UK & Germany Diet and Nutrition Apps Market Size, Share, Trends, Industry Analysis Report: By Platform (Android, iOS, and Others), Device, Type, and Service – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5544

- Base Year: 2024

- Historical Data: 2020-2023

UK & Germany Diet and Nutrition Apps Market Overview

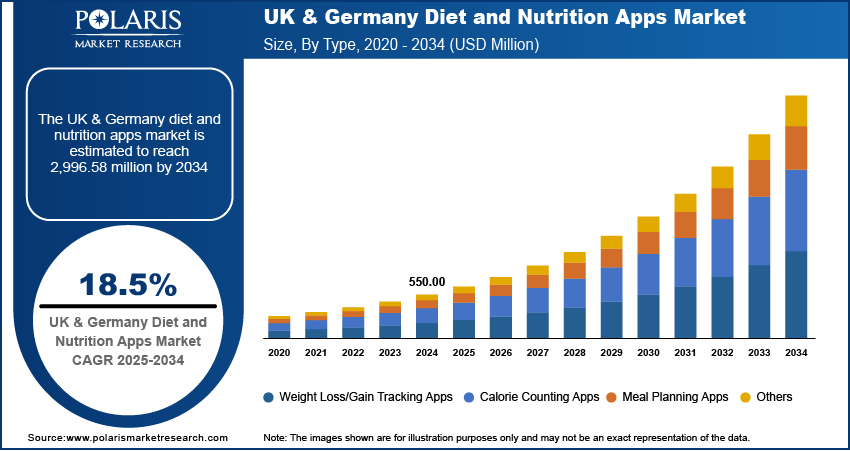

The UK & Germany diet and nutrition apps market size was valued at USD 550.00 million in 2024. The market is expected to grow from USD 650.37 million in 2025 to USD 2,996.58 million by 2034, exhibiting a CAGR of 18.5% from 2025 to 2034.

The UK & Germany diet and nutrition apps market focuses on mobile and digital platforms that assist users in managing their dietary habits, tracking nutrition intake, and optimizing health through personalized recommendations. These apps integrate AI-driven meal planning, calorie tracking, macronutrient analysis, and fitness synchronization, offering users data-driven insights to improve lifestyle choices.

Increasing consumer focus on preventive healthcare and personalized nutrition solutions is driving UK & Germany diet and nutrition apps market demand. Consumers are seeking real-time health tracking, AI-driven meal recommendations, and diet optimization features, boosting app adoption.

To Understand More About this Research: Request a Free Sample Report

Advanced AI algorithms, machine learning, and data analytics are reshaping UK & Germany diet and nutrition apps market dynamics, enabling hyper-personalized dietary recommendations based on genetic, metabolic, and lifestyle factors. Moreover, government-backed digital health policies and nutrition awareness campaigns are contributing to market growth by encouraging users to adopt digital nutrition solutions for enhanced well-being.

UK & Germany Diet and Nutrition Apps Market Dynamics

Growing Demand for Weight Management and Fitness Tracking

Escalating obesity rates and a heightened focus on fitness are driving the demand for diet and nutrition apps in the UK and Germany. For instance, according to the UK Parliament, obesity prevalence rose from 15% in 1993 to 29% in 2022. In the 2022 survey, 28% of adults in England were obese, and 36% were overweight, totaling 64% classified as overweight or obese. Men showed a higher prevalence, with 67% classified as overweight or obese compared to 61% of women. Consumers are increasingly adopting calorie counting apps, macro trackers, and AI-driven diet coaching to manage weight and improve health outcomes, creating significant market prospects. This trend is reflected in the UK & Germany diet and nutrition apps market dynamics, with a notable increase in the adoption of these digital solutions.

Surging Digital Health Ecosystem and Mobile Penetration

The proliferation of smartphones and advancements in cloud-based health data storage are significantly contributing to the UK & Germany diet and nutrition apps market expansion. For instance, in feb 2024, the UK has 111.8 million mobile subscriptions, 87 million active devices, and 25 million IoT devices. Moreover, with 98% of adults owning a mobile phone, there’s an average of 1.37 active connections per capita. Seamless integration of these apps with wearable devices enhances user experience by providing real-time health monitoring and personalized dietary recommendations, thereby increasing user engagement. This integration aligns with the growing consumer demand for mobile-first health solutions, reflecting a shift towards digital health ecosystems.

