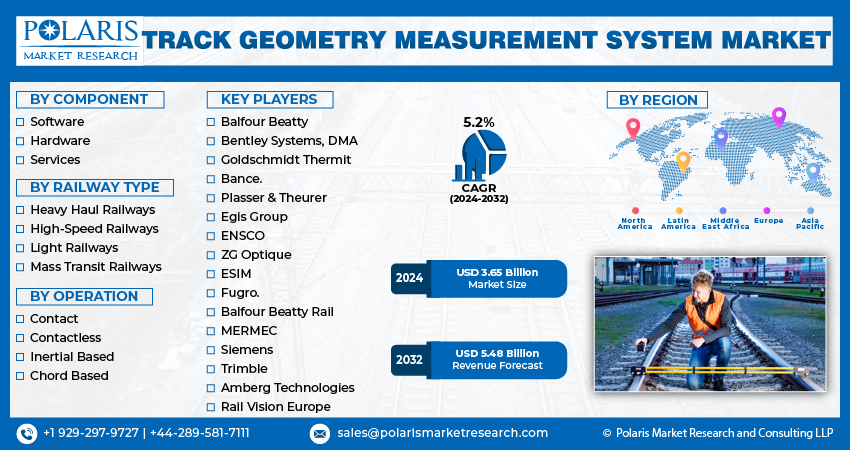

Global Track Geometry Measurement System Market Share, Size, Trends, Industry Analysis Report, By Component (Software, Hardware, Services); By Railway Type; By Operation; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3174

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

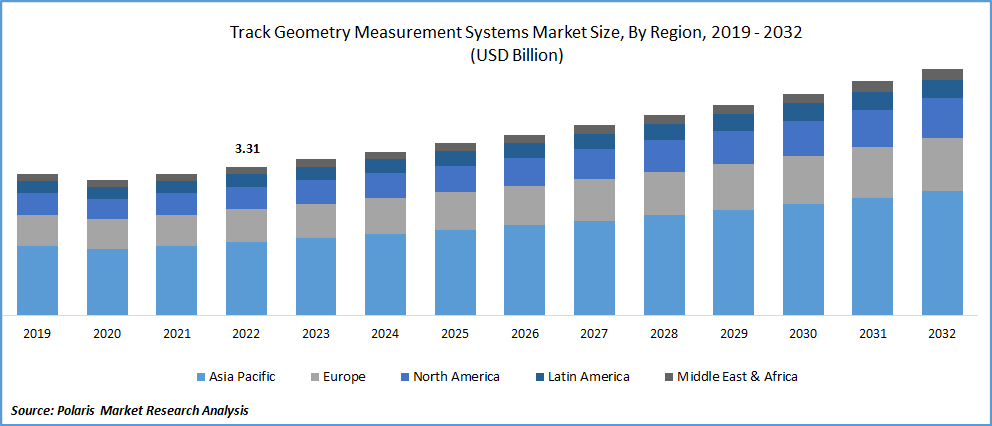

The global track geometry measurement system market was valued at USD 3.47 billion in 2023 and is expected to grow at a CAGR of 5.2% during the forecast period. Railways are one of the most important modes of transportation for both people and goods worldwide. In all markets, there is significant importance placed on the need for rail transportation safety and security.

Know more about this report: Request for sample pages

Additionally, in order to accommodate the increased demand for public transportation around the globe, the government authorities are concentrating on developing metro trains, as well as a rail network that will link previously disconnected population centers. Such large-scale expenditures in railway network development are projected to open new growth prospects for the track geometry measurement system market.

A track geometry measuring system is used to gather information on the state of a railroad track in order to prevent any sort of accident during the carriage of people or goods. In order to protect the rail network, it is crucial to have a system in place to monitor the state of the tracks. The data from the track geometry measuring system is also used to plan either short-term or long-term maintenance of the railway lines. The precision and dependability of track data are critical for either immediate or long-term maintenance.

Ensco Rail's autonomous rail geometry measuring technology was recently highlighted in the months of March and April 2020. Locomotive, passenger, and freight vehicles can all be equipped with the ENSCO Rail Autonomous Track Geometry Measurement System. The technology is described as a means for railway maintenance personnel to examine tracks at lower prices, more often, and faster than before-all without having any negative effects on the movement of trains. ?

