Unmanned Composites Market Size, Share, Trends, Industry Analysis Report: By Product Type (Carbon Fiber Reinforced Polymer, Glass Fiber Reinforced Polymer, Aramid Fiber Reinforced Polymer, and Other Products), Application, Platform, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Jan-2025

- Pages: 122

- Format: PDF

- Report ID: PM5353

- Base Year: 2024

- Historical Data: 2020-2023

Unmanned Composites Market Overview

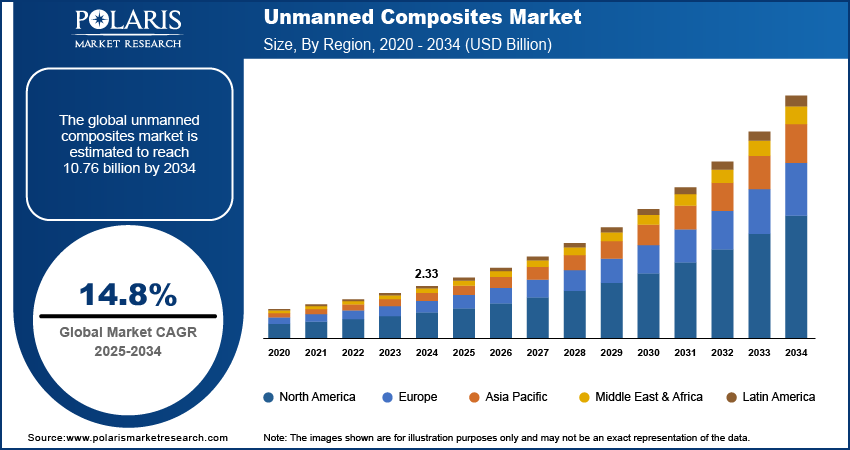

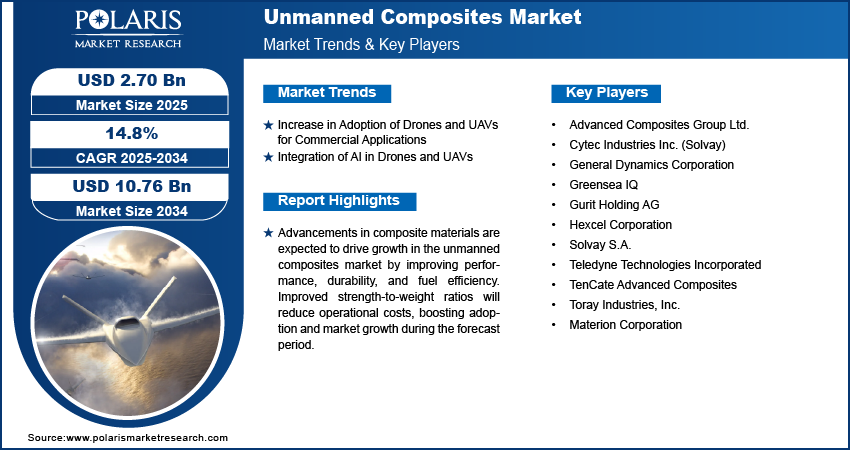

Unmanned composites market size was valued at USD 2.33 billion in 2024. It is projected to grow from USD 2.70 billion in 2025 to USD 10.76 billion by 2034, exhibiting a CAGR of 14.8% during the forecast period.

Unmanned composites are advanced materials used in constructing unmanned systems, such as drones and other autonomous vehicles. These composites are typically made from a combination of two or more materials, which improves the mechanical properties of the final product. The structure usually consists of a matrix, often a polymer, that binds reinforcing materials such as carbon or glass fibers.

The unmanned composites market growth is driven by rising demand for lightweight composites. Industries are seeking to improve the efficiency and performance of unmanned aerial vehicles (UAVs), drones, and other unmanned systems, due to which the demand for lightweight composites is increasing. These lightweight materials reduce the overall weight of these systems, allowing them to fly longer distances, carry heavier payloads, and consume less energy. These, in turn, are driving its adoption across multiple applications, such as military and defense, thereby driving the growth of the unmanned composites market.

