Tobacco Packaging Market Size, Share, Trends, & Industry Analysis Report

: By Packaging (Primary, Secondary, and Bulk), By Product, By Material Type, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 116

- Format: PDF

- Report ID: PM3320

- Base Year: 2024

- Historical Data: 2020-2023

The tobacco packaging market size was valued at USD 20.56 billion in 2024, exhibiting a CAGR of 2.7% during 2025–2034.

The tobacco packaging market is driven by increasing regulatory requirements for health warnings, rising demand for innovative and sustainable packaging solutions, and the need for brand differentiation in a competitive industry.

Market Overview

The tobacco packaging market encompasses the specialized materials and solutions used to enclose tobacco products such as cigarettes, cigars, and smokeless tobacco. This includes primary packaging, which directly contains the product, and secondary packaging, which provides additional protection and branding. The core function of tobacco packaging is to preserve product freshness, protect against environmental factors like moisture and contamination, and serve as a crucial medium for conveying mandatory health warnings and brand information, especially given stringent advertising regulations in many regions. Understanding the dynamics of this sector involves analyzing shifts in consumer preferences, evolving regulatory frameworks, and technological advancements that influence packaging design and material selection.

To Understand More About this Research: Request a Free Sample Report

The sustained global demand for various tobacco products, particularly in emerging economies, continues to fuel the need for effective packaging solutions. Furthermore, increasing consumer awareness regarding environmental sustainability has led to a growing demand for eco-friendly and biodegradable packaging materials, driving development towards paperboard or cigarette paper and other sustainable alternatives. The rise of new tobacco products, such as heated tobacco units and nicotine pouches, also necessitates innovative and compliant packaging, offering new potential for manufacturers. Lastly, the industry's focus on anti-counterfeiting measures and sophisticated branding, even within regulatory constraints, further contributes to growth, promoting advanced printing technologies and security features in tobacco packaging.

Industry Dynamics

Evolving Regulatory Landscape

The global tobacco packaging market is significantly driven by the continuous evolution of government regulations aimed at reducing tobacco consumption and enhancing public health. These regulations often mandate specific packaging features, such as prominent graphic health warnings, standardized pack designs, and plain packaging requirements. For instance, the World Health Organization (WHO) reported in January 2024 that 150 countries are successfully reducing tobacco use, partly due to the implementation of measures like large, rotating health warnings and plain packaging, which directly impact packaging specifications. Such policies compel manufacturers to regularly update their packaging designs and materials to comply with national and international standards, thereby stimulating development in terms of innovation for compliance. This constant need for adaptation and adherence to diverse and often stricter guidelines across different regions directly drives the growth by necessitating new design, printing, and material solutions.

Rise of Next-Generation Tobacco Products

The emergence and increasing acceptance of next-generation tobacco products, including heated tobacco products (HTPs) and nicotine pouches, represent a significant driver for the tobacco packaging industry. These novel products often require distinct packaging solutions tailored to their unique form factors, consumption methods, and regulatory classifications, which differ from traditional cigarettes. For example, the Centers for Disease Control and Prevention (CDC) reported in 2023 that while conventional cigarette sales have seen a decline, the U.S. nicotine pouches are projected to grow significantly, with sales increasing 300 times between 2016 and 2021. This shift in consumer preferences towards alternative nicotine delivery systems creates new potential and demand for specialized packaging that can accommodate devices, sticks, and pouches while meeting stringent safety and child-resistant packaging requirements. Consequently, the rapid penetration of these products drives innovation in packaging materials, formats, and design, contributing to the overall expansion.

Consumer Demand for Sustainable Packaging

Growing environmental consciousness among consumers and increasing corporate social responsibility initiatives are propelling the demand for sustainable packaging solutions within the tobacco industry. This trend encourages tobacco manufacturers to explore and adopt eco-friendly materials such as recycled paperboard, biodegradable plastics, and compostable films for their product packaging. This shift is not only a response to consumer preferences but also to global efforts to reduce plastic waste and carbon footprint. The continuous push for more sustainable and environmentally responsible packaging options fundamentally influences material and technological advancements, driving the industry towards greener alternatives and fostering innovation.

Segmental Insights

Market Assessment By Packaging

The market is segmented by packaging into primary, secondary, and bulk. Among these segments, primary packaging consistently holds the largest share due to its fundamental role in directly containing and protecting the tobacco product for the end consumer. This segment includes individual cigarette packs, pouches for smokeless tobacco, and specialized containers for novel tobacco products like heated tobacco sticks and nicotine pouches. The stringent regulatory requirements, particularly concerning health warnings and brand display, primarily impact primary packaging, necessitating continuous innovation in materials, printing, and design. Its direct interface with consumers makes it the most critical element for brand identity and product integrity, driving significant demand and maintaining its dominant position.

