Travel and Expense Management Software Market Size, Share, Trends, Industry Analysis Report: By Deployment (Cloud and On-Premise), Organization Size, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM2107

- Base Year: 2024

- Historical Data: 2020-2023

Travel and Expense Management Software Market Overview

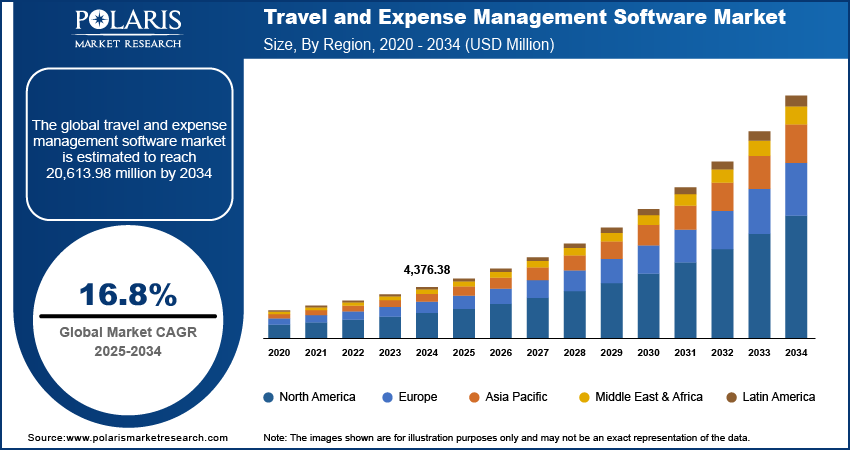

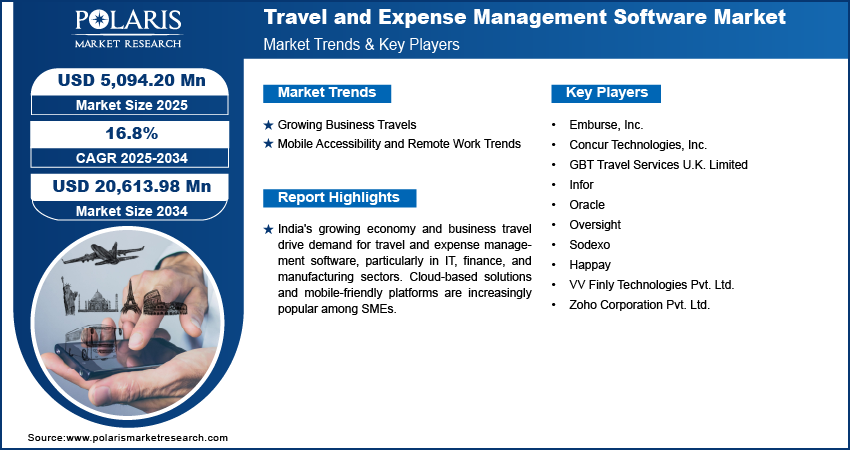

Travel and expense management software market size was valued at USD 4,376.38 million in 2024. The market is projected to grow from USD 5,094.20 million in 2025 to USD 20,613.98 million by 2034, exhibiting a CAGR of 16.8% during the forecast period.

Travel and expense management software helps businesses streamline and automate the process of booking travel, managing expenses, and ensuring compliance with company policies. It enables employees to submit, approve, and track expenses while providing organizations with real-time data and insights for better financial control.

Companies are increasingly adopting automation in their travel and expense processes to eliminate time-consuming manual tasks. Instead of relying on paper receipts and spreadsheets, businesses are able to use software to automatically capture travel data, approve expenses, and generate reports. This shift not only saves time but also reduces human errors. Automation enables quicker reimbursement cycles, streamlined approval processes, and consistent policy enforcement, which ultimately leads to better efficiency and accuracy. The growing need to reduce administrative work is further fueling the demand for automated travel and expense management tools as businesses are seeking ways to improve operational productivity, thereby driving the growth of the travel and expense management software market revenue.

