Transcritical CO2 Systems for Commercial and Industrial Refrigeration Market Size, Share, Trends, Industry Analysis Report: By Commercial Application (Supermarkets & Hypermarkets, Convenience Stores, Hotels & Restaurants, and Other Retail Stores), Industrial Application, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 107

- Format: PDF

- Report ID: PM5158

- Base Year: 2024

- Historical Data: 2020-2023

Transcritical CO2 Systems for Commercial and Industrial Refrigeration Market Overview

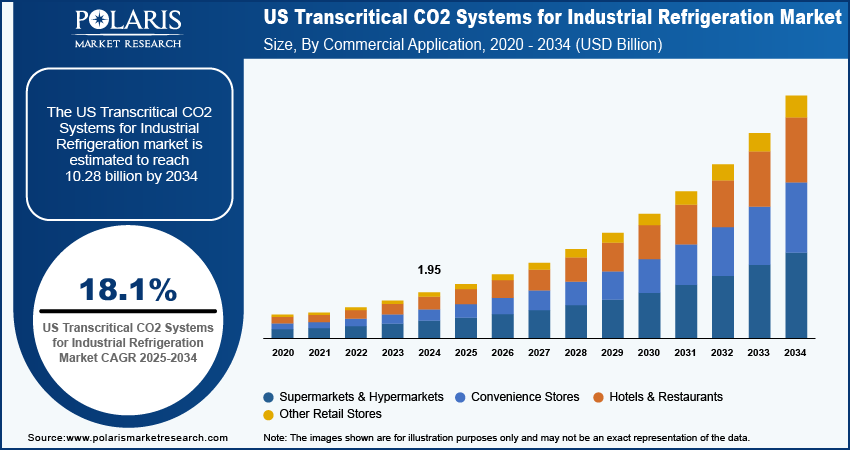

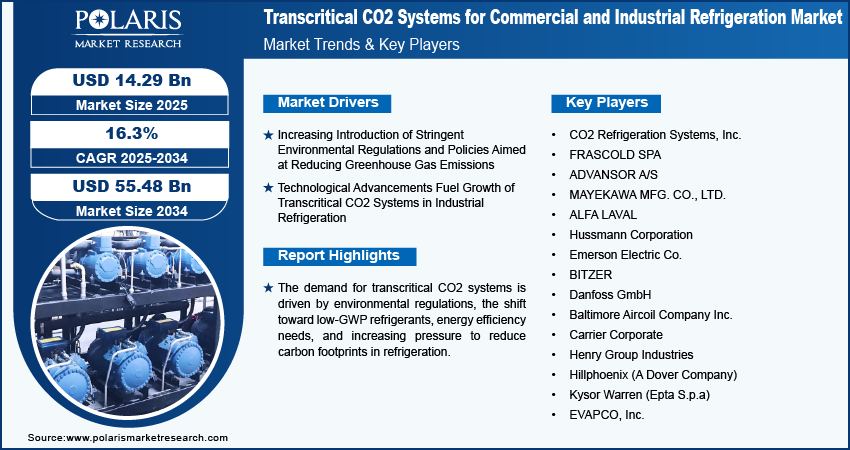

The global transcritical CO2 systems for commercial and industrial refrigeration market size was valued at USD 12.30 billion in 2024. The market is projected to grow from USD 14.29 billion in 2025 to USD 55.48 billion by 2034, exhibiting a CAGR of 16.3% during 2025–2034.

The transcritical CO2 market is the broader concept of the refrigeration and heating industry that utilizes carbon dioxide (CO2) as a natural refrigerant in a transcritical cycle. Unlike traditional refrigerants, transcritical CO2 operates at higher pressures and temperatures, making it suitable for various applications, including heat pumps, supermarkets, food processing, and ice-skating spaces. Transcritical CO2 systems have gained significant traction in commercial and industrial refrigeration due to their environmentally friendly characteristics and energy efficiency. A key driving factor behind the adoption of these systems is the increasing global pressure to reduce the carbon footprint of refrigerants. Traditional systems often rely on synthetic refrigerants with high global warming potential (GWP), whereas transcritical CO2 systems use natural CO2, which has a GWP of 1. Additionally, rising energy costs and the demand for more efficient cooling systems have accelerated the shift toward the use of transcritical CO2 technology.

