Thermoplastic Polyurethane Adhesive Market Size, Share, Trends, Industry Analysis Report: By Type (Hotmelt Adhesives, Solvent-Based Adhesives, Water-Based Adhesives, and Others), Form, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5415

- Base Year: 2024

- Historical Data: 2020-2023

Thermoplastic Polyurethane Adhesive Market Overview

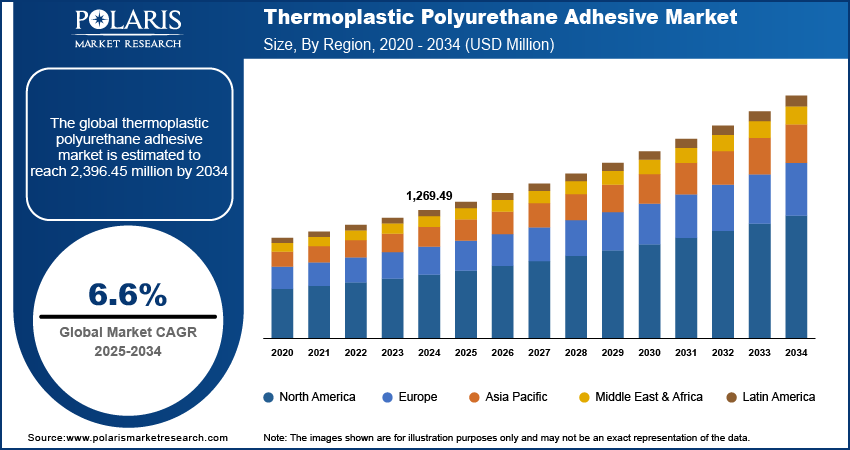

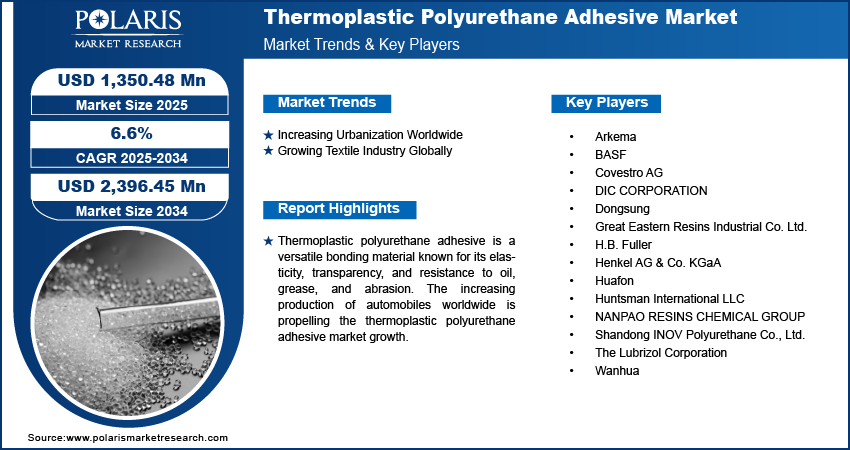

The global thermoplastic polyurethane adhesive market size was valued at USD 1,269.49 million in 2024. The market is projected to grow from USD 1,350.48 million in 2025 to USD 2,396.45 million by 2034, exhibiting a CAGR of 6.6% during 2025–2034.

Thermoplastic polyurethane adhesive is a versatile bonding material known for its elasticity, transparency, and resistance to oil, grease, and abrasion. It is a thermoplastic elastomer consisting of linear segmented block copolymers. Thermoplastic polyurethane adhesive is created through the reaction of diisocyanates with short-chain diols and long-chain diols. These adhesives are suitable for a variety of industries, such as footwear, textiles, automotive, electronics, and packaging.

The increasing production of automobiles worldwide is propelling the thermoplastic polyurethane adhesive market growth. For instance, a report by the European Automobile Manufacturers Association highlighted that 85.4 million motor vehicles were produced globally in 2022, an increase of 5.7% compared to 2021. Automakers use thermoplastic polyurethane adhesive extensively in vehicle manufacturing due to its durability, flexibility, and strong bonding properties. As the manufacturing of automobiles increases, automakers require higher quantities of thermoplastic polyurethane adhesive to assemble various components such as interior panels, headliners, and trim. Thermoplastic polyurethane adhesive further enhances vehicle performance by ensuring strong, long-lasting bonds between materials, reducing the need for mechanical fasteners and improving overall design flexibility.

