Global Titanium & Titanium Alloys Dental Implants Market Size, Share, Trends, Industry Analysis Report: By Product Type (Ti 64, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 104

- Format: PDF

- Report ID: PM5022

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

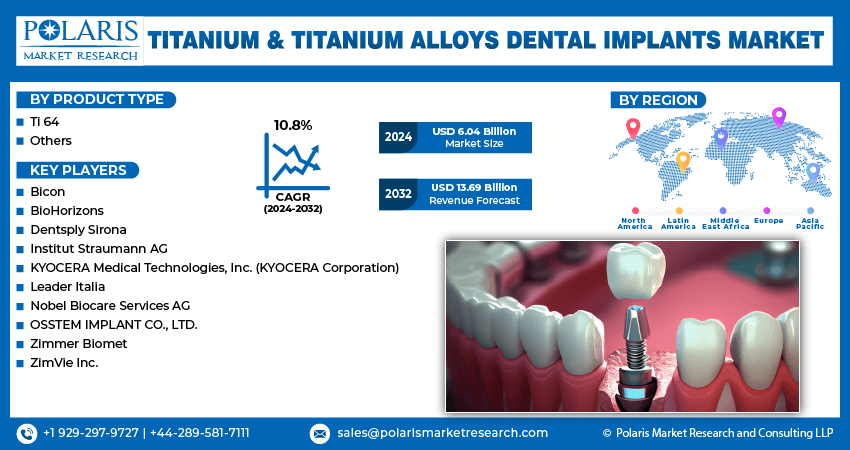

Global titanium & titanium alloys dental implants market size was valued at USD 5.67 billion in 2023. The industry is projected to grow from USD 6.04 billion in 2024 to USD 13.69 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.8% during the forecast period.

Dental implants are known as the replacement of an artificial tooth root or entire teeth, which are implanted surgically in the lower or upper jawbone. The market for titanium & titanium alloys dental implants is driven by the increasing geriatric population across the globe, as this age group experiences dental issues that necessitate implant solutions.

For instance, according to the U.S. Census Bureau, in the United States, the population of individuals aged 65 and older experienced the most significant and rapid increase during the decade from 2010 to 2020, reaching 55.8 million people, which accounted for 16.8% of the total population in 2020. Such growth in the elderly population needs restorative dental procedures and promotes advancement in implant technology. Thus, the titanium & titanium alloy dental implants market is growing. They offer a reliable and effective solution to restore missing teeth and maintain oral functionality in the increasing geriatric population.

To Understand More About this Research:Request a Free Sample Report

The titanium and titanium alloys dental implants market are driven by the focus of major players on introducing new implants and leveraging advanced technologies to meet evolving customer needs. For instance, in May 2022, Osstem Europe, a global manufacturer of dental implants, launched the Key Solution (KS) implant system in Europe.

The next-generation system has a distinct internal design that improves the structural integrity of dental implants and offers a convenient foundation for surgical procedures and prosthesis loading. Similarly, the integration of software solutions for designing dental implant restorations, supported by CAD/CAM technology, enhanced the precision and customization of dental solutions. Such innovations and the introduction of novel products and technologies in dental solutions are propelling the titanium and titanium alloys dental implants market globally.

Titanium & Titanium Alloys Dental Implants Market Trends:

Expanding Applications and Increasing Demand for Dental Implants

The expanding applications and increasing demand for dental implants in various therapeutic areas are driven by their versatility and effectiveness in addressing a wide range of dental issues. For instance, according to the American Association of Oral and Maxillofacial Surgeons, over 30 million people in the U.S. are missing teeth, with significant proportions of older adults and middle-aged individuals affected.

The demand for dental implants is substantial as approximately 500,000 people undergo dental implant procedures annually, and around 5 million implants are placed each year in the United States. This high prevalence of missing teeth and the increasing number of dental procedures highlight the essential role of dental implants in providing long-term replacements and supporting prosthetics. Thus, the expanding applications and increasing demand for dental restoration solutions are driving the growth of the titanium and titanium alloys dental implants market.

Increasing Demand for Prosthetics is Fueling Market Size

Increasing demand for prosthetics is driving market growth, as these implants are essential for effective oral rehabilitation. Prosthetics play a crucial role in restoring both oral function and facial aesthetics, which boosts the demand for titanium and titanium alloys dental implants. For instance, according to the American Academy for Implant Dentistry, over 15 million people in the U.S. receive bridge and crown replacements annually, highlighting the substantial need for durable and reliable implant solutions. This growing demand for implant solutions has resulted in the increased acceptance of titanium and titanium alloys among patients and dental professionals. Thus, the titanium and titanium alloys dental implants market are expanding across the globe due to the enhanced comfort of prosthetics and increased adoption of these implant solutions