UK & Germany Diet and Nutrition Apps Market Segment Insights

UK & Germany Diet and Nutrition Apps Market Assessment by Platform Outlook

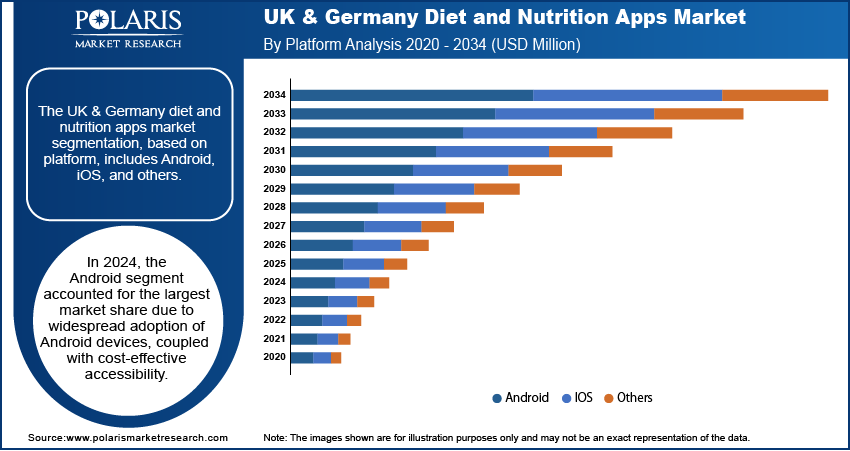

The UK & Germany diet and nutrition apps market segmentation, based on platform, includes Android, iOS, and others. In 2024, the Android segment accounted for the largest market share. The widespread adoption of Android devices, coupled with cost-effective accessibility, is contributing to the UK & Germany diet and nutrition apps market growth. The open-source nature of Android allows developers to introduce feature-rich applications tailored to diverse consumer needs. High smartphone penetration, particularly among budget-conscious users, is further driving demand. The platform's integration with Google Fit and third-party APIs enhances functionality, providing seamless data synchronization and real-time health monitoring. Additionally, increased app availability on the Google Play Store is accelerating market expansion. The segment’s dominance is also fueled by growing user preference for AI-powered personalized dietary recommendations within Android-based applications.

UK & Germany Diet and Nutrition Apps Market Evaluation by Device Outlook

The UK & Germany diet and nutrition apps market segmentation, based on device, includes smartphone, tablet, and wearable devices. In 2024, the smartphone segment accounted for the largest market share due to rapid digitalization and increasing reliance on mobile technology. Advanced sensors, biometric tracking, and app integrations with fitness apps are enhancing user engagement. The growing adoption of 5G connectivity enables real-time tracking and AI-driven health insights. The affordability and accessibility of smartphones, compared to other devices like tablets and wearables, continue to drive consumer preference. The market dynamics indicate a shift toward mobile-first health solutions, as smartphone-based diet and nutrition apps offer convenience, interactive features, and seamless integration with cloud-based health data.

UK & Germany Diet and Nutrition Apps Market Evaluation by Type Outlook

The UK & Germany diet and nutrition apps market segmentation, based on type, includes weight loss/gain tracking apps, calorie counting apps, meal planning apps, and others. In 2024, the calorie counting apps segment accounted for the largest market share due to rising awareness of nutritional intake and personalized diet planning. The increasing prevalence of obesity and lifestyle-related diseases has intensified demand for apps offering detailed macronutrient tracking and AI-driven meal recommendations. Integration with barcode scanners and voice-enabled food logging further enhances market value by improving accuracy and user experience. The adoption of subscription-based premium features, including personalized meal plans and dietitian consultations, is driving revenue growth. With rising consumer health awareness, there is a growing adoption of calorie counting apps as a critical tool in weight management and fitness optimization.

UK & Germany Diet and Nutrition Apps Market – Key Players and Competitive Insights

The competitive landscape features global leaders and regional players competing for UK & Germany diet and nutrition apps market share through technological innovation, strategic partnerships, and regional expansion. Companies leverage AI-driven personalization, machine learning algorithms, and regulatory compliance to deliver high-performance nutrition tracking solutions, meeting the growing demand for real-time dietary insights, wearable integrations, and precision nutrition. Market trends indicate a surge in AI-powered meal planning, voice-enabled food logging, and blockchain-driven data security, fueled by rising consumer awareness of health optimization, regulatory emphasis on data privacy, and increasing preference for digital wellness solutions. Strategic investments, mergers and acquisitions, and joint ventures remain crucial for market expansion, enabling firms to enhance competitive positioning and diversify service offerings. Post-merger integration and partnership ecosystems are key to unlocking market opportunities and addressing evolving consumer expectations in digital health and nutrition tracking.

