Unmanned Electronic Warfare Market Share, Size, Trends, Industry Analysis Report, By Product (Unmanned Electronic Warfare Equipment, Unmanned Electronic Warfare Operational Support); By Platform (Airborne, Naval, Ground, Space); By Capability; By Operation, By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2198

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

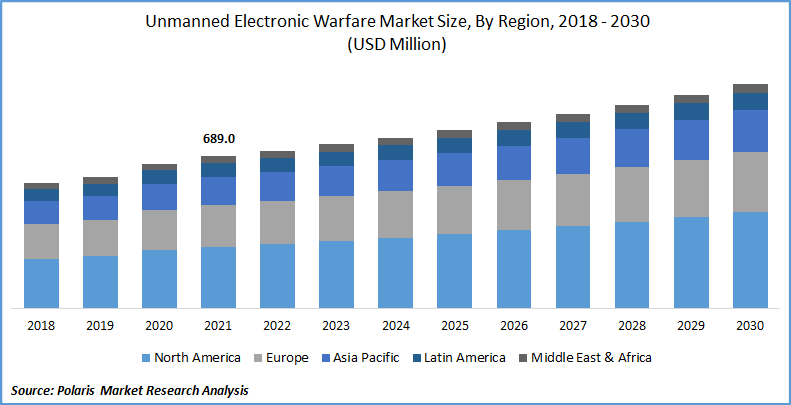

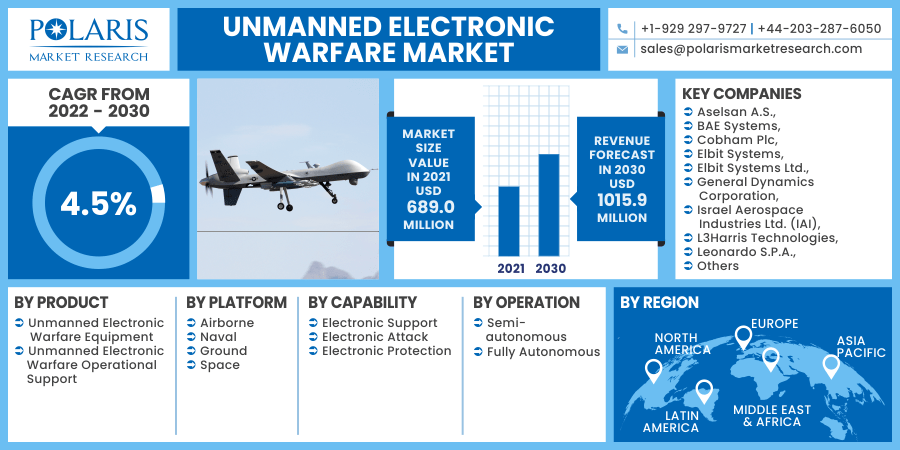

The global unmanned electronic warfare market was valued at USD 689.0 million in 2021 and is expected to grow at a CAGR of 4.5% during the forecast period. The growing use of electric warfare in UAV platforms is propelling the market forward. Over the last few years, the military has boosted its use of unmanned aerial vehicles (UAVs) for surveillance, imaging mapping, and combat operations monitoring. Integrating electric warfare data with photography or surveillance data could provide details about situational awareness. The UAV, for instance, has a radar warning receiver that provides advanced threat warnings. As a result, most governments and major industry players are spending to capitalize on the synergistic interaction between UAVs and EW, which is propelling the unmanned electronic warfare market forward.

Know more about this report: request for sample pages

For instance, in March 2021, Northrop Grumman Systems Corp. and Lockheed Martin Corp. were granted two contracts by the Department of Defense to support the Next Generation Interceptor (NGI) program. With the highest benefit of $1.6 billion through the fiscal year 2022, this contract award is expected to carry two plans through the acquisition program's development of new products and risk reduction phase, reducing technical and schedule risk. This award will ensure that NGI is a cost-effective and efficient component of a Missile Defense System (MDS) solution. Similarly, the US Army awarded Lockheed Martin Corporation a USD 75 million contract in April 2020 to develop, produce, and test operational EW pods. The market is likely to expand throughout the forecast period as a result of a growth in the use of these technologies in the UAV platform, which can be ascribed to technological advancements in defense systems.

Further, the rising popularity of modern combat methods in the market is boosting the growth. Modern warfare is defined as warfare that differs significantly from prior military philosophies, methods, and technology, highlighting the need for fighters to modernize to maintain their battle worthiness. In its broadest sense, it refers to all warfare since the "gunpowder revolution," which marked the beginning of early modern warfare. However, other significant military developments, such as the Crimean War's emphasis on artillery, the military's reliance on railroads beginning with the American Civil War, or the use of the gun, aircraft, tank, or radio in World War I, have been used instead. Besides, R&D in unmanned electric combat systems is constantly expanding, however, given the current situation and countries' reduced defense budgets, this technology's expansion may be hampered. Due to various laws, manufacturing activities have suffered operational and operating issues.

