Threat Intelligence Market Share, Size, Trends, Industry Analysis Report, By Component (Solutions, Services); By Deployment Mode (Cloud, On-premises); By Application; By Industry Vertical; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 112

- Format: PDF

- Report ID: PM2444

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

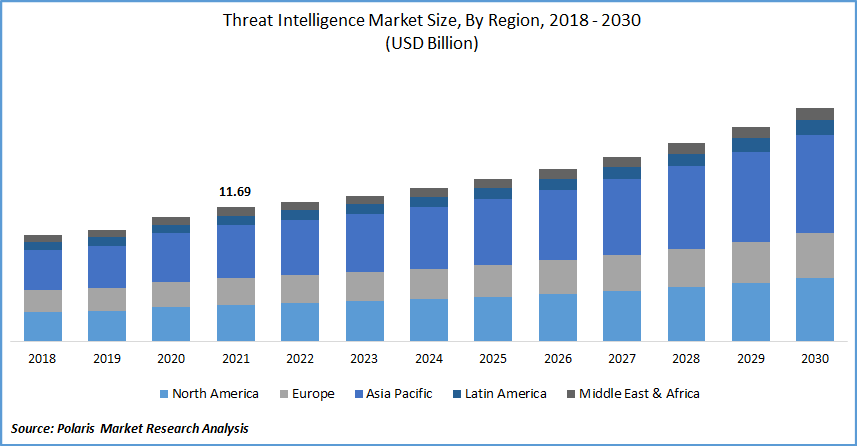

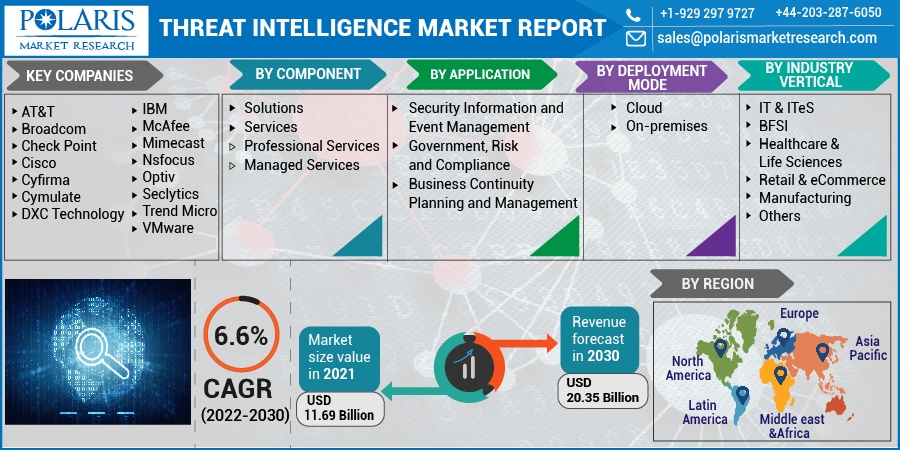

The global threat intelligence market was valued at USD 11.69 billion in 2021 and is expected to grow at a CAGR of 6.6% from the forecast period. Threat intelligence industries widely produce beneficial solutions across a wide range of verticals. The rising number of cyber-attacks has led to increased demand for the threat intelligence market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

For instance, as per the Center for Strategic and International Studies, between January 2020 and February 2022, Russian hackers attacked accounts of multiple defense contractors and stole sensitive data about the businesses' information on products and their conversations with the stakeholders.

Thus, to deal with cyber fears, retailers have begun to invest heavily in the threat intelligence market to determine the impact of these security and data breaches, allowing them to be predicted and countered. Additionally, there is a high market demand for the e-commerce industry across the globe. The rise in internet users has increased the demand for e-commerce solutions.

For instance, as per the International Trade Union, the internet users in 2020 were around 51% across the globe. The digital transformation is now extended to the E-commerce channel. More connected devices, such as kiosks, Point-of-Sale (POS) systems, and handheld devices, have made their way into physical stores, all designed to collect and access customer information.

Threat intelligence is the collection and evaluation of information useful in defending an organization against internal and external threats and analyzing that data to detect deceptions to gather accurate and relevant intelligence. However, threat intelligence market solutions necessitate company-wide coverage for smooth and secure operations, resulting in higher infrastructure costs.

Industry Dynamics

Growth Drivers

Digital technologies and industrial systems have merged into a single ecosystem. This expands profitable positions for technologies like M2M communication and the IoT. Industries require secure control systems, particularly for equipment deployed in harsh environments like subsea oil wells or mines. Failure of this equipment operating in such conditions can be disastrous, resulting in significant financial losses and putting the lives of several people near these sites in danger.

Furthermore, the market is being driven by the increased use of next-generation security services in numerous firms and their applicability in varied markets. Most banking institutions have benefited from digital platforms, putting them exposed to cyberattacks. It has sensitive data and information, leaving it vulnerable to hackers.

These organizations demand intelligent solutions to these issues to identify network sources that have been compromised and develop a strategy to combat current and future fear and warnings. Phishing, zero-day attacks, ransomware, and insider assaults are all examples of cybersecurity vulnerabilities resulting from rapid technological innovation.

As a result, the number of security vulnerabilities will rise, generating concerns among enterprises about updating their security architecture and keeping up with the shifting threat intelligence landscape. Enterprises employ risk intelligence products to acquire evidence-based insights into existing or emerging dangers so they may make informed decisions.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on component, application, deployment mode, industry vertical, and region.

|

By Component |

By Application |

By Deployment Mode |

By Industry Vertical |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by deployment

Based on the deployment segment, the cloud segment is expected to be the most significant revenue contributor in the market. Businesses use the threat intelligence cloud to reduce the attack surface, block all known risks, and use the global community to detect and convert unknown threats into known, control ability threats.

The threat intelligence cloud creates a closed loop of constant detection and prevention, safeguarding customers' networks from predictable and unpredictable warnings at every stage of the Attack Kill Chain, including delivery, exploitation, and command-and-control. The cloud deployment model is gaining a lot of traction among SMEs because it allows them to take advantage of the benefits of such platforms at a low cost.

Based on the application, the government, risk, and compliance segments held the highest growth rate over the study period in the global market. Risk management aids in the identification of critical IT assets and 'critical accesses' that are required for the organization's operation. Risk analytics is being used by businesses to gather supporting data to quantify cyber risks, automate security operations, and make intelligence-driven decisions. Additionally, mandates like PCI-DSS and the NIST Cybersecurity Framework are increasing regulatory pressure from a cyber perspective.

Geographic Overview

North America had the largest revenue share in the global market. This high share is majorly due to the rise in the adoption of IoT-enabled devices, the availability of adequate digital infrastructure, and the emergence of numerous financial institutions seeking standard risk detection services.

In addition, as per the US Department of Health & Human Services, 28 data breaches have been reported in the United States in 2020, including email hacking, malware attacks, and unauthorized access to EHRs. Cloud computing is seen as an immediate solution in the medical healthcare sector because it is scalable and cost-effective.

Moreover, Asia Pacific market is expected to witness a high CAGR in the global market. Organizations' critical data has become more vulnerable to vastly increased cyber-attacks. These cyber-attacks are having a devastating effect on revenue; due to these statistics, businesses and governments in the region have begun to invest more in threat intelligence solutions.

The level of understanding of cybercrime among SMEs and large-scale organizations in the APAC region has increased substantially, leading to the widespread adoption of threat intelligence solutions and services. The attack surface has grown as the number of connected devices has grown. As a result, robust threat intelligence solutions are required to combat the attacks. The frequency and sophistication of online attacks have also improved due to various government initiatives to accelerate the digital transformation.

Competitive Insight

Key players operating in the global market include AT&T, Broadcom, Check Point, Cisco, Cyfirma, Cymulate, DXC Technology, IBM, McAfee, Mimecast, Nsfocus, Optiv, Seclytics, Trend Micro, and VMware.

Threat Intelligence Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 11.69 billion |

|

Revenue forecast in 2030 |

USD 20.35 billion |

|

CAGR |

6.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Application, By Deployment Mode, By Industry Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AT&T, Broadcom, Check Point, Cisco, Cyfirma, Cymulate, DXC Technology, IBM, McAfee, Mimecast, Nsfocus, Optiv, Seclytics, Trend Micro, and VMware |