Tinplate Market Share, Size, Trends, Industry Analysis Report, By Product Type (Single Reduced and Double Reduced); By Grade; By End-Use Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3542

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

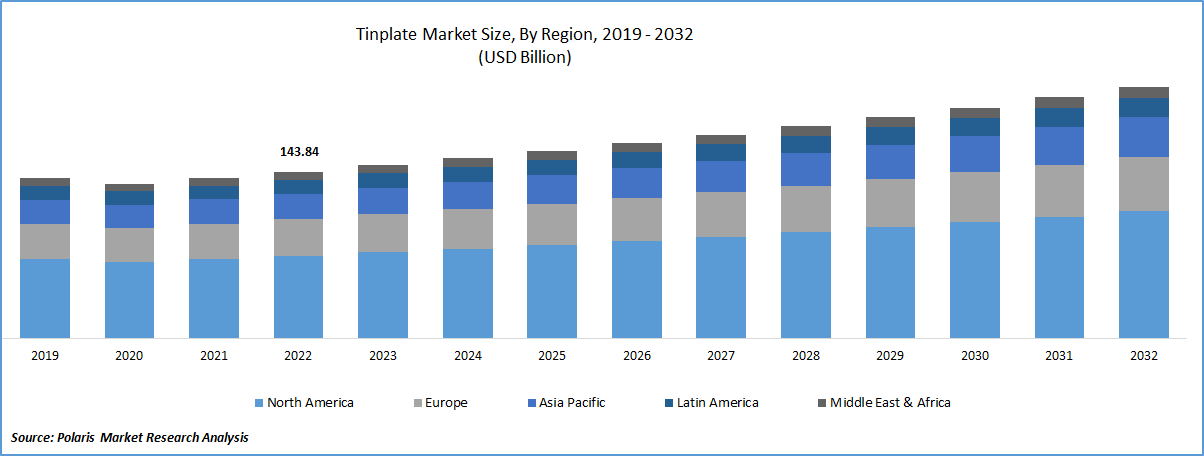

The global tinplate market was valued at USD 143.84 billion in 2022 and is expected to grow at a CAGR of 4.2% during the forecast period. The range of attractive qualities and characteristics of tinplate products such as the recyclability, recyclability, freshness of products, and anti-corrosion properties and surging demand for packaged and canned foods, particularly in the urban areas and young population due to hectic life-schedules of people, are driving the global market demand and growth.

To Understand More About this Research: Request a Free Sample Report

In addition, expansion of businesses through adopting several development strategies and advances in technology that have improved the production processes for tinplate, making it more efficient and cost-effective and has also helped to increase supply and lower prices, is also likely to have positive impact on tinplate market growth in the near future.

For instance, in January 2022, Sonoco, a leading sustainable packaging company, announced about the completion of its acquisition of Ball Metalpack, a global manufacturer of sustainable metal packaging for household and food products. The acquisition will expand the Sonoco’s established sustainable packaging portfolio by including metal packaging into its offerings, which is widely adopted across the global economy.

The introduction of easy-open ends by key market companies, which allows consumers to open and access the contents of tinplate containers more easily and conveniently, as these ends are typically designed to be safe, tamper-evident, and user-friendly, and they have helped to increase the convenience and usability of tinplate packaging, thereby creating lucrative growth opportunities for the market.

Emergence of coronavirus across the globe has caused fluctuations in demand for tinplate products, as some sectors experienced increased demand due to a surge in online shopping and home deliveries, while others have experienced a decline in demand due to a decrease in consumer spending and significant disruptions in the global supply chains.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The growing prevalence for several types of aerosol packaging like deodorant, air fresheners, mosquito repellents among others and surging popularity of environment-friendly packaging solutions coupled with the increasing number of government regulations regarding the use of sustainable and recyclable materials and ban on the single-use plastics, which has forced manufacturers to look for alternative options, are expected to drive the market growth over the years.

Furthermore, the extensive growth in the demand and adoption for processed food, dairy products, beverages, paints, and aerosols among others and emerging trends for premium packaging across the globe along with the growing focus on players towards implementing on initiatives to reduce carbon footprint & incorporation of several environment-friendly technologies in the manufacturing process, has also been propelling the market.

Report Segmentation

The market is primarily segmented based on product type, grade, application, and region.

|

By Product Type |

By Grade |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Double reduced segment accounted for the largest market share in 2022

The double reduced segment accounted for the major market share in 2022, and is projected to maintain its market position throughout the anticipated period, mainly attributable to increased penetration among key manufacturers of thinner towards the use of these materials, as they are lean compared to single reduced product types and are also high in strength. Moreover, increasing environmental concerns and continuously rising demand for sustainable and eco-friendly materials by companies in order to reduce their carbon footprint, has been positively impacting the market growth.

