Thermo Compression Forming Market Size, Share, Trends, Industry Analysis Report: By Foam Type (Thermoplastic Foams, Needle-Punch Nonwovens, and Lightweight Glass Mat Thermoplastic), End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 118

- Format: PDF

- Report ID: PM5112

- Base Year: 2023

- Historical Data: 2019-2022

Thermo Compression Forming Market Overview

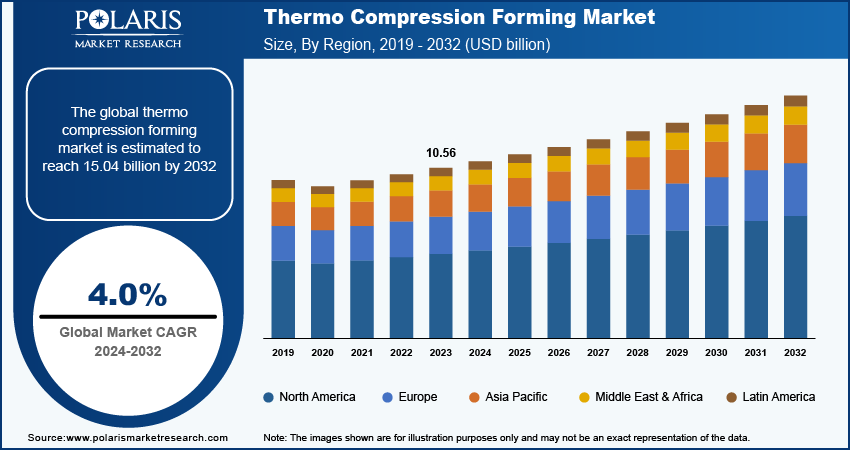

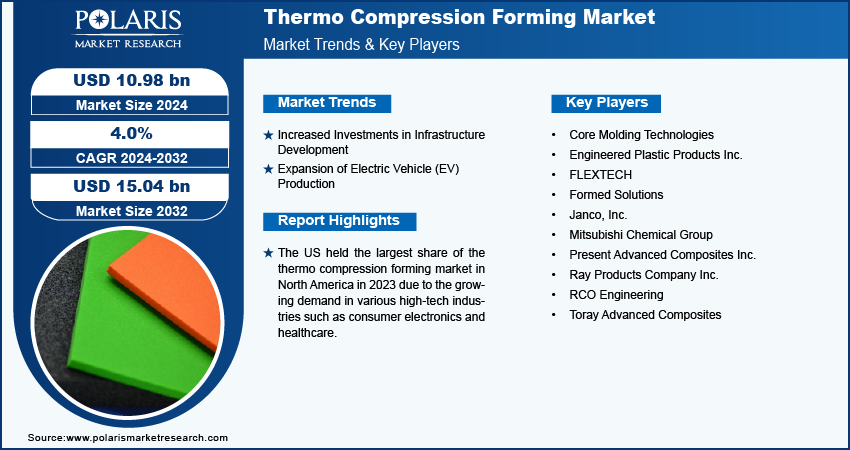

The global thermo compression forming market size was valued at USD 10.56 billion in 2023. The market is projected to grow from USD 10.98 billion in 2024 to USD 15.04 billion by 2032, exhibiting a CAGR of 4.0% during 2024–2032.

Thermo compression forming is a manufacturing process used to shape composite materials under heat and pressure. The process involves placing a preheated composite material (typically a thermoplastic or thermoset composite) into a heated mold and then applying pressure to form the material into the desired shape. Industries such as automotive and aerospace are increasingly adopting lightweight composite materials to reduce weight and improve fuel efficiency. Thus, the demand for thermo compression forming is increasing in these industries. Additionally, continuous innovations in composite materials, such as carbon fiber-reinforced plastics (CFRPs), are driving demand for thermo compression forming. The increasing advancements in foam type enable manufacturers to produce more durable and complex components, thereby facilitating the adoption of thermo compression forming technology and its market growth.

To Understand More About this Research: Request a Free Sample Report

The increasing demand for consumer electronics spurs the need for thermo compression forming. The consumer electronics sector necessitates compact, lightweight, and resilient components for products such as smartphones and wearables. Furthermore, industries are focusing on reducing their carbon footprints by adopting thermo compression forming as it enables them to use recyclable thermoplastic composites, contributing to more sustainable manufacturing processes.

