Tire Recycling Market Size, Share, Trends, Industry Analysis Report: By Tire Types (Off-the-Road (OTR) Tires Recycling, On The Road Tires Recycling and Aircraft Tire Recycling), Recycling Methods, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM5358

- Base Year: 2024

- Historical Data: 2020-2023

Tire Recycling Market Overview

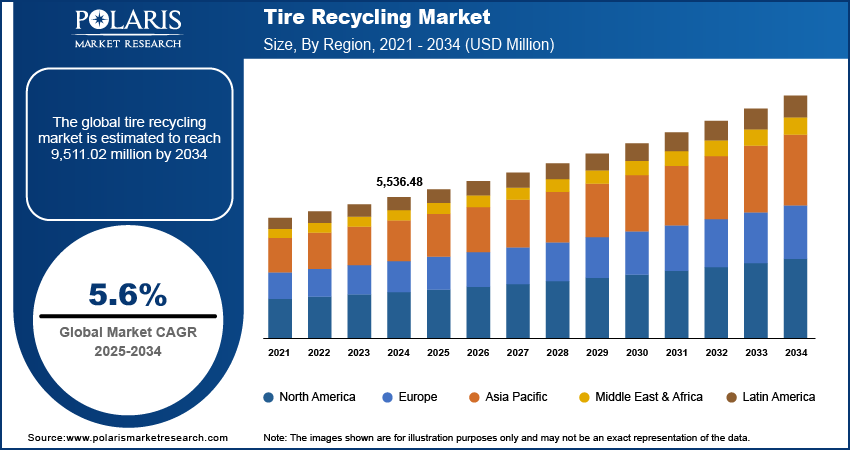

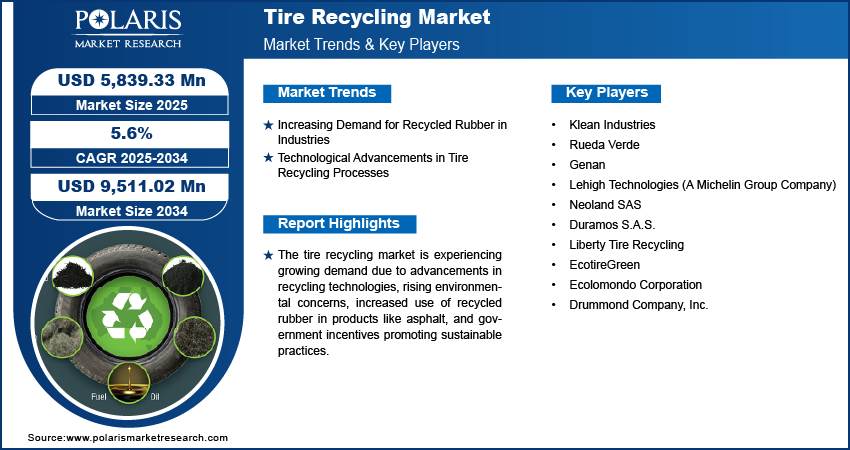

The global tire recycling market size was valued at USD 5,536.48 million in 2024. The market is projected to grow from USD 5,839.33 million in 2025 to USD 9,511.02 million by 2034, exhibiting a CAGR of 5.6% during the forecast period.

Tire recycling involves the process of converting waste tires into reusable materials, reducing environmental harm and promoting sustainability. Recycling is achieved through methods such as shredding, pyrolysis, and devulcanization, producing rubber crumbs, reclaimed rubber, or fuel.

The demand for tire recycling is growing due to increasing awareness of environmental concerns, stringent government regulations, and the rising focus on a circular economy. Recycled tire materials have applications in construction, automotive, and energy sectors, such as asphalt rubber and tire-derived fuels.

Additionally, the growing number of vehicles worldwide is generating more end-of-life tires, further boosting the market penetration. For instance, according to published information by Evonik Magazine, in 2023, nearly 1.8 billion tires were manufactured, and an equal number of end-of-life tires were removed from vehicles during the same period. Therefore, this trend towards replacement of large numbers of tires from the vehicles on annual period is driving tire recycling market expansion. In addition, innovations in recycling technologies and the push for eco-friendly products are also driving the tire recycling market expansion globally.