However, modifying and programming unmanned electronic combat systems is one of the most difficult tasks for manufacturers. To function in a crowded electromagnetic environment, advanced EW technologies are necessary, and a cost-effective open system approach will assist in achieving difficult design goals. Due to the market demand for significant R&D investments, the unmanned electronic warfare systems market is likely to be cost-dependent, posing a challenge for manufacturers. This is one of the primary reasons limiting the unmanned electronic warfare market's growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The market has observed extensive developments in the last few decades supported by various factors such as the risen acquisition of unmanned combat systems due to the increasingly transnational and regional insecurity. Bilateral military conflicts between nations are on the rise, requiring countries to beef up their defense and security capabilities. New weaponry and fighting systems are being developed to suit the needs of wars.

Electronic combat systems have been integrated into unmanned systems as a result of their growth, prompting countries to reorient their defense acquisition priorities in order to fulfill expanding military demands. For example, political unrest and terrorism in the Middle East, such as in Iraq and Syria, have resulted in military clashes since 2014, with a growing number of terrorist organizations deploying high-tech weaponry. As a result, countries in the region are increasing defense spending to include contemporary electric combat systems to secure their borders from such high-tech weaponry.

Further, Saudi Arabia, the United Arab Emirates, and Qatar have raised their investments in radar and air defense systems. Saudi Arabia, in contrast, is planning to buy Russia's S-400 air defense system in the future. China and Pakistan staged repeated incursions into India between 2015 and 2021, resulting in confrontations between the three countries. In October 2019, the Turkish government announced the purchase of Russian S-400 air defense systems.

China's neighbors, particularly Vietnam, Indonesia, Taiwan, Malaysia, and the Philippines, have increased their defense budgets in response to rising tensions in the South China Sea. Because of the tensions between Russia and NATO, countries like Romania, Poland, and Ukraine have upped their air defense spending. Russia wants to upgrade its military and electronic warfare capabilities as well. The market for unmanned electronic combat will be fueled by these military capabilities' advancements.

Report Segmentation

The market is primarily segmented based on product, platform, capability, operation, and region.

|

By Product |

By Platform |

By Capability |

By Operation |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Platform

Based on the platform segment, the unmanned airborne segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. The air-based segment is growing due to the increasing procurement of combat aircraft and UAVs by various countries' defense sectors. Also, the market demand for unmanned aerial vehicles on the battlefield for surveillance and threat detection capabilities is projected to boost the unmanned electronic warfare market.

Geographic Overview

In terms of geography, North America had the largest share. The market for the North American region is anticipated to grow significantly as a result of the rising investments in unmanned electric combat technologies by countries in the region. Furthermore, factors such as rising geopolitical tensions and increased defense spending are projected to boost market demand for unmanned electric combat in the region. For instance, the US Naval Sea Equipment Command received a contract for advanced electronic warfare (EW) systems for amphibious assault ships and aircraft carriers worth USD 74.8 million in May 2021. Northrop Grumman will provide the AN/SLQ-32(V) surface warship EW system with Surface Electronic Warfare Improvement Program (SEWIP) electronic assault systems and hardware design upgrades.

Moreover, Asia-Pacific is expected to witness a high CAGR in the global market in 2021. The expansion is assisted by a rise in defense spending. Few countries, such as Cambodia, Indonesia, China, and Bangladesh, increased their military spending significantly between 2011 and 2021. During the same time period, countries like Vietnam, the Philippines, Myanmar, Kyrgyzstan, Pakistan, Nepal, and India experienced considerable increases.

In the middle of their political and territorial disputes, the countries are investing in the creation of new electric combat systems to improve their capabilities. As a result of the danger posed by China and Russia's armed forces, Japan is beefing up its electromagnetic spectrum capabilities. The Japan Self-Defense Forces developed an electric warfare unit with 80 members in March 2021 that can collect and analyze naval and airborne communications as well as radar emissions from adjacent countries.

Competitive Insight

Some of the major players operating in the global market include Aselsan A.S., BAE Systems, Cobham Plc, Elbit Systems, Elbit Systems Ltd., General Dynamics Corporation, Israel Aerospace Industries Ltd. (IAI), L3Harris Technologies, Leonardo S.P.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, Textron Inc., Thales Group.

Unmanned Electronic Warfare Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 689.0 million |

|

Revenue forecast in 2030 |

USD 1015.9 million |

|

CAGR |

4.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Platform, By Capability, By Operation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Aselsan A.S., BAE Systems, Cobham Plc, Elbit Systems, Elbit Systems Ltd., General Dynamics Corporation, Israel Aerospace Industries Ltd. (IAI), L3Harris Technologies, Leonardo S.P.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, Textron Inc., Thales Group |