Thermo Compression Forming Market Trends

Increased Investments in Infrastructure Development

Industries such as construction and transportation are investing in advanced composite materials for infrastructural applications, such as bridges and buildings. For instance, in July 2024, the Biden-Harris Administration announced an investment of USD 5 billion in the restoration, reconstruction, and repair of nationally significant large bridges across the US. Thermo compression forming plays a role in shaping these high-performance, long-lasting components. Thus, rising investments in such projects boost the thermo compression forming market growth.

Expansion of Electric Vehicle (EV) Production

The increasing production of electric vehicles (EVs) propels the demand for lightweight components to enhance vehicle range and performance. According to the US Energy Information Administration, the electric car market reported robust growth, with over 14 million sales in 2023. The market shares of electric cars relative to total car sales increased from about 4% in 2020 to 18% in 2023. During the first quarter of 2024, the electric vehicle industry reported a significant surge, with over 3 million units sold, marking a remarkable 25% increase compared to the corresponding period in the previous year. Thermo compression forming is increasingly used to produce structural components for EVs, such as battery enclosures and chassis parts, as automakers prioritize lightweight for energy efficiency. Thermo Compression Forming is essential for ensuring the reliability and efficiency of these devices, thereby fueling market growth.

Thermo Compression Forming Market Segment Insights

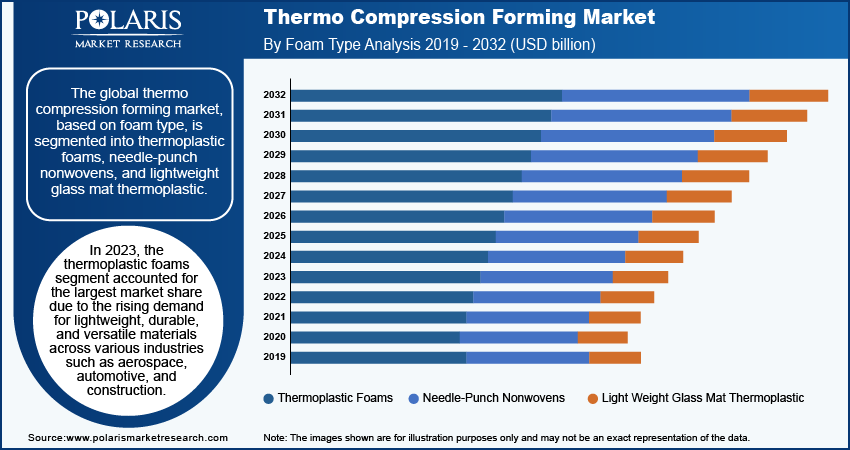

Thermo Compression Forming Market Breakdown by Foam Type Insights

The global thermo compression forming market, based on foam type, is segmented into thermoplastic foams, needle-punch nonwovens, and lightweight glass mat thermoplastic. In 2023, the thermoplastic foams segment accounted for the largest market share due to the rising demand for lightweight, durable, and versatile materials across numerous industries such as aerospace, automotive, and construction. Thermoplastic foams, including polypropylene (PP) and polyethylene (PE), offer excellent impact resistance, flexibility, and thermal insulation, making them ideal for these industries. Their recyclability also aligns with growing sustainability goals, as they can be reused, reducing environmental impact. Furthermore, thermoplastic foams provide superior thermal and acoustic insulation, enhancing energy efficiency in construction and packaging applications. Moreover, their versatility, ease of molding into complex shapes, and cost-effectiveness make them a preferred choice for manufacturers balancing performance and cost, solidifying their dominant market position.

Thermo Compression Forming Market Breakdown by End-Use Industry Insights

The global thermo compression forming market segmentation, based on end-use industry, includes automotive, aerospace, medical, construction, electrical & electronics, and other end-use industries. The construction segment is expected to register the highest CAGR during the forecast period due to increasing demand for lightweight and energy-efficient materials in building applications. Additionally, the growing focus on sustainability and green building practices is driving the adoption of recyclable and eco-friendly materials, such as thermoplastic foams, in construction projects. Moreover, rapid urbanization and infrastructure development, especially in emerging economies, fuel the need for innovative construction materials that enhance the longevity and efficiency of buildings. According to IBEF, in the interim budget 2024–2025, the capital investment outlay for infrastructure has been raised by 11.1% to reach USD 133.86 billion, which represents 3.4% of the GDP. Thus, increasing investments in developing advanced materials, with compliance with stringent regulations for energy-efficient buildings, is expected to drive the rapid growth of the thermo compression forming market for the construction segment during the forecast period.