To Understand More About this Research: Request a Free Sample Report

Managing travel expenses and ensuring compliance with corporate policies is a critical challenge for organizations. Travel and expense management software helps businesses enforce guidelines by automating the approval process and ensuring that only valid and policy-compliant expenses are reimbursed. Companies monitor trends and identify potential overspending or fraud by tracking spending in real time. The software provides transparency and control, reducing the risk of non-compliance with tax regulations or company policies. This makes it easier for businesses to manage budgets, control costs, and maintain adherence to both internal rules and external regulatory standards, driving its adoption in businesses and thereby propelling the travel and expense management software market growth.

Travel and Expense Management Software Market Dynamics

Growing Business Travels

Globalization has led companies to expand their operations worldwide, resulting in a significant increase in business travel. According to the US Travel Association, business travelers took 2.6 trips to the US in six months in 2021, showcasing a growing volume of the US travelers. This surge in travel is driving the need for effective management tools to streamline bookings, track expenses, and ensure cost control. Travel and expense management software helps businesses handle the complex process of organizing travel plans, including flights, accommodations, and transportation, while also monitoring and controlling spending. The growing number of employees traveling for work drives the demand for software that can manage the increasing volume of transactions and provide valuable insights into spending patterns. As a result, the travel and expense management market demand is expanding.

Rising Mobile Accessibility and Remote Work Trends

Remote work and flexible work arrangements have become more common, increasing the demand for mobile-accessible travel and expense management software. Employees working from various locations need the flexibility to book travel, submit expenses, and track reimbursements while on the go. Mobile-friendly platforms allow businesses to offer real-time, convenient solutions, enabling employees to submit expenses, approve reports, and make travel arrangements directly from their smartphones or tablets. The shift toward mobile accessibility is driving the demand for software that supports remote and mobile work environments, thereby driving the growth of the travel and expense management software market.

Travel and Expense Management Software Market Segment Analysis

Travel and Expense Management Software Market Assessment by Deployment

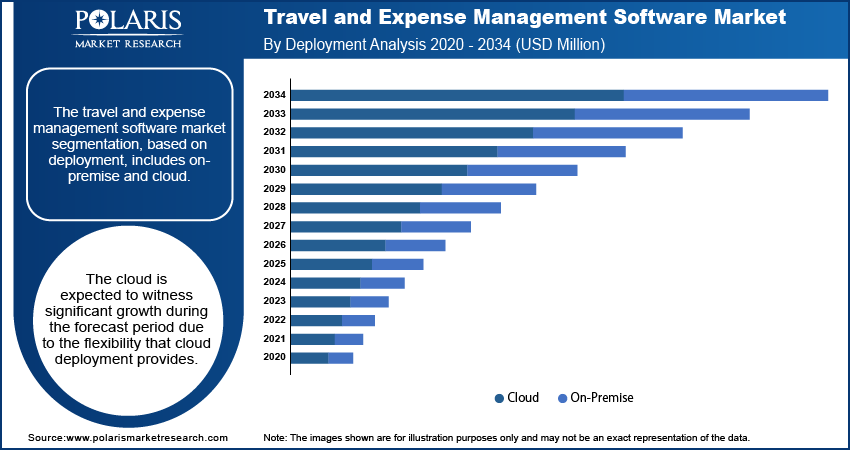

The travel and expense management software market segmentation, based on deployment, includes cloud and on-premise. The cloud segment is expected to witness significant growth during the forecast period. Cloud deployment offers businesses flexibility, scalability, and cost-effectiveness, as companies no longer need to maintain expensive on-premise infrastructure. Cloud-based software allows employees to access the system from anywhere, enabling better collaboration and real-time updates. It also provides improved security and easier integration with other business systems. The demand for cloud-based travel and expense management software continues to rise as businesses are seeking more efficient, accessible, and low-maintenance solutions, thereby driving the segmental growth in the market.

Travel and Expense Management Software Market Evaluation by Organization Size

The travel and expense management software market segmentation, based on organization size, includes SMEs and large enterprises. The large enterprises segment dominated the market in 2024. Larger organizations typically have more complex travel and expense needs, including managing a larger volume of transactions, employees, and budgets. These businesses require robust software solutions that offer advanced features, such as customizable approval workflows, integration with other enterprise systems, and detailed reporting. The ability to streamline processes, improve compliance, and reduce administrative workload is driving the demand for travel and expense management software, leading large enterprises to invest in these solutions.

