Tissue Paper Market Size, Share, Trends, Industry Analysis Report

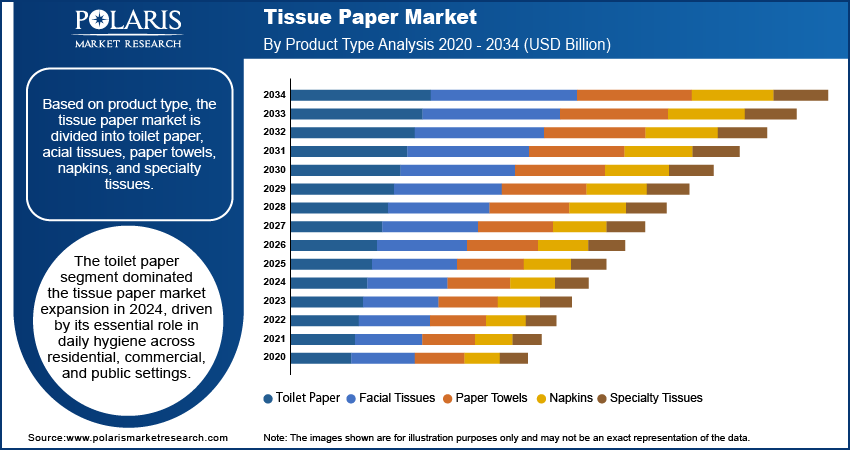

By Product Type (Toilet Paper, Facial Tissues, Paper Towels, Napkins, Specialty Tissues); End Use; Material (Virgin Pulp, Recycled Fiber, Mixed); By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM1715

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

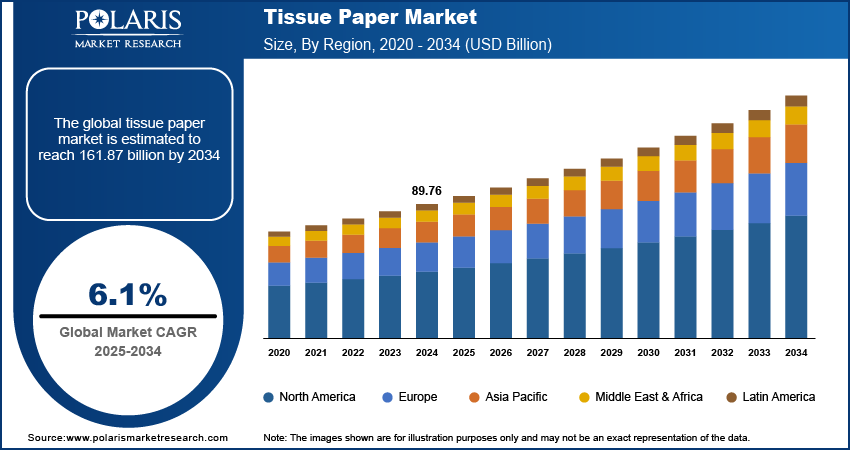

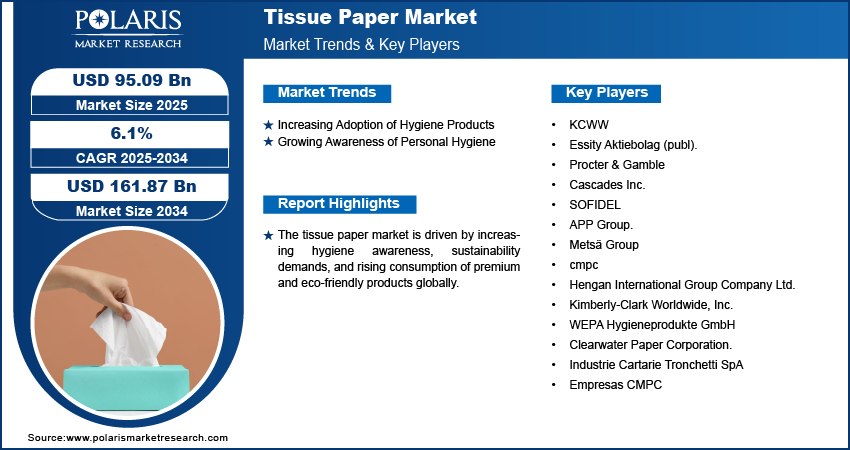

The tissue paper market was valued at USD 89.76 billion in 2024 and is expected to record a CAGR of 6.1% between 2025 and 2034. The prominent use of toilet paper, facial tissues, kitchen towels, and paper towels in hygiene, cleaning, and personal care applications favors the market growth.

