Textile Chemicals Market Share, Size, Trends, & Industry Analysis Report By Product Type (Surfactants, Colorants, Finishing Agents, De-sizing Agents, Bleaching Agents, Others); By Application; By Region, Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM1136

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

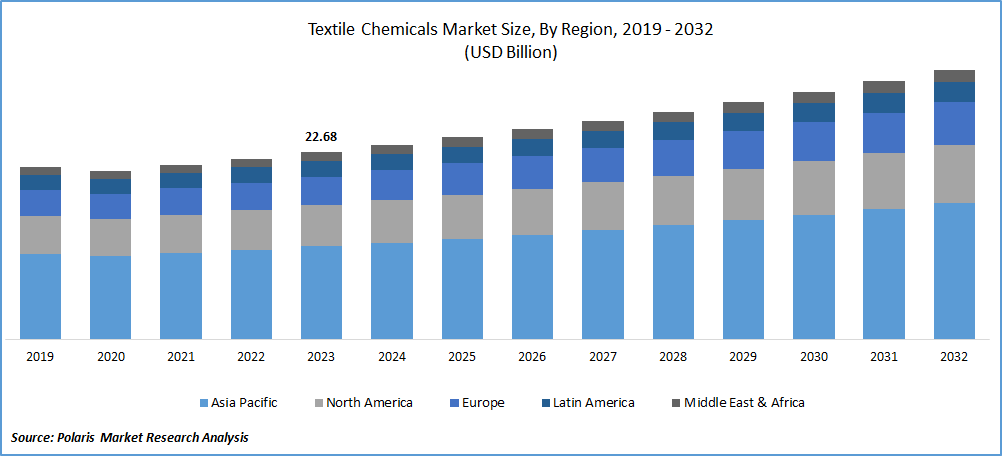

The global textile chemicals market was valued at USD 22.68 billion in 2023 and is anticipated to grow at a CAGR of 4.1% during the forecast period.

Textile chemicals refer to various groups of chemical compounds used in different stages of textile processing and manufacturing. These chemicals play a crucial role in enhancing the performance, appearance, and functionality of textiles. They are employed in processes such as pre-treatment, dyeing, printing, and finishing to achieve desired characteristics such as color fastness, durability, water repellency, and flame resistance. Textile chemicals include products like surfactants, colorants, finishing agents, de-sizing agents, and bleaching agents.

To Understand More About this Research: Request a Free Sample Report

The use of chemicals in textiles has developed into a highly specialized industry that employs a wide variety of chemicals, both organic and inorganic, to give textiles both functional and aesthetic properties. Over the last ten years, there has been notable progress in the development of chemistry formulations for tailored applications in textile manufacturing, and this trend is anticipated to continue over the forecast period. The remarkable advancements in textile manufacturing technologies have led to a significant increase in the interaction between material science and textile chemistry.

The rising standard of living, particularly in developing and developed nations, has encouraged the production of textiles used for upholstery, clothing, floor coverings, and home furnishings, which is driving the growth of the market. The use of chemicals as additional raw materials has increased due to the growing production and consumption of textile products. The manufacturing of textiles requires the use of a large range and quantity of various chemicals. Chemicals are essential for giving textiles functional qualities, from the processing of various fiber types and raw materials to the final touch of finished textiles. The chemicals used in textiles, their exposure to workers in the textile industry, and their effects on the environment are receiving more attention in the current business environment. The steady growth of these products, despite strict safety, health, and environmental regulations, has primarily been sustained by novel technologies. The latest development in novel product development involves the use of wet processing chemicals, which effectively reduce production costs.

Several restraining factors are impeding the growth of the market, such as the increasing awareness and demand for sustainable and eco-friendly practices in the textile industry. Environmental concerns associated with the use of certain chemicals in textile processing have led to a shift in consumer and industry preferences toward more sustainable alternatives. This has prompted regulatory bodies to impose stringent regulations on the use of certain chemicals, restricting their application in textile manufacturing. Also, the fluctuations in raw material prices and the fluctuating costs of petroleum-based chemicals, which are widely used in the industry, pose economic challenges for manufacturers.

Industry Dynamics

Growth Drivers

Rising Demand for Technical Textiles Drives Market Growth

The rising demand for technical textiles is a key driver propelling the growth of the textile chemicals market as technical textiles include products like medical textiles, geotextiles, and protective clothing, which require specialized characteristics such as enhanced durability, resistance to chemicals, and advanced functionalities. The production of technical textiles involves difficult processes that often demand the use of specific textile chemicals for coating, finishing, and functional enhancements.

As industries such as automotive, healthcare, construction, and aerospace increasingly adopt technical textiles for their unique applications, the demand for corresponding textile chemicals has surged. These chemicals play an important role in imparting the desired properties to technical textiles, such as waterproofing, flame resistance, and antimicrobial features. The growing emphasis on innovation and performance in technical textiles has driven research and development in the textile chemicals sector, leading to the introduction of new and advanced formulations.

