Threat Hunting Market Size, Share, Trends, Industry Analysis Report: By Deployment Mode (On-Premises and Cloud), Offering, Threat Type, Organization Size, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 – 2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5176

- Base Year: 2024

- Historical Data: 2020-2023

Threat Hunting Market Overview

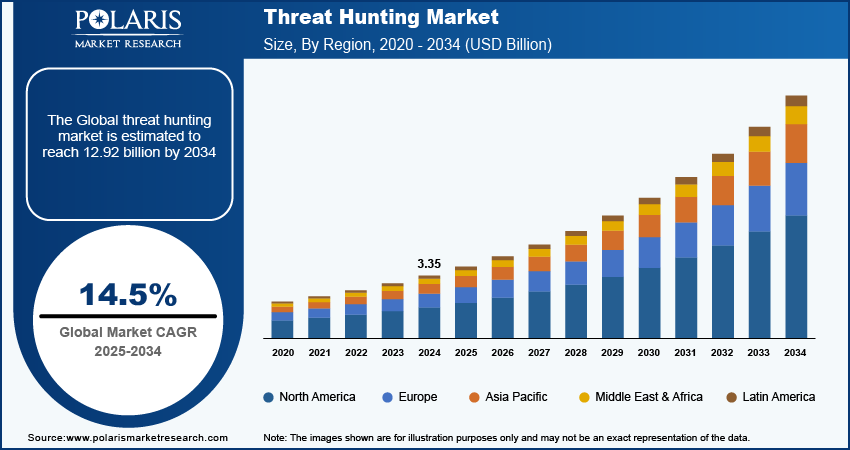

The global threat hunting market size was valued at 3.35 billion in 2024. The market is projected to grow from USD 3.83 billion in 2025 to USD 12.92 billion by 2034, exhibiting a CAGR of 14.5% during the forecast period.

Threat hunting, or cyber threat hunting, involves actively identifying undiscovered or unresolved threats within an organization. With the significant increase in online transactions, particularly within the e-commerce, banking, and financial services industries, there is a wider range of potential targets for cybercriminals. This highlights the need for advanced threat hunting solutions to proactively identify and address potential threats in real time, thereby driving the growth of the threat hunting market. Additionally, the rise in insider threats, where employees or trusted individuals deliberately or inadvertently cause harm, emphasizes the need for more advanced threat detection capabilities. This further contributes to the expansion of the threat hunting market share.

To Understand More About this Research: Request a Free Sample Report

Valuable data, including intellectual property, financial records, customer data, and personal identification information, is a prime target for cybercriminals. To combat this threat, organizations require advanced threat-hunting solutions to proactively identify and neutralize potential threats that risk this sensitive information. The growing recognition of the significance of proactive cybersecurity strategies in corporate and government domains is driving the need for advanced threat-hunting services and solutions. This is consequently bolstering the market for threat hunting. Moreover, governments globally are boosting cybersecurity budgets to defend against advanced cyber threats targeting sensitive data, critical infrastructure, and national security. For instance, the President’s Budget has allocated around USD 10.9 million for citizen cybersecurity, focusing on safeguarding Federal IT and critical national information, including personal data. These efforts often involve investments in penetration testing services, further fueling the growth market.

Threat Hunting Market Trends and Drivers Analysis

Increasing Incidence of Cyber Threats and Attacks

The rising incidence of cyber threats and attacks has led to an increased demand for threat hunting. The 2023 Annual Data Breach Report documented a 78% surge in data compromises in 2023 (3,205) compared to 2022 (1,801), marking a new record for the ITRC and representing a 72% increase from the previous high in 2021 (1,860). Threat hunting allows organizations to detect cyber threats before they cause significant harm, such as data breaches or ransomware attacks. This earlier detection reduces response times, which in turn lowers the impact of cyber-attacks or breaches. This ability of threat hunting tools encourages organizations and businesses to adopt these advanced tools to avoid further cyber threats and attacks.

Increasing Governments Initiatives

Governments are implementing and enforcing stricter cybersecurity regulations that require organizations to proactively defend against cyber threats and demonstrate their ability to detect and respond to attacks. This increases the demand for threat hunting solutions. For instance, the European Union passed the General Data Protection Regulation (GDPR) law, which mandates that companies take adequate measures to protect personal data, including detecting and responding to security breaches.