To Understand More About this Research: Request a Free Sample Report

The thermoplastic polyurethane adhesive market demand is driven by increasing environmental awareness coupled with a rising focus on reducing carbon footprints. Industries are actively seeking eco-friendly materials to minimize carbon footprints and environmental impact. Thermoplastic polyurethane adhesive aligns with these goals due to its recyclable and solvent-free properties, leading to greater adoption. In addition, thermoplastic polyurethane adhesive helps industries comply with stricter environmental regulations while reducing harmful emissions. This encourages companies operating in industries such as automotive, textile, and packaging to invest in thermoplastic polyurethane adhesive.

Thermoplastic Polyurethane Adhesive Market Dynamics

Increasing Urbanization Worldwide

Urbanization is driving city expansion and infrastructure development. For instance, according to the United Nations, 55% of the world’s population currently lives in urban areas, and is expected to increase to 68% by 2050. As a result, construction companies and manufacturers rely on thermoplastic polyurethane adhesive for various applications, including flooring, insulation panels, and structural bonding. Skyscrapers, commercial buildings, and residential complexes require durable and flexible adhesives to ensure strong material bonding in modern construction projects, which thermoplastic polyurethane adhesive provides. Moreover, rising urbanization is driving the demand for transportation infrastructure, including roads, bridges, and public transit systems. Thermoplastic polyurethane adhesives are vital in these projects for their ability to bond materials securely while withstanding heavy loads, vibrations, and weather conditions. Thus, increasing urbanization is driving the thermoplastic polyurethane adhesive market demand.

Growing Textile Industry Globally

Thermoplastic polyurethane adhesive is widely used in the textile industry to provide strong bonding to assemble multi-layered fabrics without compromising comfort or breathability. This adhesive enables textile producers to create seamless designs, waterproof coatings, and stretchable garments that cater to evolving fashion and performance trends. The rise of athleisure and performance wear further accelerates the demand for thermoplastic polyurethane adhesive, as it bonds synthetic fabrics without adding bulk, ensuring smooth finishes and long-lasting wear. Additionally, sustainability initiatives in the textile industry are contributing to the rising demand for thermoplastic polyurethane adhesive, thereby driving the thermoplastic polyurethane adhesive market development.

Thermoplastic Polyurethane Adhesive Market Segment Insights

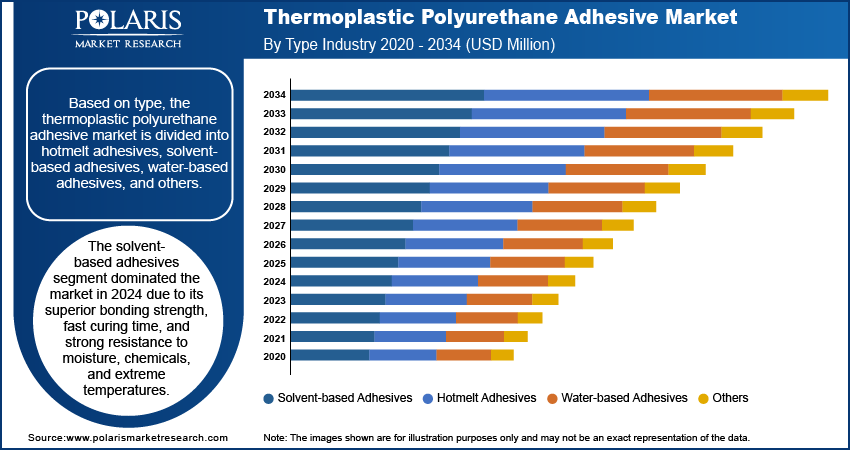

Thermoplastic Polyurethane Adhesive Market Evaluation by Type Insights

Based on type, the thermoplastic polyurethane adhesive market is divided into hotmelt adhesives, solvent-based adhesives, water-based adhesives, and others. The solvent-based adhesives segment dominated the thermoplastic polyurethane adhesive market share in 2024 due to its superior bonding strength, fast curing time, and strong resistance to moisture, chemicals, and extreme temperatures. Industries such as automotive, footwear, and construction have widely adopted solvent-based adhesives as they effectively bond various substrates, including plastics, metals, and fabrics. Automotive manufacturers favored solvent-based formulations for assembling interior components, seat cushions, and trim due to their ability to withstand high-stress conditions. The footwear industry has also contributed significantly to the segment’s dominance, as these adhesives provided durable and flexible bonds in shoe manufacturing.