Market Insights

- The toilet paper segment dominated the tissue paper market, by product type, in 2024. Segment’s growth is driven by its prominent role in routine hygiene practices across the residential, commercial, and public sectors.

- Based on end use, the healthcare segment is expected to record the highest CAGR from 2025 to 2034. Hospitals, clinics, and laboratories require different tissue paper products on a large scale.

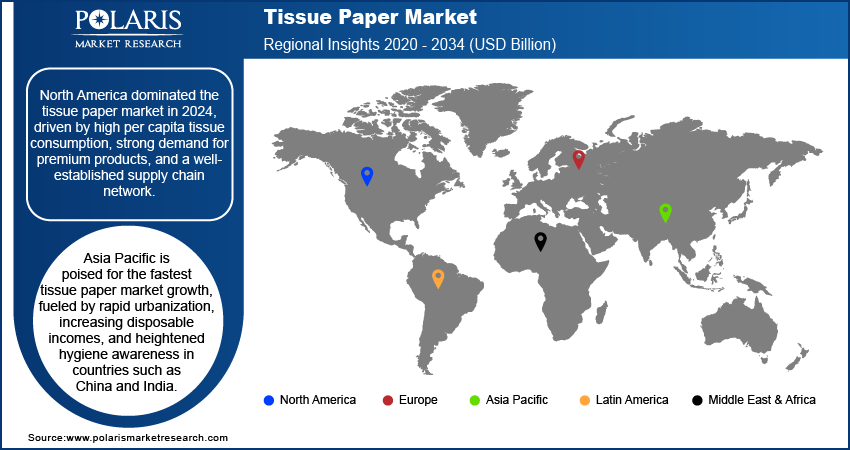

- North America dominated the tissue paper market in 2024. High per capita tissue usage, preference for premium tissue varieties, and a well-established supply chain network are the key enablers of growth.

- Asia Pacific is anticipated to register the fastest CAGR during the forecast period, owing to rapid urbanization, increasing disposable incomes, and heightened hygiene awareness, particularly in China and India.

Industry Dynamics

- Constant urbanization, rising hygiene concerns, and growing demand for biodegradable paper products are contributing to the tissue paper market growth.

- Government initiatives to promote environmentally friendly innovations and advancements in manufacturing technologies in line with stringent environmental regulations will create growth opportunities for tissue paper manufacturers in the coming years.

- Elevated consumer preference for premium tissue varieties, along with the surging penetration of private-label brands, is expected to provide significant growth prospects in the market in the future.

- Fluctuating raw material prices (especially wood pulp), high manufacturing costs and energy consumption, and rising environmental concerns such as deforestation hamper the performance of tissue paper businesses.

Market Statistics

Market Size in 2024: USD 89.76 billion

Projected Market Size in 2034: USD 161.87 billion

CAGR, 2025–2034: 6.1%

Largest Market in 2024: North America

AI Impact on Tissue Paper Market

- AI can optimize pulping and bleaching processes, among others, thereby enhancing production efficiency by reducing energy usage and minimizing raw material wastage. These tools can augment water, energy, and raw material (fiber) usage, aligning production with sustainability and ESG specifications.

- AI-based smart vision systems ensure desired sheet thickness, softness, absorbency, and perforation, especially in premium-quality tissue products.

- AI tools can carry out demand forecasting, inventory planning, and logistics, in turn helping manufacturers keep track of raw material availability and consumer demand.

- Manufacturers can utilize AI-driven insights to develop distinguishing product varieties (such as ultrasoft, eco-friendly, and antimicrobial) to establish presence in niche segments.

