Third Party Logistics (3PL) Market Size, Share, Trends, Industry Analysis Report: By Service (Dedicated Contract Carriage, Domestic Transportation Management, International Transportation Management, Warehousing and Distribution, and Others), Mode of Transport, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 119

- Format: PDF

- Report ID: PM1414

- Base Year: 2024

- Historical Data: 2020-2023

Third Party Logistics Market Overview

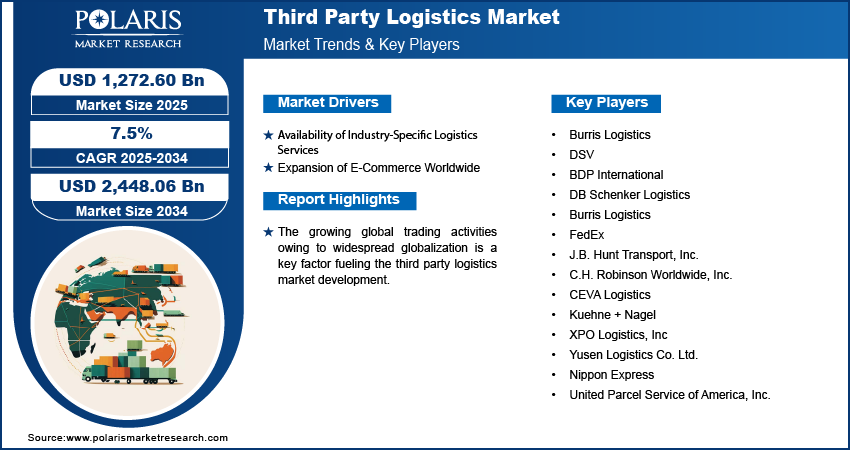

The global third party logistics (3PL) market size was valued at USD 1,184.48 billion in 2024. The market is projected to grow from USD 1,272.60 billion in 2025 to USD 2,448.06 billion by 2034. It is estimated to exhibit a CAGR of 7.5% from 2025 to 2034.

Third party logistics (3PL) is the outsourcing of some or all of the retail and supply chain operations of a retailer from another company. The 3PL practice allows small businesses, which may not have their supply chain infrastructure, to manage large-scale supply chains effectively. 3PL providers independently manage stock control, warehousing, IT infrastructure, and delivery solutions. This model helps reduce significant operational costs and also improves overall efficiency.

Market.png)

To Understand More About this Research: Request a Free Sample Report

The rise in global trading activities as a result of widespread globalization serves as a key factor fueling the third party logistics market development. Manufacturers and retailers, recognizing the importance of focusing on their core competencies, are increasingly relying on external businesses to perform various logistics functions. In addition, digitalization and the growing adoption of various disruptive technologies to streamline and automate processes are expected to drive third party logistics market growth in the coming years.

Manufacturers and end-use industries in emerging countries face challenges in addressing logistics needs, which drives the need for 3PL services. The adoption of cloud-based customer relationship management (CRM) to improve shipper-merchant conversations and reduce supply chain complexities by offering enhanced visibility throughout the process is expected to provide significant opportunities for small and medium-sized businesses in the third party logistics (3PL) market.

Third Party Logistics Market Dynamics

Availability of Industry-Specific Logistics Services

The absence of vital internal control has prompted various mid-sized companies to outsource logistic services to overcome challenges. At the same time, the growing variety in transportation capacity and increasing shipping demand enable service providers to improve their supply chain operations. Thus, more service providers shift to offering industry-specific services, the demand for third party logistics is expected to rise. The availability of industry-specific logistics services is one of the key market demand trends anticipated to drive third party logistics market expansion.

Expansion of E-Commerce Worldwide

The rising number of consumers preferring online shopping has compelled businesses to optimize their supply chains to cater to the growing demand for fast and efficient services. As e-commerce demand continues to grow worldwide, businesses face the challenge of delivering orders rapidly and cost-effectively, which often requires the outsourcing of logistics from specialized third-party logistics service providers. 3PL service providers, with their ability to provide scalable solutions tailored to specific industry needs, can streamline business operations, reduce delivery times, and improve customer satisfaction. Thus, the rising penetration of e-commerce propels the third party logistics market demand.

