Thermal Spray Coatings Market Share, Size, Trends, Industry Analysis Report, By Product (Flame Spray, Plasma Spray); By Material; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3980

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

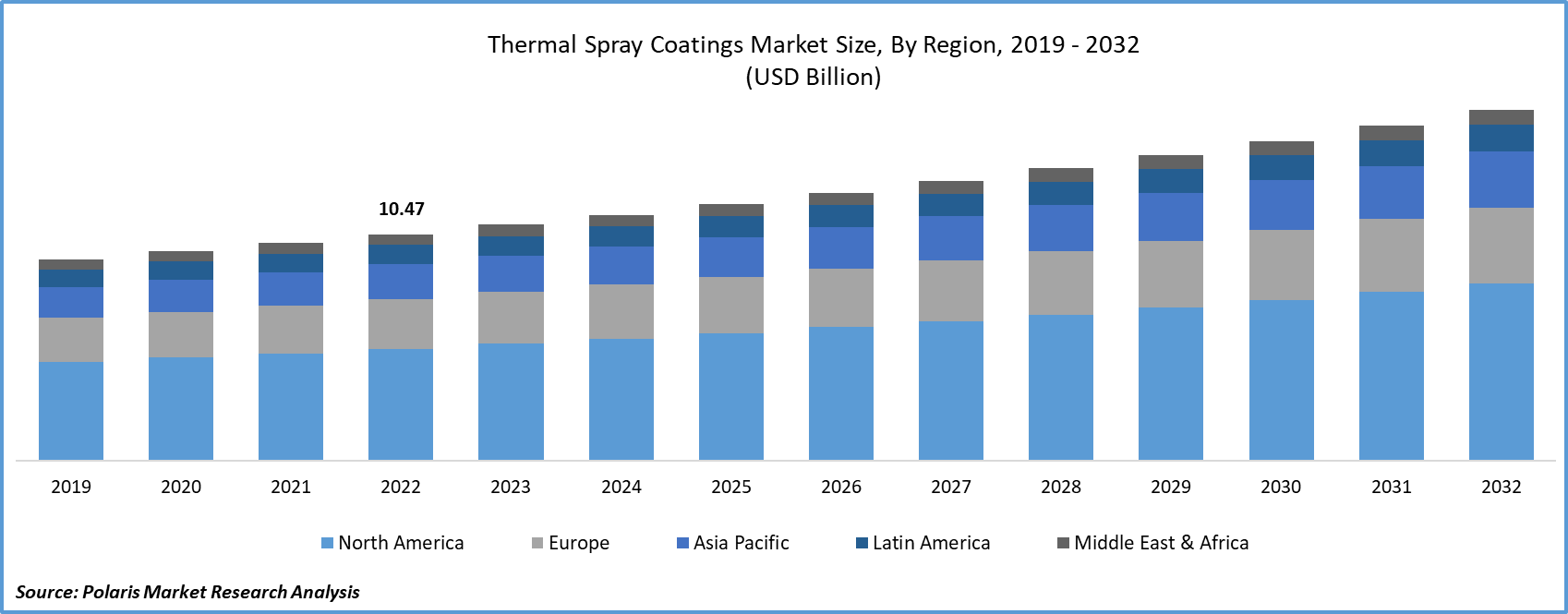

The global thermal spray coatings market was valued at USD 10.9 billion in 2023 and is expected to grow at a CAGR of 4.50% during the forecast period.

Thermal spray coating is a technique that involves projecting a stream of liquefied or partially liquefied droplets of consumable material, ultimately forming a coating. Virtually any substance can serve as a coating, provided it undergoes a melting or plasticizing transformation as it is expertly applied to the target surface. Upon reaching the substrate's surface, these particles create interconnected structures known as 'splats' or 'platelets,' ultimately giving rise to the desired coating.

To Understand More About this Research: Request a Free Sample Report

Thermal spray coatings are widely used across different industries such as automotive, aerospace, gas turbines, printing, medical, oil & gas, steel, pulp & paper, and others. These coatings are essential for protecting surfaces and are made from various materials such as aluminum, steel, nickel, copper, and more. The growth of this market is driven by several factors, including the rising demand for increased surface durability to prolong equipment lifespan, the growing acceptance of thermal ceramic spray coating technologies, and the increased product demand from the industrial gas turbine sector.

The surge in demand for high-performance coatings across various industrial sectors is a key driver propelling the global market. The escalating requirement for economical repair and maintenance solutions further amplifies the demand for thermal spray coatings. These coatings, frequently employed to refurbish damaged or worn components, offer a cost-effective alternative to replacement. Additionally, sustained advancements in materials science and manufacturing, coupled with ongoing innovations in thermal spray coating processes and the introduction of enhanced coatings, play a crucial role in bolstering the global market.

The global thermal spray coatings market was significantly affected by the COVID-19 pandemic. The virus's global spread caused operational disruptions in various industries, including aerospace, automotive, and energy. Lockdowns, disruptions in the supply chain, and reduced manufacturing capacity collectively resulted in a decreased demand for thermal spray coatings. Furthermore, the pandemic-induced economic uncertainty led some businesses to postpone or cancel projects that would have otherwise utilized these coatings. Despite these challenges, the market displayed resilience, particularly in healthcare-related industries, where the demand for specialized coatings on medical devices and equipment increased.

