Text-to-Speech Market Size, Share, Trends, Industry Analysis Report: By Offering, Deployment Mode (On-Premises and Cloud-Based), Voice Type, Organization Size, Language, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5406

- Base Year: 2024

- Historical Data: 2020-2023

Text-to-Speech Market Overview

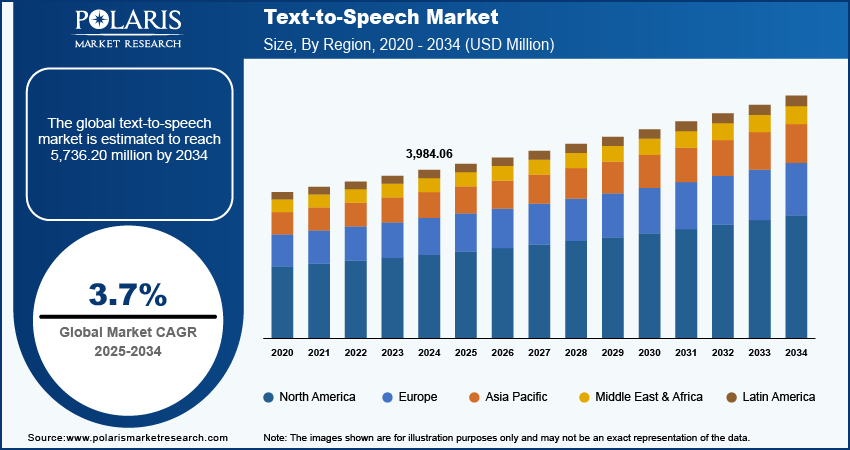

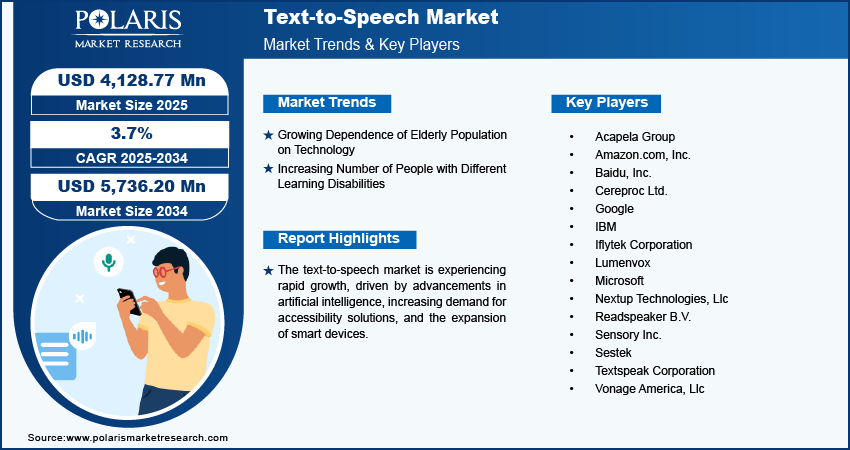

The global text-to-speech market size was valued at USD 3,984.06 million in 2024. It is expected to grow from USD 4,128.77 million in 2025 to USD 5,736.20 million by 2034, at a CAGR of 3.7% from 2025 to 2034.

Text-to-speech (TTS) technology converts written text into natural-sounding speech, enabling seamless interaction between humans and digital systems. The market for TTS solutions is expanding as businesses increasingly adopt interactive voice response (IVR) systems to enhance customer engagement and streamline operations. IVR systems rely on text-to-speech to deliver automated responses, improving efficiency in customer service, banking, healthcare, and telecommunications. The demand for high-quality, AI-driven TTS solutions continues to grow as companies seek to reduce operational costs and improve user experience. Additionally, advancements in speech synthesis, including prosody modeling that involves the rhythmic and international aspects of speech, are enabling more natural and expressive voices, boosting the text-to-speech market development.

Governments worldwide are also promoting TTS technology to support the education of differently-abled students, ensuring accessibility and inclusion in learning environments. Various initiatives focus on integrating TTS into digital learning platforms, audiobooks, and assistive technologies, enabling students with visual impairments or reading disabilities to access educational content effortlessly. For instance, in September 2024, the SEVP Response Center (SRC) launched a new phone system featuring an interactive voice response (IVR) menu for various stakeholders, such as school officials, students, exchange visitors, and government officials. The IVR system directs callers to the appropriate customer service representative based on their keypad selection. This push for inclusive education aligns with broader digital transformation efforts, fostering the development of advanced text-to-speech solutions with multilingual and adaptive capabilities and driving the text-to-speech market expansion.

