Transcatheter Aortic Valve Replacement (TAVR) Market Size, Share, Trends, Industry Analysis Report: By Mechanism (Self-Expandable and Balloon-Expandable), Material, Procedure, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM1240

- Base Year: 2024

- Historical Data: 2020-2023

Transcatheter Aortic Valve Replacement (TAVR) Market Overview

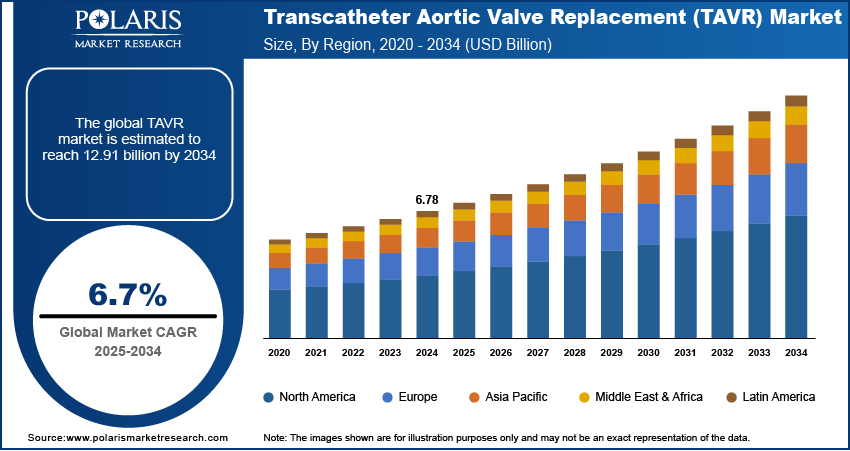

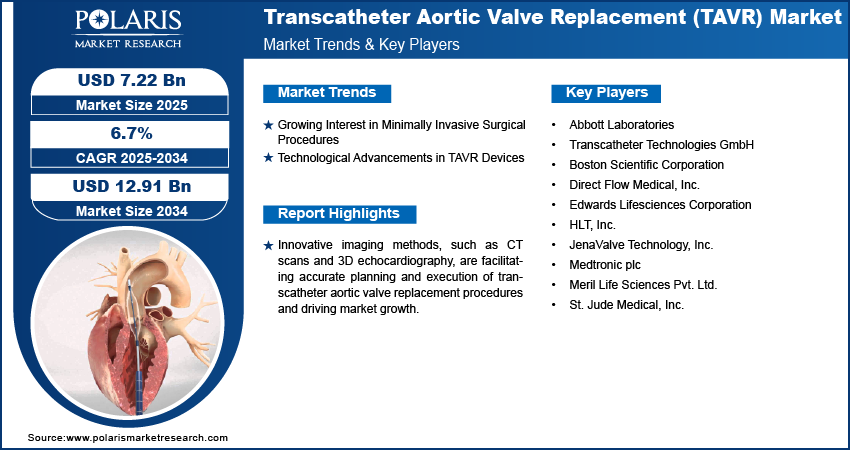

The global transcatheter aortic valve replacement (TAVR) market size was valued at USD 6.78 billion in 2024. The market is projected to grow from USD 7.22 billion in 2025 to USD 12.91 billion by 2034, at a CAGR of 6.7% from 2025 to 2034.

Transcatheter aortic valve replacement (TAVR) is a minimally invasive surgical treatment that involves replacing a sick or malfunctioning aortic valve with an artificial valve. TAVR is used to treat aortic stenosis, which occurs when the aortic valve narrows, making it difficult for the heart to flow blood throughout the body.

The growing incidence of cardiac valve diseases and the implementation of favorable government initiatives are a few of the key factors driving the transcatheter aortic valve replacement market growth. The approval of new products by governments worldwide and the benefits of transcatheter technology over surgical valves are also contributing to the market expansion. TAVR is currently the recommended alternative to traditional open-heart surgery as it is less invasive, has quicker recovery times, and has lower death rates. In addition, the market is being positively impacted by the growing number of obese people and the frequency of congenital cardiac problems.

To Understand More About this Research:Request a Free Sample Report

The rising aging population globally is one of the major transcatheter aortic valve replacement market trends projected to drive market development in the coming years. The aging population is more susceptible to aortic valve diseases, which drives the demand for novel treatments like TAVR. Advances in catheter technology, imaging methods, and valve design have increased TAVR's accessibility, safety, and effectiveness. Cutting-edge imaging technologies, including CT scans and 3D echocardiography, allow for precise operation planning and execution, thereby reducing problems and supporting market growth.

