Ultrasound Probe Cover Market Size, Share, Trends, Industry Analysis Report: By Type, Product (Instruments and Consumables), Disinfection, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 119

- Format: PDF

- Report ID: PM3250

- Base Year: 2024

- Historical Data: 2020-2023

Ultrasound Probe Cover Market Overview

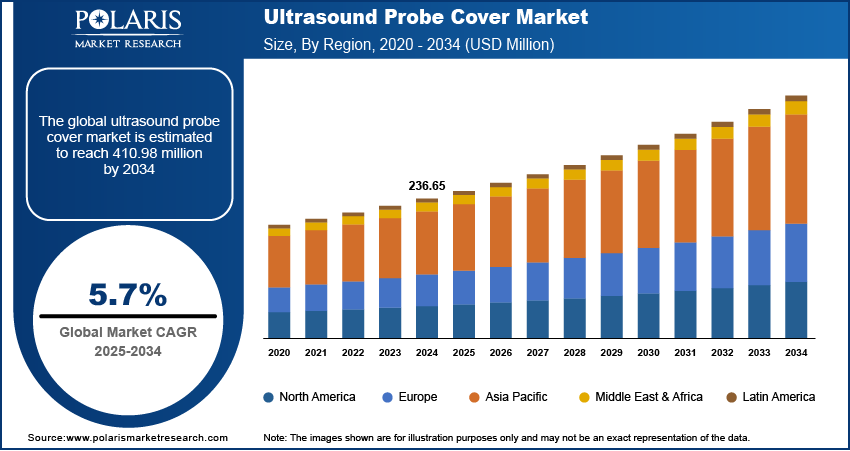

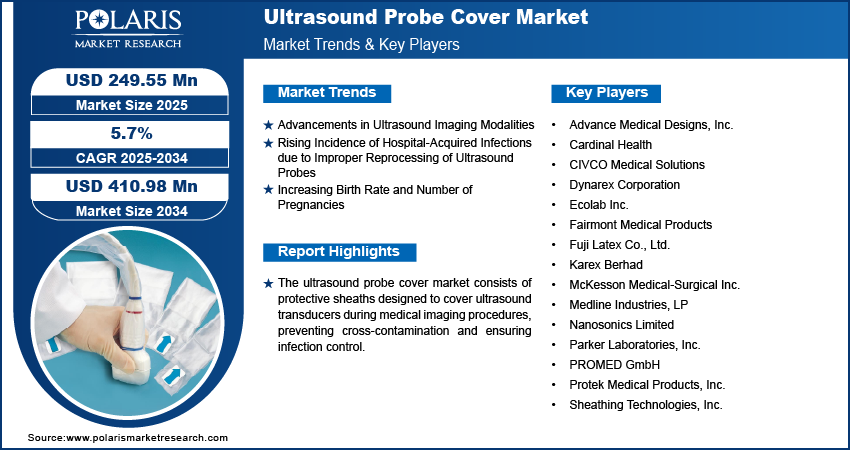

The ultrasound probe cover market size was valued at USD 236.65 million in 2024. The market is projected to grow from USD 249.55 million in 2025 to USD 410.98 million by 2034, exhibiting a CAGR of 5.7% during 2025–2034.

An ultrasound probe cover is a protective sheath used to cover ultrasound transducers during medical imaging procedures. The ultrasound probe cover market encompasses disposable and reusable covers designed to maintain hygiene and prevent cross-contamination during ultrasound procedures. The increasing adoption of ultrasound imaging in diagnostics, rising concerns over infection control, and stringent regulatory guidelines for medical device sterilization are driving the ultrasound probe cover market growth. The growing preference for single-use probe covers to minimize hospital-acquired infections and advancements in material technology improving durability and sensitivity are key trends. Additionally, the expanding use of point-of-care ultrasound in emergency and critical care settings further supports market expansion.

To Understand More About this Research: Request a Free Sample Report

Ultrasound Probe Cover Market Dynamics

Advancements in Ultrasound Imaging Modalities

The evolution of ultrasound technology has significantly expanded its diagnostic applications, necessitating the use of protective probe covers to maintain hygiene and prevent cross-contamination. The emergence of portable, handheld, and smartphone-based ultrasound devices has increased the accessibility and frequency of ultrasound procedures across various medical fields. This technological progression underscores the importance of high-quality probe covers to ensure patient safety during diverse imaging applications. Thus, advancements in ultrasound imaging modalities boost the ultrasound probe cover market development.