The single reduce segment is anticipated to gain significant growth rate over the next coming years, on account of growing consumer preferences for single tinplate packaging solutions because of its easy to use nature and lightweight along with the influence of market trends like popularity of packaged and canned food products and personal care products.

Prime grade segment held the significant market revenue share in 2022

The prime grade segment held the maximum market share in terms of revenue in 2022, which is mainly driven by growing premiumization trend and increasing number of consumers who are looking for high-quality products, which offers superior performance, aesthetics, and durability coupled with its growing adoption among eco-conscious consumers due to its recyclable properties.

Beside this, prime grade tinplate products have excellent corrosion resistance as compared to others available in the market, which makes them ideal for packaging food and beverages that are acidic or have a high salt content and also offer superior printability, allowing for high-quality graphics and branding on packaging, which in turn, fueling the demand and growth of the segment market.

Personal care segment is anticipated to witness highest growth

The personal care segment is anticipated to grow at a healthy CAGR during the forecast period, mainly due to several factors including growing demand for sustainable packaging, rising consumer disposable income, growing urbanization, and awareness regarding the advantages associated with tinplate packaging including ability to preserve the quality and freshness of products it contains and higher durability.

The food & beverage segment led the industry market with substantial market share in 2022, on account of increasing demand for food & beverage products because of the rising global population and emerging prevalence for consuming packaged food products due to surge in the busy and hectic lifestyles of people mainly in the urban regions along with the presence of several regulations mandating the use of high-quality food-grade packaging materials globally.

According to United Nations, the total global population was estimated to be around 8.0 billion in November 2022, with an increase of over 1 billion since 2010 and 2 billion since1998. And, the global population is likely to reach 9.7 billion adding another 2 billion by 2050 and estimated to peak at nearly 10.4 billion in 2080.

North America region dominated the global market in 2022

The North America region dominated the global market with considerable market share in 2022, and is expected to maintain its dominance throughout the projected period, that is highly attributable to robust presence of leading food & beverage industry players and increased canned food consumption in developed economies like US and Canada. Additionally, several technological advancements in the manufacturing of tinplate such as the development of new coatings and surface treatments, that are expected to increase the efficiency and durability of tinplate, fostering the regional market growth at rapid pace.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR over the study period, owing to drastic rise in the product demand from numerous end-use industries including food, personal care, and household appliances coupled with the availability of strong manufacturing base for several consumer goods in countries like China, Japan, Indonesia, and India among others.

Competitive Insight

Some of the major players operating in the global market include Toyo Kohan, Tata Tinplate GPT, JFE Steel Corporation, ArcelorMittal, Sino East Steel, Tianjin Jiyu Steel, Tinplate Co., United States Steel, JSW Steel, POSCO Group, Thyssenkrupp, Jiangsu Shagang Group, Massilly Holding, Berlin Metals, Hyundai Steel, Ardagh Group, and Nippon Steel.

Recent Developments

In December 2022, Kyushu Works of Nippon Steel Corporation received FSSC22000 certification for their steel sheets including tinplate, TFS, and can light, and has become the Japan’s firs steel manufacturing organization to obtain this certification. The company is also focused to obtain this certification for their other major steel manufacturing sites for container sheets to expand their business and going forward.

In September 2021, KSP Capital announced that the company has completed the acquisition of European tinplate business from Crown Holdings, against a consideration of € 2.25 billion, and the Crown will retain approx. 20% ownership stake in the business. With this acquisition, the company will expand its production capacities of food cans and ends, metal closures, aerosol cans, and promotion packaging for their customers globally.

Tinplate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 149.50 billion |

|

Revenue forecast in 2032 |

USD 217.05 billion |

|

CAGR |

4.2% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Grade, By End-Use Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Toyo Kohan Co. Ltd., Tata Tinplate GPT Steel Industries Ltd., JFE Steel Corporation, ArcelorMittal S.A., Sino East Steel Enterprise Ltd., Tianjin Jiyu Steel Co. Ltd., Tinplate Co. of India Ltd., United States Steel Corporation, JSW Steel Ltd., POSCO Group, Thyssenkrupp AG, Jiangsu Shagang Group Su, Massilly Holding SAS, Berlin Metals, Hyundai Steel, Ardagh Group, and Nippon Steel Corp. |

FAQ's

key companies in Tinplate Market are Toyo Kohan, Tata Tinplate GPT, JFE Steel Corporation, ArcelorMittal, Sino East Steel, Tianjin Jiyu Steel.

The global tinplate market expected to grow at a CAGR of 4.2% during the forecast period.

The Tinplate Market report covering key are product type, grade, application, and region.

key driving factors in Tinplate Market are High growth in the deodorant consumption in India.

The global tinplate market size is expected to reach USD 217.05 billion by 2032.