Report Segmentation

The market is primarily segmented based on product type, application, and region.

|

By Product Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

Colorant Segment Dominated the Market in 2023

In 2023, the colorants segment dominated the textile chemicals market because of the demand for vibrant and appealing textiles across various industries, including fashion, home furnishings, and automotive. Colorants, including dyes and pigments, play a crucial role in enhancing the visual appearance of textiles, meeting consumer preferences for diverse and eye-catching color options. Also, the textile industry's continuous innovation and development has spurred the adoption of advanced colorant technologies, such as eco-friendly and sustainable dyes. The colorants segment's dominance is also influenced by the versatility of these chemicals, allowing for a wide spectrum of color choices and applications in different textile materials.

By Application Analysis

The Apparel Segment is Expected to Hold the Largest Revenue Share over the Forecasted Period

The apparel segment is expected to hold the largest revenue share in the market because the fashion and apparel industry is one of the largest consumers of textile chemicals, depending heavily on these chemicals for various stages of the manufacturing process. Textile chemicals play an important role in enhancing the functional properties of apparel, including color fastness, durability, and comfort. As consumer preferences continue to evolve, there is a growing demand for apparel with advanced features such as stain resistance, wrinkle resistance, and moisture-wicking, all of which are achieved through the application of specialized textile chemicals. Also, the highly competitive nature of the fashion industry, with its rapid trend-changing cycles and demand for quick product turnovers, has led manufacturers to invest in innovative textile chemical solutions for efficient and high-quality production processes.

Regional Insights

The Asia-Pacific Region Dominated the Textile Chemicals Market in 2023

In 2023, the dominance of the Asia-Pacific region in the market was due to the region's robust textile and apparel manufacturing base, particularly in countries like China, India, and Bangladesh, which played a crucial role. These countries have been known as major textile producers, benefitting from cost-effective labor, extensive raw material availability, and well-established manufacturing infrastructure.

Also, the increasing population and rising disposable incomes in the Asia-Pacific region fueled domestic demand for textiles and apparel, driving the need for advanced textile chemicals to enhance the quality and aesthetic appeal of these products.

Europe is expected to have the fastest growth rate in the textile chemicals market because of evolving consumer preferences, regulatory initiatives, and a growing emphasis on innovative textile production practices. Europe has been at the front line of adopting and promoting environmentally friendly and sustainable manufacturing processes. The region's stringent regulations related to chemical usage and environmental impact have promoted textile manufacturers to invest in cutting-edge technologies and eco-friendly formulations for textile chemicals.

Key Market Players & Competitive Insights

The market is extremely competitive due to the large number of manufacturers with a global presence. Company strategies have placed a strong emphasis on digitalization, artificial intelligence, and the Internet of Things (IoT) in manufacturing processes. Adopting strategic initiatives, like new product launches and acquisitions, is another activity in which market participants are actively involved to compete with other manufacturers.

Some of the major players operating in the global Textile Chemicals market include:

- Archroma

- BASF SE

- BioTex Malaysia

- Covestro AG

- Dow

- Cosmo Speciality Chemicals

- Evonik Industries AG

- Fibro Chem, LLC

- Huntsman International LLC

- Kemira Oyj

- Kiri Industries Limited

- LANXESS

- Lonsen Inc.

- OMNOVA Solutions Inc

- Omya United Chemicals

- Pulcra Chemicals GmbH

- Resil Chemicals Pvt. Ltd.

- Solvay S.A

- The DyStar Group

- The Lubrizol Corporation

Recent Developments

- In April 2022, Cosmo Speciality Chemicals launched the Wetofast range, which is an eco-friendly solution to maintain the quality of fabrics. The range includes three new products named Wetofast GN, Wetofast LOR, and Wetofast LD.

- In February 2021, Kemin Industries, a global ingredient manufacturer, announced that its business unit, Garmon Chemicals, launched Kemzymes, which is the new range of enzymes developed for garment washing.

- In November 2021, Fineotex Chemical launched its new facility in Ambernath, India. The new manufacturing hub is an important step in strengthening the company’s competitive position at a local and international level.

Textile Chemicals Market Report Scope

|

Report Attributes |

Details |

|

The market size value in 2024 |

USD 23.54 billion |

|

Revenue Forecast in 2032 |

USD 32.59 billion |

|

CAGR |

4.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product Type, By Application, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

Explore the market dynamics of the 2024 Textile Chemicals Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Textile Chemicals Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Bestselling Reports:

Ready Mix Concrete Market Size, Share Research Report

Medical Foods Market Size, Share Research Report

Location Based Advertising Market Size, Share Research Report

FAQ's

Archroma, BASF SE, BioTex Malaysia, Covestro AG, Dow, Cosmo Speciality Chemicals are the key companies in Textile Chemicals Market.

The global textile chemicals market is anticipated to grow at a CAGR of 4.1% during the forecast period.

The Textile Chemicals Market report covering key segments are product type, application, and region.

Rising demand for technical textiles drives market growth are the key driving factors in Textile Chemicals Market.

The global textile chemicals market size is expected to reach USD 32.59 Billion by 2032