Test and Measurement Equipment Market Size, Share, Trends, Industry Analysis Report: By Product Type (General-Purpose Test Equipment and Mechanical Test Equipment), Service Type, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 125

- Format: PDF

- Report ID: PM5362

- Base Year: 2024

- Historical Data: 2020-2023

Test and Measurement Equipment Market Overview

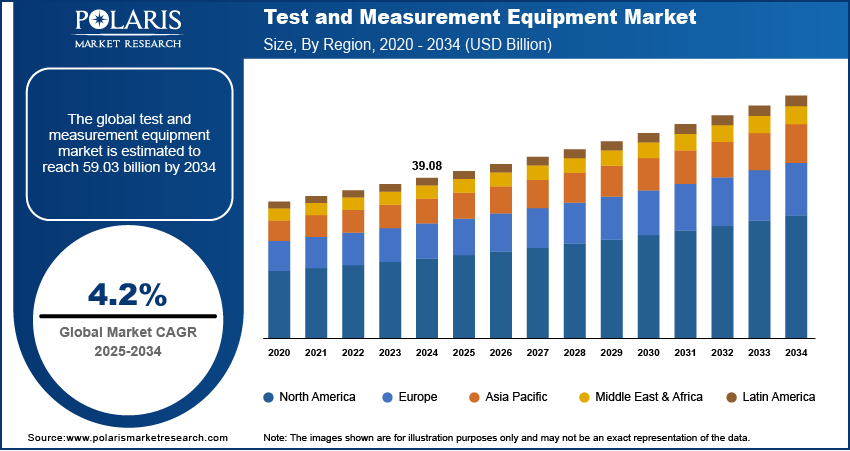

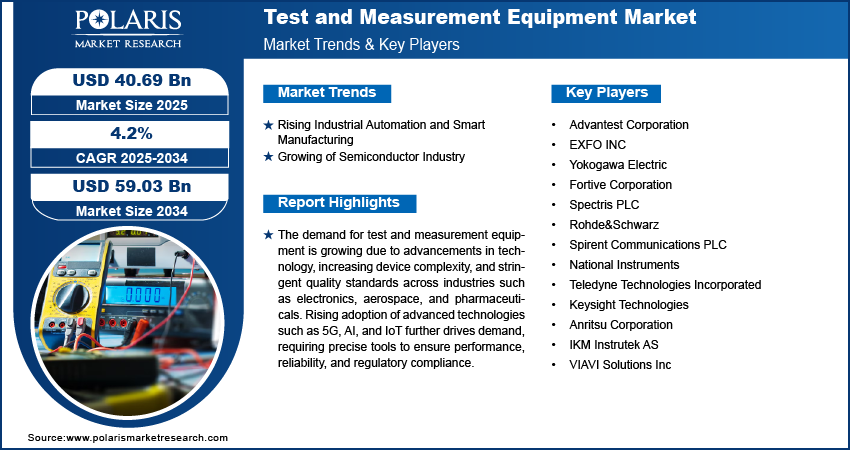

The global test and measurement equipment market size was valued at USD 39.08 billion in 2024. The market is projected to grow from USD 40.69 billion in 2025 to USD 59.03 billion by 2034, exhibiting a CAGR of 4.2% from 2025 to 2034.

Test and measurement equipment refers to a wide range of instruments and systems used to calibrate and inspect the parameters of systems or end products such as machinery, electronics, and consumer goods.

The rising focus on predictive maintenance and condition monitoring is one of the key factors driving the test and measurement equipment market growth. Industries are increasingly adopting proactive maintenance strategies to prevent unexpected equipment failures and reduce downtime, resulting in a rising need for advanced test and measurement tools. Predictive maintenance utilizes real-time data and precise diagnostics to anticipate equipment wear and possible malfunctions before they arise, thus optimizing operational efficiency and prolonging asset lifecycles. Condition monitoring systems continuously assess the performance and health of machinery and support the predictive maintenance approach by providing critical insights into equipment status. The shift from reactive to predictive maintenance is particularly prevalent in sectors such as manufacturing, aerospace, and energy, where maintaining operational continuity is essential.