Titanium & Titanium Alloys Dental Implants Market Segment Insights:

Titanium & Titanium Alloys Dental Implants Product Type Insights:

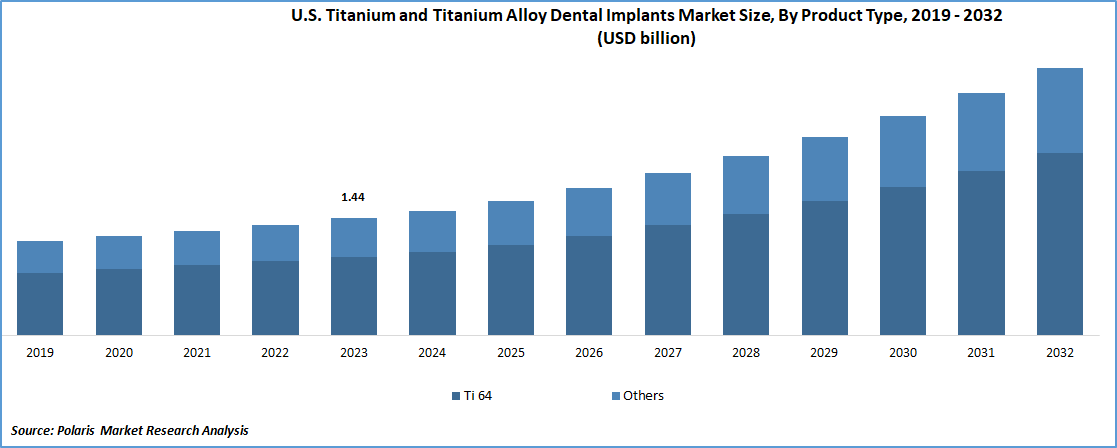

The global titanium & titanium alloys dental implants market segmentation, based on product type, includes Ti 64 and others. The Ti 64 segment dominated the titanium and titanium alloys dental implants market with a revenue share of over 65% in 2023 due to superior mechanical properties that make it a high-performance material for dental implants. Ti 64, an alloy of titanium, aluminum, and vanadium, possesses a high strength-to-weight ratio, corrosion resistance, and excellent biocompatibility. These attributes ensure that Ti 64 implants provide enhanced durability and stability, essential for successful long-term dental restorations. Consequently, dental professionals have preferred Ti 64 for its reliability and performance, which contributed to the dominance of this segment in the global titanium and titanium alloys dental implants market.

Titanium & Titanium Alloys Dental Implants Regional Insights:

By region, the study provides the titanium & titanium alloys dental implants market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. In 2023, Europe held the largest revenue share of over 35% in the global market due to the presence of a geriatric population in the countries of the region. For instance, according to the European Commission, as of January 1, 2023, the estimated population of the European Union stood at 448.8 million, with over 21.3% of the population being 65 years and older. This high proportion of the geriatric population has created an increased demand for dental care.

Growing awareness of self-care, a favorable reimbursement scenario, and increasing government expenditure on healthcare further contribute to the market's expansion. These factors collectively contributed to the dominance of the European region in the titanium & titanium alloys dental implants market.

Global Titanium & Titanium Alloys Dental Implants Market, Regional Coverage, 2019 - 2032 (USD billion)

The Asia Pacific region is projected to grow with a substantial CAGR of 13.0% in the titanium & titanium alloys dental implants market due to the increasing investment in implant manufacturers by global organizations. Multinational firms are investing in implant manufacturers to enhance their capabilities in producing high-quality, advanced dental implants by supporting the development of manufacturing facilities and technologies.

For instance, in October 2023, Mubadala, in collaboration with Unison Capital and MBK Partners, announced an investment in Osstem Implant, a South Korean manufacturer of dental implant materials. Such investments facilitate the introduction of innovative products tailored to the specific needs and preferences of the Asia Pacific market. Consequently, the influx of investment is expected to drive market expansion as they cater to the rising demand for dental restoration solutions.

The titanium and titanium alloys dental implants market in India is expected to experience significant growth primarily due to the increasing number of dental procedures performed in the country. India's population is becoming more aware of and seeking advanced dental care solutions, which has resulted in growing demand for high-quality dental implants. The rise in dental procedures is driven by factors such as improved healthcare infrastructure, increasing disposable incomes, and a greater focus on oral health. This surge in demand for effective and durable dental implants, along with an increasing number of dental procedures is expected to drive the significant growth of the market in India.