One prominent trend influencing the adoption of transcritical CO2 systems is the growing focus on sustainability and the circular economy. Governments across the globe have introduced stringent regulations, such as the European Union’s F-gas regulations, to phase out harmful refrigerants. The regulations force companies to transition toward natural alternatives such as CO2. These systems are now increasingly adopted in supermarkets, cold storage facilities, and industrial processes, showcasing their versatility and scalability in diverse applications such as cold storage warehouses and food & beverage processing.

To Understand More About this Research: Request a Free Sample Report

The transcritical CO2 refrigeration market is expected to experience robust growth as more businesses seek eco-friendly, cost-efficient cooling solutions. The demand for low-GWP systems will continue to rise, particularly in regions with strong regulatory frameworks. Market growth will also be fueled by the increased awareness of environmental sustainability and the long-term cost savings offered by energy-efficient systems. As the technology matures, the adoption of transcritical CO2 systems will become a standard in commercial and industrial refrigeration, further shaping the future of the refrigeration industry.

Transcritical CO2 Systems for Commercial and Industrial Refrigeration Market Drivers

Increasing Introduction of Stringent Environmental Regulations and Policies Aimed at Reducing Greenhouse Gas Emissions

Increasingly strict environmental regulations and policies aimed at reducing greenhouse gas emissions drive the demand for transcritical CO2 systems in the industrial refrigeration market. Traditional refrigerants, such as hydrofluorocarbons (HFCs), have a high global warming potential (GWP), which contributes to climate change and environmental degradation. Governments and regulatory bodies around the world are implementing stricter rules to phase out or limit the use of such refrigerants. For instance, the Kigali Amendment to the Montreal Protocol mandates a global phase-down of HFCs, prompting industries to seek environmentally friendly alternatives. CO2, with its low GWP and non-ozone-depleting properties, emerges as a viable solution that aligns with these regulatory demands. The regulatory pressure accelerates the shift toward transcritical CO2 systems as industries strive to comply with environmental standards and avoid potential fines and penalties.

Government incentives, subsidies, and grants for green technologies, including renewable energy and electric vehicles, play a crucial role in promoting the shift toward sustainability. These initiatives encourage the adoption of eco-friendly innovations by making them more affordable and accessible, helping to accelerate the transition to a cleaner, more energy-efficient future. Moreover, by investing in transcritical CO2 systems, companies ensure compliance with regulations and also earn benefits such as increased energy efficiency, reduced operating costs, and improved corporate governance. Collectively, these factors boost the demand for sustainable refrigeration solutions such as transcritical CO2 systems for commercial and industrial refrigeration.

Technological Advancements Fuel Growth of Transcritical CO2 Systems in Industrial Refrigeration

Technological advancements have led to the development of more efficient and reliable system components, such as enhanced compressors, heat exchangers, and control systems. These innovations have improved the overall performance and energy efficiency of CO2 systems, making them a more viable and attractive option for industrial applications.

The introduction of multi-stage and variable-speed compressors has optimized the operation of CO2 systems under varying load conditions, resulting in reduced energy consumption and lower operational costs. Furthermore, advancements in heat exchanger design such as microchannel heat exchangers have enhanced heat transfer efficiency, boosting the overall efficiency of the system.

The integration of smart controls and Internet of Things (IoT) technologies into CO2 refrigeration systems has transformed their management and maintenance. Real-time monitoring and predictive maintenance capabilities allow for proactive issue resolution, reducing downtime and ensuring optimal system performance. Enhanced data analytics and machine learning algorithms further optimize operational parameters, leading to increased energy savings and improved reliability. These ongoing technological innovations make transcritical CO2 systems more appealing and address traditional challenges related to their adoption, such as efficiency in warmer climates and technical complexity. As a result, advancements in CO2 refrigeration drive greater acceptance and implementation of transcritical CO2 systems. Thus, technological advancements in transcritical CO2 systems boost the transcritical CO2 systems for commercial and industrial refrigeration market growth.