Threat Hunting Market Segment Analysis

Threat Hunting Market Analysis by Vertical Insights

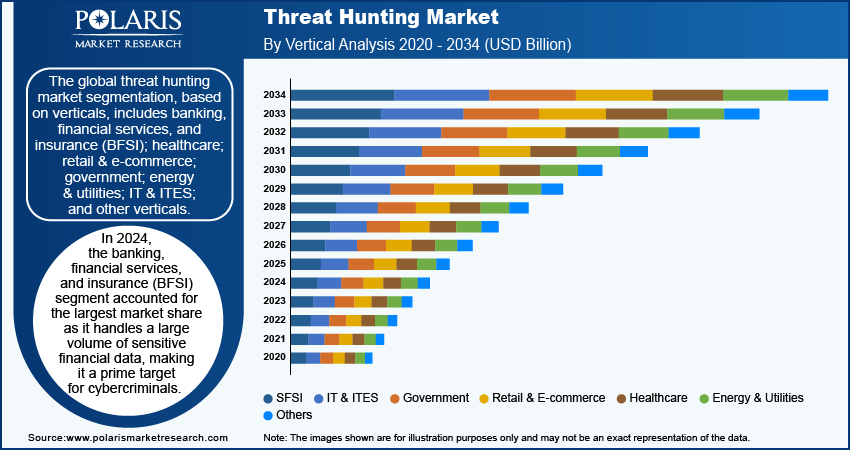

The global threat hunting market segmentation, based on verticals, includes banking, financial services, and insurance (BFSI); healthcare; retail & e-commerce; government; energy & utilities; IT & ITES; and other verticals. In 2024, the banking, financial services, and insurance (BFSI) segment accounted for the largest market share. The BFSI sector handles a large volume of sensitive financial data, making it a prime target for cybercriminals. To safeguard this data from breaches and theft, threat hunting solutions are necessary. Financial institutions are frequent targets of cyber-attacks due to the valuable information they possess. Advanced threat hunting is crucial for early detection and mitigation of these threats before they cause substantial damage. Financial fraud poses a significant risk for the BFSI sector, and threat hunting solutions play a vital role in identifying and preventing fraudulent activities, thereby safeguarding both the institution and its customers. The banking, financial services, and insurance (BFSI) sector is making significant investments in cybersecurity strategies. This is leading to an increased need for advanced threat hunting solutions, which is propelling the growth of the threat hunting market.

Threat Hunting Market Analysis by Deployment Mode Insights

The global threat hunting market segmentation, based on deployment mode, includes on-premises and cloud. The cloud category is expected to be the fastest growing market segment. Businesses are quickly adopting cloud services due to their ability to scale rapidly, their flexibility, and their cost efficiency. With the migration of more operations and data to the cloud, there is a critical need for strong security measures. Consequently, organizations are ramping up their investments and advancements in cloud security to align with the increasing adoption of cloud technology and cloud computing. This surge in demand is fueling the need for specialized cloud-centric threat hunting solutions.

Threat Hunting Market Analysis by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America threat hunting market accounted for the largest market share in 2024 due to the high prevalence of advanced and multifaceted cyberattacks. Cybercriminals and state-sponsored actors often target a diverse range of entities, such as businesses, government bodies, and critical infrastructure, utilizing advanced tactics to breach defenses and steal sensitive data. North America has made significant investments in cybersecurity infrastructure and technologies to counter advanced cyber threats. This includes the implementation of advanced threat hunting solutions with real-time detection and response capabilities, empowering organizations to identify and mitigate potential threats proactively. Subsequently, the rising cyber-attacks play a pivotal role in expanding the accessibility of threat hunting in the region.

The US threat hunting market accounted for the largest market share in 2024 due to increasing government investment. The government has allocated substantial funding and grants to enhance the cybersecurity capabilities of both public and private sectors. This financial support encourages organizations to invest in robust threat hunting solutions. For instance, in July 2024, the Department of Homeland Security, via the Federal Emergency Management Agency and the Cybersecurity and Infrastructure Security Agency, disclosed awards totaling over USD 18.2 million under the Tribal Cybersecurity Grant Program. These funds are aimed at helping Tribal Nations manage and mitigate cyber risks and threats, thereby contributing to the growth of the threat hunting market.

Asia Pacific threat hunting market is expected to grow at the highest CAGR during the forecast period. The region is experiencing significant digital transformation, marked by the growing uptake of digital technologies and online services. This surge in digital activity has expanded the attack surface, necessitating advanced threat hunting solutions to mitigate cyber threats. The rapid expansion of cloud computing services in the region has carried new security challenges. Organizations leveraging cloud services require advanced threat hunting tools to monitor and secure their cloud environments effectively. Moreover, the economic growth in many Asia Pacific countries is accompanied by large-scale digital initiatives and smart city projects. These initiatives are strengthening the reliance on digital infrastructure, consequently necessitating advanced cybersecurity protocols, which in turn is boosting the demand for the threat hunting market.