To Understand More About this Research: Request a Free Sample Report

Tissue paper is a thin, soft, and absorbent paper used primarily for hygiene, cleaning, and personal care applications, including toilet paper, facial tissues, kitchen towels, and paper towels. The global tissue paper market encompasses a wide range of paper products designed for hygiene and sanitary applications, including facial tissues, toilet paper, paper towels, and napkins. The market serves both consumer and institutional segments such as businesses, organizations, hotels, restaurants, hospitals, offices, and educational establishments. Increasing urbanization, rising hygiene awareness, and growing demand for sustainable and biodegradable paper products is further contributing to the tissue paper market growth. The tissue paper market is evolving to meet stringent environmental regulations with advancements in manufacturing technologies and the adoption of eco-friendly practices.

For instance, in March 2020, Green Seal made temporary changes to fiber sourcing rules since the COVID-19 pandemic affected the fiber supply. This helped ensure that hygienic paper products continued to meet high sustainability standards, covering things such as the environment, health, and safety for items such as toilet paper, facial tissues, paper towels, and napkins. Furthermore, heightened consumer preference for premium and soft tissues, along with increasing penetration of private-label brands, is contributing to the tissue paper expansion of this market.

Market Dynamics

Increasing Adoption of Hygiene Products

The adoption of hygiene products is increasing as consumers prioritize cleanliness and health in both personal and public spaces. Growing awareness of hygiene practices has led to higher demand for tissue paper products such as napkins, facial tissues, and toilet paper. The rising focus on sanitation in public places, restaurants, and workplaces further accelerates the consumption of tissue products. Additionally, the rising standard of living and the growing middle class, particularly in emerging markets, further boost tissue paper market demand. The convenience, affordability, and effectiveness of tissue paper in maintaining hygiene make it an indispensable product for households and businesses.

For instance, in May 2024, Sofidel, a manufacturer of tissue paper, expanded its Regina Rotoloni toilet paper maxi rolls to major retailers in Spain, Poland, the Netherlands, Hungary, and Romania. Furthermore, environmental concerns are also driving the market toward sustainable tissue paper options, with more consumers opting for eco-friendly products.

Rising Government Initiatives Propel Eco-Friendly Innovations in the Tissue Paper Market

Governments worldwide are increasingly implementing initiatives and regulations to promote eco-friendly practices, driving the adoption of sustainable products in the tissue paper market. Policies encouraging the use of recycled materials, reducing deforestation, and minimizing carbon footprints are prompting manufacturers to develop biodegradable and recyclable tissue paper. Furthermore, rising government initiative such as subsidies and incentives for using environmentally friendly raw materials and sustainable production processes are reshaping the market, aligning it with global environmental goals. For instance, in September 2024, the U.S. Department of Commerce has allocated USD 0.50 million to enhance the development of the environmentally sustainable packaging sector in Wisconsin. This funding aims to foster innovation and growth within the industry, promoting advanced practices and materials that minimize environmental impact while meeting the rising consumer demand for sustainable options.

Segment Assessment

Market Assessment by Product Type Outlook

The global tissue paper market segmentation, based on product type, includes toilet paper, facial tissues, paper towels, napkins, and specialty tissues. The toilet paper segment dominated the market in 2024, driven by its essential role in daily hygiene across residential, commercial, and public sector. The rising demand for premium and specialized toilet papers, such as ultra-soft, scented, and anti-bacterial variants, has further reinforced its market leadership. Innovations, such as moisture-lock technology and biodegradable options, have attracted environmentally conscious consumers, contributing to steady demand. Moreover, increasing public and private investment in sanitation facilities and the construction of modern restrooms, particularly in urban areas, has boosted the segment's consumption. The commercial and hospitality sectors, including hotels and airports, are noteworthy contributors to this segment’s dominance due to their continuous requirement for high-quality toilet paper to ensure customer satisfaction.

Market Evaluation by End Use Outlook

The global tissue paper market segmentation, based on end use, includes residential, commercial, hospitality, and healthcare. The healthcare segment is expected to grow fastest during the forecast period, driven by the increasing demand for hygiene products in medical sector, such as hospitals, clinics, and healthcare facilities. The heightened focus on infection prevention, sanitation, and the use of disposable products in healthcare environments is contributing to this growth. Additionally, the recycled fiber segment is anticipated to experience rapid growth within the material outlook due to increasing consumer demand for sustainable products, regulatory pressure for eco-friendly materials, and the growing trend of recycling.

Market Outlook by Region

By region, the report provides the tissue paper market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market, driven by high per capita tissue consumption, strong demand for premium products, and a well-established supply chain network. The US leads this region due to its advanced manufacturing capabilities and high consumer spending on hygiene products.