To Understand More About this Research: Request a Free Sample Report

Text-to-Speech Market Dynamics

Growing Dependence of Elderly Population on Technology

Many senior citizens face challenges in reading digital content or typing responses with declining vision and motor skills. A January 2023 report from the UN Department of Economic and Social Affairs forecasted that the number of people aged 65 and older will more than double, rising from 761 million in 2021 to 1.6 billion by 2050. The population aged 80 and older is growing even more rapidly. The integration of TTS in smartphones, healthcare applications, and smart home devices enables seniors to engage with technology through voice commands and audio outputs. TTS-integrated devices promote independence as they enhance accessibility and ease of communication. For instance, in August 2024, ReadSpeaker, a digital voice provider, collaborated with Qualitus to develop a text-to-speech plugin for ILIAS, offering personalized learning features such as adjustable reading speed, text customization, and word lookup capabilities. The increasing adoption of digital healthcare solutions, such as telemedicine and medication reminders, further drives the demand for high-quality TTS systems. Thus, as the global elderly population continues to grow, the need for intuitive and user-friendly voice-based interfaces is expected to drive the text-to-speech market demand.

Increasing Number of People with Different Learning Disabilities

Individuals with dyslexia, auditory processing disorders, and other cognitive challenges often struggle with traditional text-based learning methods, making TTS a vital support tool. A November 2021 report by UNICEF stated that nearly 240 million children worldwide have different disabilities. TTS facilitates improved comprehension and retention, assuring that individuals with learning disabilities can engage with digital content more effectively by converting written content into spoken words. Also, it plays a crucial role in enhancing accessibility to information and education. Educational institutions and e-learning platforms are integrating TTS technology to create more inclusive learning environments, reducing barriers to education. For instance, in December 2024, the Indian Ministry of Education launched the ePathshala app and the Voice Aloud Reader to support inclusive education for children with special needs by offering accessible learning resources and text-to-speech functionality. Therefore, as awareness of learning disabilities rises, the demand for advanced TTS solutions with customizable voices and adaptive speech features continues to increase, thereby boosting the text-to-speech market revenue.

Text-to-Speech Market Segment Insights

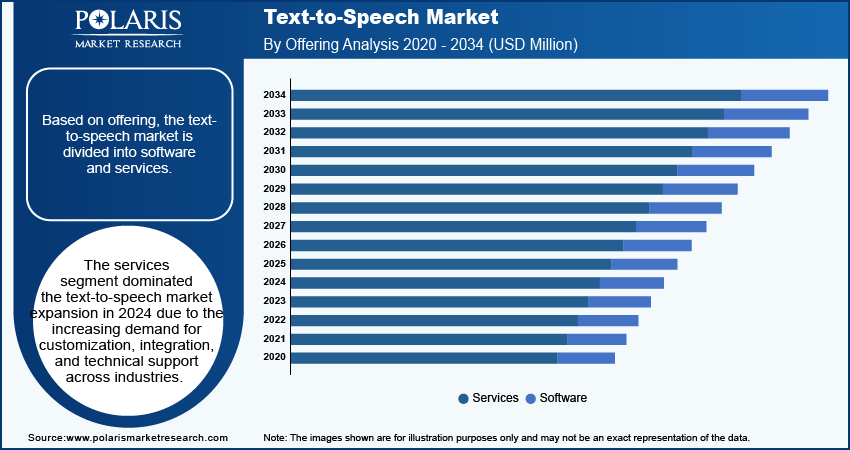

Text-to-Speech Market Assessment by Offering Outlook

The global text-to-speech market assessment, based on offering, includes software and services. The services segment dominated the market in 2024 due to the increasing demand for customization, integration, and technical support across industries. Businesses and organizations require specialized services to tailor TTS solutions to their specific needs, such as language adaptation, voice modulation, and integration with existing digital platforms. Additionally, managed services and ongoing support play a crucial role in ensuring seamless deployment and optimization of TTS technology. The need for professional services, such as consulting, training, and maintenance, continues to grow as enterprises focus on improving user engagement through voice-enabled applications. This rising demand for end-to-end support and personalized TTS solutions has positioned the services segment at the forefront of test-to-speech market expansion.

Text-to-Speech Market Evaluation by Deployment Mode Outlook

The global text-to-speech market evaluation, based on deployment mode, includes on-premises and cloud-based. The cloud-based segment is expected to witness the fastest text-to-speech market growth during the forecast period driven by its scalability, cost efficiency, and ease of accessibility. Cloud-based text-to-speech solutions eliminate the need for complex on-premises infrastructure, allowing businesses to deploy voice-enabled applications with minimal investment. The flexibility of cloud deployment allows seamless updates, improved processing speed, and enhanced storage capabilities, serving enterprises of all sizes. Additionally, the increasing adoption of artificial intelligence (AI) and machine learning (ML) in cloud-based TTS platforms is improving speech synthesis accuracy and naturalness. Therefore, as organizations prioritize remote accessibility and real-time voice processing, cloud-based solutions are emerging as the preferred choice in the text-to-speech market.