To Understand More About this Research: Request a Free Sample Report

The automotive industry outlook, driven by rising consumer demand and technological advancements, is leading to an increase in tire replacement rates. A higher number of vehicles on the road results in more used tires, creating a pressing need for efficient recycling solutions. This surge in tire waste has significantly expanded the tire recycling market, where recycling reduces environmental impact and also generates valuable products such as rubber crumbs and asphalt.

Stricter government regulations and a growing consumer demand for sustainability are further accelerating the tire recycling industry. Increasingly, businesses are investing in innovative recycling technologies such as advanced shredding and Pyrolysis to comply with these regulations. For instance, companies such as VTTI and Enviro are investing in large-scale tire recycling plants to produce sustainable raw materials, including recovered carbon black and oils. These factors, combined with the automotive sector's expansion and rising tire replacement rates, are driving the tire recycling market growth.

Tire Recycling Market Drivers

Increasing Demand for Recycled Rubber in Industries

The increasing demand for recycled rubber across various industries is fueling the tire recycling market growth. Industries such as automotive, construction, and manufacturing are actively seeking sustainable alternatives to reduce waste and minimize environmental impact. Recycled rubber serves as an affordable and eco-friendly option used in the production of automotive components such as mats, seals, and gaskets. In construction, it is valued for its industry applications such as flooring, soundproofing, and paving. The sports industry also favors recycled rubber for creating durable, shock-absorbing surfaces on playgrounds and athletic fields. Environmental regulations and growing awareness about the benefits of circular economies are pushing businesses to adopt recycling methods. This rising demand for recycled rubber in multiple sectors is propelling the tire recycling market to new heights, offering a viable solution for reducing landfill waste and conserving resources.

For instance, according to The U.S. Tire Manufacturers Association (USTMA) report 2021, the growing use of ground rubber from end-of-life tires (ELTs) across various applications has increased by 29% compared to the year 2019. The application of end-of-life tires includes rubber mulch improves shock absorption in playgrounds, and rubberized asphalt improves road durability, among others. Thus, there has been a constant demand for end-of-life tires for the production of various byproducts, which is ultimately fuelling its demand in the global market.

Technological Advancements in Tire Recycling Processes

Technological advancements in tire recycling processes are significantly driving the tire recycling market demand. Innovations such as pyrolysis and cryogenic grinding are improving efficiency and enabling the extraction of valuable materials such as carbon black, steel, and oil from used tires. These advancements reduce energy consumption and environmental impact, making tire recycling more sustainable. Moreover, enhanced recycling technologies are increasing the production of high-quality recycled products, such as rubber powders and crumb rubber, which have applications in industries such as construction, automotive, and sports. The ability to repurpose these materials into new products is fueling demand as companies and governments seek more sustainable waste management solutions. This technological evolution is positioning tire recycling as a key component of the circular economy.

Tire Recycling Market Segment Analysis

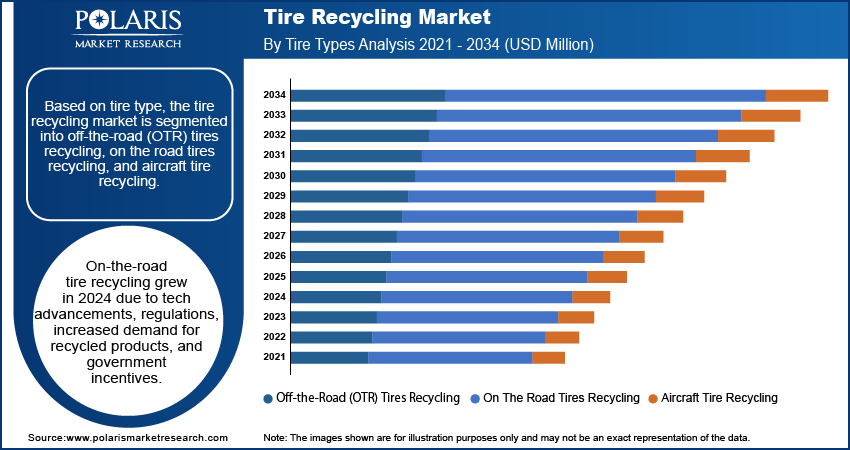

Tire Recycling Market Assessment by Tire Types Outlook

The global tire recycling market segmentation, based on tire types, includes off-the-road (OTR) tires recycling, on the road tires recycling, and aircraft tire recycling. On-the-road tire recycling segment held a significant tire recycling market share in 2024 due to increasing tire waste and environmental concerns. The growth is driven by advancements in recycling technologies, improved collection systems, and growing regulations encouraging sustainable practices. The tire recycling industry is benefiting from a surge in demand for recycled rubber products, which are being used in various applications such as asphalt, playgrounds, and industrial materials. Additionally, rising consumer awareness and government incentives are boosting the sector, contributing to its rapid expansion within the tire recycling market.

Tire Recycling Market Evaluation by Recycling Methods Outlook

The global tire recycling market segmentation, based on recycling methods, includes shredding & grinding, pyrolysis, retreading, and others. Pyrolysis is expected to experience significant growth opportunity in the tire recycling market during the forecast period due to its ability to efficiently convert tires into valuable by-products such as oil, gas, and carbon black. This process offers an eco-friendly alternative to traditional tire disposal methods, reducing landfill waste and carbon emissions. Pyrolysis technology is advancing, with improvements in efficiency and cost-effectiveness, making it more attractive to tire recycling companies. Additionally, increasing demand for recycled materials in various industries is driving the adoption of pyrolysis, fueling the tire recycling market growth.

Tire Recycling Market Regional Analysis

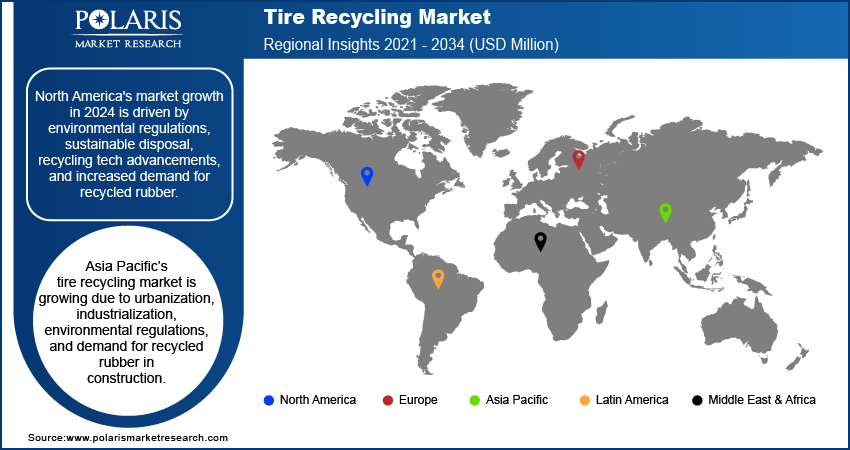

By region, the study provides tire recycling market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market share in 2024 due to increasing environmental regulations and a shift toward sustainability. Rising tire waste and the need for eco-friendly disposal methods are driving market growth. Advancements in recycling technologies and the rising demand for recycled rubber products, such as in construction and manufacturing, are boosting the industry. Government initiatives and consumer awareness further support this growing demand in the region. In addition, increasing demand for electric vehicles in the developed nations such as US is promoting the growth of tire recycling market. For instance, according to a report by Consumer Affairs, around 660,000 electric vehicles were sold by the half-year of 2023, accounting for an increase of 57% year-over-year growth. Thus, such continuous rising demand for electric vehicles is estimated to generate a large volume of end-of-life tires, which is promoting the growth of the tire recycling market.

The tire recycling market is significantly influencing the Asia Pacific as governments increasingly focus on sustainable waste management and environmental regulations. Growing urbanization, industrialization, and automotive production are leading to a surge in tire waste, prompting the need for efficient recycling solutions. Advancements in recycling technologies, along with rising demand for recycled rubber in construction and manufacturing, are driving market growth, making Asia Pacific a key player in the global tire recycling industry.