As economies gradually recover, the thermal spray coatings market is anticipated to bounce back. This resurgence will be driven by the revival of deferred projects and a renewed emphasis on the coatings' key advantages, such as corrosion protection, wear resistance, and thermal insulation. Additionally, as industries adapt to the "new normal," characterized by an increased focus on safety and efficiency, thermal spray coatings may discover expanded applications, further enhancing their market potential.

Industry Dynamics

Growth Drivers

- Increasing expansion of thermal spray coatings in the chemical sector will boost the Market Growth

The rising expansion of thermal spray coatings in the chemical sector will bolster the thermal spray coatings market growth. Coatings are applied to the surfaces of valves, pumps, turbine blades, machinery, and various industrial equipment to enhance their operational efficiency, quality, and reliability. In the automotive sector, these coatings are utilized on components such as piston rings, cylinder rings, brake discs, exhaust pipes, crankshafts, and shifters to boost performance and fuel efficiency. Additionally, the market is experiencing growth due to a shift in consumer preference from traditional chrome plating to thermal spray coatings. As environmental concerns gain prominence, consumers are increasingly favoring thermal spray coatings, which offer superior fatigue resistance and leave minimal residue during application.

Moreover, as advancements in thermal spray technology and materials continue, the industry benefits from coatings that enhance energy efficiency, regulatory compliance, and overall equipment performance. The expansion of thermal spray coatings in the chemical sector underscores their significant role in ensuring the longevity, safety, and efficiency of chemical manufacturing processes.

Report Segmentation

The market is primarily segmented based on type, material, application and region.

|

By Type |

By Material |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The Flame spray coatings segment dominated the market in the forecast period

The flame spray coatings segment dominated the market with largest revenue share. The Flames spray coatings procedure utilizes a combination of fuel gas and propellant gas to liquefy the coating material, subsequently applying it onto the surface of the substrate. The prevalence of flame spray coatings can be credited to numerous factors. Initially, flame spraying is a firmly established and extensively utilized method with a lengthy track record in industrial applications. Additionally, it provides adaptability by accommodating a diverse range of coating materials, such as alloys, metals, polymers, and ceramics.

On the other hand, the plasma spray coatings segment is expected to witness substantial growth throughout the forecast period. The surging need for cutting-edge thermal barrier coatings (TBCs) in gas turbines and aerospace engines stands out as a pivotal factor propelling the expansion of plasma spray coatings. Furthermore, the escalating focus on environmental sustainability, energy efficiency, and the imperative for top-tier coatings across diverse industries are driving the widespread uptake of plasma spray technology.

By Material Analysis

The metals and alloys segment accounted for the highest market share in the forecast period

The metals and alloys segment accounted for the highest market share in the forecast period, these coatings encompass a range of materials, including stainless steel, titanium, nickel, aluminum, and various alloys. They provide exceptional resistance to corrosion, impressive strength, and advantageous thermal properties, which render them widely utilized in sectors such as automotive, aerospace, and energy. The prevalence of coatings based on metals and alloys can be attributed to their versatility across various industries and their well-established role in thermal spray procedures.

On the other hand, ceramics segment is anticipated to experience significant growth throughout the forecast period. As a result of technological progress and a rising need for specialized coatings, growth is predominantly driven by the expanding use of advanced ceramic coatings in sectors like aerospace, electronics, and healthcare. These applications require advanced ceramic coatings to enhance wear resistance, provide electrical insulation, and ensure thermal protection.

Regional Insights

- North America dominated the market in the forecast period

North America dominated the market during the forecast period. The region's economic upswing can be credited to the robust demand for thermal spray coatings across various sectors, including aerospace, automotive, and power generation. Moreover, the escalating embrace of sustainable solutions, in compliance with stringent regulations imposed by regulatory authorities such as OSHA and EPA, is a key driver for the expansion of the thermal spray coatings market in this area.

The Asia-Pacific region is accounted for the fastest growth in the forecast period due to the increasing demand for thermal spray coatings in emerging economies such as India, Japan, and China have significantly contributed to the region's expansion. This growth is driven by the increasing need for thermal spray coatings across diverse industries, including aerospace, automotive, and healthcare. Furthermore, the region's rapid industrialization, urbanization, and ongoing infrastructural developments in these countries are additional factors propelling its growth.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- American Roller Company, LLC

- H.C. Starck, Inc.

- Lincotek Surface Solutions

- Oerlikon Balzers Coating USA

- Powder Alloy Corp.

- Praxair Surface Technologies, Inc.

- Progressive Surface, Inc.

- Saint-Gobain S.A.

- Turbocoating Spa

- Wall Colmonoy Corp.

Recent Developments

- In April of 2023, Praxair Surface Technologies revealed their acquisition of K-Tech Specialty Coatings, a prominent supplier of cutting-edge coatings tailored for the aerospace and defense sectors.

- In February of 2023, Kennametal Inc. unveiled an advanced turning grade featuring state-of-the-art coating technology. The KCP25C with KENGold emerges as the premier choice for metal-cutting inserts in steel-turning applications, offering superior wear resistance and increased metal removal rates.

- In January 2023, H.C Starck Solutions unveiled a fresh array of thermal spray powders specifically designed for the medical device sector. This extensive lineup encompasses coatings intended for use in orthopedic implants and dental applications.

Thermal Spray Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 11.36 billion |

|

Revenue forecast in 2032 |

USD 16.22 billion |

|

CAGR |

4.50% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Material, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |