceanography, and natural resource mapping & exploration.

To Understand More About this Research: Request a Free Sample Report

Equipped with a differential global positioning system (DGPS) receiver, this vehicle can function under remote control or autopilot mode through its onboard control software. For LBL positioning, it utilizes an acoustic transceiver towed behind the Sonobot, establishing a wireless connection with a PC running positioning software (SiNAPS). Leveraging a USV with LBL positioning offers time and cost efficiencies, enabling the deployment of larger vessels, with the added benefit of an extended battery life exceeding 10 hours.

This trend fuels market expansion in the projected timeframe. Unmanned surface vehicles (USVs) excel at executing predefined missions, capturing high-quality optical and acoustic imagery, and collecting vital environmental data, including parameters like temperature, salinity, depth, and currents. Further technological advancements and enhanced intelligence will empower USVs to engage in cooperative autonomous operations with similar vehicles, bolstering network capabilities. The primary emphasis remains on technological improvements aimed at enhancing performance while reducing power consumption and costs. A significant area of concentration revolves around enhancing computing and communication capabilities to streamline data processing.

The unmanned surface vehicle market study is a compilation of first-hand data, quantitative and qualitative assessment by industry experts, and inputs from the most relevant stakeholders in the value chain. It uses a number of analytical tools to study and assess the data of key industry players and their unmanned surface vehicle market share. Analytical tools used to prepare the report include SWOT analysis, Porter’s Five Forces analysis, feasibility study and investment return analysis, amongst others.

Industry Dynamics

Growth Drivers

The Growth of the Market is Driven by the Rising Demand and Necessity for Ocean Cleaning Through Unmanned Vehicles

In recent years, the Surface-to-Air Missile (SAM) market has undergone a revolutionary transformation, enhancing naval operations significantly. SAM systems have evolved from basic tools into highly autonomous systems with versatile capabilities. Additionally, numerous nations are grappling with asymmetric warfare, characterized by diverse strategies devised by various defense departments. Asymmetric warfare involves unconventional tactics and strategies and can manifest as threats such as attacks by individuals, organizations, or nations targeting governments, militaries, or valuable assets for acquisition or destruction. Countries maintain vigilant monitoring of these threats for protection and to address various applications, including combatting illicit drug trafficking, investigating air crashes and maritime incidents, and facilitating payload delivery.

As an illustrative instance, in January 2023, the Indian Navy engaged in a contract under the 'SPRINT' initiative to develop Armed Autonomous Boat Swarms. This contract was executed with Sagar Defense Engineering Pvt. Ltd., with a focus on advancing 75 indigenous technologies for the Indian Navy. SPRINT marks India's 50th contract dedicated to supporting the development of specialized defense technologies by domestic companies.

Report Segmentation

The market is primarily segmented based on size, mode of operation, component, hull type, endurance, application, and region.

|

By Size |

By Mode of Operation |

By Component |

By Hull Type |

By Endurance |

By Application |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

The Power & Propulsion Systems Segment Held the Largest Revenue Share in 2022

In 2022, The power & propulsion systems segment is anticipated to lead as the dominant and swiftest-growing segment during the forecast period. In the realm of Unmanned Surface Vehicles (USVs), builders are tasked with substituting human interface components with remote human interfaces. The development of remote control capabilities for propulsion systems necessitates engagement with their proprietary and restricted internal communications. Companies like Torqeedo, Volvo, Mercury, and numerous others provide control interfaces primarily designed for human operation. Enhanced control interfaces are indispensable for uncrewed vessels to simplify the designer's tasks.

For Instance, In July 2023, USV AS inked a deal with the shipyard Astilleros Gondán to manufacture an unmanned surface vessel. This vessel is poised to bring about substantial reductions in emissions and operational expenses when compared to conventional vessels employed for subsea Inspection, Maintenance, and Repair (IMR) tasks. The USV will boast dimensions of 24 meters in length and 7.5 meters in width, equipped with a hybrid diesel and electric propulsion system. This system incorporates a battery package provided by Seam, enabling the uncrewed vessel to remain at sea for a remarkable duration of 30 days without the need for refueling or recharging.