The primary packaging segment is experiencing the highest growth during the forecast period. This trend is largely attributable to the rapid expansion and diversification of new tobacco and nicotine product categories, such as heated tobacco products and oral nicotine pouches. As these products gain penetration, they necessitate unique and often sophisticated primary packaging solutions tailored to their specific form factors and usage patterns. Furthermore, evolving consumer preferences for convenient and aesthetically appealing individual product formats, alongside the ongoing push for sustainable packaging materials at the primary level, continue to fuel robust development and propel the primary packaging segment's growth within the broader tobacco packaging outlook.

Market Evaluation By Product

The market is segmented by product into boxes, folding cartons, bags & pouches, and others. Boxes, particularly those used for individual cigarette packs, typically command the largest share of the tobacco packaging industry. This dominance stems from the widespread global consumption of traditional cigarettes, where rigid paperboard boxes are the established and preferred primary packaging format. These boxes offer robust protection, ease of handling, and ample surface area for mandatory health warnings and brand information despite increasingly plain packaging regulations. The sheer volume of cigarette production and sales worldwide ensures a consistent and substantial demand for this product type, solidifying its leading position in the overall dynamics of tobacco packaging.

The bags & pouches segment is currently demonstrating the highest growth rate over anticipated years. This accelerated growth is primarily fueled by the increasing popularity and penetration of modern oral tobacco and nicotine products, such as nicotine pouches and snus, as well as various forms of loose and smokeless tobacco. These products are ideally suited for flexible packaging and medical flexible packaging solutions like pouches due to their convenience, portability, and resealable features. The rapid consumer shift towards these innovative alternatives creates significant potential and drives substantial development within the bags & pouches category, influencing the future forecast for tobacco packaging.

Market Assessment By Material Type

The market is segmented by material type into paper, paperboard, plastic, film, jute, and others. Paperboard consistently holds the predominant share within the tobacco packaging industry. This is primarily due to its extensive use in manufacturing traditional cigarette boxes, which represent a significant volume of tobacco products globally. Paperboard offers an ideal balance of rigidity, printability for branding and mandatory health warnings, and cost-effectiveness. Its versatility also extends to folding cartons for secondary packaging, providing both structural integrity and a robust surface for graphical elements. The established infrastructure for paperboard production and recycling, coupled with its suitability for high-speed manufacturing processes, solidifies its leading position in the material type segment.

In terms of growth rate, the film is experiencing significant acceleration within the tobacco packaging sector. The increasing adoption of flexible packaging solutions for emerging tobacco and nicotine product categories, such as nicotine pouches, loose tobacco, and certain heated tobacco products, largely drives this surge. Film materials, including various polymers and laminates, offer excellent barrier properties, lightweight design, and high flexibility, which are crucial for product freshness and portability. The innovation in sustainable film options and the shift towards convenient, resealable pouch formats for new product introductions are key factors contributing to the robust development and high growth potential for film.

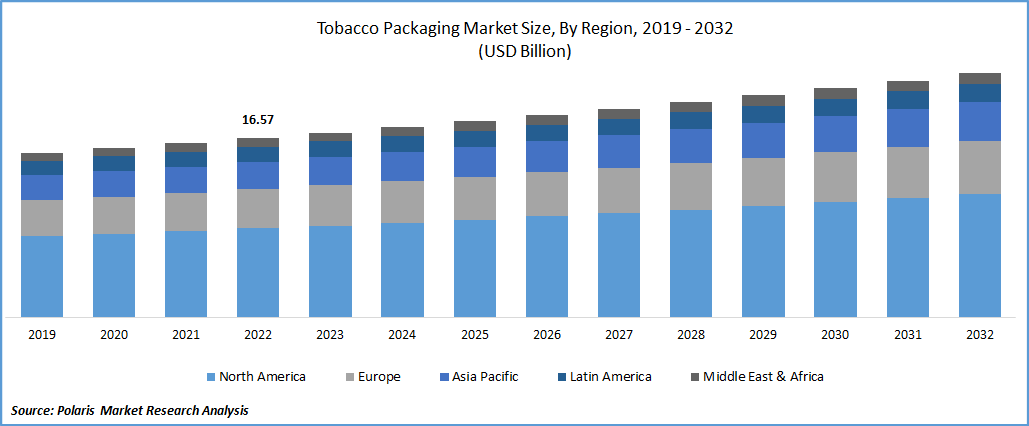

Regional Analysis

The Asia Pacific tobacco packaging market consistently commands the largest share due to the region's vast population base, substantial tobacco consumption, and significant manufacturing capabilities, particularly in countries like China and India. The sheer volume of traditional cigarette production and sales, combined with the growing penetration of modern oral and heated tobacco products, sustains a massive demand for diverse packaging solutions. The extensive consumer base and evolving purchasing power within Asia Pacific ensure its leading position in the overall size and market insights for tobacco packaging.

