Ultrasound Probe Disinfection Market Share, Size, Trends, Industry Analysis Report, By Product (Consumables, Instruments, and Services); By Disinfection Process; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3401

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

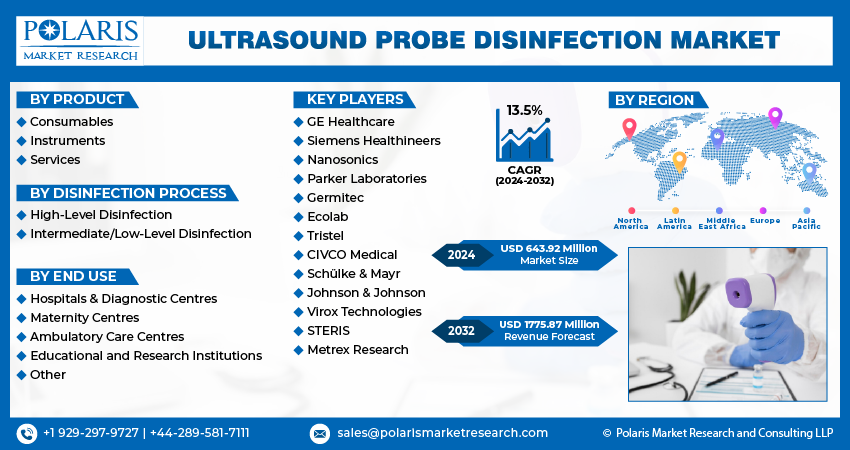

The global ultrasound probe disinfection market was valued at USD 568.13 million in 2023 and is expected to grow at a CAGR of 13.5% during the forecast period. The growing adoption of several technologies in the ultrasound industry is generating huge potential. Artificial intelligence, shear wave elastography, portable ultrasound, and many other technologies are heavily used to improve diagnosis. For example, 4D ultrasound is a real-time imaging technique that provides a more detailed assessment of fetal anatomy and cardiac function. Philips has already launched an ultrasound system that combines 3D and 4D imaging technology.

To Understand More About this Research: Request a Free Sample Report

In addition to this, the company has also launched a next-generation compact portable ultrasound solution in November 2022. Similarly, several companies are focusing on the latest technologies in the ultrasound market. This not only improves efficiency but also gains traction with the bulk of the population worldwide. As a result, all these technologies are apparently promoting the probe disinfection market.

Ultrasound probe disinfection market is essential to prevent the spread of infections in healthcare settings. Ultrasound probes are in contact with patients' skin, mucous membranes, and bodily fluids, making them a potential source of transmission for infectious agents such as bacteria, viruses, and fungi. Proper disinfection of ultrasound probes helps prevent the transmission of infections between patients, healthcare workers, and visitors. It also helps to maintain the quality and accuracy of ultrasound imaging, ensuring that healthcare professionals can make accurate diagnoses and provide appropriate treatment.

With the rapid spread of COVID-19, there has been an increased focus on infection prevention and control in healthcare settings, including the proper disinfection of medical equipment such as ultrasound probes. Hospitals and clinics have been investing in new disinfection technologies and solutions to ensure the safety of patients and healthcare workers. This has led to an increase in the number of companies offering ultrasound probe disinfection products and services, as well as an expansion of the market.

However, the pandemic has also led to disruptions in the supply chain, which have impacted the availability of some disinfection products. There have also been challenges in maintaining adequate staffing levels to perform the necessary disinfection procedures, as healthcare workers have been stretched thin due to the increased demand for care.

Industry Dynamics

Growth Drivers

The rising incidence of hospital-acquired infections is heightening the growth of the market. This is primarily due to the improper reprocessing of ultrasound probes. Rising HAIs are also attributed to a combination of factors, including antibiotic resistance, immunosuppression, inadequate infection control measures, and more. For example, the Centers for Disease Control (CDC) projected that HAIs accounted for about 1.7 million infections and 99,000 associated deaths per year in American hospitals alone. Hospitals can reduce the risk of HAIs and improve patient safety by disinfecting ultrasound probes between patients. As it plays an essential role in reducing the spread of pathogens between patients. As a result, the demand for probe disinfection has risen dramatically. This in turn augments the global market's revenue.

Product development is another prime aspect that largely enhances the growth of the market. A large number of businesses are struggling to avoid HAIs and improve the safety of their patients by introducing various disinfection consumables or instruments for ultrasound probes. For example, in December 2021, with the addition of Juama as its new distributor for the trophon device, accessories, consumables, and service in Mexico, Nanosonics, a pioneer in infection prevention, is extending its reach into Latin America. Apart from this, many other industry participants are also innovating new products to stay competitive in the market. As a result, spurring product innovation among the market players is bolstering the global market’s growth.

Report Segmentation

The market is primarily segmented based on product, disinfection process, end use, and region.

|

By Product |

By Disinfection Process |

By End use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Instrument segment held largest share of the global market in 2022

In fiscal year 2022, the instrument segment dominates the market share. This is due to the benefits such as higher efficiency, standardization, better effectiveness, safety features, and many more. While instruments are highly effective in killing a wide range of microorganisms, including bacteria, viruses, and fungi, thereby reducing the risk of hospital-acquired infections. The cost of these instruments is relatively high, which enhances the revenue of this segment.

In 2022, the intermediate/low-level disinfection segment held the largest global share

As it is the basic method that is followed as a standard process in hospital facilities. This is appropriate for certain types of probes that are considered lower-risk, such as those used in non-invasive procedures or those that do not come into contact with sterile body sites. Low-level disinfection processes are more cost-effective than high-level disinfection processes, as they typically use less expensive disinfectants and may require less equipment. Hence, a large number of hospitals and diagnostic centres are adopting this disinfection process.