Travel and Expense Management Software Market Regional Insights

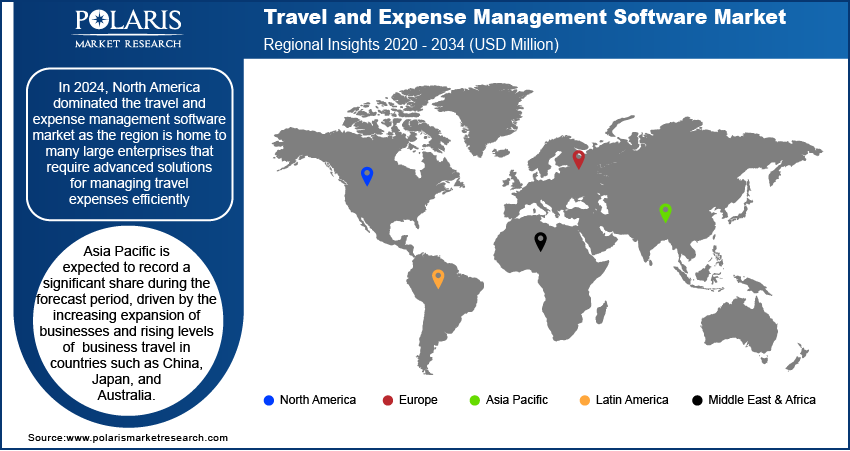

By region, the study provides the travel and expense management software market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market. The region is home to many large enterprises that require advanced solutions for managing travel expenses efficiently. Companies in North America are early adopters of new technology, driving demand for automation, cloud-based platforms, and data analytics. Additionally, the focus on compliance, cost control, and enhanced productivity has led to significant investments in travel and expense management tools. The high number of business travelers and the growing trend of remote work are further contributing to the rise in the demand for software, thereby driving the market in North America.

Asia Pacific is expected to record a significant travel and expense management software market share during the forecast period. This growth is driven by the increasing expansion of businesses and rising levels of business travel in countries such as China, Japan, and Australia. The growth of companies in the region has led to a higher demand for software solutions to manage travel expenses, improve compliance, and ensure cost control. Digitalization, a growing middle class, and a shift toward automation are further contributing to the rise in the demand for travel and expense management software. Additionally, cloud-based solutions are becoming more popular in Asia Pacific due to their flexibility, scalability, and lower upfront costs, driving the market in the region.

The travel and expense management software market in India is experiencing substantial growth, driven by the country's expanding economy and the increasing number of business travelers. Many Indian companies, particularly in sectors such as IT, finance, and manufacturing, are adopting these solutions to streamline travel processes and reduce costs. The adoption of cloud-based solutions is growing in India due to their cost-effectiveness and scalability, making them ideal for small and medium-sized enterprises (SMEs). Additionally, the rising trend of remote workplace models is boosting the demand for mobile-friendly travel and expense management platforms in India, thereby driving the regional footprint in the travel and expense management software market statistics.

Travel and Expense Management Software Market Key Players & Competitive Analysis Report

The travel and expense management software market stats are constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. According to the market analysis these companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive trend is amplified by continuous progress in product offerings. Major players in the travel and expense management software market include Emburse, Inc.; Concur Technologies, Inc.; GBT Travel Services U.K. Limited; Infor; Oracle; Oversight; Sodexo; Happay; VV Finly Technologies Pvt. Ltd.; and Zoho Corporation Pvt. Ltd.

