Trade Surveillance Systems Market Size, Share, Trends, Industry Analysis Report: By Component (Solutions and Services), Deployment Mode, Organization Size, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM2853

- Base Year: 2024

- Historical Data: 2020-2023

Trade Surveillance Systems Market Overview

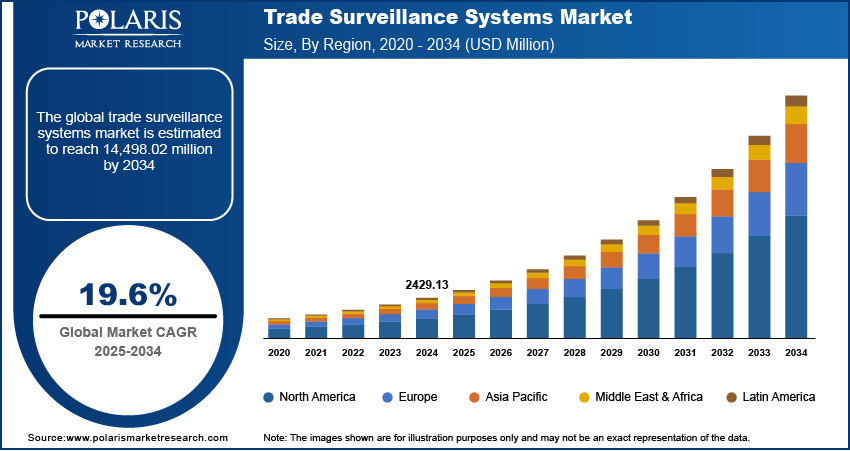

The global trade surveillance systems market size was valued at USD 2,429.13 million in 2024. The market is projected to grow from USD 2,899.90 million in 2025 to USD 14,498.02 million by 2034, exhibiting a CAGR of 19.6 % during 2025–2034.

Trade surveillance systems monitor financial transactions to detect potentially illegal or abusive trading activities. These systems are typically automated web applications or software designed to capture a firm’s trade data and automatically test it to find and raise any potential instances of fraud. These systems identify irregularities such as market manipulation, insider trading, and other unethical or unlawful market behavior.

The increasing cases of data manipulation and cyber fraud in financial institutes are propelling the trade surveillance systems market growth. As per published data, USD 387.67 million (₹3,207 crore) was lost because of 5,82,000 cases of cyber fraud in the banking sector between FY2020 and FY2024 in India. Regulators in the financial sector are imposing stringent compliance requirements, forcing finance firms to adopt advanced trading surveillance tools to analyze vast amounts of trading data in real time, which leads to early detection and prevention of data manipulation and fraud. The need for transparency and investor confidence further fuels the demand for trade surveillance systems, as these systems protect investors from losses caused by market abuse such as spoofing, layering, and wash trading.

To Understand More About this Research: Request a Free Sample Report

The trade surveillance systems market demand is driven by the growing digitalization. Digitalization leads to increased adoption of digital platforms that execute trades in milliseconds, creating massive data flows that require real-time monitoring. This drives financial firms to adopt advanced trade surveillance systems to detect and prevent manipulative practices such as insider trading.

Trade Surveillance Systems Market Dynamics

Advancements in technology

The introduction of high-frequency trading, algorithmic trading, and digital asset exchanges generate massive volumes of transactions at high speeds, creating a need for advanced trade surveillance systems to monitor these activities in real time and detect potential market abuses such as spoofing and layering. Furthermore, artificial intelligence (AI) and machine learning (ML) are revolutionizing trade surveillance systems by enhancing the accuracy and efficiency of market monitoring. AI-powered trade surveillance tools learn from historical data, recognize emerging threats, and adapt to new forms of market manipulation. These systems process structured and unstructured data across multiple platforms, providing real-time alerts and predictive insights, encouraging financial institutions to invest in AI-driven trade surveillance to reduce false positives, improve detection capabilities, and stay ahead of evolving fraudulent tactics.

Blockchain and distributed ledger technology also contribute to the rising demand for trade surveillance systems. The expansion of cryptocurrency and decentralized finance (DeFi) introduces new risks, including wash trading, price manipulation, and illicit transactions. Regulatory bodies impose stringent compliance measures on digital asset trading, compelling firms to implement blockchain analytics and trade surveillance solutions. These tools track transactions across multiple exchanges, detect suspicious activities, and ensure transparency in decentralized markets.

Rising Trading Activities in Emerging Nations

Consumers in emerging nations such as India are participating in trading activities such as short selling, share buying, and others, creating a higher risk of data manipulation, insider trading, and fraud. This drives the need for trade surveillance systems to monitor transactions, identify suspicious activities, and comply with evolving regulations. Furthermore, governments and regulatory bodies in these nations are strengthening their financial oversight to attract foreign investments and ensure market transparency, thereby propelling the trade surveillance systems market development as these systems protect foreign investors from losses.