Transcatheter Aortic Valve Replacement Market Dynamics

Growing Interest in Minimally Invasive Surgical Procedures

TAVR is a less invasive alternative to traditional surgical aortic valve replacement (SAVR). The less invasive nature of TAVR procedures makes them appealing to both patients and healthcare professionals, as they result in shorter hospital stays, faster recovery times, and fewer post-operative problems. These procedures are highly beneficial for elderly patients and those with several comorbidities. With healthcare systems placing a higher priority on patient-centered and cost-effective methods, there is a growing shift toward minimally invasive procedures like TAVR. Thus, the growing need for minimally invasive surgeries is driving the transcatheter aortic valve replacement market expansion.

Technological Advancements in TAVR Devices

Innovations like next-generation valve designs, delivery systems, and imaging techniques have made TAVR operations safer and more efficient. These developments also help in addressing limitations like durability, convenience of implantation, and anatomical variances among patients. This, in turn, has increased the number of patients who can benefit from TAVR, improved procedural outcomes, and lowered the risk of complications. Thus, technological advancements in TAVR devices are propelling the transcatheter aortic valve replacement market revenue.

Transcatheter Aortic Valve Replacement Market Segment Insights

Transcatheter Aortic Valve Replacement Market Evaluation by Mechanism Insights

The transcatheter aortic valve market segmentation, based on mechanism, includes self-expandable and balloon-expandable. The balloon-expandable segment led the market with a 57.4% market share in 2024. The non-repositionable, intra-annular architecture and reduced stent frame profile of balloon-expandable TAVR provide easy coronary access. In addition, ballon-expandable TAVR has a more steerable delivery mechanism as opposed to self-expanding devices, making it highly beneficial for patients with complicated vascular anatomy, such as a horizontal aorta. The introduction of several innovative ballon-expandable TAVR products by market participants also contributes to the segment’s leading market position.

The self-expandable segment is projected to witness significant growth during the forecast period. Most self-expanding valves are supra-annular, which reduces the rate of severe prosthesis-patient mismatch (PPM), lowers gradients, and increases the effective orifice area. Major manufacturers are also focusing on advanced product development, which contributes to the growth of the segment.

Transcatheter Aortic Valve Replacement Market Assessment by End Use Insights

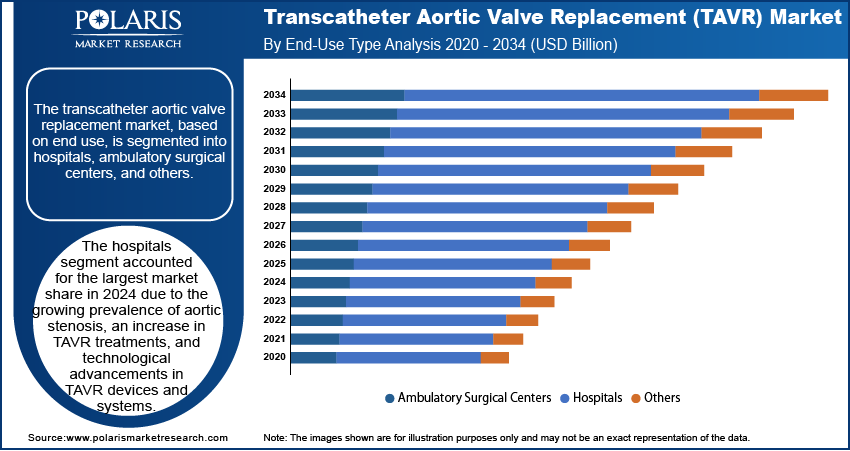

Based on end use, the transcatheter aortic valve replacement market is segmented into ambulatory surgical centers, hospitals, and others. The hospitals segment dominated the market with the largest revenue share of 89.4% in 2024. The segment’s dominance is largely attributed to the presence of favorable reimbursement policies in both developed and developing nations, improved healthcare infrastructure, and technological improvements in TAVR devices and systems.

The ambulatory surgical centers segment is projected to witness the fastest growth during the forecast period. These facilities have reduced overhead, fixed costs, and shorter stays than hospitals, which makes them more affordable and drives the segment’s growth.

