Terminal Tractor Market Size, Share, Trends, Industry Analysis Report

: By Fuel Type (Diesel, Natural Gas, Electric, and Hybrid), Application, Capacity, Technology Level, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM3087

- Base Year: 2024

- Historical Data: 2020-2023

Terminal Tractor Market Overview

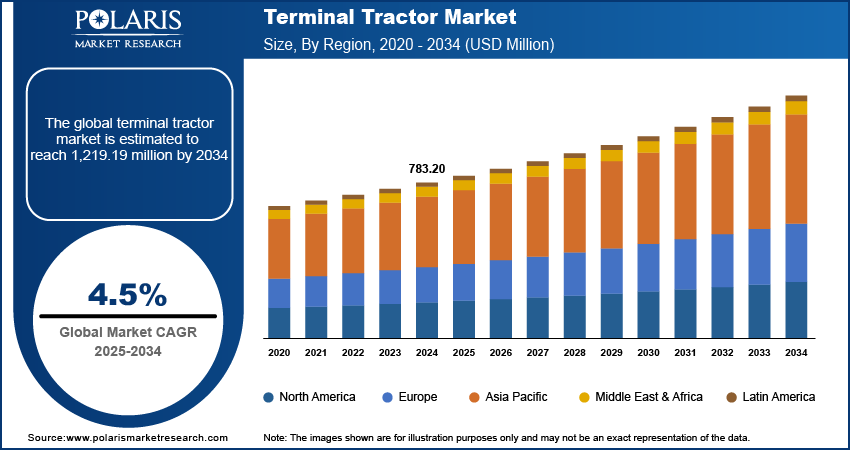

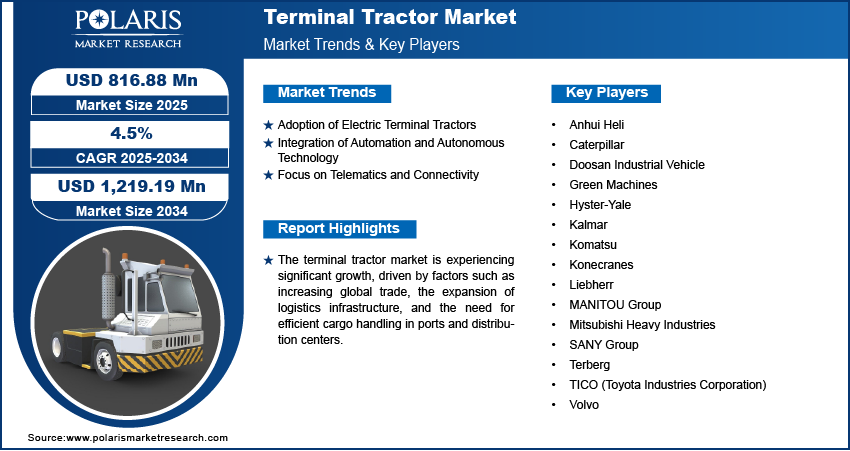

The terminal tractor market size was valued at USD 783.20 million in 2024. The market is projected to grow from USD 816.88 million in 2025 to USD 1,219.19 million by 2034, exhibiting a CAGR of 4.5% during 2025–2034.

The terminal tractor market refers to the segment of the automotive and material handling industry focused on vehicles specifically designed for moving trailers and cargo containers within confined areas such as ports, logistics hubs, and warehouses. Key drivers for market growth include increasing global trade, expansion in e-commerce, and the demand for efficient material handling solutions in distribution centers. The adoption of automation and electric terminal tractors is a notable trend, driven by efforts to enhance operational efficiency and reduce carbon emissions. Additionally, advancements in telematics and fleet management systems are supporting the integration of these vehicles into modern logistics operations.

To Understand More About this Research: Request a Free Sample Report

Terminal Tractor Market Dynamics

Adoption of Electric Terminal Tractors

The transition toward electric vehicle such as terminal tractors is a significant trend in the terminal tractor market, driven by environmental concerns and regulatory mandates to reduce emissions. These vehicles offer reduced operating costs due to lower fuel and maintenance requirements compared to diesel-powered alternatives. Companies are increasingly adopting electric terminal tractors to comply with sustainability goals and government incentives promoting clean energy solutions. For instance, the Port of Long Beach in California has introduced electric terminal tractors to align with its zero-emission targets. A report by the International Energy Agency highlights that the global stock of electric heavy-duty vehicles, including terminal tractors, increased by approximately 20% in 2023, reflecting growing adoption. Hence, the adoption of electric terminal tractors is expected to boost the terminal tractor market development in the coming years.