Latin America is exhibiting robust momentum within the tobacco packaging sector. This region is characterized by a dynamic environment, where increasing disposable incomes and a relatively younger demographic contribute to evolving consumption patterns. While traditional tobacco products maintain their presence, there's a discernible rise in the demand for next-generation tobacco and nicotine products, which often require specialized and innovative packaging. The combination of sustained population growth, urbanization, and the adoption of newer product categories drives significant development. It presents considerable potential, positioning Latin America for a high growth rate in the tobacco packaging industry.

Key Players and Competitive Insights

The tobacco packaging market features several global and regional players providing diverse packaging solutions tailored to the industry's unique requirements. Some of the active major players contributing to this development include Amcor plc, WestRock Company, International Paper Company, Graphic Packaging International LLC, Mondi plc, Mayr-Melnhof Group, Smurfit Kappa Group plc, Huhtamaki Oyj, Constantia Flexibles Group GmbH, Essentra plc, and Sonoco Products Company. These corporations offer a range of products from paperboard boxes and folding cartons to flexible films and specialized components, addressing various aspects of the demand.

The competitive landscape is characterized by a strong emphasis on innovation, sustainability, and compliance with evolving global regulations. Companies actively invest in research and development to offer advanced materials and designs that meet stringent health warning requirements, anti-counterfeiting measures, and the growing demand for environmentally friendly solutions. The ability to provide versatile packaging for both traditional and next-generation tobacco products, coupled with efficient supply chain management and global reach, are critical competitive advantages.

List of Key Companies

- Amcor plc

- Constantia Flexibles Group GmbH

- Essentra plc

- Graphic Packaging International LLC

- Huhtamaki Oyj

- International Paper Company

- ITC Packaging (part of ITC Limited)

- Mayr-Melnhof Group

- Mondi plc

- Smurfit Kappa Group plc

- Sonoco Products Company

- WestRock Company

Tobacco Packaging Industry Developments

- May 2025: Smurfit Kappa Group plc and WestRock Company completed their combination to form Smurfit Westrock. This merger creates a global leader in paper-based packaging solutions. The combined entity is now better positioned to deliver innovative and sustainable packaging, including paperboard and corrugated solutions which are integral to both primary and secondary tobacco packaging.

- March 2025: Constantia Flexibles Group GmbH announced it successfully completed the acquisition of a majority of shares of Aluflexpack AG. This strategic move strengthens Constantia Flexibles' position in the European flexible packaging market, enhancing its capabilities in product innovation and sustainability.

Tobacco Packaging Market Segmentation

By Packaging Outlook (Revenue – USD Billion, 2020–2034)

- Primary

- Secondary

- Bulk

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Boxes

- Folding Cartons

- Bags & Pouches

- Others

By Material Type Outlook (Revenue – USD Billion, 2020–2034)

- Paper

- Paperboard

- Plastic

- Film

- Jute

- Other

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Tobacco Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 20.56 billion |

|

Market Size Value in 2025 |

USD 21.06 billion |

|

Revenue Forecast by 2034 |

USD 26.77 billion |

|

CAGR |

2.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The tobacco packaging market has been segmented into detailed segments of packaging, product, and material type. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: Growth and marketing strategies are heavily influenced by the industry's unique regulatory environment and evolving consumer landscape. Companies are increasingly focusing on innovation in materials and design to meet stringent compliance requirements, such as plain packaging and graphic health warnings, while also incorporating anti-counterfeiting measures. A significant driver involves developing sustainable packaging solutions, including recyclable and biodegradable options, to align with global environmental trends and consumer demand.

FAQ's

The global market size was valued at USD 20.56 billion in 2024 and is projected to grow to USD 26.77 billion by 2034.

The market is projected to register a CAGR of 278% during the forecast period, 2024-2034.

Asia Pacific had the largest share of the market.

Some of the key players contributing to this market development include Amcor plc, WestRock Company, International Paper Company, Graphic Packaging International LLC, Mondi plc, Mayr-Melnhof Group, Smurfit Kappa Group plc, Huhtamaki Oyj, Constantia Flexibles Group GmbH, Essentra plc, and Sonoco Products Company.

The primary segment accounted for the largest share of the market in 2024.

Following are some of the trends: ? Increasing Demand for Sustainable Packaging: There's a growing market demand for eco-friendly and biodegradable packaging materials. ? Stringent Regulatory Compliance and Plain Packaging: Governments worldwide are implementing stricter regulations, such as plain packaging laws and enlarged graphic health warnings.

Tobacco packaging refers to the containers and materials used to enclose tobacco products, such as cigarettes, luxury cigars, smokeless tobacco, and newer forms like heated tobacco sticks or nicotine pouches. Its primary functions include protecting the product from environmental factors, preserving freshness, and providing crucial information to consumers. Critically, tobacco packaging also serves as the main vehicle for mandated health warnings and, in many regions, is subject to strict regulations regarding branding, design, and appearance, often requiring plain or standardized packaging to reduce its promotional appeal.