Transcritical CO2 Systems for Commercial and Industrial Refrigeration Market Segment Insights

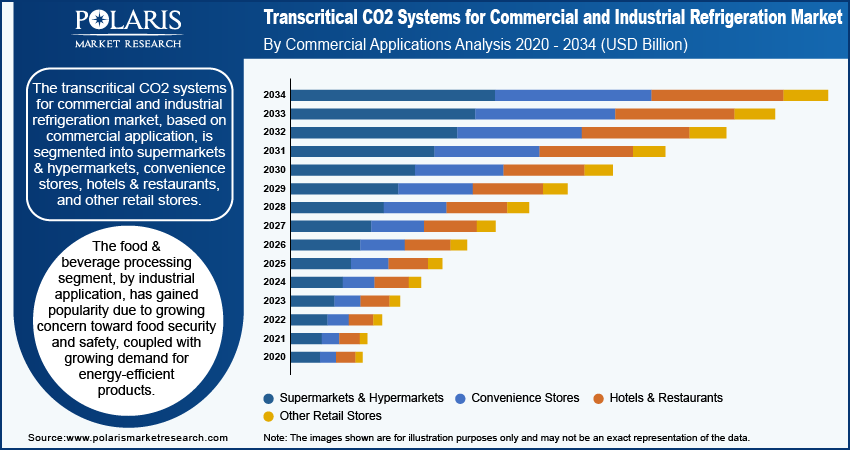

Transcritical CO2 Systems for Commercial and Industrial Refrigeration Market Breakdown by Commercial Application Insights

The transcritical CO2 systems for commercial and industrial refrigeration market, based on commercial application, is segmented into supermarkets & hypermarkets, convenience stores, hotels & restaurants, and other retail stores. In 2024, the supermarkets & hypermarkets segment dominated the market, accounting for 40.3% of market revenue (USD 10.30 billion) share. The application of transcritical CO2 systems in commercial sectors such as supermarkets and hypermarkets plays a crucial role, especially in terms of energy efficiency and preservation of goods. Large retail outlets such as supermarkets and hypermarkets require extensive refrigeration solutions to maintain the freshness and quality of perishable goods, including dairy products, meats, and produce. Thus, transcritical CO2 systems provide a sustainable and energy-efficient alternative to traditional refrigerants, which is increasingly important to create a balance between growing environmental and regulatory concerns. Therefore, by adopting CO2-based refrigeration systems, supermarkets and hypermarkets can lower their carbon footprint and reduce operational costs. Moreover, the enhanced performance and reliability of transcritical CO2 systems ensure consistent cooling, which is vital for customer satisfaction and food safety. As a result, the demand for transcritical CO2 systems in these retail environments to maintain a balance between environmental concerns and cater to consumer demand is propelling the global transcritical CO2 systems for commercial and industrial refrigeration market for the supermarkets & hypermarkets segment.

Transcritical CO2 Systems for Commercial and Industrial Refrigeration Market Breakdown by Industrial Application Insights

The transcritical CO2 systems for commercial and industrial refrigeration market, based on industrial application, is segmented into food & beverage processing, cold storage warehouses, chemical & pharmaceutical, and other industrial applications. The other industrial applications segment is expected to register a CAGR of 17.2% during the forecast period, owing to increasing demand for cooling systems across industries such as data centers, ice rinks, and manufacturing facilities. The market is expected to witness significant growth during the forecast period, as companies across various sectors i.e. commercial and industrial prioritize by factors such as demand for energy efficiency and eco-friendly cooling solutions. Moreover, the shift toward transcritical CO2 systems in industrial refrigeration is driven by increasing regulatory pressures from governments across the globe and the rising need for sustainable practices across a broader range of industrial applications.

Technological advancements have improved the performance of transcritical CO2 systems over the past few years, making them adaptable to diverse industrial settings beyond traditional refrigeration needs. The growing emphasis on sustainability, coupled with cost savings over time, is likely to influence the adoption of transcritical CO2 systems across industries such as pharmaceuticals, chemicals, food & beverages, and others.