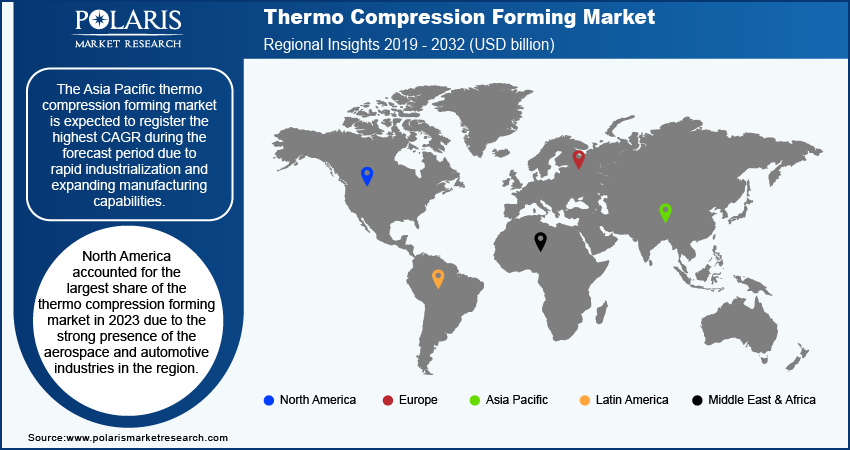

Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the thermo compression forming market in 2023 due to the strong presence of the aerospace and automotive industries in the region, both of which have increasingly adopted lightweight, high-performance materials to meet stringent fuel efficiency and emissions regulations. These industries rely heavily on thermo compression forming technology to produce complex, durable composite components. Additionally, advancements in material science, particularly the development of high-strength thermoplastics and carbon fiber-reinforced composites, have driven the demand for thermo-compression forming. Well-established manufacturing infrastructure, a rising focus on innovation, and significant investments in research and development activities across North America also contribute to the region’s dominance in the global market. Furthermore, the rising emphasis on sustainability and the adoption of environmentally friendly manufacturing practices have encouraged companies in North America to embrace thermo compression forming due to its ability to reduce material waste and facilitate recycling. In July 2024, the US Environmental Protection Agency granted nearly USD 160 million across the country to help reduce climate pollution from the manufacturing of construction materials and products.

The US held the largest share of the North America thermo compression forming market in 2023 due to the growing demand in other high-tech industries such as consumer electronics and healthcare. Thermo compression forming is increasingly used in the production of lightweight, durable components for electronic devices such as smartphones, tablets, and wearables, where precision and strength are essential.

The Asia Pacific thermo compression forming market is expected to register the highest CAGR during the forecast period due to rapid industrialization and expanding manufacturing capabilities in countries such as China, Japan, South Korea, and India. Key industries in these nations such as automotive, aerospace, and electronics are increasingly adopting thermo compression forming technology to produce lightweight, high-performance components. Additionally, the growing demand for electric vehicles (EVs) in Asia Pacific has spurred the need for lightweight materials to improve energy efficiency and battery performance, further boosting the adoption of thermo compression forming.

The China thermo compression forming market is expected to record the highest CAGR during the forecast period due to the strong presence of consumer electronics manufacturing across the country. The demand for thinner and more durable electronic components for smartphones, tablets, and other devices is driving the adoption of thermo compression forming techniques. China's extensive electronics manufacturing infrastructure and its low production costs fuel the thermo compression forming market growth in the country.

Thermo Compression Forming Market – Key Players and Competitive Insights

The competitive landscape of the thermo compression forming market is marked by intense innovation and the presence of established players and emerging companies. Leading firms such as Toray Industries, Hexcel Corporation, and Solvay dominate the market, leveraging their expertise in high-performance composite materials and advanced manufacturing technologies to cater to industries such as aerospace, automotive, and electronics. These players are heavily investing in research and development to create next-generation thermoplastics and hybrid composites that offer superior strength, durability, and recyclability. Strategic collaborations between material suppliers and OEMs are also prevalent, allowing companies to develop tailored solutions that meet the stringent requirements of sectors such as aviation and automotive. Additionally, smaller companies and new entrants are focusing on niche markets and specialized technologies, contributing to the competitive dynamics. Major players include BASF SE; Core Molding Technologies; Engineered Plastic Products Inc.; FLEXTECH; Formed Solutions; Janco, Inc.; Mitsubishi Chemical Group; Present Advanced Composites Inc.; Ray Products Company Inc.; RCO Engineering; and Toray Advanced Composites.

