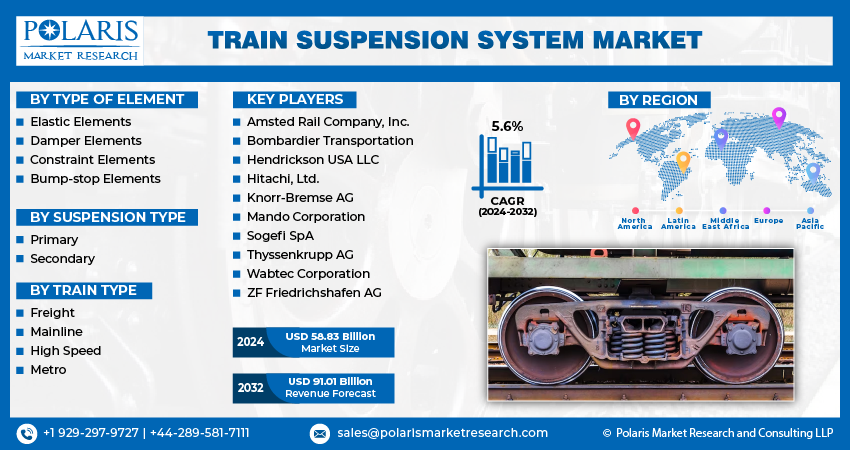

Train Suspension System Market Share, Size, Trends, Industry Analysis Report, By Type of Element (Elastic, Damper, Constraint, Bump-stop); By Suspension Type; By Train Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4175

