Thermoplastic Vulcanizates Market Share, Size, Trends, Industry Analysis Report, By Application (Automotive, Fluid Handling, Consumer goods, Medical, Footwear, Others); By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3185

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

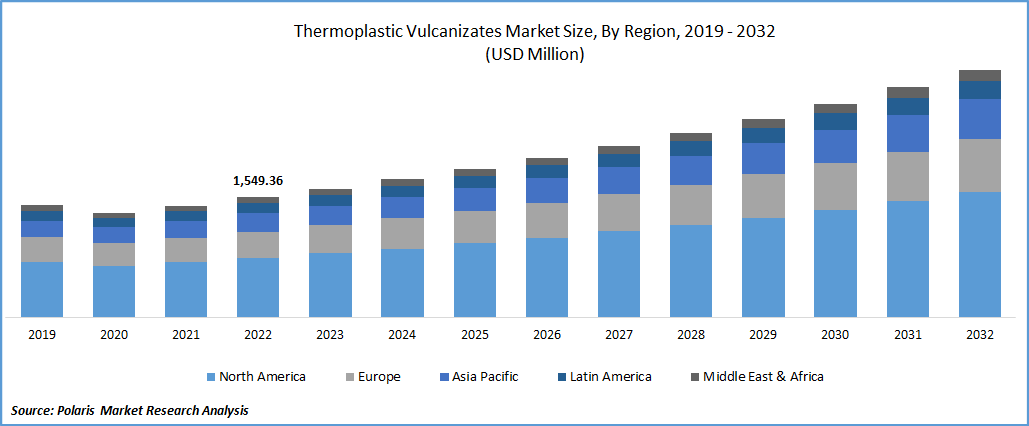

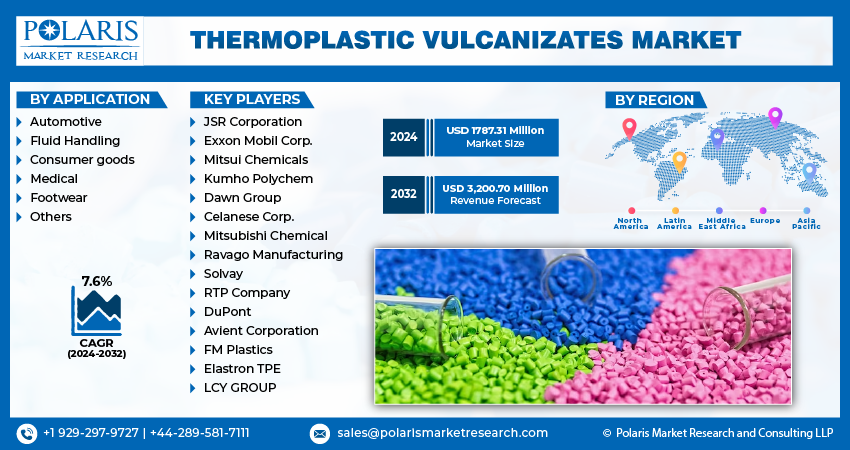

The global thermoplastic vulcanizates market was valued at USD 1663.86 million in 2023 and is expected to grow at a CAGR of 7.6% during the forecast period. Thermoplastic vulcanizates (TPV) are now being used more often as an alternative to PVC plastic due to several strict rules governing the use of PVC in the automobile sector. This is projected to lead to an increase in market demand in the upcoming years. In addition, a significant move toward using lightweight materials like thermoplastic vulcanizates (TPV) instead of heavier ones, such as metals, is anticipated to boost demand for TPV throughout the projection period.

Know more about this report: Request for sample pages

In November 2022, Celanese Corporation announced the completion of its acquisition of DuPont’s material and mobility business. Celanese has acquired a large portfolio of engineered thermoplastics and elastomers, well-known trademarks and intellectual property, worldwide manufacturing assets, and a top-tier organization as part of the purchase.

The COVID-19 pandemic negatively impacted the market. An automobile is a major market for Thermoplastic vulcanizates. The coronavirus outbreak has significantly affected car production and disrupted the whole automotive sector value chain. Other than for necessities, manufacturing was paused in a number of nations to slow the spread of the coronavirus. During the forecast period, this is anticipated to influence the demand for plastics in automotive applications.

Industry Dynamics

Growth Drivers

Many automotive interior & exterior parts, including wiper systems, air guides & dams, spoilers and trim, and flappers, are made with TPVs. Rising demand for TPV in the automotive sector is caused by customers' global propensity for fuel-efficient automobiles, which is anticipated to fuel thermoplastic vulcanizates market expansion throughout the study period. This is due to the growing need for lightweight, environmentally viable solutions that provide outstanding durability and greater safety. Due to the numerous strict laws regulating the use of PVC, thermoplastic vulcanizates (TPV) are currently being used more frequently as an alternative to PVC plastic, which is projected to lead to an increase in thermoplastic vulcanizates market demand in the next years.