Titanium & Titanium Alloys Dental Implants Key Market Players & Competitive Insights

The market players are expanding their business presence across various geographies and entering new markets in developing regions to expand their customer base and increase sales in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Global companies are dominating the market with their advanced implant technologies and extensive product portfolios. These companies focus on continuous innovation, leveraging research and development to enhance implant designs, improve biocompatibility, and integrate advanced features. Major players in the titanium & titanium alloys dental implants market include Bicon, BioHorizons, Dentsply Sirona, Institut Straumann AG, KYOCERA Medical Technologies, Inc. (KYOCERA Corporation), Leader Italia, Nobel Biocare Services AG, OSSTEM IMPLANT CO., LTD., Zimmer Biomet, and ZimVie Inc.

Institut Straumann AG is a global provider of advanced tooth replacement and orthodontic solutions. The company conducts extensive research and development to manufacture and supply a wide range of dental products, including CADCAM prosthetics, dental implants, biomaterials, orthodontic aligners, and digital solutions. The products are used for tooth replacement, correction, and restoration, as well as in preventive dental care. Straumann offers dental implants and components made from titanium alloy, titanium, and ceramics, as well as prosthetic elements made of metal, ceramics, or polymer. The company also provides resins for 3D printing, clear aligners, thermoplastics for clear aligner production, and biomaterials for tissue generation.

Additionally, the company offers digital equipment such as milling machines, scanners, and 3D printers, along with comprehensive training and education services. In March 2019, Institut Straumann AG and Anthogyr signed an agreement that allowed Straumann to acquire full ownership of Anthogyr, increasing its current 30% stake. The move enabled Straumann to integrate a high-quality, competitively-priced European brand into its portfolio.

ZimVie Inc. specializes in the development, manufacturing, and global marketing of a wide range of products and solutions for addressing various spinal pathologies and providing support for dental tooth replacement and restoration procedures. The company operates two segments, including the dental segment and the spine segment. In the dental segment, the company offers prosthetic and abutment products, dental implant systems, kits, surgical instrumentation, and patient-specific restorative solutions under the BellaTek brand name.

Furthermore, the company provides barrier membranes, bone grafts, collagen wound care products, guided surgery solutions, intra-oral scanners, virtual treatment planning services, and CAD/CAM workflow systems. In the spine segment, the company specializes in designing, manufacturing, and distributing spinal fusion implants and instrumentation for various spinal procedures, biologics, and bone healing technologies. In February 2024, ZimVie Inc. introduced the TSX Implant in the Japanese market. TSX Implants are specifically engineered for immediate standard loading and extraction protocols, offering placement predictability and primary stability in both soft and dense bone.

Key Companies in the Titanium & Titanium Alloys Dental Implants Market include:

- Bicon

- BioHorizons

- Dentsply Sirona

- Institut Straumann AG

- KYOCERA Medical Technologies, Inc. (KYOCERA Corporation)

- Leader Italia

- Nobel Biocare Services AG

- OSSTEM IMPLANT CO., LTD.

- Zimmer Biomet

- ZimVie Inc.

Titanium & Titanium Alloys Dental Implants Industry Developments

December 2021: Health Canada approved the first Canadian additively manufactured medical implant. The implant, a customized 3D Specifit mandibular (lower jaw) plate, was created at the 3D Anatomical Construction Laboratory at Investissement Québec – CRIQ’s facilities. It is made from biocompatible metals, specifically titanium grade 23 (Ti6Al4V-ELI).

August 2020: Dentsply Sirona launched two imaging solutions, including the Axeos 3D/2D imaging system and Schick AE intraoral sensors, to establish a new benchmark for extraoral and intraoral imaging.

July 2020: The Straumann Group made an agreement with DrSmile, an expanding provider of orthodontic treatment solutions in Europe, to leverage the opportunities in the field of aesthetic dentistry for both companies.

Titanium & Titanium Alloys Dental Implants Market Segmentation:

Titanium & Titanium Alloys Dental Implants, Product Type Outlook

- Ti 64

- Others

Titanium & Titanium Alloys Dental Implants, Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Titanium & Titanium Alloys Dental Implants Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 5.67 billion |

|

Market size value in 2024 |

USD 6.04 billion |

|

Revenue Forecast in 2032 |

USD 13.69 billion |

|

CAGR |

10.8% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global titanium & titanium alloys dental implants market size was valued at USD 5.67 billion in 2023 and is projected to grow to USD 13.69 billion by 2032

The global market is projected to grow at a CAGR of 10.8% during the forecast period, 2024-2032

Europe had the largest share contributing over 35% of the global market

The key players in the market are Bicon, BioHorizons, Dentsply Sirona, Institut Straumann AG, KYOCERA Medical Technologies, Inc. (KYOCERA Corporation), Leader Italia, Nobel Biocare Services AG, OSSTEM IMPLANT CO., LTD., Zimmer Biomet, and ZimVie Inc.

The Ti 64 segment held a significant market share of over 65% in the titanium and titanium alloys dental implants market in 2023 because of its superior mechanical properties, which designate it as a high-performance material for dental implant applications.