By Mode of Operation Analysis

The Remotely Operated Segment Accounted for the Highest Market Share During the Forecast Period

In 2022, the remotely operated segment took the lead in market share. Companies are actively exploring the benefits of remote operation and uncrewed vessel technologies to enhance efficiency while simultaneously reducing costs and mitigating risks in diverse offshore wind farm and subsea development activities. For instance, in June 2023, a Norwegian Joint Undertaking, comprising DeepOcean and SOLstad Offshore, secured a contract for the inaugural uncrewed surface vessel uniquely crafted for offshore inspection, maintenance, and repair operations.

On the other hand, the autonomous segment is set for the most rapid growth between 2023 and 2030. Autopilot technology enables Unmanned Surface Vehicles (USVs) to independently carry out missions, employing advanced features similar to those used in Unmanned Aerial Vehicles (UAVs). The substantial technological advancements are a driving force pushing the autonomous segment to the forefront.

By Application Analysis

The Hydrography & Oceanography Segment Accounted for the Highest Market Share During the Forecast Period

Hydrographic surveys represent the most prevalent and well-established domain for the utilization of unmanned surface vehicles. These surveys usually entail extended durations and continual back-and-forth journeys. Thanks to the embedded autonomous navigation system in hydrographic survey USVs, repetitive and labor-intensive tasks can be effectively eliminated.

The intelligence, surveillance, and reconnaissance (ISR) segment is anticipated to be the most rapidly growing sector. Unmanned Surface Vehicles (USVs) serve diverse military purposes, encompassing powered seabed targets, mine detection, surveillance and reconnaissance, strike operations, and area denial or sea denial strategies. The projected robust growth of this segment is primarily attributed to the expanding array of military applications in the foreseeable future.

Regional Insights

North America Dominated the Largest Market in 2022

In 2022, North America is poised to command the largest share of the Unmanned Surface Vehicle market, mainly due to the concentration of developers in the region. This expansion is a result of the rising defense budget allocated by the U.S. Navy, which has subsequently boosted the demand for these vehicles in the United States. Additionally, the surge in Canadian exports and economic development is anticipated to propel market growth further.

During the forecast period, Asia Pacific is anticipated to be the most rapidly growing region in the market. The Chinese market is poised to take the lead in Asia Pacific, driven by a surging demand for robust Unmanned Surface Vehicles (USVs) in both commercial and defense sectors, encompassing applications like combat and cargo transport. The increasing utilization of USVs in India is also expected to contribute to market expansion.

In Europe, the expected rise in market share is driven by increased oil and gas production, exploration activities, and marine operations. For example, in January 2022, Holland Shipyards Group secured a contract with Trafficikverket Sweden to build and operate up to four fully electric autonomous ferries. These ferries will feature IMO Autonomy level 2 and will be remotely controlled from a center in Stockholm.

The rest of the world is also poised for substantial growth during the forecast period, with the UAE experiencing a surge in autonomous vessel deployments. Remarkable growth is anticipated in the rest of the world, driven by the expanding exploration and oil & gas sectors in Latin America and the Middle East & Africa.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- 5G international

- ASV

- Atlas Elektronik GmbH

- ECA Group

- Elbit Systems

- Fugro

- Kongsberg Maritime

- L3 Harris Technologies

- Liquid Robotics

- Rafael Advanced Defense Systems Ltd.

- SaaB AB

- Teledyne Technologies

- Textron Inc

- Thales Group

Recent Developments

- In June 2023, The Thales Unmanned Surface Vessel (USV) named Apollo successfully concluded a demanding set of autonomous trials for Mine Countermeasure (MCM) operations. This achievement marks a significant milestone toward enabling autonomous mine-hunting operations in both the Royal Navy and the wider industry. Apollo, an RNMB (Royal Navy Motor Boat) developed by Thales, underwent a series of rigorous open-water assurance tests.

- In February 2023, The Blue Essence, an Unmanned Surface Vessel (USV) manufactured by Fugro, represents the United Kingdom's inaugural electric Remotely Operated Vessel (eROV). It has obtained approval from the Maritime and Coastguard Agency (MCA), making it the first USV equipped with an eROV to operate in U.K. waters.

- In October 2022, L3Harris Technologies unveiled a strategic collaboration with Seasats, a privately owned company renowned for its expertise in creating affordable solar-powered Autonomous Surface Vehicles (ASVs) tailored for both military and commercial uses in maritime environments.

Unmanned Surface Vehicle Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.24 billion |

|

Revenue Forecast in 2032 |

USD 3.25 billion |

|

CAGR |

4.80% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Size, By Mode of Operation, By Component, By Hull type, By Endurance, By Application, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the landscape of unmanned surface vehicles in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.