Third Party Logistics Market Segment Insights

Third Party Logistics Market Outlook by Service Insights

The third party logistics market analysis, based on service, is segmented into dedicated contract carriage, domestic transportation management, international transportation management, distribution and warehousing, and others. The domestic transportation segment dominated the market with the largest revenue share of 35.1% in 2024. Domestic transportation involves the flow of goods between states of the same country. The rising carrier rates, growing fuel surcharges, and a surge in cross-decking services are a few major factors driving the segment growth. Besides, the rising consumer demand in various sectors, such as healthcare and retail, fuels the need for domestic transportation management services.

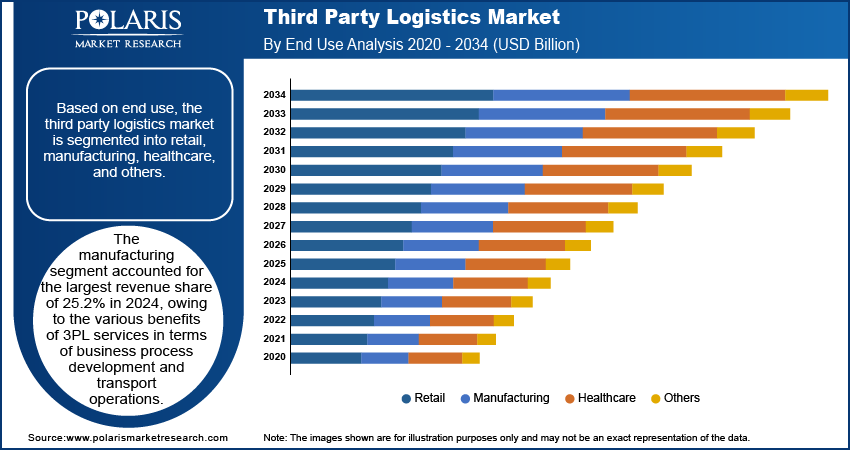

Third Party Logistics Market Outlook by End Use Insights

The 3PL market analysis, based on end use, is segmented into retail, manufacturing, healthcare, and others. The manufacturing segment accounted for the largest revenue share of 25.2% in 2024. The manufacturing sector has a complex supply chain process involving the procurement of materials and parts from various regions and resources. The involvement of multiple distributors and suppliers located across different geographies makes managing the logistics operations a complex process. Thereby, the manufacturing sector is turning to third party logistics owing to its various benefits in terms of business process development and transport operations.

Third Party Logistics Market Regional Analysis

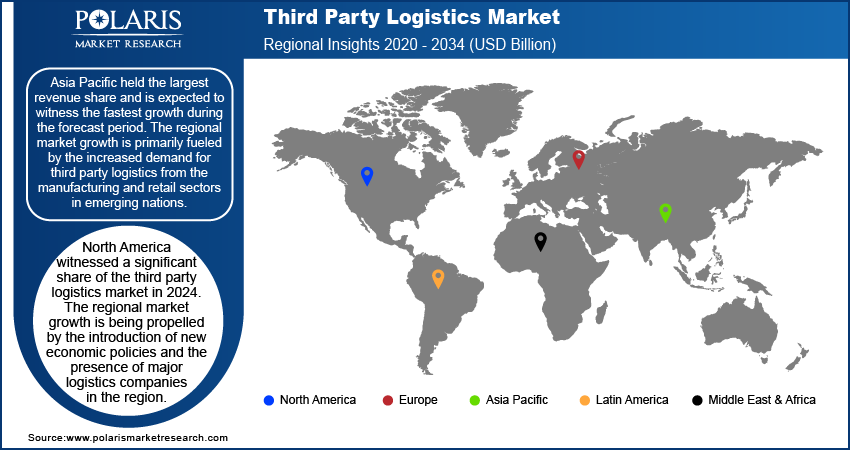

The market report offers third party logistics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest revenue share of 45.12% in 2024 and is expected to witness the fastest growth during the forecast period. The regional market growth is primarily fueled by the increased demand for third party logistics from the manufacturing and retail sectors in emerging nations. Besides, the growing trans-regional trade corridors and gateways are anticipated to provide lucrative opportunities for regional 3PL providers and boost the regional market size.