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

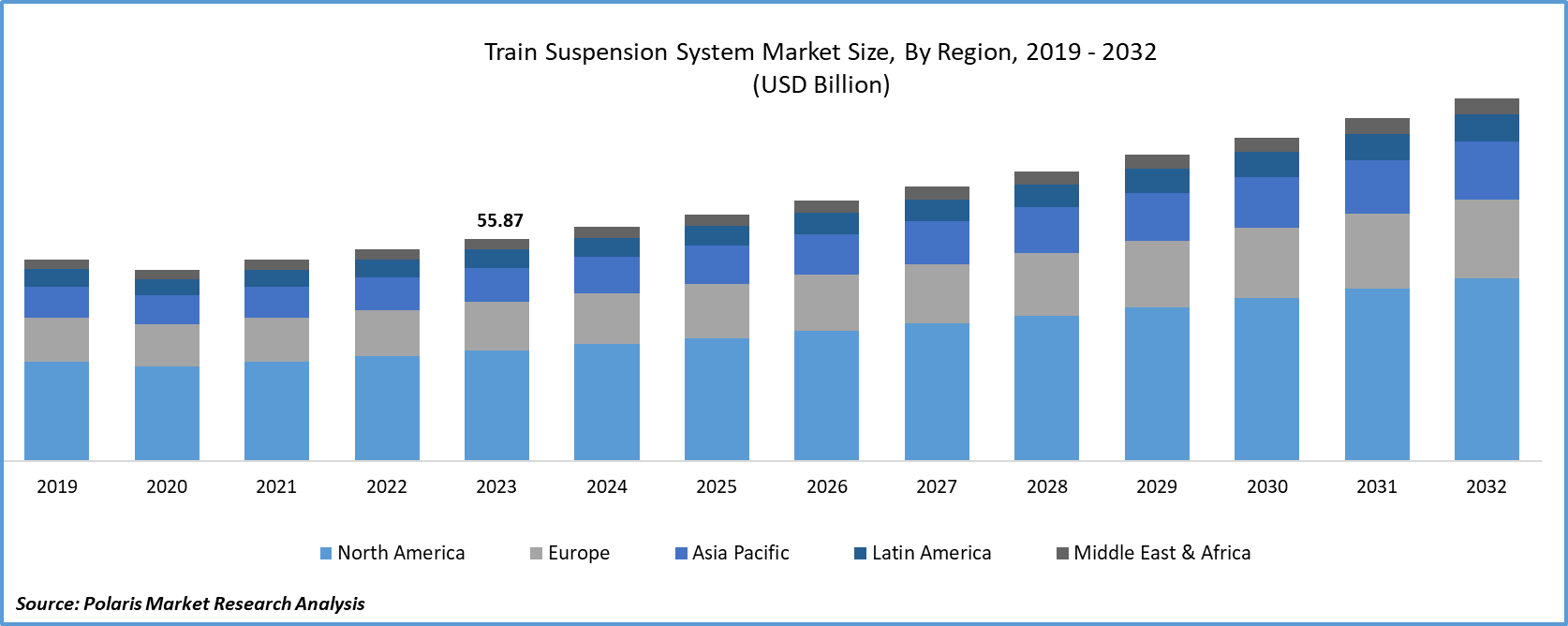

The global train suspension system market was valued at USD 55.87 billion in 2023 and is expected to grow at a CAGR of 5.6% during the forecast period.

The train suspension system plays a significant role in reducing noise and vibrations in the compartments, ensuring wheel-track interaction, passenger comfort, and operational efficiency. Most people prefer train transportation compared to other modes due to the increased safety and speedy delivery of cargo. According to the International Energy Agency (IEA), the railway is one of the most energy-efficient transport modes, constituting 8% of the global population and 7% of world freight in 2020.

To Understand More About this Research: Request a Free Sample Report

The demand for high rail passenger activity is expected to reach 15 trillion passenger kilometers by 2050, demonstrating the increasing need for high-speed trains. This may facilitate the demand for train suspension systems owing to the rising demand for rail transport. The increasing research activities on finding the factors determining railway failures and the prevalence of train accidents are expected to widen the importance of the train suspension system in the market.

- For instance, in April 2022, a study published in MDPI focused on developing fault detection for a primary suspension damper in a railway vehicle by analyzing the compartment's vertical vibration response using experimental data along with numerical simulations.

Moreover, the growing expansion of metro and high-speed trains on a global scale is also positively influencing the demand for train suspension systems with advanced technologies.

However, the higher costs of maintenance, adoption, and difficulty in renovating older trains with advanced suspension technologies are hindering the growth of the train suspension system market.

Growth Drivers

- The rising need for an efficient transport network

The increasing global economic activities and rising disposable income among the population are creating demand for effective transportation with higher comfort and speed. This is addressing most of the governments by enhancing the earlier trains with advanced suspension technologies, as they act effectively in improving vehicle speed by catering numerous amenities to the passengers.

Furthermore, the growing steel industry and energy-related products, including oil, refined petroleum, and gas, are likely to necessitate the demand for suitable transportation, mainly trains. It is known to be a safe and affordable travel option for passengers with longer journeys as well as cargo transportation. The rising government emphasis on tackling lower train performance will further create new growth opportunities for the train suspension system throughout the forecast period.

Furthermore, the presence of better transport infrastructure is likely to boost the country's development, driving new investments in transportation facilities. According to a study, there is a strong relationship between geographic integration and its embrace in the international market. The study revealed that a rise in one standard deviation of geographic integration led to a 4% increase in the firm's revenue from exports, leading to a 5% decrease in the unit price of exported goods and a 9% rise in export volume. This will fuel countries to improve their trade networks, including railways during the forecast period.

Report Segmentation

The market is primarily segmented based on type of element, suspension type, train type product and region.

|

By Type of Element |

By Suspension Type |

By Train Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type of Element Analysis

- Elastic segment is expected to witness the highest growth during the forecast period

The elastic segment is growing at the rapid pace, mainly driven by its wide range of beneficial characteristics and market. Elastic and damping suspension types are crucial in determining the quality of tracks and the dynamic load intensity of railways.