Report Segmentation

The market is primarily segmented based on application and region.

|

By Application |

By Region |

|

|

Know more about this report: Request for sample pages

Automotive Segment is Expected to Dominate the Market During the Forecast Period

The automotive segment is expected to dominate the market during the forecast period. The rising need for lightweight and high-performance materials in the automotive sector is anticipated to increase demand for thermoplastic vulcanizates during the forecast period (TPV). Wheel well flares, steering system bellows, air intake tubes, and sound-dampening elements are examples of TPV flexible automotive under-the-hood components. The market expansion is anticipated to be aided by OEMs' expanding use of thermoplastic vulcanizates (TPVs) and increased demand for lightweight vehicles and passenger automobiles.

The medical segment is expected to grow substantially during the forecast period. TPV is employed in a wide range of medical applications, including surgical tools, drug delivery systems, and parts for medical devices. These applications fit the material's qualities of good wear resistance, low compression set, good weather ability, and chemical resistance. For instance, in January 2023, for Teknor Apex's line of thermoplastic elastomers (TPEs) throughout Europe, Nexeo Plastics was designated as a strategic distributor. A wide range of TPE technologies, such as styrene block copolymer, thermoplastic vulcanizate, thermoplastic polyolefin, & specific alloys, are now available to Nexeo Plastics clients thanks to the extension of this collaboration. Of these, Medalist is a medical-grade TPE and is made particularly for use in medical equipment and applications.

North America Region is Expected to Lead the Market Growth in 2022

North America region led the market in 2022 and held approximately a significant revenue share. Strong demand from the auto sector and other end-use industries, including healthcare and consumer products, is responsible for the huge market share. Favorable government regulations regarding using thermoplastic vulcanizates (TPV) as a substitute for alloys and metals in automotive applications and rising passenger car production in the United States and Mexico are anticipated to further drive regional demand for TPV over the forecast period. The United States is one of the largest consumers of thermoplastic vulcanizates globally.

For instance, in September 2022, a strategic partnership between polymer distributor Ravago and Celanese Corporation was announced. For the Santoprene & Geolast TPV product lines in North American nations, including the USA, Canada, & Mexico, Ravago has been selected as Celanese's only distributor.

Asia Pacific is expected to be the fastest-growing global market during the forecast period. One of the main factors influencing demand in the Asia-Pacific market is the great demand from China and Japan. Numerous multinational businesses have established production facilities in China due to the enormous potential of the Chinese consumer products market. The demand for thermoplastic vulcanizate may rise along with the manufacture of consumer products. For investments and development potential, Tokyo in Japan outperformed the other main cities in the area, with the residential sector making up the majority of those prospects. The domestic demand for thermoplastic vulcanizate is therefore projected to be driven throughout the projection period by the anticipated increase in the automotive, construction, consumer goods, and electronics industries.

For instance, in July 2022, Mitsui Chemicals created a grade of the "Milastomer thermoplastic vulcanizate" that is environmentally friendly and uses recycled polyolefin as its main component. Milestone is mostly employed in the automobile industry (building and construction industry) and in commonplace items like toothbrush grips.

Competitive Insight

Some of the major players operating in the global thermoplastic vulcanizates market include JSR Corporation, Exxon Mobil Corp., Mitsui Chemicals, Kumho Polychem, Dawn Group, Celanese Corp., Mitsubishi Chemical, Ravago Manufacturing, Solvay, RTP Company, DuPont, Avient Corporation, FM Plastics, Elastron TPE, and LCY GROUP.

Recent Developments

- In November 2022, to form a cooperation for the manufacturing of suspension-grade polyvinylidene fluoride (PVDF) in North America, Solvay & Orbia declared their entry into a framework joint venture agreement. A coating and binder for lithium-ion batteries, PVDF is a thermoplastic fluoropolymer.

- In August 2022, Kumho Petrochemical announced a significant investment push into new and current companies over the following five years. In its primary business sectors, which include the production of styrene solution butadiene rubber (SSBR) and nitrile butadiene latex (NB latex), Kumho will invest 5.9 billion USD.

Thermoplastic Vulcanizates Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1787.31 million |

|

Revenue forecast in 2032 |

USD 3,200.70 million |

|

CAGR |

7.6% from 2024 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 20201 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

JSR Corporation, Exxon Mobil Corp., RTP Company, DuPont de Nemours, Inc., Mitsui Chemicals, Inc., Kumho Polychem, Dawn Group, Celanese Corp., Lyondell Basell Industries Holdings B.V., Mitsubishi Chemical Corp., Ravago Manufacturing, Solvay SA, Avient Corporation, FM Plastics, Elastron TPE, LCY GROUP among others. |

FAQ's

The global thermoplastic vulcanizates market size is expected to reach USD 3,200.70 million by 2032.

Key players in the thermoplastic vulcanizates market are JSR Corporation, Exxon Mobil Corp., Mitsui Chemicals, Kumho Polychem, Dawn Group, Celanese Corp., Mitsubishi Chemical, Ravago Manufacturing, Solvay.

North America contribute notably towards the global thermoplastic vulcanizates market.

The global thermoplastic vulcanizates market expected to grow at a CAGR of 7.5% during the forecast period.

The thermoplastic vulcanizates market report covering key segments are application and region.