The demand for sophisticated sensors, data acquisition systems, and analysis tools that monitor and interpret complex data feeds is driving the test and measurement equipment market expansion. As businesses increasingly seek to enhance their maintenance strategies and avoid costly unplanned downtime, the need for reliable test and measurement equipment that supports predictive maintenance and condition monitoring continues to rise, fostering advancements within the market.

To Understand More About this Research: Request a Free Sample Report

The increasing need for precise measurements in research and development (R&D) is another major factor boosting the test and measurement equipment market revenue. This trend reflects the rising demand for accuracy and reliability across various scientific and industrial fields. As technology advances, industries are striving for innovation, making accurate measurement tools essential to ensure precision and reproducibility in experimental results. High-precision instruments play a vital role in sectors such as pharmaceuticals, electronics, aerospace, and materials science. These tools are indispensable for developing new products, upholding strict quality standards, and achieving technological breakthroughs. For instance, in the electronics industry, precise measurements are crucial for testing components to meet rigorous performance and safety criteria.

Test and Measurement Equipment Market Dynamics

Rising Industrial Automation and Smart Manufacturing

Industry automation has increased the need for advanced measurement solutions as industries adopt automation technologies such as robotics, sensors, and intelligent control systems. For instance, according to the International Trade Organization, 33,000 manufacturing industries in the US have already integrated robotic systems and adopted industrial automation, and this number is expected to grow. Automation systems require continuous monitoring and calibration to maintain accuracy and efficiency, leading to a demand for sophisticated test equipment that handles complex data and provides real-time feedback. Additionally, smart manufacturing, which utilizes IoT and data analytics, boosts demand by integrating advanced sensors and measurement devices into production processes. These systems rely on accurate measurements to monitor and control various parameters such as temperature, pressure, and product dimensions, thus guaranteeing consistent quality and reducing waste. As a result, the expansion of industrial automation and smart manufacturing is driving the test and measurement equipment market development.

Growing Semiconductor Industry

The growing semiconductor industry is significantly driving the test and measurement equipment market demand. According to the Semiconductor Industry Association (SIA), global semiconductor sales reached USD 51.3 billion in July 2024, reflecting an 18.7% increase from July 2023 and a 2.7% rise from June 2024. This significant growth highlights the expansion of the semiconductor industry and the increasing need for high-performance test and measurement tools. As semiconductor technology advances, devices are becoming smaller and more complex, necessitating sophisticated measurement solutions for design, manufacturing, and quality control. Precision in testing is crucial for ensuring the performance and reliability of semiconductor components, which are vital for applications ranging from consumer electronics to automotive systems. Innovations such as 5G, artificial intelligence, and IoT are further fueling the demand for semiconductors, amplifying the need for advanced measurement equipment.

Test and Measurement Equipment Market Segment Insights

Test and Measurement Equipment Market Evaluation Based on Service Type

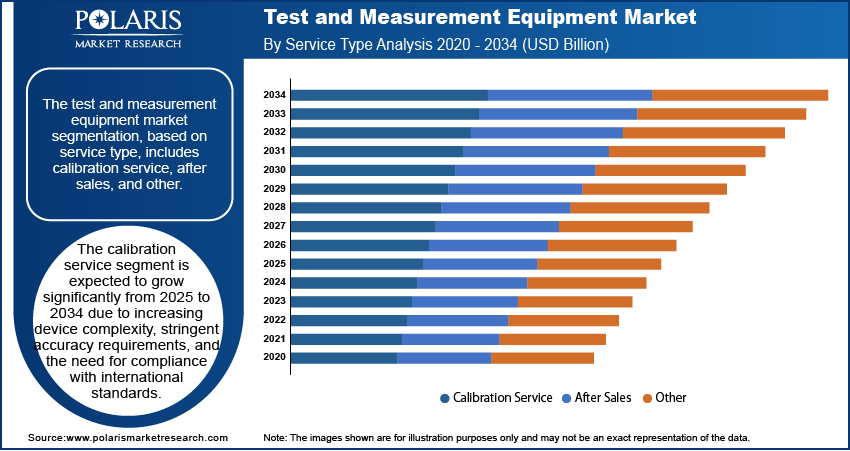

The test and measurement equipment market segmentation, based on service type, includes calibration service, after sales, and other. The calibration service segment is expected to register a higher CAGR from 2025 to 2034. The growth is attributed to the increasing complexity of modern electronic devices and the stringent accuracy requirements across various industries. Calibration ensures that measurement instruments remain precise and reliable, adhering to international standards and regulations. As technology evolves, the need for regular calibration to maintain equipment performance and compliance grows, propelling the demand for calibration services.