Emburse, Inc. is a financial technology company that provides solutions for managing expenses and automating accounts payable processes. Founded in 2014, it is headquartered in Los Angeles, California, with additional offices in Portland, Maine, and San Francisco. Emburse serves a large user base across 120 countries, supporting over 20,000 organizations, including large corporations, small businesses, government agencies, and nonprofits. The company offers a range of software-as-a-service (SaaS) products designed to help organizations manage their financial operations more efficiently. These includes tools for tracking and automating employee expenses, automating accounts payable processes, managing business travel, issuing corporate cards, and analyzing spending patterns. E burse's product portfolio includes several brands, such as Abacus, Chrome River, Certify, Nexonia, Tallie, SpringAhead, and Cards. These solutions aim to reduce manual processes and integrate with existing enterprise systems. Emburse operates globally, supporting clients in North America, Europe, Asia Pacific, and other regions. Its solutions are available in multiple currencies and tax jurisdictions, catering to diverse industries such as healthcare, legal services, construction, education, and professional services. burse offers travel and expense management software that streamlines corporate travel booking, automates expense reporting, ensures policy compliance, and provides real-time insights to control costs while enhancing operational efficiency.

Oracle Corporation is a global technology company that specializes in cloud-based solutions, database management systems, and enterprise software. Founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates, Oracle initially focused on relational database management systems (RDBMS) and has since grown into a major IT vendor. The company is headquartered in Austin, Texas, and operates across the Americas, Europe, the Middle East, and Asia Pacific. Oracle's product portfolio includes several key segments. The cloud services and license support segment generate significant revenue from infrastructure-as-a-service (IaaS), software-as-a-service (SaaS), and platform-as-a-service (PaaS) offerings. Additionally, Oracle provides hardware systems, including servers, storage solutions, and networking hardware. Its database software is widely used, with Oracle Database being a popular choice for transaction processing, business intelligence, and analytics applications. The company also owns MySQL, an open-source database system. Oracle also offers applications such as enterprise resource planning (ERP), customer relationship management (CRM), and human capital management (HCM) software within its SaaS suite. Oracle operates globally with a presence in key markets across the Americas, Europe, the Middle East, and Asia Pacific. Its cloud infrastructure spans multiple global data centers. The company has expanded through acquisitions, such as Sun Microsystems, and developed technologies like the autonomous database. Oracle Expenses Cloud, part of the Oracle ERP Cloud Financials suite, streamlines travel and expense management by automating expense tracking, policy compliance, and audits. It enables mobile expense submission, corporate card integration, and detailed analytics for cost control and efficient approval processes.

Key Companies in Travel and Expense Management Software Market

- Emburse, Inc.

- Concur Technologies, Inc.

- GBT Travel Services U.K. Limited

- Infor

- Oracle

- Oversight

- Sodexo

- Happay

- VV Finly Technologies Pvt. Ltd.

- Zoho Corporation Pvt. Ltd.

Travel and Expense Management Software Market Developments

June 2024: Ramp, the finance operations platform designed to save businesses time and money, announced the launch of Ramp Travel, a solution designed to make booking travel and automating expenses easy, low-cost, and intuitive.

July 2021: Infiniti Software Solutions relaunched the all-new ExpenseOut, which features AI-powered features to reduce indirect expenses and streamline expense management for companies worldwide.

Travel and Expense Management Software Market Segmentation

By Deployment Outlook (Revenue USD Million, 2020–2034)

- Cloud

- On-Premises

By Organization Size Outlook (Revenue USD Million, 2020–2034)

- SMEs

- Large Enterprises

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Travel and Expense Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4,376.38 million |

|

Market size value in 2025 |

USD 5,094.20 million |

|

Revenue Forecast in 2034 |

USD 20,613.98 million |

|

CAGR |

16.8% from 2025–2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The travel and expense management software market size was valued at USD 4,376.38 million in 2024 and is projected to grow to USD 20,613.98 million by 2034.

The global market is projected to register a CAGR of 16.8% during the forecast period 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are Emburse, Inc.; Concur Technologies, Inc.; GBT Travel Services U.K. Limited; Infor; Oracle; Oversight; Sodexo; Happay; VV Finly Technologies Pvt. Ltd.; and Zoho Corporation Pvt. Ltd.

The large enterprise segment dominated the travel and expense management software market in 2024 as larger organizations typically have more complex travel and expense needs, including managing a larger volume of transactions, employees, and budgets.

The cloud is expected to witness significant growth during the forecast period due to the flexibility that cloud deployment provides.