Rising Incidence of Hospital-Acquired Infections Due to Improper Reprocessing of Ultrasound Probes

Hospital-acquired infections (HAIs) pose a significant challenge to healthcare systems, often resulting from inadequate disinfection of medical equipment, including ultrasound probes. The Centers for Disease Control and Prevention (CDC) emphasizes that proper reprocessing of ultrasound probes is critical to preventing HAIs. This heightened awareness has led to increased adoption of disposable probe covers as a preventive measure. Hence, the rising incidence of hospital-acquired infections due to improper reprocessing of ultrasound probes drives the ultrasound probe cover market demand.

Ultrasound Probe Cover Market Segment Insights

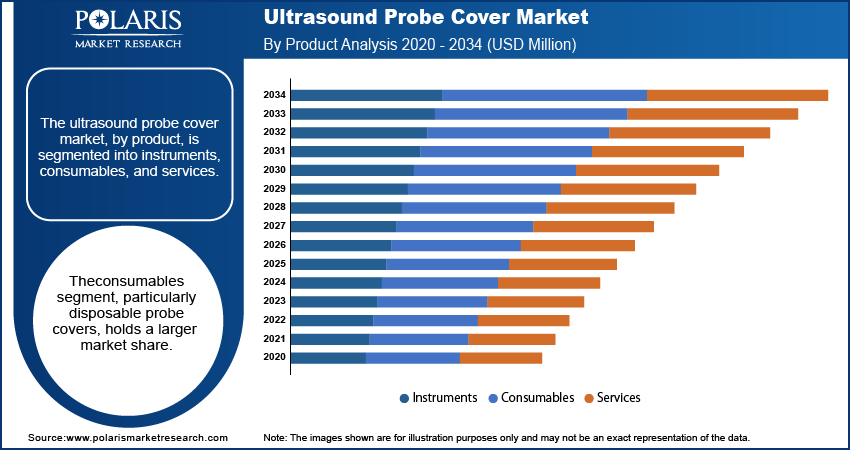

Ultrasound Probe Cover Market Assessment by Product Outlook

The ultrasound probe cover market, by product, is segmented into instruments and consumables. The consumables segment, particularly disposable probe covers, held a larger share of the ultrasound probe cover market revenue in 2024. This dominance is attributed to their cost-effectiveness and the ability to mitigate the risk of disease or infection transmission among patients. Disposable probe covers are convenient and easy to use, as they can be swiftly disposed of after each use, ensuring a higher level of hygiene and reducing the burden of cleaning and sterilization processes.

Ultrasound Probe Cover Market Evaluation by Disinfection Outlook

The ultrasound probe cover market, by disinfection, is segmented into high-level disinfection and intermediate/low-level disinfection. The intermediate/low-level disinfection segment holds a larger market share. This dominance is attributed to the widespread adoption of basic disinfection protocols in medical facilities, which adhere to standard procedures to prevent cross-contamination during routine ultrasound examinations. The simplicity and cost-effectiveness of intermediate/low-level disinfection methods make them a preferred choice for many healthcare providers.

The high-level disinfection segment is experiencing significant growth. This surge is driven by the increasing awareness of infection control and the necessity for stringent disinfection protocols, especially for probes used in semi-critical and critical procedures. High-level disinfection ensures the elimination of all microorganisms, including bacteria, viruses, and fungi, thereby providing a higher safety margin in invasive diagnostic and therapeutic applications. The rising incidence of hospital-acquired infections has further propelled the demand for advanced disinfection solutions, contributing to the expansion of this segment.

Ultrasound Probe Cover Market Assessment by End Use Outlook

Based on end use, the ultrasound probe cover market is segmented into hospitals and clinics, diagnostic imaging centers, and others. The hospitals and clinics segment holds the largest market share, driven by the high volume of ultrasound procedures performed in these settings. The increasing prevalence of chronic diseases necessitates frequent diagnostic imaging, thereby elevating the demand for ultrasound probe covers to maintain hygiene and prevent cross-contamination. Additionally, the emphasis on infection control protocols in hospitals and clinics further propels the adoption of these protective covers.

The diagnostic imaging centers segment is experiencing the highest growth within this market. This surge is attributed to the rising demand for specialized imaging services, advancements in ultrasound technology, and the growing trend of outpatient diagnostic procedures. As these centers expand their service offerings to accommodate a broader patient base, the utilization of ultrasound probe covers correspondingly increases to ensure patient safety and compliance with health regulations.