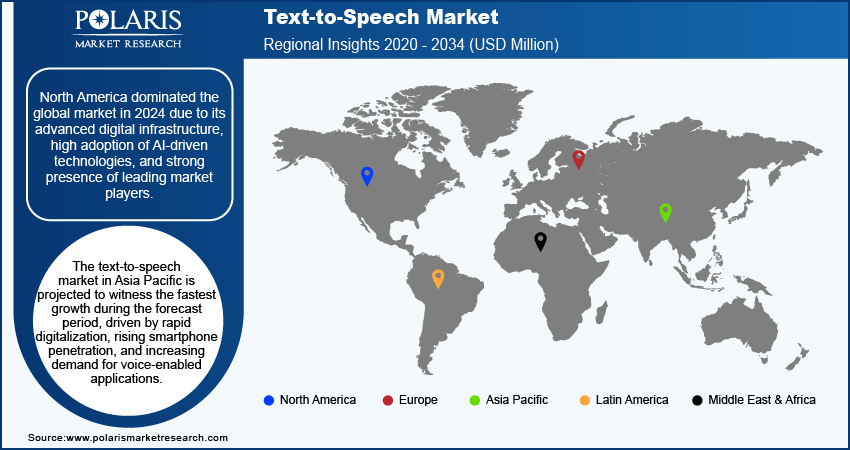

Text-to-Speech Market Regional Analysis

By region, the report provides the text-to-speech market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the text-to-speech market revenue in 2024 due to its advanced digital infrastructure, high adoption of AI-driven technologies, and strong presence of leading market players. The region's well-established technology ecosystem enables continuous innovation in speech synthesis, resulting in the development of highly sophisticated TTS solutions. For instance, in October 2024, smallest.ai launched Lightning, an ultra-fast multilingual text-to-speech model generating audio in 100ms with minimal VRAM requirements. It supports English and Hindi languages, with quick adaptability to new languages and accents. Additionally, the increasing use of TTS in industries such as healthcare, e-learning, and customer service has contributed to the regional market expansion. Government initiatives promoting accessibility for individuals with disabilities have also accelerated the adoption of TTS solutions across public and private sectors. For instance, in July 2022, the US Department of Transportation adopted a set of Disability Policy Priorities under the Americans with Disabilities Act (ADA). These priorities aim to improve access for individuals with disabilities, including key actions to ensure safe and accessible air travel. Thus, with a strong emphasis on digital transformation and voice-driven technologies, North America remains the leading market for TTS adoption and revenue generation.

The Asia Pacific text-to-speech market is projected to witness the fastest growth during the forecast period, driven by rapid digitalization, rising smartphone penetration, and increasing demand for voice-enabled applications. Countries in the region are experiencing substantial advancements in AI and cloud computing, leading to the widespread adoption of TTS solutions across various sectors such as education, entertainment, and healthcare. Additionally, government initiatives aimed at improving accessibility for differently-abled individuals and promoting e-learning are driving market expansion in the region. A February 2025 report by the Ministry of Social Justice & Empowerment stated that India's Department of Empowerment of Persons with Disabilities launched 16 initiatives, such as AI-enabled accessibility assessment apps, high-power spectacles, and employment partnerships. The program includes digital platforms, assistive technologies, and educational resources, supported by a national helpline that has assisted 65,000 people since January 2024. The region’s diverse linguistic landscape has also increased demand for multilingual TTS solutions, encouraging continuous innovation in speech synthesis technology. Therefore, as businesses and consumers embrace voice-based interaction, the Asia Pacific TTS market expansion is poised for substantial growth in the coming years.

Text-to-Speech Market – Key Players and Competitive Insights

The competitive landscape features a mix of global leaders and regional players aiming for text-to-speech market share through innovation, strategic partnerships, and geographic expansion. Global companies such as Google, Microsoft, Amazon, and IBM leverage advanced R&D capabilities and extensive distribution networks to deliver advanced TTS solutions, including AI-driven voice synthesis and natural language processing technologies. Text-to-speech market trends highlight increasing demand for multilingual, real-time, and customizable TTS solutions driven by advancements in AI and machine learning. According to text-to-speech market analysis, the market is projected to grow immensely, fueled by rising adoption in industries such as education, healthcare, entertainment, and customer service.