Threat hunting market in India is expected to grow significantly during the forecast period due to rapid digital transformation, with increased adoption of digital technologies, online services, and e-commerce. However, this growth has expanded the attack surface, making advanced threat hunting solutions essential for protecting digital assets. For instance, according to NIC, in June 2021, UPI recorded over 1.49 million transactions, and by 2023, this volume is expected to reach 83.75 million transactions in India. The surge in online transactions has led to an increase in cyber-attacks, thereby driving the growth of the threat hunting market.

Threat Hunting Key Market Players & Competitive Insights

Major market players are investing heavily in research and development in order to expand their product lines, which will help the threat hunting market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the threat hunting market must offer cost-effective items.

In recent years, the threat hunting market has offered some technological advancements. Major players in the market include Capgemini, CrowdStrike, Cynet, Eviden, IBM, Kaspersky, Palo Alto Networks, Rapid 7, Sangfor, SecureWork, Solidworks, Trend Micro, Trustwave, Verizon, and VMware.

Capgemini SE is engaged in digital transformation, consulting, technology, and engineering services on a global scale. The company provides strategy and transformation services in the areas of strategy, data science, technology, and creative design to assist organizations in developing innovative models and products within the digital economy. In December 2021, Capgemini opened a new Cyber Defense Center in Poland to provide data protection and threat intelligence services, supporting organizations in securing their digital and cloud transformation processes.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. It is the largest technology firm in the world. The company mainly sells software, which generates 29% of its revenue. It provides healthcare and healthcare payer solutions through the IBM Watson Health business. In April 2023, IBM launched the IBM Security QRadar Suite, a comprehensive security solution designed to streamline the security analyst experience and boost threat detection, investigation, and response capabilities.

List of Key Companies in the Threat Hunting Industry Outlook

- Capgemini

- CrowdStrike

- Cynet

- Eviden

- IBM

- Kaspersky

- Palo Alto Networks

- Rapid 7

- Sangfor

- SecureWork

- Solidworks

- Trend Micro

- Trustwave

- Verizon

- VMware

Threat Hunting Industry Developments

May 2024: Palo Alto Networks and IBM collaborated to provide an AI-driven security solution. As part of this partnership, IBM will offer security consulting services tailored for Palo Alto Networks' platforms. The goal is to expand their presence in the cybersecurity and AI security sectors.

May 2024: CrowdStrike launched new Cloud Detection and Response updates to enhance managed threat hunting and provide deeper visibility across cloud, endpoints, and identity for faster detection and response during a cloud attack. The initial focus is on Microsoft Azure, with expanded visibility into cloud control plane activity and improved threat hunting capabilities for cloud runtime environments.

January 2023: Trustwave launched an enhanced version of Advanced Persistent Threat hunting, leveraging a novel patent-pending methodology for identifying previously unknown threats.

Threat Hunting Market Segmentation

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- On-Premises

- Cloud

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Tools

- Endpoint Detection and Response

- Security Information and Event Management

- Network Detection and Response

- Others

- Services

- Professional Services

- Managed Services

By Threat Type Outlook (Revenue, USD Billion, 2020–2034)

- Advanced Persistent Threats

- Malware and Ransomware

- Insider Threats

- Phishing and Social Engineering

- Others

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium Enterprises (SMES)

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Banking, Financial Services, And Insurance (BFSI)

- Healthcare

- Retail & E-commerce

- Government

- Energy & Utilities

- IT & ITES

- Other Verticals

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Threat Hunting Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.35 billion |

|

Market Size Value in 2025 |

USD 3.83 billion |

|

Revenue Forecast in 2034 |

USD 12.92 billion |

|

CAGR |

14.5% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global threat hunting market size was valued at USD 3.35 billion in 2024 and is expected to reach USD 12.92 billion by 2034.

The global market is projected to grow at a CAGR of 14.5% during the forecast period 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are Capgemini, CrowdStrike, Cynet, Eviden, IBM, Kaspersky, Palo Alto Networks, Rapid 7, Sangfor, SecureWork, Solidworks, Trend Micro, Trustwave, Verizon, and VMware

The banking, financial services, and insurance (BFSI) category dominated the market in 2024.

The cloud deployment had the fastest share in the global market.