Tire Recycling Market – Key Players and Competitive Analysis Report

The competitive landscape of the tire recycling market is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic partnerships, and regional expansion. Key players such as Klean Industries, Drummond Company, Inc., and others in the market leverage their robust research and development (R&D) capabilities along with extensive distribution networks to offer advanced tire recycling solutions tailored for various applications. These major companies focus on continuous product innovation to improve efficiency, reliability, and scalability to meet the evolving needs of industries that require advanced power management solutions. At the same time, smaller regional firms are entering the market with specialized tire recycling solutions targeting local market demands, often focusing on customized and cost-effective applications. A few competitive strategies in the tire recycling market include mergers and acquisitions, collaborations with technology firms, and expanding product portfolios to enhance market presence and cater to the growing demand for advanced grid solutions. Klean Industries; Ruedaverde; Liberty Tire Recycling; Neoland SAS; Duramos; EcoTireGreen; Genan; Drummond Ltd.; Lehigh Technologies (A Michelin Group Company); and Ecolomondo Corporation are among the key major players.

Rueda Verde is a Colombian tire management organization focused on recycling end-of-life tires through a sustainable, circular economy model, ensuring compliance, efficient collection, and resource recovery with environmental responsibility.

Genan specializes in tire recycling, transforming end-of-life tires into high-quality materials like rubber powder and steel, promoting sustainability, resource efficiency, and reduced CO₂ emissions across industries in the circular economy.

List of Key Companies in Tire Recycling Market

- Klean Industries

- Rueda Verde

- Genan

- Lehigh Technologies (A Michelin Group Company)

- Neoland SAS

- Duramos S.A.S.

- Liberty Tire Recycling

- EcotireGreen

- Ecolomondo Corporation

- Drummond Company, Inc.

Tire Recycling Industry Development

In April 2024, Klean Industries Inc. has signed a Memorandum of Understanding with L4T Group Life for Tyres Ltd., a company specializing in pyrolysis and recycling facilities for end-of-life tires. This partnership aims to combine their expertise to develop integrated solutions for the sustainable recovery of commodities from end-of-life tires in the global marketplace.

In January 2024, Liberty Tire Recycling's acquisition of Empire Tire and McGee Tire in Central Florida was announced, expanding its footprint and recycling operations in the growing region to improve tire collection and sustainability efforts.

In June 2022, Drummonds collaborated with Duramos SAS to hire their services for the proper disposal of waste tires.

Tire Recycling Market Segmentation

By Tire Types Outlook (Revenue, USD Million, 2021–2034)

- Off-the-Road (OTR) Tires Recycling

- On The Road Tires Recycling

- Aircraft Tire Recycling

- Airplanes

- Helicopters

- Others

By Recycling Methods Outlook (Revenue, USD Million, 2021–2034)

- Shredding & Grinding

- Pyrolysis

- Retreading

- Others

By Application Outlook (Revenue, USD Million, 2021–2034)

- Energy Generation

- Consumer Goods

- Manufacturing and Industrial Uses

- Civil Engineering and Infrastructure

By Regional Outlook (Revenue, USD Million, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Tire Recycling Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5,536.48 million |

|

Market Size Value in 2025 |

USD 5,839.33 million |

|

Revenue Forecast by 2034 |

USD 9,511.02 million |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global tire recycling market size was valued at USD 5,536.48 million in 2024 and is projected to grow to USD 9,511.02 million by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

North America dominated the Tire Recycling market in 2024.

A few key players in the market are Klean Industries; Ruedaverde; Liberty Tire Recycling; Neoland SAS; Duramos; EcoTireGreen; Genan; Drummond Ltd.; Lehigh Technologies (A Michelin Group Company); and Ecolomondo Corporation.

The on the road tires recycling segment led the market share in 2024.

The pyrolysis segment of the tire recycling market is anticipated to register the highest growth rate during the forecast period.