Ultrasound Probe Cover Market Regional Outlook

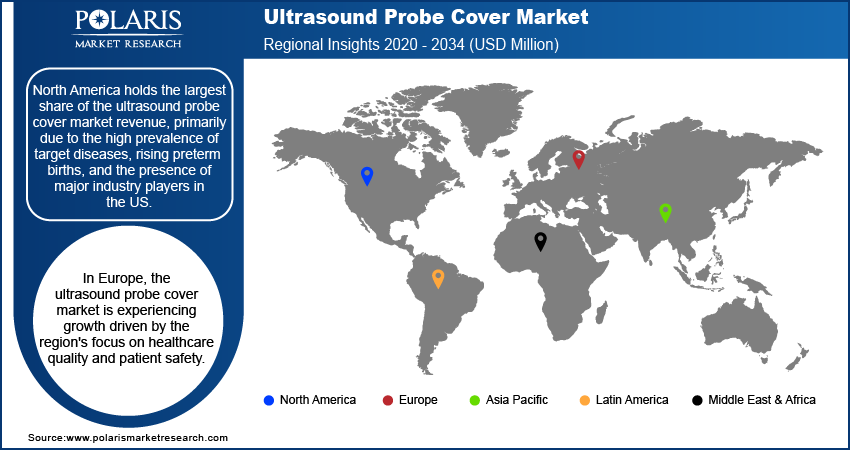

By region, the study provides ultrasound probe cover market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the ultrasound probe cover market share, primarily due to the high prevalence of target diseases, rising preterm births, and the presence of major industry players in the US. The region's well-developed healthcare infrastructure and increasing awareness of infection control and ultrasound disinfection practices further drive the demand for ultrasound probe covers. Additionally, the availability of medical reimbursements for ultrasound procedures and a growing number of diagnostic centers and hospitals contribute to market growth in North America.

The Europe ultrasound probe cover market is experiencing growth, driven by the region's focus on healthcare quality and patient safety. Countries such as Germany, France, and the UK are leading in the adoption of ultrasound probe covers, supported by well-established healthcare infrastructures and stringent infection control regulations. The presence of key market players in these countries further bolsters the market, as they provide a range of products designed to meet the specific needs of healthcare providers. Additionally, the increasing prevalence of chronic diseases necessitating frequent ultrasound procedures contributes to the sustained demand for probe covers in the region.

The Asia Pacific ultrasound probe cover market is anticipated to witness the highest growth rate during the forecast period. This surge is attributed to several factors, including significant investments in healthcare infrastructure, rising healthcare expenditures, and growing awareness about infection control practices. Countries such as China, India, and Japan are major contributors to this growth, driven by large populations, an increasing number of ultrasound diagnostic procedures, and a heightened focus on patient safety. The expanding middle-class population and improving access to healthcare services in these countries further amplify the demand for ultrasound probe covers, positioning Asia Pacific as a lucrative market for industry stakeholders.

Ultrasound Probe Cover Market – Key Players and Competitive Insights

The ultrasound probe cover market features several key players actively contributing to its growth and innovation. Notable companies include CIVCO Medical Solutions; Ecolab Inc.; Parker Laboratories, Inc.; Medline Industries, LP; Cardinal Health; Sheathing Technologies, Inc.; Protek Medical Products, Inc.; McKesson Medical-Surgical Inc.; Fairmont Medical Products; PROMED GmbH; Nanosonics Limited; Advance Medical Designs, Inc.; Dynarex Corporation; Karex Berhad; and Fuji Latex Co., Ltd.

These companies are recognized for their extensive product portfolios and commitment to enhancing infection control measures in medical settings. CIVCO Medical Solutions offers a range of ultrasound probe covers designed to prevent cross-contamination during procedures. Ecolab Inc. provides infection prevention solutions, including probe covers that align with stringent hygiene standards. Parker Laboratories, Inc. is known for its medical supplies, including ultrasound probe covers that ensure patient safety. Medline Industries, LP, and Cardinal Health supply a variety of medical products, with probe covers being integral to their offerings.

In the competitive landscape, these companies focus on product innovation, quality assurance, and strategic partnerships to maintain their market positions. For example, Nanosonics Limited specializes in ultrasound probe disinfection technologies, complementing the use of probe covers to enhance infection control. Protek Medical Products, Inc. and Sheathing Technologies, Inc. emphasize the development of high-quality, user-friendly probe covers suitable for various medical applications. Collaborations between manufacturers and healthcare providers are common, aiming to develop products that meet evolving clinical needs and regulatory requirements. Continuous investments in research and development, along with a focus on customer feedback, enable these companies to adapt to market demands and contribute to the overall improvement of patient care standards.

CIVCO Medical Solutions is a provider of ultrasound probe covers and related accessories, offering products designed to prevent cross-contamination during medical procedures. Their portfolio includes the Envision ultrasound probe covers and scanning pads, which enable gel-free ultrasound procedures, enhancing patient safety and simplifying the clinician's workflow.