Asia Pacific is poised for the fastest tissue paper market growth, fueled by rapid urbanization, increasing disposable incomes, and heightened hygiene awareness in countries such as China and India. Among these, China stands out as the leading country, supported by large-scale domestic production, export opportunities, and government initiatives promoting sustainable paper manufacturing. The growing hospitality and healthcare sectors further augment tissue paper consumption in this region.

Tissue Paper Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the tissue paper industry grow even more. The top 15 companies dominated the global tissue paper market by leveraging advanced technologies, strong brand presence, and extensive distribution networks. Kimberly-Clark and Procter & Gamble lead with innovative product portfolios and premium branding strategies, while Essity and Sofidel focus on sustainability and geographic expansion. Many players are investing in recycled and biodegradable materials to align with consumer preferences and environmental regulations. Collaborative ventures, acquisitions, and technological innovations further strengthen their competitive edge, enabling them to address diverse market needs efficiently.

KCWW, operates in the hygiene and personal care sector and is engaged in the tissue paper market. The company manufactures and markets a diverse range of tissue paper products, including facial tissues, paper towels, and toilet paper under well-known brands such as Kleenex, Scott, and Cottonelle. The company is headquartered in Irving, Texas, KCWW prioritizes innovation, sustainability, and customer-centric solutions. The company focuses on using responsibly sourced raw materials and implementing water- and energy-efficient production practices. KCWW’s distribution network and global presence enable it to meet the growing demand for premium and eco-friendly tissue paper products.

Essity, a Sweden-based hygiene and health company, is a key player in the global tissue paper market. The company offers an extensive range of tissue products, including toilet paper, napkins, and paper towels, marketed under brands like Tork and Tempo. Essity emphasizes sustainability by incorporating recycled fibers and adopting circular business models in its production processes. Essity has it presence in over 150 countries. In November 2024, the company launched the world's first tissue paper machine powered exclusively by geothermal steam at its Kawerau facility in New Zealand.

Key Companies

- KCWW

- Essity Aktiebolag (publ).

- Procter & Gamble

- Cascades Inc.

- SOFIDEL

- APP Group.

- Metsä Group

- cmpc

- Hengan International Group Company Ltd.

- Kimberly-Clark Worldwide, Inc.

- WEPA Hygieneprodukte GmbH

- Clearwater Paper Corporation.

- Industrie Cartarie Tronchetti SpA

- Empresas CMPC

Tissue Paper Industry Developments

October 2023: Procter & Gamble launched Charmin Ultra Soft with Active Fresh Technology. This toilet paper has a soft texture and built-in freshness, offering customers extra comfort and hygiene.

November 2023: Asia Pulp & Paper - Opened a new facility in MEA to support its tissue paper export business.

June 2023: Georgia-Pacific LLC - Invested in advanced manufacturing technologies to improve tissue product quality and reduce waste.

Tissue Paper Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Toilet Paper

- Facial Tissues

- Paper Towels

- Napkins

- Specialty Tissues

By End Use Outlook (Revenue, USD Billion, 2020 - 2034)

- Residential

- Commercial

- Hospitality

- Healthcare

By Material Outlook (Revenue, USD Billion, 2020 - 2034)

- Virgin Pulp

- Recycled Fiber

- Mixed

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 89.76 billion |

|

Market Size Value in 2025 |

USD 95.09 billion |

|

Revenue Forecast in 2034 |

USD 161.87 billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global tissue paper market size was valued at USD 89.76 billion in 2024 and is projected to grow to USD 161.87 billion by 2034.

The global market is projected to register a CAGR of 6.1% during the forecast period.

North America dominated the tissue paper market size in 2024, driven by high per capita tissue consumption, strong demand for premium products, and a well-established supply chain network.

Some of the key players in the market are KCWW; Essity Aktiebolag (publ); Procter & Gamble; Cascades Inc.; SOFIDEL; APP Group; Metsä Group; cmpc; Hengan International Group Company Ltd.; Kimberly-Clark Worldwide, Inc.

The toilet paper segment dominated the tissue paper market in 2024, driven by its essential role in daily hygiene across residential, commercial, and public sector