Regional companies focus on cost-effective and GDPR-compliant diet and nutrition applications, leveraging localized dietary preferences and increasing adoption of AI-driven personalized health solutions to cater to industry-specific demands. Competitive benchmarking involves market entry strategies, technological advancements, and regulatory landscape assessments to align with the evolving UK & Germany health tech ecosystem. The market is witnessing technological advancements such as AI-integrated calorie tracking, cloud-based interoperability, and real-time analytics-driven meal recommendations, reshaping digital nutrition management and consumer engagement. Companies are investing in AI-powered nutrition coaching, blockchain-secured health data, and sustainable digital health solutions to align with market growth, industry trends, and evolving dietary habits. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying scalability opportunities and long-term profitability in this rapidly evolving digital health sector.

MyNetDiary Inc. is engaged in the development of digital health applications focused on diet and nutrition. The company specializes in providing a comprehensive calorie and exercise tracking platform. MyNetDiary's product portfolio includes a mobile app available on iOS and Android, featuring a vast food database, personalized diet plans, and various health-tracking tools. The services offered by MyNetDiary aim to assist users in achieving their weight loss and health goals through accurate calorie counting and nutritional insights. The company has a significant presence, with over 26 million registered users worldwide.

Lifesum AB is engaged in creating innovative health and wellness solutions through its digital platform. The company specializes in personalized nutrition and meal planning. The company's product portfolio includes a user-friendly app that provides meal plans, recipes, and tracking tools for both food intake and exercise. Lifesum's services are designed to help users make healthier food choices and develop sustainable eating habits. The company operates globally, across diverse audience seeking to improve their overall well-being through better nutrition. Lifesum is also involved in the diet and nutrition app sector, offering tailored solutions that address individual dietary needs and preferences.

List of Key Companies in UK & Germany Diet and Nutrition Apps Market

- Adidas

- Azumio, Inc.

- Eat This Much Inc.

- fatsecret

- Fitbit, Inc. (Google)

- FitNow, Inc.

- Lifesum AB

- MyFitnessPal, Inc.

- MyNetDiary Inc.

- Noom, Inc.

- Under Armour, Inc.

UK & Germany Diet and Nutrition Apps Industry Developments

In June 2024, Lifesum strengthened its presence in the European wellness sector by acquiring LYKON, integrating LYKON’s advanced biomarker testing with Lifesum’s software design. This partnership will deliver users in-depth insights into their nutritional needs and metabolic profiles, enhancing personalized health management.

In October 2023, Lifesum launched a healthy fasting program designed to enhance employee well-being and boost productivity. Used by companies like Amazon, GE, and PayPal, this initiative focuses on innovative nutritional strategies to support sustainable health and performance in the workplace.

In October 2023, MyFitnessPal launched an updated app for Wear OS by Google, incorporating features designed to enhance the user experience in health and fitness tracking.

UK & Germany Diet and Nutrition Apps Market Segmentation

By Platform Outlook (Revenue, USD Million, 2020–2034)

- Android

- iOS

- Others

By Device Outlook (Revenue, USD Million, 2020–2034)

- Smartphone

- Tablet

- Wearable Devices

By Type Outlook (Revenue, USD Million, 2020–2034)

- Weight Loss/Gain Tracking Apps

- Calorie Counting Apps

- Meal Planning Apps

- Others

By Service Outlook (Revenue, USD Million, 2020–2034)

- Paid (In App Purchase)

- Free

UK & Germany Diet and Nutrition Apps Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 550.00 million |

|

Market Size Value in 2025 |

USD 650.37 million |

|

Revenue Forecast by 2034 |

USD 2,996.58 million |

|

CAGR |

18.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The UK & Germany diet and nutrition apps market size was valued at USD 550.00 million in 2024 and is projected to grow to USD 2,996.58 million by 2034.

The market is projected to register a CAGR of 18.5% during the forecast period.

Some of the key players in the market are Adidas; Azumio, Inc.; Eat This Much Inc.; fatsecret; Fitbit, Inc. (Google); FitNow, Inc.; Lifesum AB; MyFitnessPal, Inc.; MyNetDiary Inc.; Noom, Inc.; and Under Armour, Inc.

In 2024, the Android segment accounted for the largest market share due to widespread adoption of Android devices, coupled with cost-effective accessibility.

In 2024, the smartphone segment accounted for the largest market share due to rapid digitalization and increasing reliance on mobile technology.