Undersea Warfare Systems Market Share, Size, Trends, Industry Analysis Report

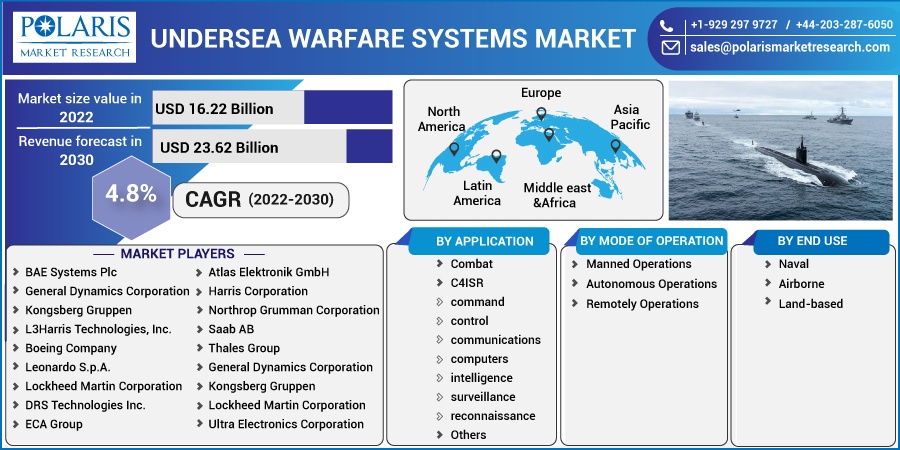

By Application (Combat, C4ISR, and Others); By Mode of Operation (Manned Operations, Autonomous Operations, and Remotely Operations); By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2904

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

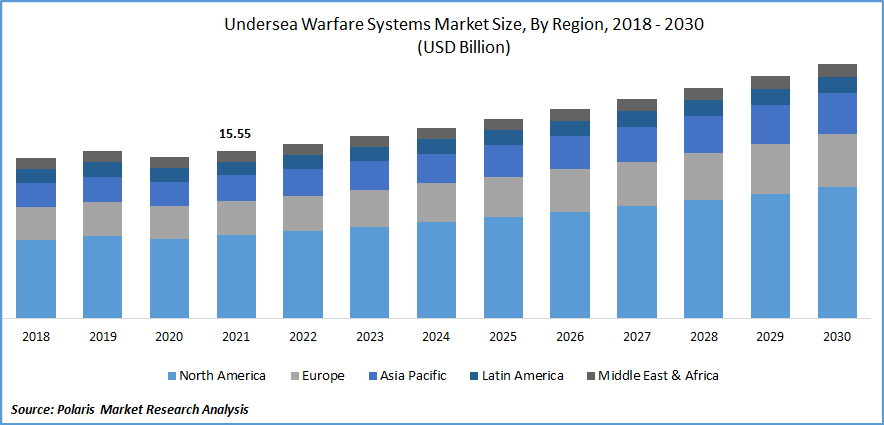

The global undersea warfare systems market was estimated at USD 15.55 billion in 2021 and is projected to grow at a CAGR of 4.8% during the forecast period.

Demand for undersea warfare systems is expected to rise as disputes over offshore resources, trade routes, and maritime borders increase. Increasingly, navies are using counter-access, and anti-access area denial as integral parts of their global naval strategies, and undersea warfare is supposed to become more prominent. Through underwater operations, friendly forces achieved battlespace supremacy, enabling them to conduct a wide range of missions and denying rival troops the ability to use underwater weapons. Mine warfare, anti-submarine warfare, offensive submarine warfare, and defensive submarine warfare are all included.

Know more about this report: Request for sample pages

Undersea warfare is the naval use of submarines and other underwater systems in military operations in the underwater domain. These systems are offensive and defensive and include surveillance, the deployment of special forces, and the destruction or neutralization of enemy military forces and undersea infrastructure. The significant increase in computer processing power, likely to induce new anti-submarine warfare (ASW) capabilities, is driving the growth of the global market.

Furthermore, advanced battery and fuel cell technology and the introduction of advanced long-range sensors such as L.F. active sonar or wake detection will propel the global market.

Combat and C4ISR (command, control, communications, computers, intelligence, surveillance, and reconnaissance) activities conducted beneath the surface of the water to address security threats. Undersea warfare systems are both offensive and defensive, with the goal of monitoring, detecting, categorizing, tracking, localizing, and neutralizing marine threats. Sensors, weapon systems, uncrewed underwater vehicles, counter-measure systems, & communication systems are all part of the marine warfare systems. Furthermore, these systems can operate autonomously or remotely.

COVID-19 has slowed supply chains, damaged business confidence, and sparked panic among key clientele. Several regions have declared a total lockdown & temporary shutdown of industries, affecting overall production and sales. The COVID-19 pandemic has slowed the development of undersea warfare systems, delayed trials, and demonstrations, & restricted vital players' operations. Governments worldwide prioritized the healthcare industry to combat the widespread COVID-19 virus, which harmed the defence industry's performance.