To Understand More About this Research: Request a Free Sample Report

Advancements in composite manufacturing techniques are expected to produce materials with superior performance characteristics and increased durability for UAV and drone systems. These exceptional strength-to-weight ratios offered by composites are anticipated to optimize fuel efficiency and reduce overall operational costs UAV and drone systems, which in turn is expected to boost adoption. Therefore, advancement in composite materials is expected to boost the unmanned composites market demand during the forecast period.

Unmanned Composites Market Dynamics

Increase in Adoption of Drones and UAVs for Commercial Applications

The market is growing due to the increasing adoption of UAVs and drones in commercial applications such as delivery services and filmmaking. The expansion of e-commerce and on-demand delivery is driving the demand for drones and UAVs. For instance, in June 2023, Zipline supplied 37000 medical supplies through commercial UAVs, showcasing the growing adoption of UAVs and drones in commercial applications. Additionally, in filmmaking, drones are used for capturing stunning aerial shots that were once impossible or too costly. Therefore, the growing adoption of UAVs and drones in commercial applications is driving the demand for unmanned composites, positively impacting the growth of the unmanned composites market.

Integration of AI in Drones and UAVs

AI enables drones to perform complex tasks such as autonomous navigation, real-time data processing, and decision-making, enhancing their functionality in sectors including logistics, agriculture, and surveillance. For instance, in September 2023, Ada launched a project aimed at enhancing warehouse management with the integration of AI-enabled drones. To support these advanced features, lightweight, durable unmanned composites are essential, which in turn is driving the demand for unmanned composite, positively impacting unmanned composites market growth.

Unmanned Composites Market Segment Analysis

Unmanned Composites Market Assessment by Product Type Outlook

The unmanned composites market is segmented based on product type, which includes carbon fiber reinforced polymer, glass fiber reinforced polymer, aramid fiber reinforced polymer, and other products. The carbon fiber reinforced polymer (CFRP) segment dominated the market in 2024 due to its exceptional properties. CFRP boasts a very low coefficient of thermal expansion, chemical resistance, and better fuel efficiency due to its lightweight nature. Additionally, CFRP exhibits high stiffness, making it ideal for applications requiring structural rigidity, such as aerospace, military, construction, mining, and manufacturing for complex tasks.

For instance, in February 2024, Hexcel Corporation showcased its latest aerospace and industrial innovations at JEC World 2024 in Paris. Highlights included advanced composite materials and carbon fiber solutions designed to enhance performance in aerospace applications.

The glass fiber reinforced polymer (GFRP) market is also expected to grow significantly over the forecast period due to its versatility. GFRP can be readily molded into a wide range of shapes and sizes, catering to diverse applications. GFRP's affordability and ease of fabrication make it a compelling option for many industries. The increasing use of GFRP across various sectors suggests its potential for substantial future growth in the composites market.