Ecolab Inc. was founded in 1923 and headquartered in Minnesota, US. The company is engaged in water, hygiene, and infection prevention solutions. Ecolab Inc., operating across 170 countries, the company serves diverse industries such as healthcare, foodservice, hospitality, and manufacturing. Ecolab delivers science-based solutions to optimize operational efficiencies and sustainability. The company’s global healthcare & life sciences segment focuses on infection prevention and contamination control, including products like ultrasound probe covers. Ecolab's innovative technologies and personalized service aim to make environments cleaner, safer, and healthier worldwide.

List of Key Companies in Ultrasound Probe Cover Market

- Advance Medical Designs, Inc.

- Cardinal Health

- CIVCO Medical Solutions

- Dynarex Corporation

- Ecolab Inc.

- Fairmont Medical Products

- Fuji Latex Co., Ltd.

- Karex Berhad

- McKesson Medical-Surgical Inc.

- Medline Industries, LP

- Nanosonics Limited

- Parker Laboratories, Inc.

- PROMED GmbH

- Protek Medical Products, Inc.

- Sheathing Technologies, Inc.

Ultrasound Probe Cover Industry Developments

- In March 2025, Pajunk launched premium ultrasound probe covers designed for optimal performance.

- In April 2024, Medline Industries announced a definitive agreement to acquire the global surgical solutions business of Ecolab, Inc., including the Microtek product lines. This acquisition aims to enhance Medline’s portfolio with innovative sterile drape solutions for surgeons, patients, and operating room equipment.

Ultrasound Probe Cover Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Disposable Probe Covers

- Reusable Probe Covers

By Product Outlook (Revenue – USD Million, 2020–2034)

- Instruments

- Consumables

By Disinfection Outlook (Revenue – USD Million, 2020–2034)

- High-Level Disinfection

- Intermediate/Low-Level Disinfection

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals & Clinics

- Diagnostic Imaging Centres

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ultrasound Probe Cover Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 236.65 million |

|

Market Size Value in 2025 |

USD 249.55 million |

|

Revenue Forecast by 2034 |

USD 410.98 million |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The ultrasound probe cover market has been segmented into detailed segments of type, product, disinfection, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the ultrasound probe cover market focus on growth and marketing strategies that emphasize product innovation, regulatory compliance, and strategic partnerships. Manufacturers invest in research and development to introduce advanced probe covers that enhance infection control and user convenience. Collaborations with healthcare providers and distributors help expand market reach, while compliance with stringent safety regulations strengthens product credibility. Digital marketing, participation in medical conferences, and direct engagement with hospitals and diagnostic centers further support market penetration. Additionally, companies focus on geographical expansion to tap into emerging markets with growing healthcare infrastructure.

FAQ's

The ultrasound probe cover market size was valued at USD 236.65 million in 2024 and is projected to grow to USD 410.98 million by 2034.

The market is projected to register a CAGR of 5.7% during the forecast period.

North America held the largest share of the market in 2024.

The consumables segment accounted for a larger market share in 2024.

An ultrasound probe cover is a protective sheath used to cover ultrasound transducers during medical imaging procedures. It acts as a barrier to prevent cross-contamination between patients and helps maintain hygiene by reducing the risk of infection transmission. These covers are commonly made from latex, polyethylene, or polyurethane and are available in sterile and non-sterile forms. They are widely used in diagnostic imaging, obstetrics, gynecology, and interventional procedures where maintaining a sterile environment is critical.

A few key trends in the market are described below: Increasing Focus on Infection Control – Rising concerns about hospital-acquired infections (HAIs) are driving the demand for high-quality probe covers to ensure patient safety. Shift Towards Latex-Free Covers – Due to latex allergies among patients and healthcare professionals, there is a growing preference for latex-free materials such as polyurethane and polyethylene. Adoption of Gel-Free Probe Covers – Innovative gel-free ultrasound probe covers are gaining popularity as they help reduce contamination risks and improve imaging quality. Stringent Regulatory Compliance – Regulatory bodies such as the FDA and CE are enforcing strict guidelines, prompting manufacturers to develop products that meet high safety standards

A new company entering the ultrasound probe cover market can focus on innovation, regulatory compliance, and strategic partnerships to gain a competitive edge. Developing latex-free, antimicrobial, and gel-free probe covers can address growing healthcare demands and safety concerns. Ensuring compliance with regulatory standards such as FDA and CE certifications will enhance product credibility. Collaborating with hospitals, diagnostic centers, and medical device manufacturers can help establish a strong market presence. Additionally, investing in emerging markets with rising healthcare infrastructure and increasing ultrasound procedures can provide ultrasound probe cover market opportunities. Digital marketing and participation in medical trade shows can further support brand awareness and customer acquisition.