Trade Surveillance Systems Market Assessment by Segments

Trade Surveillance Systems Market Evaluation by Deployment Mode

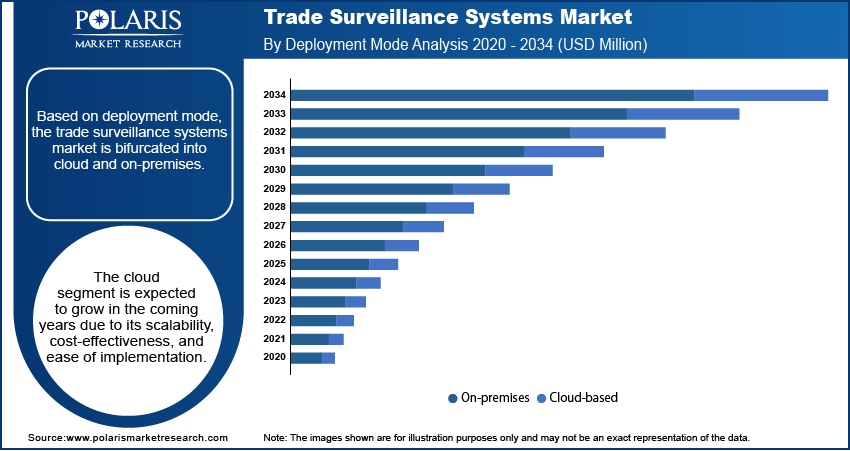

Based on deployment mode, the trade surveillance systems market is divided into cloud and on-premises. The cloud segment is expected to grow at a higher rate in the coming years due to its scalability, cost-effectiveness, and ease of implementation. Financial institutions increasingly preferred cloud solutions to reduce infrastructure costs while ensuring real-time monitoring and compliance with stringent regulatory requirements. Cloud-based platforms enabled firms to integrate advanced technologies such as AI and ML, enhancing their ability to detect fraudulent activities and market manipulation more efficiently. Additionally, the rising adoption of Software-as-a-Service (SaaS) models allowed organizations to access advanced surveillance tools without the burden of extensive hardware investments. The ability to rapidly deploy updates and security patches strengthened the appeal of cloud-based systems, making them the preferred choice for financial firms aiming to maintain regulatory compliance while optimizing operational efficiency.

Trade Surveillance Systems Market Outlook by Organization Size

In terms of organization size, the trade surveillance systems market is segregated into small and medium-sized enterprises and large enterprises. The large enterprises segment accounted for a major trade surveillance systems market share in 2024 due to their extensive trading activities and stringent regulatory compliance requirements. These organizations operate across multiple asset classes and jurisdictions, necessitating robust trade surveillance systems to detect market manipulation, insider trading, and other illicit activities. The need to comply with evolving global regulations, such as MiFID II, Dodd-Frank, and MAR, further accelerated the adoption of sophisticated trade monitoring systems in large organizations.

Trade Surveillance Systems Market Regional Analysis

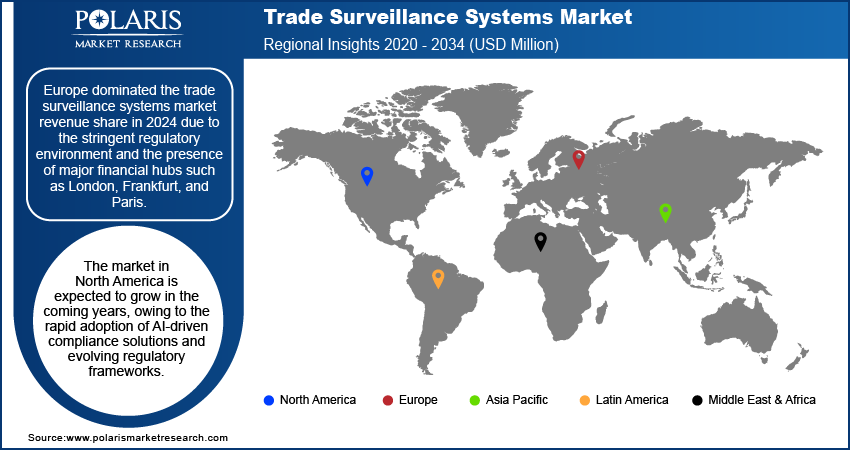

By region, the report provides the trade surveillance systems market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the trade surveillance systems market revenue share in 2024 due to the stringent regulatory environment and the presence of major financial hubs such as London, Frankfurt, and Paris. The region's strict enforcement of regulations, including MiFID II, MAR, and GDPR, compelled financial institutions to invest in advanced trade monitoring systems. The growing complexity of financial instruments and the increasing sophistication of fraudulent activities further accelerated the demand for trade surveillance technologies. The UK led the European market in 2024, benefiting from its status as a global financial center and its proactive approach to financial market supervision. The region's emphasis on transparency, investor protection, and regulatory alignment across multiple jurisdictions contributed to the Europe trade surveillance systems market expansion.