Thermoplastic Polyurethane Adhesive Market Assessment by Form Insights

In terms of form, the thermoplastic polyurethane adhesive market is segregated into granular, powder, and liquid. The granular segment is expected to grow at the fastest pace after the liquid segment during the forecast period, owing to its increasing use in hotmelt adhesive applications and rising demand for sustainable and efficient bonding solutions. Manufacturers prefer granules as they offer easy handling, consistent melting properties, and precise application control. The packaging, textile, and automotive industries increasingly rely on this form to enhance production efficiency and reduce material waste. Footwear brands are also contributing to the rising demand, as granules enable rapid adhesion and seamless bonding while maintaining durability. The shift toward eco-friendly and solvent-free adhesives has further accelerated the adoption of granules, as they produce minimal emissions and support cleaner manufacturing processes.

Thermoplastic Polyurethane Adhesive Market Regional Analysis

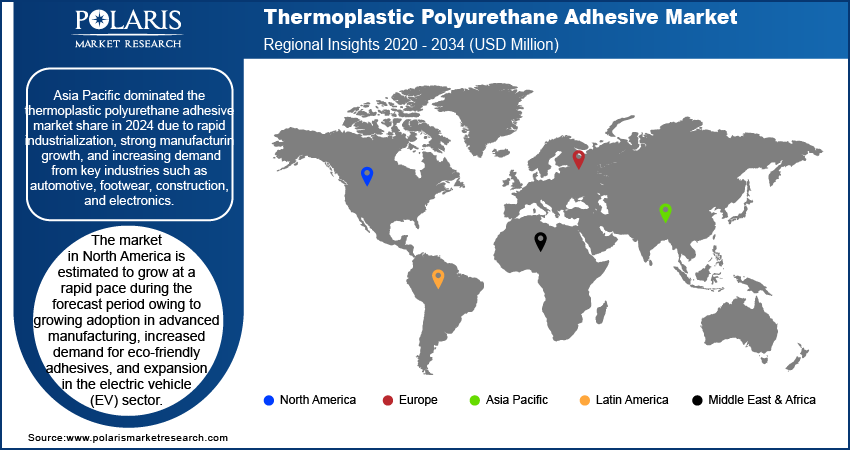

By region, the report provides the thermoplastic polyurethane adhesive market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the thermoplastic polyurethane adhesive market share in 2024 due to rapid industrialization, strong manufacturing growth, and increasing demand from key industries such as automotive, footwear, construction, and electronics. Countries such as China, India, Japan, and South Korea have contributed significantly to market expansion by driving large-scale production and consumption. China holds the largest share of the market within the region due to its massive manufacturing sector, which includes automotive assembly lines, footwear production hubs, and consumer electronics factories. The country's booming construction industry has also fueled demand for thermoplastic polyurethane adhesives as infrastructure projects require high-performance adhesives for bonding and insulation applications. Additionally, government initiatives promoting domestic manufacturing and foreign investments have strengthened the region’s industrial base, propelling the thermoplastic polyurethane adhesive market revenue.

The North America thermoplastic polyurethane adhesive market is estimated to grow at a rapid pace during the forecast period owing to growing adoption in advanced manufacturing, increased demand for eco-friendly adhesives, and expansion in the electric vehicle (EV) sector. The US is expected to lead the region, driven by strong investments in sustainable production practices and innovation in adhesive technologies. Automakers in the US are increasingly incorporating advanced bonding solutions to improve vehicle performance and reduce weight, aligning with stringent environmental regulations. The footwear and textile industries also contribute to regional growth as leading brands emphasize sustainability and efficiency. Additionally, the rising focus on energy-efficient buildings and infrastructure projects is boosting the demand for thermoplastic polyurethane adhesive in the construction sector in North America.

Thermoplastic Polyurethane Adhesive Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the thermoplastic polyurethane adhesive market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The thermoplastic polyurethane adhesive market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Arkema; BASF; Covestro AG; DIC CORPORATION; Dongsung; Great Eastern Resins Industrial Co. Ltd.; H.B. Fuller; Henkel AG & Co. KGaA; Huafon; Huntsman International LLC; NANPAO RESINS CHEMICAL GROUP; Shandong INOV Polyurethane Co., Ltd.; The Lubrizol Corporation; and Wanhua.