Regional players focus on addressing localized linguistic and cultural needs, particularly in emerging markets. Text-to-speech market competitive strategies include mergers and acquisitions, collaborations with academic and research institutions, and the launch of innovative TTS products tailored to specific industries. These developments underscore the importance of technological innovation, market adaptability, and regional investments in driving the expansion of the market. A few key major players are Acapela Group; Amazon.com, Inc.; Baidu, Inc.; Cereproc Ltd.; Google; IBM; Iflytek Corporation; Lumenvox; Microsoft; Nextup Technologies, LLC; Readspeaker B.V.; Sensory Inc.; Sestek; Textspeak Corporation; and Vonage America, LLC.

Google LLC is an American multinational technology company specializing in internet related services and products. Founded in September 1998 as a search engine company, Google has since grown to offer a multitude of products and services, including Gmail, Maps, Cloud, Chrome, YouTube, and mobile operating systems (Android). The company's business areas include advertising, search, platforms and operating systems, and enterprise and hardware products. Google Search and YouTube are the two most-visited websites worldwide. Google is also the largest search engine, mapping and navigation application, email provider, office suite, online video platform, photo and cloud storage provider, mobile operating system, web browser, machine learning framework, and AI virtual assistant provider in the world as measured by market share. Google Cloud Text-to-Speech provides a robust API that leverages Google's AI technologies to produce natural-sounding speech in over 40 languages, with a selection of more than 220 voices. It allows for the personalization of communication through voice and language preferences and offers high-fidelity speech with human-like intonation. The service supports various audio formats, including MP3, and can be integrated with different applications and devices via REST and gRPC APIs. Google Cloud Text-to-Speech is priced based on the number of characters processed, with a free tier available for new customers.

Microsoft is an American multinational technology corporation headquartered in Redmond, Washington. The company develops, licenses, and supports a wide array of software products, services, and hardware. Its offerings include operating systems for computers, servers, phones, and other devices; server applications; productivity applications; business solutions; desktop and server management tools; software development tools; and video games. Flagship hardware products include the surface line of personal computers and Xbox video game consoles. Additionally, Microsoft provides cloud-based solutions through Azure, along with services such as Bing web search, MSN, and Outlook.com. Microsoft's Text-to-Speech (TTS) technology uses AI and machine learning for natural-sounding voice synthesis, available through Azure AI Services. It offers real-time and asynchronous speech synthesis, making it suitable for applications such as audiobooks and podcasts. Users can choose from various male and female voices and install language packs for multilingual support. Integration is easy via Azure AI Services, and built-in TTS features are also available in Windows applications such as Word, Outlook, PowerPoint, and OneNote.

List of Key Companies in Text-to-Speech Market

- Acapela Group

- Amazon.com, Inc.

- Baidu, Inc.

- Cereproc Ltd.

- IBM

- Iflytek Corporation

- Lumenvox

- Microsoft

- Nextup Technologies, Llc

- Readspeaker B.V.

- Sensory Inc.

- Sestek

- Textspeak Corporation

- Vonage America, Llc

Text-to-Speech Industry Developments

January 2024: Azure AI Speech unveiled the zero-shot text-to-speech (TTS) models designed for the development of Personal Voices.

March 2024: Deepgram launched Deepgram Aura, the first text-to-speech model designed for responsive, conversational AI. It offers a dozen natural-sounding voices with lower latency than competing options.

Text-to-Speech Market Segmentation

By Offering Outlook (Revenue, USD Million, 2020–2034)

- Software

- Services

- Software-as-a-Service and Support

- Implementation & Consulting

By Deployment Mode Outlook (Revenue, USD Million, 2020–2034)

- On-Premises

- Cloud-Based

By Voice Type Outlook (Revenue, USD Million, 2020–2034)

- Neural & Custom

- Non-Neural

By Organization Size Outlook (Revenue, USD Million, 2020–2034)

- SMEs

- Large Enterprise

By Language Outlook (Revenue, USD Million, 2020–2034)

- English

- Mandarin Chinese

- Hindi

- Arabic

- Spanish

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Text-to-Speech Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,984.06 million |

|

Market Size Value in 2025 |

USD 4,128.77 million |

|

Revenue Forecast by 2034 |

USD 5,736.20 million |

|

CAGR |

3.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global text-to-speech market size was valued at USD 3,984.06 million in 2024 and is projected to grow to USD 5,736.20 million by 2034.

• The global market is projected to register a CAGR of 3.7% from 2025 to 2034.

• North America dominated the text-to-speech market revenue in 2024.

• Some of the key players in the market are Acapela Group; Amazon.com, Inc.; Baidu, Inc.; Cereproc Ltd.; Google; IBM; Iflytek Corporation; Lumenvox; Microsoft; Nextup Technologies, LLC; Readspeaker B.V.; Sensory Inc.; Sestek; Textspeak Corporation; and Vonage America, LLC.

• The services segment dominated the text-to-speech market expansion in 2024.