Test and Measurement Equipment Market Assessment Based on End User

The test and measurement equipment market segmentation, based on end user, includes electronic & semiconductor industry, automotive industry, telecommunication & data centers, aerospace & defense, medical technology industry, and other industries. The electronic & semiconductor industry segment dominated the test and measurement equipment market share in 2024, driven by the rising number of semiconductor manufacturing industries globally. This growth stems from the surging demand for advanced semiconductors fueled by technological advancements and innovations in areas such as 5G, IoT, and artificial intelligence. The increasing complexity of semiconductor devices has boosted the need for precise testing and measurement solutions to ensure quality, performance, and reliability.

Test and Measurement Equipment Market Regional Analysis

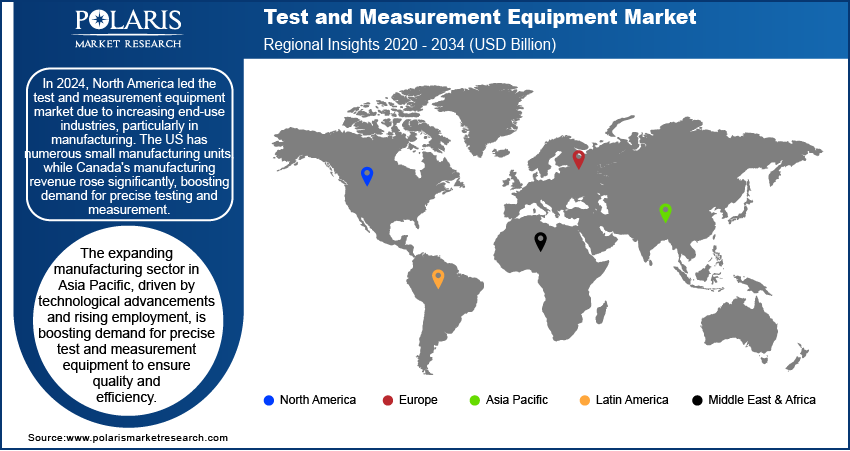

By region, the study provides the test and measurement equipment market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America led the test and measurement equipment market share in 2024, driven by the growing number of end-use industries in the region. The increasing establishment of manufacturing units across various sectors, coupled with advancements in technology, has elevated the demand for testing and measurement equipment.

The Asia Pacific test and measurement equipment market is projected to register a substantial CAGR during the forecast period due to the expanding manufacturing sector. In 2018, the manufacturing sector in Asia Pacific employed approximately 310,000 individuals, and by 2022, this number increased to 323,000, indicating a strong expansion in manufacturing activities. This growth in employment reflects the broader trend of increasing industrial output and technological advancement across the region. Also, it emphasizes the sector's crucial role in economic development and its growing reliance on advanced testing solutions to maintain a competitive edge. As manufacturing processes become more advanced, the demand for precise and reliable test and measurement equipment increases to ensure product quality and operational efficiency. Countries such as China, Vietnam, and Southeast Asian nations are leading this trend, driving investments in modern manufacturing technologies and, consequently, in test and measurement equipment. This dynamic is expected to continue fueling the test and measurement equipment market growth during the forecast period.

Test and Measurement Equipment Market – Key Market Players and Competitive Insights

The test and measurement equipment market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, advanced manufacturing technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the test and measurement equipment market to benefit clients. Major players in the test and measurement equipment market include Advantest Corporation, EXFO INC, Yokogawa Electric, Fortive Corporation, Spectris PLC, Rohde&Schwarz, Spirent Communications PLC, National Instruments, Teledyne Technologies Incorporated, Keysight Technologies Anritsu Corporation, IKM Instrutek AS, and VIAVI Solutions Inc.

Advantest Corporation, established in 1954, is a global player in the test and measurement equipment market. The company operates as a subsidiary of Advantest Holdings, a major parent company with a strong focus on the electronic testing industry. Advantest specializes in the design, development, and manufacture of test systems for semiconductor devices, telecommunications equipment, and electronic components. Its operations span across various regions, including Asia Pacific, North America, and Europe, catering to a diverse global market. In 2024, Advantest launched the V93000 WaveScale Test System, aimed at enhancing test efficiency and accuracy for high-performance semiconductor devices.