The trade surveillance systems market in North America is expected to grow in the coming years, owing to the rapid adoption of AI-driven compliance solutions and evolving regulatory frameworks. The US leads the regional market, with institutions strengthening their monitoring systems to comply with SEC, FINRA, and CFTC regulations. The rise of algorithmic and high-frequency trading has increased the need for real-time trade monitoring, pushing firms to integrate advanced analytics and cloud-based trade surveillance tools. The growing prevalence of digital assets and cryptocurrency trading further drives demand for trade surveillance systems in the region.

Trade Surveillance Systems Market Players & Competitive Analysis Report

The competitive landscape of the trade surveillance systems market is shaped by leading players making significant investments in research and development to enhance their product offerings and gain a competitive edge. Companies are actively pursuing strategic initiatives such as product innovation, international collaborations, increased capital investments, and mergers and acquisitions to expand their global footprint. By developing advanced solutions, forging strategic partnerships, and strengthening manufacturing capabilities, these market participants are driving industry growth and positioning themselves for long-term success.

The trade surveillance systems market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Abel Noser Holdings LLC, Accenture, Aquis Technologies, B-next, CINNOBER FINANCIAL TECHNOLOGY, Cognizant, Crisil Limited, FIS, IBM, Red Deer, Scila AB, Software AG, and Trapets AB.

Cognizant, a prominent company in global IT consulting and outsourcing, has developed a comprehensive suite of trade surveillance systems aimed at enhancing compliance and operational efficiency within financial markets. Established in 1994 and headquartered in Teaneck, New Jersey, the company has evolved from its origins as an in-house technology unit of Dun & Bradstreet into a major provider of technology solutions across various sectors, including capital markets. The company’s trade surveillance systems are designed to address the complexities of trading environments by ensuring data integrity, compliance with regulatory requirements, and the ability to respond swiftly to market changes.

IBM is a global technology and consulting company that offers a robust suite of trade surveillance systems through its IBM surveillance insight platform, specifically designed for financial services. This platform is crucial for financial institutions aiming to enhance compliance, mitigate risks, and ensure market integrity. The IBM surveillance insight system further provides a comprehensive solution that proactively monitors vast volumes of trading data and communications to detect non-compliant behavior.

List of Key Companies in Trade Surveillance Systems Market

- Abel Noser Holdings LLC

- Accenture

- Aquis Technologies

- B-next

- CINNOBER FINANCIAL TECHNOLOGY

- Cognizant

- Crisil Limited

- FIS

- IBM

- Red Deer

- Scila AB

- Software AG

- Trapets AB

Trade Surveillance Systems Industry Developments

January 2025: Solidus Labs, a global player in cross-asset trade surveillance and risk monitoring, launched the first-of-its-kind Trade Surveillance Academy (TSA), a publicly available training program to address the knowledge gap in the emerging field of trade surveillance.

January 2024: Eventus, a major provider of comprehensive trade surveillance software, announced to redefine trade surveillance with client-driven solutions and customizable technology.

Trade Surveillance Systems Market Segmentation

By Component Outlook (Revenue, USD Million, 2020–2034)

- Solutions

- Risk & Compliance

- Reporting & Monitoring

- Surveillance & Analytics

- Case Management

- Other Solutions

- Services

- Managed Services

- Professional Services

By Deployment Mode Outlook (Revenue, USD Million, 2020–2034)

- Cloud

- On-Premises

By Organization Size Outlook (Revenue, USD Million, 2020–2034)

- Small and Medium-Sized Enterprises

- Large Enterprises

By End User Outlook (Revenue, USD Million, 2020–2034)

- Banks

- Institutional Brokers

- Retail Brokers

- Market Centers and Regulators

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Trade Surveillance Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,429.13 million |

|

Revenue Forecast in 2025 |

USD 2,899.90 million |

|

Revenue Forecast in 2034 |

USD 14,498.02 million |

|

CAGR |

19.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global trade surveillance systems market size was valued at USD 2,429.13 million in 2024 and is projected to grow to USD 14,498.02 million by 2034.

The global market is projected to register a CAGR of 19.6 % during the forecast period.

Europe held the largest share of the global market in 2024.

A few of the key players in the market are Abel Noser Holdings LLC, Accenture, Aquis Technologies, B-next, CINNOBER FINANCIAL TECHNOLOGY, Cognizant, Crisil Limited, FIS, IBM, Red Deer, Scila AB, Software AG, and Trapets AB.

The cloud segment is expected to grow during the forecast period.

The large enterprises segment dominated the market share in 2024.