However, global defense spending is expected to reach USD 1.8 trillion in 2020, representing a 3.9% annual increase. Global spending as a percentage of GDP increased sharply from a median of 1.8% in 2019 to 2.1% in 2020, as military funds were maintained despite a severe economic crisis caused by the COVID-19 pandemic and a series of lockdowns implemented around the world in response. Pandemic lockdowns were lifted and then reinstated to slow the spread of COVID-19 infections as public utilities were gradually restored in major countries such as the United Kingdom, India, and Italy.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rising war situations and escalating conflicts between countries such as Russia and Ukraine, China, and Taiwan have increased the demand for undersea warfare. Governments are actively strengthening their maritime bases to maintain underwater security and combat threats from terrorism and other countries. In the worldwide undersea warfare system, unmanned naval systems, helicopters, maritime patrol aircraft, submarines, optronics, navigation systems, communications, torpedoes with homing heads, mine warfare and airborne systems, and surface ships are all included.

The acceptance of air force warfare was prompted by increasing terrorism and enemy attacks, along with technological advances. During the forecast period, these will be some of the critical growth drivers for the global market. The global undersea warfare systems market is driven by a growing number of defense expenditures across various countries, the number of undersea threats, and the introduction of innovative advanced technologies.

Report Segmentation

The market is primarily segmented based on application, mode of operation, end-use, and region.

|

By Application |

By Mode of Operation |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The Combat Segment is Expected to Witness the Fastest Growth

In 2021, the combat segment was anticipated to increase throughout the projected period. The combat systems segment is expected to be the most significant market, followed by C4SIR. New developments in maritime technology, such as stealth submarines, uncrewed vehicles, marine robots, network-centric warfare, undersea communications, and enhanced sonar detection ranges, are expected to inspire R&D investment, boosting the market for the global market during the forecast period.

Furthermore, the communication segment will grow at the highest CAGR during the forecast period. Activities carried out beneath the water's surface to address security threats & maintain battle-space dominance in the underwater environments. Sensors, unmanned underwater vehicles, and communication systems are all part of such warfare systems. Furthermore, these systems can operate autonomously or remotely.

Naval Accounted for the Largest Market Share in 2021

In 2021, the most critical market will be the naval segment, followed by the component market, which is the most significant, then operated and unmanned systems and sensors. Demand for submarines, surface ships, helicopters, and combat planes will drive the market during the forecast period. Another factor is warfare between surface-to-air missiles, ships and submarines, helicopters, and combat planes. Furthermore, the U.K. Navy is developing Manta, an unmanned version of the prevailing S201 manned submersible warship designed by the British company MSubs.

The Remotely Operations Segment is Expected to Witness the Fastest Growth

Remote segment is expected to increase at the fastest rate over the study period. Remotely operated systems are used for observation, surveillance, mining, & payload delivery for under-the-sea operations. Several companies are developing & testing remote underwater warfare systems to improve their operational capabilities.

For instance, in March 2022, RE2 Robotics announced that its maritime mine neutralization system (M2NS) reached to depth of more than 1 km during an open-water demonstration for the U.S. naval research program. M2NS comprises the RE2 Sapien Sea Class robot arms mounted onto the “VideoRay's Defender” remotely operated vehicle (ROV). It further utilizes RE2 detection & RE2 intellect to enable a target's goal.

The Demand in North America is Expected to Witness Significant Growth

The region's dominance is primarily due to a highly advanced defence sector combined with heavy expenditure by the United States. For nearly a generation, the country has held the title of the world's sole hyperpower, and it has always embraced the most advanced and cutting-edge technologies. This factor is bolstered by the fact that the United States has the world's largest defence budget. Some of the world's leading undersea warfare system companies, including Northrop Grumman Corporation, Lockheed Martin Corporation, and Textron, Inc., have their headquarters in the region, contributing to market growth.

Asia Pacific has the highest revenue share of the global market and is expected to increase during the forecast period. Because of its massive defence budget, China has the largest market share in the region. The country's defence budget increased by 7% in 2021 over 2020. A sizable portion of this budget is earmarked for advancing naval technologies. Furthermore, China has recently had maritime disputes with several countries over claims in the East and South China Seas.

Competitive Insight

Key players include BAE Systems, Ultra Electronics, General Dynamics, Kongsberg Gruppen, L3Harris Technologies, Boeing Company, Lockheed Martin, DRS Technologies, General Dynamics, Kongsberg Gruppen, S.A. de Electronica Submarina, Atlas Elektronik, Harris Corporation, Northrop Grumman, ECA Group, Raytheon Technologies, SAAB, and Thales Group.

Recent Developments

In October 2022, BAE Systems unveiled the 'Herne' underwater drone. It also announced a configurable autonomous underwater vehicle (XLAUV) for the future battle space. The underwater drone, dubbed "Herne," is intended for various missions such as maritime surveillance, counter-attacks & mine-hunting.

In March 2021, the US Navy announced the deployment of unmanned surface vessels in deep waters far ahead of crewed ships to hunt mines, monitor ships & submarines, & launch ship-killing missiles.

Undersea Warfare Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 16.22 billion |

|

Revenue forecast in 2030 |

USD 23.62 billion |

|

CAGR |

4.8% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Application, By Mode of operation, By End-Use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

BAE Systems Plc, General Dynamics Corporation, Kongsberg Gruppen, L3Harris Technologies, Inc., Boeing Company, Leonardo S.p.A., Lockheed Martin Corporation, DRS Technologies Inc., ECA Group, General Dynamics Corporation, Kongsberg Gruppen, Lockheed Martin Corporation, Ultra Electronics Corporation, S.A. de Electronica Submarina (SAES), Atlas Elektronik GmbH, Harris Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Saab AB, Thales Group and others. |