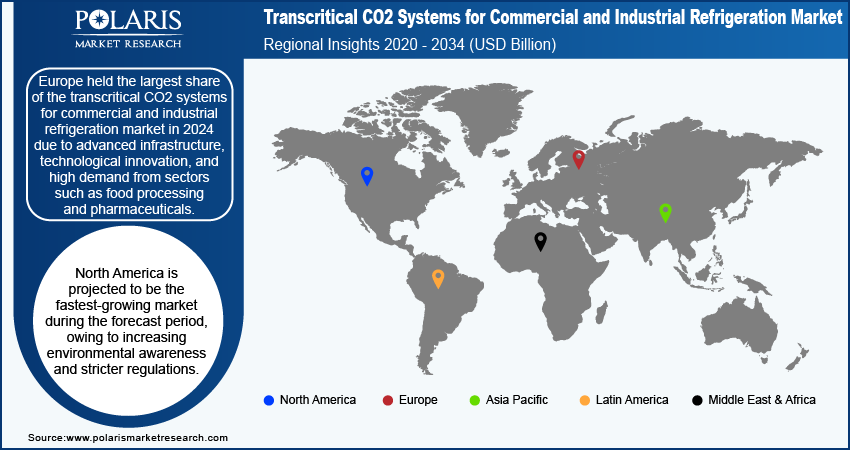

Transcritical CO2 Systems for Commercial and Industrial Refrigeration Market Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Europe held the largest share of the transcritical CO2 systems for commercial and industrial refrigeration market in 2024, driven by stringent environmental regulations and a strong emphasis on sustainability. Policies such as the F-Gas Regulation focus on reducing the use of high-GWP refrigerants, which drives the adoption of eco-friendly CO2 systems. Additionally, Europe benefits from advanced infrastructure, technological innovation, and high demand from sectors such as food processing and pharmaceuticals. Countries such as Germany, the UK, and France have been leading in the adoption of transcritical CO2 systems, particularly in sectors such as retail, food processing, and cold storage. These factors collectively contribute to the widespread implementation of CO2 refrigeration systems, resulting in a significant market share. The advanced infrastructure and strong regulatory frameworks in Europe make it a hub for sustainable refrigeration solutions, solidifying its leadership in this market.

North America is projected to be the fastest-growing market during the forecast period. While the region’s adoption of transcritical CO2 systems has been slower compared to Europe, increasing environmental awareness and stringent regulations accelerate the market growth. The US and Canada are seeing a surge in demand for low-GWP refrigeration solutions, particularly in supermarkets and industrial applications. Moreover, the region’s commitment to reduce greenhouse gas emissions and improve energy efficiency aligns with the benefits of CO2 systems. Additionally, rising advancements in technology and a growing focus on green practices within industries such as food processing and pharmaceuticals drive rapid adoption, fueling the transcritical CO2 systems for commercial and industrial refrigeration market growth in North America.

As companies seek to reduce their carbon footprint and meet regulatory standards, the North America transcritical CO2 systems for commercial and industrial refrigeration market is expected to witness significant expansion during the forecast period.

Transcritical CO2 Systems for Commercial and Industrial Refrigeration Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will boost the transcritical CO2 systems for commercial and industrial refrigeration market growth in the coming years. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the transcritical CO2 systems for commercial and industrial refrigeration market must offer cost-effective items.

Manufacturing products locally to minimize operational costs is one of the key business tactics used by manufacturers in the global transcritical CO2 systems for commercial and industrial refrigeration market to benefit clients.. Major players in the transcritical CO2 systems for commercial and industrial refrigeration market are CO2 Refrigeration Systems, Inc.; FRASCOLD SPA; ADVANSOR A/S; MAYEKAWA MFG. CO., LTD.; ALFA LAVAL; Hussmann Corporation; Emerson Electric Co.; BITZER; Danfoss GmbH; Baltimore Aircoil Company Inc.; Carrier Corporate; Henry Group Industries; Hillphoenix (A Dover Company); Kysor Warren (Epta S.p.a); and EVAPCO, Inc.