Teledyne Technologies Incorporated, established in 1960, is a diversified industrial company headquartered in Thousand Oaks, California. The company’s operations span multiple sectors, including aerospace and defense, industrial technologies, and environmental instrumentation. The company provides a wide range of products and services, including test and measurement equipment for various industries. Teledyne's regional presence extends across North America, Europe, and Asia Pacific, serving a global customer base. In 2024, Teledyne launched the Teledyne SP Devices ADQ7, a high-performance data acquisition board designed for advanced test and measurement applications. This new product is aimed at improving data acquisition speed and accuracy in complex testing environments.

List of Key Companies in Test and Measurement Equipment Market

- Advantest Corporation

- EXFO INC

- Yokogawa Electric

- Fortive Corporation

- Spectris PLC

- Rohde&Schwarz

- Spirent Communications PLC

- National Instruments

- Teledyne Technologies Incorporated

- Keysight Technologies

- Anritsu Corporation

- IKM Instrutek AS

- VIAVI Solutions Inc.

Test and Measurement Equipment Industry Developments

June 2024: Advantest Corporation launched the WEL2100, a new addition to its nanoSCOUTER particle measuring equipment. This instrument, which utilizes a nanopore sensor and microcurrent measurement technology, is designed for high-speed, precise measurement of particles such as lipid nanoparticles, viruses, and exosomes. The proprietary APT-Pore device allows accurate size distribution measurement for particles under 30 nm. With a new pressure application mechanism, the WEL2100 is suited for pharmaceutical and biotechnology R&D, with potential applications in medicine and other fields.

March 2024: GW Instek launched the MPO-2000 series programmable oscilloscopes, introducing Python programming for enhanced test and measurement automation. The series, available in Basic and Professional versions, integrates five instruments into one: an oscilloscope, spectrum analyzer, arbitrary waveform generator, digital multimeter, and programmable DC power supply. Python scripts allow for single and multi-instrument testing without a personal computer. The MPO-2000 series aims to improve convenience and efficiency in testing applications, benefiting education, production testing, and quality control.

January 2023: ABB launched its L&W Bending Tester with new features to improve operator-independent bending resistance and stiffness measurements. The upgraded standalone benchtop instrument now includes a large touchscreen with a user-friendly interface and improved post-processing for easier use and calibration. Integration with ABB's L&W Lab Management System (LMS) was also introduced, providing connectivity to the Quality Data Management module within the Manufacturing Execution System (MES). These updates aim to address issues in bending property measurement, enhancing productivity and cost efficiency.

Test and Measurement Equipment Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- General-Purpose Test Equipment

- Oscilloscopes

- Signal Generator

- Logic Analyzer

- Multimeter

- Spectrum Analyzer

- BERT Solutions

- Network Analyzer

- Electronic Counters

- Other

- Mechanical Test Equipment

- Non-Destructive Test Equipment

- Machine Vision Inspection Systems

- Machine Condition Monitoring Systems

By Service Type Outlook (Revenue – USD Billion, 2020–2034)

- Calibration Service

- After Sales

- Other

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Electronic & Semiconductor Industry

- Automotive Industry

- Telecommunication & Data Centers

- Aerospace & Defense

- Medical Technology Industry

- Other Industries

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Test and Measurement Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 39.08 billion |

|

Market Size Value in 2025 |

USD 40.69 billion |

|

Revenue Forecast by 2034 |

USD 59.03 billion |

|

CAGR |

4.2% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The test and measurement equipment market size was valued at USD 39.08 billion in 2024 and is projected to grow to USD 59.03 billion by 2034.

The global market is projected to register a CAGR of 4.2% from 2025 to 2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Advantest Corporation, EXFO INC, Yokogawa Electric, Fortive Corporation, Spectris PLC, Rohde&Schwarz, Spirent Communications PLC, National Instruments, Teledyne Technologies Incorporated, Keysight Technologies Anritsu Corporation, IKM Instrutek AS, and VIAVI Solutions Inc.

The calibration service segment is projected to account for a higher CAGR from 2025 to 2034.

The after sales segment held the highest share of the market revenue in 2024.