Toray Industries, Inc., is a global company known for its diverse portfolio of products and innovations. Specializing in fibers and textiles, performance chemicals, carbon fiber composite materials, environmental engineering, and life sciences, Toray is a player in various industries. The company is engaged in manufacturing, processing, and sales of various products, including fibers and textiles such as nylon, polyester, and acrylic fabrics; performance chemicals such as resins, molded products, and films; carbon fiber composite materials and related products; environmental engineering solutions; and life science products, including pharmaceuticals and medical devices. The company also offers services such as analysis, physical evaluation, and research. Additionally, it produces nonwoven fabrics, apparel, polyolefin foam, and materials for housing and building applications, demonstrating a diverse range of offerings across multiple sectors. In September 2024, Toray Advanced Composites launched Toray Cetex TC1130 PESU, a high-performance thermoplastic composite material designed for lightweight and sustainable aircraft interiors.

Mitsubishi Chemical Group Corporation operates in five segments—industrial gases, specialty materials, MMA, healthcare, and basic materials. The specialty materials segment offers a wide range of products, including performance polymers, engineering plastics, sustainable polymers, and composite materials. The industrial gases segment supplies various industrial gases, while the healthcare segment focuses on delivering ethical pharmaceuticals. In September 2020, Mitsubishi Chemical Advanced Materials, Inc. partnered with R3 Composites Corp. to offer comprehensive solutions to North American customers. The collaboration will focus on designing, developing, and producing advanced carbon-based composites for mobility applications.

Key Companies in Thermo Compression Forming Market

- BASF SE

- Core Molding Technologies

- Engineered Plastic Products Inc.

- FLEXTECH

- Formed Solutions

- Janco, Inc.

- Mitsubishi Chemical Group

- Present Advanced Composites Inc.

- Ray Products Company Inc.

- RCO Engineering

- Toray Advanced Composites

Thermo Compression Forming Industry Developments

In August 2023, Kulicke and Soffa Industries, Inc. launched APTURA Thermo-Compression platform and achieved three new industry adoption milestones for its chiplet-enabling Thermo-Compression technology.

In July 2024, FLEXTECH and Sun Path Products, Inc. partnered to develop and choose materials for the laminated and molded Spyn System foam components that are crucial to skydiving equipment.

In July 2024, ASMPT and IBM collaborated to advance chiplet packaging technologies. This joint development aims to push the boundaries of chiplet packaging and drive technological innovation in this area.

Thermo Compression Forming Market Segmentation

By Foam Type Outlook (Revenue – USD billion, 2019–2032)

- Thermoplastic Foams

- Needle-Punch Nonwovens

- Lightweight Glass Mat Thermoplastic

By End-Use Industry Outlook (Revenue – USD billion, 2019–2032)

- Automotive

- Aerospace

- Medical

- Construction

- Electrical & Electronics

- Other End-Use Industries

By Regional Outlook (Revenue – USD billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Thermo Compression Forming Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 10.56 billion |

|

Market Size Value in 2024 |

USD 10.98 billion |

|

Revenue Forecast by 2032 |

USD 15.04 billion |

|

CAGR |

4.0% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global thermo compression forming market size was valued at USD 10.56 billion in 2023 and is projected to grow to USD 15.04 billion by 2032.

The global market is projected to grow at a CAGR of 4.0% during the forecast period.

North America accounted for the largest share of the global market in 2023 owing to the strong presence of the aerospace and automotive industries in the region.

BASF SE, Core Molding Technologies, Engineered Plastic Products Inc., FLEXTECH, Formed Solutions, Janco, Inc., Mitsubishi Chemical Group, Present Advanced Composites Inc., Ray Products Company Inc., RCO Engineering, and Toray Advanced Composites are among the key players in the market.

The thermoplastic foams segment dominated the market in 2023 due to rising demand for lightweight, durable, and versatile materials.

The construction segment is expected to record the highest CAGR during the forecast period due to the increasing demand for lightweight and energy-efficient materials in building applications