North America held a significant third party logistics market share in 2024. The regional market growth is being propelled by the introduction of new economic policies; better infrastructure of rail, road, sea, and air transport; and the presence of major logistics companies focused on technological advancements. Further, increased investments from traditional logistics and new e-commerce companies are expected to boost the market in the coming years.

Third Party Logistics Market – Key Players and Competitive Insights

The third party logistics market has the presence of established players and new entrants. The leading market participants are making significant investments in R&D initiatives to enhance their product offerings. Also, they are focusing on product innovations, mergers and acquisitions, collaborations, and increased investments to expand their market reach.

One of the major strategies adopted by industry players is offering technologically advanced logistics services such as real-time tracking, fleet management, online documentation, shipment tracking, and real-time status of the fleet and shipment. A few key players in the market are Burris Logistics; DSVl BDP International; DB Schenker Logistics; Burris Logistics; FedEx; J.B. Hunt Transport, Inc.; C.H. Robinson Worldwide, Inc.; CEVA Logistics; Kuehne + Nagel; XPO Logistics, Inc; Yusen Logistics Co. Ltd.; Nippon Express; and United Parcel Service of America, Inc.

List of Key Companies in Third Party Logistics Market

- Burris Logistics

- DSV

- BDP International

- DB Schenker Logistics

- Burris Logistics

- FedEx

- J.B. Hunt Transport, Inc.

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics

- Kuehne + Nagel

- XPO Logistics, Inc

- Yusen Logistics Co. Ltd.

- Nippon Express

- United Parcel Service of America, Inc.

Third Party Logistics Industry Developments

February 2024: Reflaunt, a resale-as-a-service firm, partnered with Germany-based DHL. The company under this partnership aims to offer fulfillment, shipping, and platforming solutions to clients who are looking to enter the branded resale space.

January 2024: C.H. Robinson became one of the third-party logistics providers to embrace the latest e-version of important shipping documents. The company has advanced the digitalization of the less-than-truckload industry by implementing eBOL with 10 of the top LTL carriers.

Third Party Logistics Market Segmentation

By Service Outlook

- Dedicated Contract Carriage

- Domestic Transportation Management

- International Transportation Management

- Distribution and Warehousing

- Others

By Mode of Transport Outlook

- Roadways

- Railways

- Waterways

- Airways

By End Use Outlook

- Retail

- Manufacturing

- Healthcare

- Others

By Region Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Third Party Logistics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,184.48 billion |

|

Market Size Value in 2025 |

USD 1,272.60 billion |

|

Revenue Forecast by 2034 |

USD 2,448.06 billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The third party logistics market size was valued at USD 1,184.48 billion in 2024 and is projected to grow to USD 2,448.06 billion by 2034.

The market is projected to register a CAGR of 7.5% from 2025 to 2034.

Asia Pacific accounted for the largest third party logistics market share in 2024.

Burris Logistics; DSVl BDP International; DB Schenker Logistics; Burris Logistics; FedEx; J.B. Hunt Transport, Inc.; C.H. Robinson Worldwide, Inc.; CEVA Logistics; Kuehne + Nagel; XPO Logistics, Inc; Yusen Logistics Co. Ltd.; Nippon Express; and United Parcel Service of America, Inc. are among the key players in the market.

The domestic transportation segment accounted for the largest market share in 2024.

The manufacturing segment dominated the third party logistics market revenue share in 2024.