The Lubrizol Corporation, founded in 1928 as Graphite Oil Products Company, is a specialty chemical company and a subsidiary of Berkshire Hathaway. Headquartered in Wickliffe, Ohio, USA, Lubrizol operates more than 100 facilities and sells products in over 100 countries. The company is dedicated to creating value for customers through science-based solutions that enhance mobility, improve well-being, and advance modern life. Lubrizol is divided into two primary business segments: Lubrizol Additives and Lubrizol Advanced Materials. The Lubrizol Additives segment focuses on engine and driveline lubricant additives and industrial specialty products. The Lubrizol Advanced Materials segment produces engineered materials, including polymers, performance coatings, and life science products for the beauty, personal care, and health sectors. Lubrizol is a supplier of thermoplastic polyurethane (TPU) adhesives, which are part of the Lubrizol Advanced Materials segment. Lubrizol TPU solutions satisfy needs across a wide range of melting temperatures and crystallization speeds. The product offerings include solvent-based adhesives under the Pearlstick TPU product section, as well as solutions for hot melt adhesives, reactive hot melts, and adhesive films under the Pearlbond TPU brand.

BASF SE, headquartered in Ludwigshafen, Germany, is one of the world's major chemical companies, renowned for its commitment to sustainability and innovation. Established in 1865, BASF operates across various segments, including Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care, and Agricultural Solutions. BASF's extensive portfolio features a wide range of products, such as solvents, adhesives, surfactants, fuel additives, electronic chemicals, pigments, paints, and crop protection products. The company's global reach spans Europe, Asia Pacific, North America, South America, Africa, and the Middle East. BASF's TPU offerings include both solvent-based and water-based adhesives that provide versatility in various applications, such as footwear manufacturing, automotive interiors, and electronic device assembly.

List of Key Companies in Thermoplastic Polyurethane Adhesive Market

- Arkema

- BASF

- Covestro AG

- DIC CORPORATION

- Dongsung

- Great Eastern Resins Industrial Co. Ltd.

- H.B. Fuller

- Henkel AG & Co. KGaA

- Huafon

- Huntsman International LLC

- NANPAO RESINS CHEMICAL GROUP

- Shandong INOV Polyurethane Co., Ltd.

- The Lubrizol Corporation

- Wanhua

Thermoplastic Polyurethane Adhesive Industry Developments

February 2025: REVO announced the launch of REVOSTICK, a revolutionary line of thermoplastic polyurethanes (TPU) specifically developed for solvent-based adhesives. REVOSTICK is a highly performant and adaptable solution for companies operating in the wood, construction, and footwear sectors.

May 2024: Lubrizol announced the expansion of its bio-based thermoplastic polyurethane (TPU) portfolio for adhesives with the addition of Pearlbond ECO 590 HMS TPU for hot melt adhesives (HMAs).

Thermoplastic Polyurethane Adhesive Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Hotmelt Adhesives

- Solvent-Based Adhesives

- Water-Based Adhesives

- Others

By Form Outlook (Revenue, USD Million, 2020–2034)

- Granular

- Powder

- Liquid

By Industry Vertical Outlook (Revenue, USD Million, 2020–2034)

- Packaging

- Automotive

- Building & Construction

- Electronics

- Consumer Goods

- Textile

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Thermoplastic Polyurethane Adhesive Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,269.49 million |

|

Revenue Forecast in 2025 |

USD 1,350.48 million |

|

Revenue Forecast by 2034 |

USD 2,396.45 million |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global thermoplastic polyurethane adhesive market size was valued at USD 1,269.49 million in 2024 and is projected to grow to USD 2,396.45 million by 2034.

The global market is projected to register a CAGR of 6.6% during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

Some of the key players in the market are Arkema; BASF; Covestro AG; DIC CORPORATION; Dongsung; Great Eastern Resins Industrial Co. Ltd.; H.B. Fuller; Henkel AG & Co. KGaA; Huafon; Huntsman International LLC; NANPAO RESINS CHEMICAL GROUP; Shandong INOV Polyurethane Co., Ltd.; The Lubrizol Corporation; and Wanhua.

The solvent-based adhesives segment dominated the market in 2024.