Healthcare & diagnostic centres segment is growing with the fastest CAGR

Based on end-user outlook, the healthcare & diagnostic centres segment is projected to grow at the fastest CAGR during the forecast period. This is attributed to their high demand, regulatory requirements, high volume of procedures, centralized management, and focus on patient safety. This segment typically performs a high volume of ultrasound procedures, which means that there is a greater need for rapid and effective disinfection methods. However, the segment prioritizes patient safety and infection control, and effective ultrasound probe disinfection is a key component of this. By investing in high-quality disinfection methods and equipment, healthcare and diagnostic centres can ensure that their patients receive the highest level of care and safety.

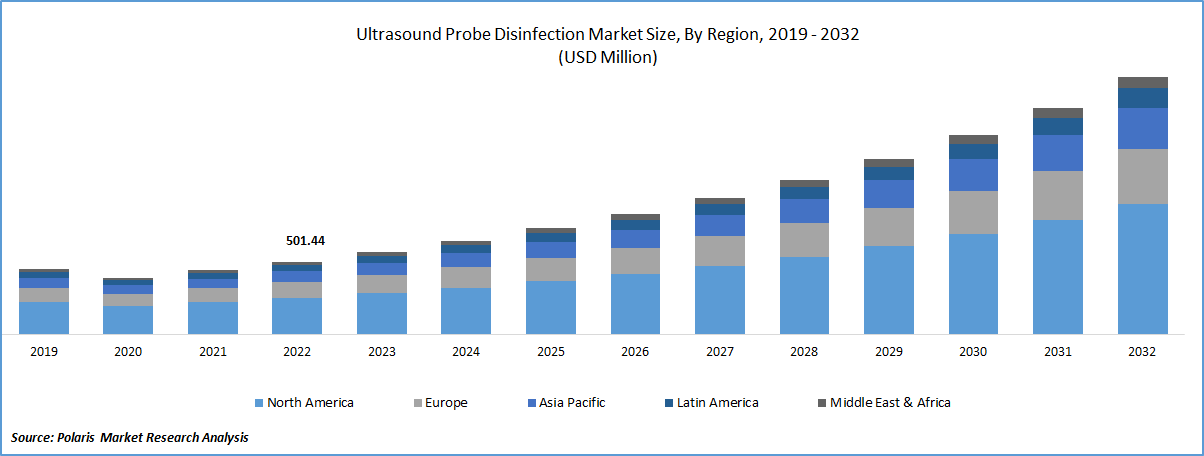

North America is accounting the largest share of the global market

This is primarily due to the increasing number of ultrasound scans performed, growing healthcare expenditure, and other factors. Expanding healthcare spending in the region is one of the prominent factors expected to drive market share. For example, the United States has one of the highest costs of healthcare globally. Health care spending in the U.S. increased 2.7 percent in 2021, reaching US$ 4.3 trillion, or US$ 12,914 per person. North America spends considerably more on healthcare compared to other regions.

Healthcare spending has been steadily increasing for many years. The demand for effective and efficient ultrasound probe disinfection is therefore likely to continue to grow as healthcare spending increases and ultrasound technology becomes more widely used in medical settings. This is supporting the probe disinfection market in North American countries.

Asia Pacific is witnessed to be the fastest-growing region in the global market. This is attributed to the presence of local manufacturers that provide high-quality products at lower prices, growing investments in healthcare facilities by emerging countries, and many other factors. Escalating cases of breast cancer in the region is an important factor boosting the demand for probe disinfection. For instance, nearly 25% of the female cancer cases are breast cancer in India.

While the National Institute of Health has also reported that breast cancer is now the foremost cancer among Japanese women. The World Health Organization reported approximately 65,858 cases of breast cancer in Indonesia in 2020. As a result, the continually increasing prevalence of breast cancer is booming, and the use of ultrasound in breast cancer diagnosis and treatment has led to a greater need for proper disinfection of ultrasound probes.

Competitive Insight

The global market involves GE Healthcare, Siemens Healthineers, Nanosonics, Parker Laboratories, Germitec, Ecolab, Tristel, CIVCO Medical, Schülke & Mayr, Johnson & Johnson, Virox Technologies, STERIS, and Metrex Research.

Recent Developments

- In May 2022, Germitec raised €11 million (US$11.6 million) in order to finance commercial scale-up and get ready to submit its ultrasound probe disinfection system for FDA 510k approval.

- In September 2022, Parker Laboratories partnered with Tristel to distribute the disinfectant foams in the U.S. market will produce and Tristel DUO, including ultrasound transducers.

Ultrasound Probe Disinfection Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 643.92 million |

|

Revenue forecast in 2032 |

USD 1775.87 million |

|

CAGR |

13.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Segments covered |

By Product, By Disinfection Process, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

GE Healthcare, Siemens Healthineers GmbH, Nanosonics, Parker Laboratories Inc., Germitec, Ecolab Inc., Tristel, CIVCO Medical Solutions, Schülke & Mayr GmbH, Johnson & Johnson Inc. (Advanced Sterilization Products), Virox Technologies Inc., STERIS plc., and Metrex Research LLC |

FAQ's

key companies in the Ultrasound Probe Disinfection Market are Healthineers, Nanosonics, Parker Laboratories, Germitec, Ecolab, Tristel, CIVCO Medical, Schülke & Mayr, Johnson & Johnson.

The global ultrasound probe disinfection market expected to grow at a CAGR of 13.5% during the forecast period.

The Ultrasound Probe Disinfection Market report covering key segments are product, disinfection process, end use, and region.

key driving factors in Ultrasound Probe Disinfection Market are Rising prevalence of Hospital Acquired Infections

The global ultrasound probe disinfection market size is expected to reach USD 1775.87 million by 2032.