Unmanned Composites Market Evaluation by Application Outlook

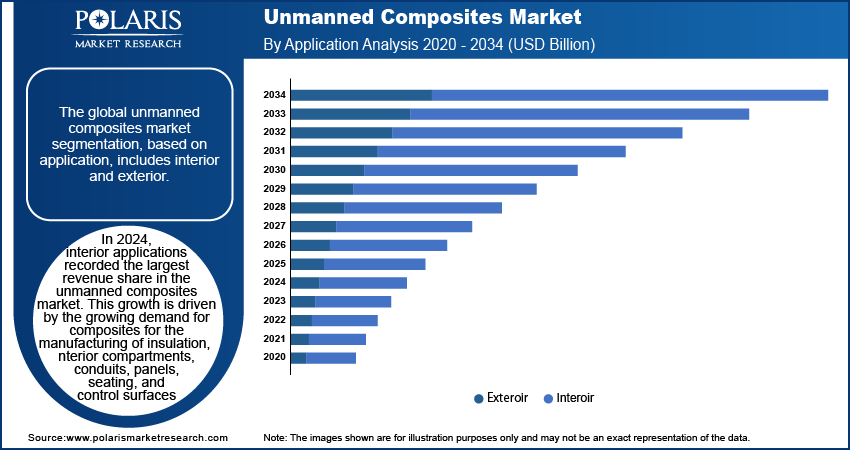

The unmanned composites market segmentation, based on application, includes interior and exterior. The interior applications recorded largest unmanned composites market revenue share in 2024. This growth is driven by growing demand of composites for manufacturing of insulation, interior compartments, conduits, panels, seating, and control surfaces. Composites are known for their low weight, durability, and enhanced performance and safety, which are essential for manufacturing various interior components of unmanned systems, thereby driving the growth of the interior segment in the global market.

For instance, on August 15, 2023, Advanced Composites Group Ltd. revealed a new series of high-performance composite materials designed for use in the internal components of unmanned aerospace and defense devices. This release demonstrates the company's commitment to advancing material innovation to improve durability and efficiency.

The exterior application segment is also expected to experience significant growth in the global market during the forecast period. This growth is due to the increasing use of composites in building external components such as wings, control surfaces, rotor blades, landing gear, and external housings. The superior strength and efficiency of composites in these external parts improve overall performance of unmanned systems, thereby driving growth of the segment in the global market.

Unmanned Composites Market Share by Region

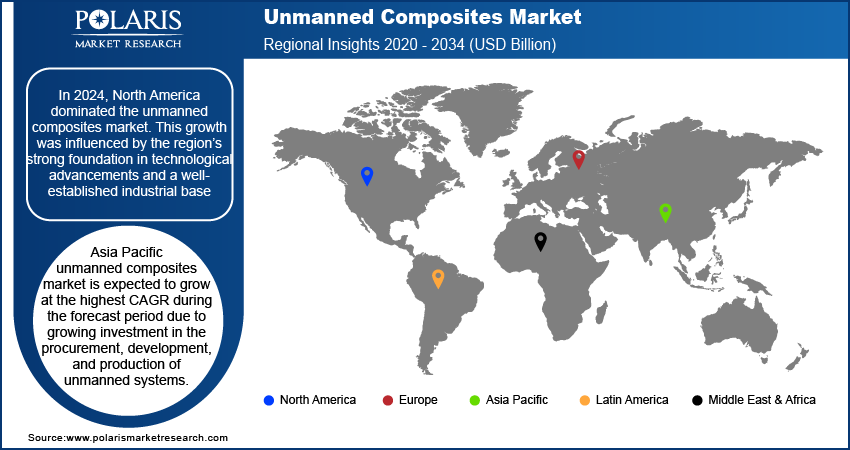

By region, the study provides the unmanned composites market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024. This growth was influenced by several factors, including the region’s strong foundation in technological advancements and a well-established industrial base. This foundation leads to a readily available pool of skilled professionals and a mature infrastructure for composite material development and production. Moreover, investments in research and development initiatives further drive innovation in the unmanned composites material, driving unmanned composites market growth in the region.

The US market is projected to experience substantial growth in the coming years. This is due to government initiatives and regulatory support for integrating drones across various sectors, which are expected to increase the demand for advanced composites. These materials are essential for creating lightweight and high-strength unmanned vehicles that meet regulatory standards, thereby driving the growth of the unmanned composites market in the US.

The unmanned composites market in Asia Pacific is expected to register the highest CAGR during the forecast period. This growth is primarily driven by the emergence of powerful economies such as China, Japan, and India, which are strategically investing in the procurement, development, and production of unmanned systems for both commercial and defense applications. For instance, in July 2023, India procured 31 MQ-9B RPAS for approximately USD 3.07 billion through the US government’s foreign military sales (FMS) program. This procurement enhances the intelligence, surveillance, and reconnaissance capabilities of the Indian Armed Forces.