Integration of Automation and Autonomous Technology

Operators are leveraging automation and autonomous driving technologies to improve safety and operational efficiency, particularly in high-traffic areas such as ports and logistics hubs. Automated terminal tractors are equipped with features such as obstacle detection, remote operation, and real-time communication with fleet management systems. For instance, several European ports have implemented autonomous terminal tractor systems to streamline container handling operations. Thus, the integration of automation and autonomous technologies drives the terminal tractor market growth.

Focus on Telematics and Connectivity

Telematics and connectivity are becoming central to the functionality of terminal tractors, enabling real-time data exchange and predictive maintenance capabilities. Fleet operators are adopting telematics solutions to monitor vehicle performance, optimize routes, and enhance productivity. The deployment of Internet of Things (IoT)-enabled sensors enhances visibility into equipment status, reducing downtime and operational costs. A survey conducted by ABI Research in 2023 indicated that over 60% of logistics companies consider telematics a critical factor for competitive differentiation in their operations. Therefore, the rising focus on telematics and connectivity propels the terminal tractor market expansion.

Terminal Tractor Market Segment Insights

Terminal Tractor Market Outlook – Fuel Type-Based Insights

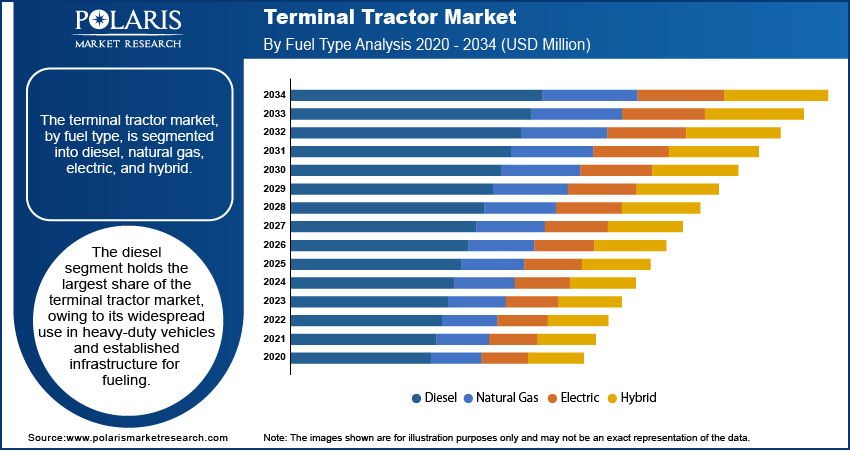

The terminal tractor market, by fuel type, is segmented into diesel, natural gas, electric, and hybrid. The diesel segment holds the largest market share owing to its widespread use in heavy-duty vehicles and established infrastructure for fueling. Diesel-powered terminal tractors continue to be the preferred choice for operations in regions where fuel availability and cost-effectiveness are critical factors. However, the segment is experiencing slower growth as environmental concerns and regulatory pressures drive a shift toward cleaner alternatives. As a result, the electric fuel segment is registering the highest growth, driven by advancements in battery technology and increasing adoption of sustainable practices within logistics and port operations. Electric terminal tractors offer lower operating costs due to reduced fuel consumption and fewer maintenance requirements, making them an attractive option for companies seeking to reduce their carbon footprint and comply with stringent emission standards.

The hybrid and natural gas segments are witnessing moderate growth as they serve as intermediate solutions for companies transitioning toward greener alternatives. Hybrid terminal tractors combine the benefits of diesel and electric power, offering improved fuel efficiency and reduced emissions, while natural gas-powered vehicles are gaining traction due to lower emissions compared to diesel. These segments are growing steadily as they offer viable solutions for operations that require long working hours and heavy-duty performance while complying with environmental regulations. The gradual but steady adoption of these fuel types indicates a broader industry trend toward diversifying fuel sources to meet operational and environmental goals.

Terminal Tractor Market Assessment – Application-Based Insights

The terminal tractor market, by application, is segmented into container handling, trailer handling, and others. The container handling segment holds the largest market share, driven by the high demand for efficient equipment in ports and intermodal transportation hubs. Container handling operations require specialized equipment to manage the movement of heavy, standardized shipping containers, a task that terminal tractors are well-suited for due to their high maneuverability and power. As global trade continues to expand, particularly with the increase in containerized cargo, the demand for terminal tractors in container handling applications is expected to remain strong in the coming years.