Transcatheter Aortic Valve Replacement Market Regional Analysis

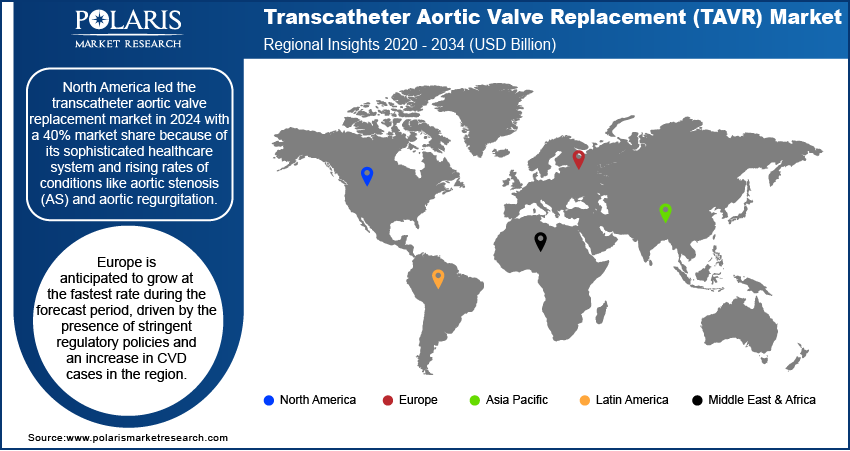

By region, the report provides the transcatheter aortic valve replacement market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America led the global market with a 40% revenue share in 2024, driven by its advanced healthcare system and rising incidence of diseases like aortic stenosis coupled with a well-developed healthcare infrastructure that supports the adoption of advanced medical technologies.

The Europe transcatheter aortic valve replacement market is expected to witness the fastest growth during the forecast period. The region’s robust growth is driven by several factors, including rapid economic development, the presence of stringent regulations, and an increase in cardiovascular disease (CVD) cases. For instance, a May 2024 article from the World Health Organization highlighted that CVD accounts for over 42.5% of all yearly deaths in Europe, or around 10,000 deaths every day, making them the primary cause of disability and premature death. Besides, the introduction of new, innovative products in the EU has made TAVR more accessible, thereby contributing to the regional market development.

TAVR Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their offerings, which will help the market grow even more. Market participants are also undertaking a variety of strategic activities, such as innovative product launches, international collaborations, higher investments, and mergers and acquisitions to expand their global footprint. To expand and survive in a more competitive and rising market climate, market participants must offer cost-effective solutions.

The transcatheter aortic valve replacement market faces competition from major global players. These players dominate the market with their extensive production capacities and advanced technologies. Competition is further heightened by fluctuating raw material prices, stringent environmental regulations, and the necessity for technological advancements to improve device efficiency. A few major players in the market are Boston Scientific Corporation; Direct Flow Medical, Inc.; Edwards Lifesciences Corporation; HLT, Inc.; Abbott Laboratories; JenaValve Technology, Inc.; Medtronic plc; Meril Life Sciences Pvt. Ltd.; St. Jude Medical, Inc.; Medtronic; and Transcatheter Technologies GmbH.

List of Transcatheter Aortic Valve Replacement Market Key Players

- Abbott Laboratories

- Boston Scientific Corporation

- Direct Flow Medical, Inc.

- Edwards Lifesciences Corporation

- HLT, Inc.

- JenaValve Technology, Inc.

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- St. Jude Medical, Inc.

- Transcatheter Technologies GmbH

Transcatheter Aortic Valve Replacement Industry Developments

In November 2024, Abbott announced the first patient procedures with its investigational transcatheter aortic valve implantation (TAVI) balloon-expandable system. The company stated that the system is a first step toward creating a TAVI platform that is AI-integrated and software-guided. In addition to the commercially available Navitor TAVI system, this innovation will expand Abbott's structural heart portfolio and give doctors another treatment option.

In August 2024, Boston Scientific received CE Mark approval for their Acurate Prime TAVR system, which is intended for patients with severe aortic stenosis. It is based on the Acurate Neo2 platform and has a better valve frame, improved valve sizes for larger anatomies, and faster, controlled deployment.

Transcatheter Aortic Valve Replacement Market Segmentation

By Mechanism Outlook

- Self-Expandable

- Balloon-Expandable

By Material Outlook

- Stainless Steel

- Cobalt Chromium

- Nitinol

- Others

By Procedure Outlook

- Transapical

- Transaortic

- Transfemoral

By End Use Outlook

- Ambulatory Surgical Centers

- Hospitals

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Transcatheter Aortic Valve Replacement Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.78 billion |

|

Market Size Value in 2025 |

USD 7.22 billion |

|

Revenue Forecast by 2034 |

USD 12.91 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The transcatheter aortic valve replacement market was valued at USD 6.78 billion in 2024 and is projected to grow to USD 12.91 billion in 2034.

The market is projected to register a CAGR of 6.7% during the forecast period.

North America held the largest market share in 2024.

Boston Scientific Corporation; Direct Flow Medical, Inc.; Transcatheter Technologies GmbH; Edwards Lifesciences Corporation; HLT, Inc.; St. Jude Medical; Medtronic, and Abbott Laboratories are a few of the key players in the market.

The hospitals segment dominated the market in 2024.

The balloon-expandable segment held the largest market share in 2024.