The market severely suffered from the COVID-19 epidemic. Globally increasing coronavirus infections led to strict social restrictions and lockdown standards, which disrupted the supply chain and impacted product demand. Global sectors were impacted by the COVID-19 problem, and 2020 and 2021 saw the harshest effects on the international economy. The pandemic has wreaked havoc on main businesses such as shipping, retail, and e-commerce. The severe fall in the transportation industry has hampered the expansion of the worldwide market.

Quarantine regulations, travel restrictions, and lockdown procedures complicated operations for cross-border projects and caused staffing and project delays for Fugro, a global corporation based in the Netherlands. COVID-19 had an impact on the U.K.-based Balfour Beatty’s business, although the extent of the damage varied depending on the company's operational and geographic footprint. The prolongation of site programs, increased operating expenses, decreased productivity, and site closures led to a reevaluation of the Group's contract-end projection positions, which led to U.K. Construction recording an underlying loss for the whole year.

Industry Dynamics

Growth Drivers

Regularly monitoring and analyzing railway geometry helps avoid derailments that may cause enormous damage. One of the main drivers of the industry's growth is the increasing need for safety and security in rail transportation, together with the expansion of rail networks and metro lines. Numerous incidents and catastrophes involving trains have raised worries throughout the world and encouraged governments to digitize the means of transportation to provide a safer ride. Additional factors driving industry growth include the rising demand for smart technology to maintain the operational effectiveness of tracks.

Also, track geometry is significantly impacted by vibrations and the impact of high-speed trains. Along with significant gauge wear and tear, the cross-level and alignment are also compromised. Consequently, there is more pressure for proactive rail maintenance. The requirement for the use of track geometry measuring systems arises from the necessity for inspections to be performed more often, with faster and more accurate measurements than previously. The CALIPRI Track Geometry Gauge was created by Nextsense, a company in the railway sector and a member of the Hexagon AB group, as an addition to their portable measuring system in November 2020.

Additionally, the improvement of the safety of railroad networks is receiving more funding from governmental bodies. For example, the United Kingdom's government has agreed on financing for High-Speed Rail and System Integration. A budget of EURO 11 million has been offered for the project, which is expected to be paired with a fund of EURO 13 million granted by Leeds City Region Enterprise. These expenditures go toward the construction of trains, rails, power systems, signal interaction facilities, and other essential activities.

Report Segmentation

The market is primarily segmented based on component, railway type, operation, and region.

|

By Component |

By Railway Type |

By Operation |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The software segment is expected to witness the fastest growth over the forecast period

The track geometry measurement system market was led by the hardware segment; however, throughout the projection period, it is anticipated that the software sector would develop at the highest pace. For analysis and planning of the work on the track's routine maintenance and repair, all collected information is analyzed in real-time, recorded, and preserved. With the help of the system's software, it is possible to automatically compare data from the database of the track section with information about the real state of the rails, create reports, and provide suggestions for managing and running railway units.

The TGMS, which uses various measuring tools to document the state of railway track geometry, maintains rail safety. The system is made up of a mix of software and hardware parts that determine track geometry parameters. Track data are recorded together with abnormalities in track geometry that are found. By viewing and examining the collected data, choices about construction and maintenance are made. For the cost-effective construction, upkeep, and operating safety of tracks, accurate and trustworthy track geometry data is necessary. Railroad firms and operators can rapidly and accurately measure track geometry with the use of different software, which they can then inspect and analyze to identify any errors.

Mass transit railway segment accounted for the largest market share in 2022

The requirement for more precise track geometry measurements and the ability to identify deviations from the planned track geometry is driving the expansion of mass transit systems. Both the building of brand-new railroads and the upkeep of already-existing ones may be done using TGMS.

During the projection period, it is predicted that the heavy haul railroads segment will see a high CAGR. The necessity for assessing and enhancing track conditions to reduce restoration times and maintenance costs is fueling the expansion of heavy freight railways. Rail seat wear, gauge widening, and cross-level concerns are just a few examples of possible issues that heavy haul or freight trains utilize TGMS to monitor the geometry of tracks and identify.