The trailer handling segment is registering the highest growth, primarily due to the expansion of warehousing and logistics operations that rely on quick and efficient trailer movements within distribution centers. As e-commerce continues to drive growth in the logistics sector, trailer handling applications are increasingly vital for improving turnaround times and operational efficiency in warehouses. The adoption of advanced technologies, such as automation and telematics, within trailer handling operations is further boosting growth, providing greater control and optimizing vehicle deployment. This trend is particularly prominent in regions with advanced logistics infrastructure, such as North America and Europe.

Terminal Tractor Market Evaluation – Capacity-Based Insights

The terminal tractor market, by capacity, is segmented into light duty, medium duty, and heavy duty. The heavy-duty segment holds the largest market share, as these vehicles are designed to handle the most demanding tasks in ports, logistics centers, and intermodal terminals. Heavy-duty terminal tractors are essential for moving large, heavy containers and trailers, where high power and durability are required. The increasing global trade and expansion of containerized freight transportation have contributed to the dominance of this segment, with heavy-duty models being the preferred choice for large-scale, high-capacity operations. As industries continue to emphasize efficient material handling and the movement of bulk goods, the demand for heavy-duty terminal tractors remains robust.

The medium duty segment is experiencing the highest growth, driven by its flexibility in handling a range of operations in industrial and logistics environments. Medium-duty terminal tractors offer a balance between capacity and fuel efficiency, making them suitable for diverse applications such as warehouse management and trailer transport within distribution centers. With the rise of e-commerce and the need for efficient freight movement in urban and suburban areas, medium-duty models are gaining popularity. This segment's growth is further supported by technological advancements, such as automation and electric drivetrains, which are increasingly being incorporated into medium-duty models to enhance performance and reduce operational costs.

Terminal Tractor Market Outlook – Technology Level-Based Insights

The terminal tractor market, by technology level, is segmented into conventional, automated, and autonomous. The conventional segment holds the largest market share as these vehicles continue to dominate in regions with established infrastructure and where traditional operational methods remain widely employed. Conventional terminal tractors are well-suited for handling heavy loads and performing tasks that require human oversight, making them a reliable option for companies that prioritize cost-efficiency and proven technology. Despite the growing adoption of more advanced systems, conventional terminal tractors still play a crucial role in many logistics and port operations due to their lower upfront costs and familiarity with operators.

The automated technology segment is registering the highest growth, driven by the increasing demand for efficiency, safety, and cost reduction in large-scale terminal operations. Automated terminal tractors, which feature semi-autonomous features such as self-driving capabilities for specific tasks, offer improved productivity by reducing human error and operational downtime. As logistics companies and ports increasingly adopt digitalization, the integration of automated systems is expected to grow in the coming years. This shift is supported by advancements in machine learning, sensor technology, and connectivity, which enhance the operational capabilities of automated terminal tractors. The growing emphasis on safety and optimization of fleet management further drives the adoption of this technology.

Terminal Tractor Market Regional Insights

By region, the study provides terminal tractor market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the terminal tractor market revenue, driven by its advanced logistics infrastructure, high levels of industrialization, and extensive port operations, particularly in the US. The region's dominance is attributed to the strong demand for terminal tractors in major transportation hubs such as the ports of Los Angeles, Long Beach, and New York, which handle a significant volume of containerized freight. Furthermore, North America's push toward automation and sustainability in logistics operations, including the adoption of electric and automated terminal tractors, contributes to the regional market growth. The presence of key market players and favorable government policies promoting green technologies also boost the North America terminal tractor market demand.

Europe is a significant market for terminal tractors, with a strong focus on sustainability and technological advancements. The region's demand is driven by its well-established logistics infrastructure, especially in major ports such as Rotterdam, Hamburg, and Antwerp. Europe is increasingly adopting electric and automated terminal tractors as part of its broader commitment to reducing carbon emissions and meeting stringent environmental regulations. Countries such as the Netherlands, Germany, and France are leading in implementing green technologies in logistics operations. The growth of e-commerce and the need for efficient cargo handling at distribution centers also contribute to the Europe terminal tractor market expansion.