The damper elements segment dominated the market, due to its ability to enhance ride comfort. Dampers ensure the safety and stability of trains, as they work efficiently to reduce derailment, which can assist in ensuring the safety of railway passengers and cargo transportation on time.

By Suspension Type Analysis

- Secondary segment accounted for the largest market share in 2023

The secondary segment accounted for the largest market. It is situated between the wheels and bhogi and plays a vital role in enhancing passenger comfort by separating track vibration transmission from the vehicle. With the use of air springs, it reduces the lower-frequency accelerations in the train body, which are beneficial to freight trains.

The primary segment is expected to grow at the fastest rate over the next few years on account of increased safety in curves, stabilized train running with lower track forces, and diminished wear. Primary suspension is a normal spring damper system, which can promote the structural suspension of the carriage and train. In general, it is present in between every bogie and axle box and has springs and dampers for optimal performance.

By Train Type Analysis

- High Speed segment held the significant market revenue share in 2023

The high-speed train segment held the largest share, due to the rising demand for high-speed rails attributable to the rising time value, primarily among working professionals. The increasing demand for high-speed trains necessitates the need for efficient railway tracks, driving the use of advanced train suspension systems to cater to the ongoing consumer need for high-speed journeys with safety.

Regional Insights

- North America region registered the largest share of the global market in 2023

The North America region dominated the market. This is attributable to the rising number of countries increasing investments in railways, primarily the United States. According to the White House fact sheet, 16.4 billion is funded by the US government for the development of 25 new railway projects on Amtrak’s Northeast Corridor. This grant is used to rebuild bridges and tunnels that are older than 100 years, upgrade tracks, signal systems, power systems, and other infrastructure development activities to improve rail speed, enhance travel time, and lessen train delays. These development activities are likely to stimulate the demand for train suspension systems as they significantly improve the travel experience among travelers.

The Asia Pacific region will grow at the rapid pace, owing to the rising development in travel infrastructure. The rising expansion of metro and high-speed trains in the region is driving the demand for strong suspension systems to satisfy customer needs while also ensuring safety. Countries like China and India are increasing investments in the transportation sector to cater to consumer preferences.

For instance, in September 2023, China unveiled its first suspended monorail line in Wuhan, which operates for 12 hours every day at 60km per hour. Furthermore, the increasing urban population and road traffic are driving the adoption of trains, primarily metro. The ongoing transition towards the adoption of modern railway technologies is likely to stimulate the adoption of train suspension systems in this region.

Key Market Players & Competitive Insights

The train suspension system market is expected to witness higher competition owing to the rising adoption of technology and growing collaboration studies in the marketplace to create effective suspension technologies to promote the travelling experience and the safety of passengers and freight. The increasing partnerships, research investments, mergers, and acquisitions are expected to propel the growth of the train suspension system market during the forecast period.

Some of the major players operating in the global market include:

- Amsted Rail Company, Inc.

- Bombardier Transportation

- Hendrickson USA LLC

- Hitachi, Ltd.

- Knorr-Bremse AG

- Mando Corporation

- Sogefi SpA

- Thyssenkrupp AG

- Wabtec Corporation

- ZF Friedrichshafen AG

Recent Developments

- In May 2022, the Indian Ministry of Railways collaborated with the Indian Institute of Technology (IIT), Madras, on hyperloop technology with a Rs 8.34 crore project investment. It is the 5th mode of transportation, in which high-speed trains travel in a near vacuum tube.

Train Suspension System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 58.83 billion |

|

Revenue forecast in 2032 |

USD 91.01 billion |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type of Element, By Suspension Type, By Train Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global train suspension system market size is expected to reach USD 91.01 billion by 2032

Key players in the market are Amsted Rail Company., Bombardier Transportation, Knorr-Bremse, Mando Corporation

North America contribute notably towards the global train suspension system market

The global train suspension system market is expected to grow at a CAGR of 5.6% during the forecast period.

The train suspension system market report covering key segments are type of element, suspension type, train type product and region.