Unmanned Composites Market Key Market Players & Competitive Insights

The unmanned composite industry is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the unmanned composites industry to benefit clients and increase the market sector. In recent years, the market has offered some technological advancements. Major players in the unmanned composites market include Materion Corporation; Hexcel Corporation; Teledyne Technologies Incorporated; Toray Industries, Inc.; Solvay S.A.; Gurit Holding AG; General Dynamics Corporation; Advanced Composites Group Ltd.; TenCate Advanced Composites; and Cytec Industries Inc.

Hexcel is a leader in advanced composite materials. The company supplies carbon fiber, resins, and honeycombs for aerospace, industrial, and defense applications. In February 2024, Hexcel Corporation showcased its latest aerospace and industrial innovations at JEC World 2024 in Paris. The highlights included advanced composite materials and carbon fiber solutions to improve performance and reduce environmental impact in aerospace applications.

Teledyne Technologies Incorporated specializes in advanced technology solutions across digital imaging, aerospace and defense electronics, and engineered systems. They provide innovative products and services globally, focusing on precision instrumentation and digital imaging. In June 2024, Teledyne Brown Engineering was selected to participate in the Natrium project in Huntsville, AL. This project aims to enhance energy efficiency and sustainability through innovative nuclear solutions.

Key Companies in Unmanned Composites Market

- Advanced Composites Group Ltd.

- Cytec Industries Inc. (now part of Solvay)

- General Dynamics Corporation

- Greensea IQ

- Gurit Holding AG

- Hexcel Corporation

- Solvay S.A.

- Teledyne Technologies Incorporated

- TenCate Advanced Composites

- Toray Industries, Inc.

- Materion Corporation

Unmanned Composites Industry Developments

March 2024: The new Toray Cetex TC915 PA+ was launched by Toray Advanced Composites, expanding its product portfolio. The thermoplastic material was designed for high-performance applications, offering enhanced strength, stiffness, temperature stability, and moisture resistance, complementing Toray Cetex TC910.

August 2023: Indian materials company Carborundum Universal Limited (CUMI) partnered with drone maker Idea Forge to develop innovative composite drone parts reinforced with nanomaterials. These composites promise superior strength-to-weight ratios, potentially revolutionizing the design of future drones.

Unmanned Composites Market Segmentation

By Product Type Outlook (Revenue USD Billion, 2020–2034)

- Carbon Fiber Reinforced Polymer

- Glass Fiber Reinforced Polymer

- Aramid Fiber Reinforced Polymer

- Other Products

By Application Outlook (Revenue USD Billion, 2020–2034)

- Interior

- Exterior

By Platform Outlook (Revenue USD Billion, 2020–2034)

- Unmanned Aerial Vehicle (UAV)

- Unmanned Ground Vehicle (UGV)

- Unmanned Surface Vehicle (USV)

- Autonomous Underwater Vehicle (AUV)

- Remotely Operated Vehicle (ROV)

- Autonomous Ship

- Passenger Drone

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Unmanned Composites Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.33 Billion |

|

Market Size Value in 2025 |

USD 2.70 Billion |

|

Revenue Forecast in 2034 |

USD 10.76 Billion |

|

CAGR |

14.8% from 2025 to 2034 |

|

Base Year |

2023 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product type By Application By Platform |

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The unmanned composites market size was valued at USD 2.33 billion in 2024, and USD 10.76 billion in 2034.

The global market is projected to grow at a CAGR of 14.8% during the forecast period, 2025-2034.

North America had the largest share of the global market.

The key players in the market are Materion Corporation, Hexcel Corporation, Teledyne Technologies Incorporated, Toray Industries, Inc., Solvay S.A., Gurit Holding AG, General Dynamics Corporation, Advanced Composites Group Ltd., TenCate Advanced Composites, and Cytec Industries Inc.

The carbon fiber reinforced polymer category dominated the market in 2024. CFRP exhibits high stiffness, making it ideal for applications requiring structural rigidity

The interior had the largest share in the global market due to an increase in demand for composites for insulation, interior compartments, conduits, panels, seating, and control surfaces.