FRASCOLD SPA is a mechanical and industrial engineering company that specializes in HVAC, semi-hermetic compressors, commercial refrigeration, open drive screw compressors, ammonia refrigeration, heat pump, heating, propane, NH3, rack, chiller, process cooling, and industrial refrigeration. In April 2024, Frascold’s launched new TK HD series transcritical CO2 compressors. The company claims that the compressors offer high performance, energy efficiency, and reduced noise for 24/7 operations, emphasizing sustainability and durability.

MAYEKAWA MFG. CO., LTD. is a mechanical and industrial engineering company that specializes in thermal engineering, gas compression, food processing equipment, refrigeration technologies, and energy savings. The company is developing sustainable and efficient industrial solutions across various sectors. It offers advanced technologies under the MYCOM brand, including high-quality compressors for industrial refrigeration, freezing, and gas applications. Mayekawa's expertise extends to specialized gas compressors handling a range of gases. In April 2023, Mayekawa launched Unimo AW CO2 (R744) air-source heat pump in the US for hot water production in multi-family, mixed-use buildings, and small industrial applications.

List of Key Companies in Transcritical CO2 Systems for Commercial and Industrial Refrigeration Market

- CO2 Refrigeration Systems, Inc.

- FRASCOLD SPA

- ADVANSOR A/S

- MAYEKAWA MFG. CO., LTD.

- ALFA LAVAL

- Hussmann Corporation

- Emerson Electric Co.

- BITZER

- Danfoss GmbH

- Baltimore Aircoil Company Inc.

- Carrier Corporate

- Henry Group Industries

- Hillphoenix (A Dover Company)

- Kysor Warren (Epta S.p.a)

- EVAPCO, Inc.

Transcritical CO2 Systems for Commercial and Industrial Refrigeration Industry Developments

March 2023: Emerson introduced the transcritical CO2 screw compressor for industrial refrigeration, showcased at the 2023 IIAR Expo.

December 2023: Hussmann expanded CO2 rack system production in response to rising demand driven by ESG regulations and HFC phase-outs.

March 2022: Alfa Laval introduced the AC540 brazed-plate heat exchanger series for CO2 refrigeration, featuring the DynaStatic system, reducing refrigerant charge and pressure drop for energy savings.

Transcritical CO2 Systems for Commercial and Industrial Refrigeration Market Segmentation

By Commercial Application Outlook

- Supermarkets & Hypermarkets

- Convenience Stores

- Hotels & Restaurants

- Other Retail Stores

By Industrial Application Outlook

- Food & Beverage Processing

- Cold Storage Warehouses

- Chemical & Pharmaceutical

- Other Industrial Applications

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Transcritical CO2 Systems for Commercial and Industrial Refrigeration Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.30 billion |

|

Market Size Value in 2025 |

USD 14.29 billion |

|

Revenue Forecast by 2034 |

USD 55.48 billion |

|

CAGR |

16.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global transcritical CO2 systems for commercial and industrial refrigeration market size was valued at USD 12.30 billion in 2024 and is projected to grow to USD 55.48 billion by 2034

The global market is expected to register a CAGR of 16.3% during the forecast period.

Europe held the largest share in 2024, driven by stringent environmental regulations and a strong emphasis on sustainability. Policies such as F-Gas Regulation focus on reducing the use of high-GWP refrigerants, which drives the adoption of eco-friendly CO2 systems.

A few key players in the market are CO2 Refrigeration Systems, Inc.; FRASCOLD SPA; ADVANSOR A/S; MAYEKAWA MFG. CO., LTD.; ALFA LAVAL; Hussmann Corporation; Emerson Electric Co.; BITZER; Danfoss GmbH; Baltimore Aircoil Company Inc.; Carrier Corporate; Henry Group Industries; Hillphoenix (A Dover Company); Kysor Warren (Epta S.p.a); and EVAPCO, Inc.

The supermarkets & hypermarkets segment dominated the market in 2024

The food & beverage processing segment held the largest share of the market in 2024.