Contact TGMS sector is expected to hold the significant revenue share

Contact Based TGMS is a system that employs sensors to determine the shape of a railroad track and provides information for analysis and maintenance. The technology may be put on both new and old railroad lines and can be utilized on everything from high-speed to light rail systems. Contact-based systems outperform non-contact systems in terms of accuracy.

Over the course of the projected period, the contactless sector is expected to see significant growth. A method known as a non-contact-based TGMS may be used to measure the geometry of a railroad track without touching it. This is accomplished by mounting sensors on a car that travels down the track. In order to construct a three-dimensional representation of the track, the sensor data is processed further.

The key benefit of utilizing non-contact TGMS is that there is no chance of track damage as it does not require any physical contact with the track. It also has the benefit of measuring extremely long stretches of track, making it perfect for usage in extensive railway networks. Contactless TGMS is expanding in the worldwide market due to the quick deployment of inertial-based rail track geometry measuring systems.

The Asia Pacific is held largest market share in 2022

The market's expansion in the Asia Pacific region is accelerated by the rising uptake of cutting-edge technology. Track geometry measuring systems are becoming more prevalent in this region due to the mass transit systems, the rapid growth of high-speed railroads in China and India, and other forms of railway developments in nations like China, Australia, and India. Regional growth is also accelerated by the fast expansion of metro lines. Over the course of the forecast period, it is anticipated that these nations would considerably drive the Asia Pacific market.

During the projection period, North America is anticipated to grow significantly at a high CAGR. The region's TGMS market is anticipated to develop at a high rate due to the increasing regulatory safety requirements in the rail transportation industry. RailPod & STANLEY Infrastructure, both based in the United States, will collaborate in August 2022 to combine STANLEY Infrastructure's industrial tool and client base with RailPod.'s track inspection technology.

Vehicles made by RailPod Inc. have the ability to map assets for freight, passenger, and transit systems, as well as detect and measure rail faults, track geometry, wear, tunnel and bridge clearances, and catenary. The track inspection technology and associated services from RailPod Inc. will be supported in their global adoption by this agreement. It will make it easier for managers and owners of infrastructure to decide precisely where capital needs to be invested.

Competitive Insight

Key players include Balfour Beatty, Bentley Systems, DMA, Goldschmidt Thermit, Bance., Plasser & Theurer, Egis Group, ENSCO, ZG Optique, ESIM, Fugro., Balfour Beatty Rail, MERMEC, Siemens, Trimble, Amberg Technologies, and Rail Vision Europe.

Recent Developments

- In October 2022, The Republic of Turkey State Railways (TCDD) and Tesmec, received a contract for the provision of an innovative diagnostic tool equipped with measurement tools to examine the railway network. This agreement covers the design & development of the diagnostic tool & onboard diagnostic systems, as well as the instruction of local operators and the inspection of the diagnostic equipment.

- In August 2022, STANLEY Infrastructure and RailPod., two American businesses, linked together to integrate STANLEY Infrastructure's clientele with the RailPod.'s inspection technology. Through this collaboration, RailPod's track inspection technology & related services will be supported in their global rollout.

- ?Furthermore, in February 2019, Balfour Beatty stated that it has been selected by Transport for London to design and build the 1,047-kilometer London Underground network. The authority will make significant investments in necessary resources to finish building a strong underground transit network. In order to guarantee the network is delivered safely and without any inconvenience to the traveling public, Balfour Beatty will also implement new standards and technology.

Global Track Geometry Measurement System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.65 billion |

|

Revenue forecast in 2032 |

USD 5.48 billion |

|

CAGR |

5.2% from 2023 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2023 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Railway Type, By Operation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Balfour Beatty PLC, Bentley Systems Inc., DMA, Goldschmidt Thermit Group, Bance & Co Ltd., Plasser & Theurer, Egis Group, ENSCO, ZG Optique SA, ESIM, Fugro N.V., Balfour Beatty Rail Limited, MERMEC S.P.A, Siemens AG, Trimble, Amberg Technologies AG, Rail Vision Europe. |

FAQ's

The track geometry measurement system market report covering key segments are component, railway type, operation, and region.

Global Track Geometry Measurement System Market Size Worth $5.48 Billion By 2032.

The global track geometry measurement system market expected to grow at a CAGR of 5.2% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors in track geometry measurement system market increasing need for safety and security in rail transportation.