The Asia Pacific terminal tractor market is experiencing robust growth, driven by rapid industrialization, expanding trade activities, and the development of major ports, particularly in China, India, and Japan. As one of the largest and fastest-growing regions in terms of manufacturing and shipping, Asia Pacific witnesses high demand for terminal tractors to support container handling and logistics operations. The region is also witnessing increasing adoption of automation and electric vehicles, particularly in more developed markets such as Japan and South Korea. China's Belt and Road Initiative further enhances the demand for terminal tractors, particularly for use in transportation hubs along trade routes. The growing emphasis on port modernization and logistics efficiency positions Asia Pacific as a key player in the global terminal tractor market.

Terminal Tractor Market – Key Market Players and Competitive Insights

A few key players in the terminal tractor market include Kalmar, Terberg, TICO (Toyota Industries Corporation), Volvo, Konecranes, and Mitsubishi Heavy Industries. Other notable players include Hyster-Yale, Doosan Industrial Vehicle, SANY Group, Liebherr, MANITOU Group, and Caterpillar. Companies such as Green Machines, Anhui Heli, and Komatsu provide significant contributions to the market, focusing on diverse fuel types, including electric and hybrid models. A few newer entrants such as China National Heavy Duty Truck Group (SINOTRUK) are also expanding their presence in this sector. Many market players emphasize the development of electric and automated terminal tractors, aligning with the growing trends toward sustainability and efficiency in logistics.

In terms of competitive dynamics, companies are focusing on enhancing their product portfolios by integrating automation, electrification, and advanced fleet management systems to stay competitive. Manufacturers are increasingly offering a variety of fuel options, such as electric, hybrid, and natural gas, in response to environmental regulations and the demand for cost-efficient solutions. While the market is dominated by well-established players, the rapid technological advancements and shift toward automation are encouraging new entrants, especially those specializing in electric and autonomous vehicles. The adoption of automation technology is a key factor influencing the competitive landscape, with several companies investing in research and development to introduce autonomous terminal tractors that reduce labor costs and improve operational efficiency.

Collaboration and partnerships between key players and technology providers are shaping the market's future. Companies are working to integrate telematics and smart fleet management systems into their terminal tractors, providing operators with enhanced monitoring and data analytics capabilities. The ongoing trend of environmental sustainability also drives competition, as firms aim to offer eco-friendly solutions, such as electric-powered terminal tractors, to meet regulatory standards and market demand. Strategic investments in automation and electric vehicle technologies are expected to influence the competitive environment as the market players work toward expanding their reach and improving the efficiency of their terminal tractor offerings.

Kalmar, a part of Cargotec Corporation, is a prominent player in the terminal tractor market. The company is known for providing a wide range of equipment for port and terminal operations. The company offers solutions that include both diesel and electric terminal tractors, with a focus on improving operational efficiency and reducing emissions. Kalmar has been investing heavily in automation, integrating advanced features in its vehicles to support modern logistics operations.

Terberg is another key player in the terminal tractor market, specializing in the design and manufacturing of vehicles used for trailer handling and other industrial applications. The company’s products are known for their durability and flexibility in various environments, including ports, airports, and warehouses. Terberg has also been investing in electric and automated models to cater to the increasing demand for sustainable solutions.

List of Key Companies in Terminal Tractor Market

- Anhui Heli

- Caterpillar

- Doosan Industrial Vehicle

- Green Machines

- Hyster-Yale

- Kalmar

- Komatsu

- Konecranes

- Liebherr

- MANITOU Group

- Mitsubishi Heavy Industries

- SANY Group

- Terberg

- TICO (Toyota Industries Corporation)

- Volvo

Terminal Tractor Industry Developments

- In September 2023, Terberg received a significant order from a Port of Helsingborg in Sweden for its electric terminal tractors, emphasizing its commitment to supporting green technologies in the logistics and transport sector.

- In July 2023, Kalmar announced the delivery of ten electric terminal tractors to the Port of Gothenburg, marking a step forward in its efforts to provide environmentally friendly solutions for container handling.

Terminal Tractor Market Segmentation

By Fuel Type Outlook

- Diesel

- Natural Gas

- Electric

- Hybrid

By Application Outlook

- Container Handling

- Trailer Handling

- Others

By Capacity Outlook

- Light Duty

- Medium Duty

- Heavy Duty

By Technology Level Outlook

- Conventional

- Automated

- Autonomous

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Terminal Tractor Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 783.20 million |

|

Market Size Value in 2025 |

USD 816.88 million |

|

Revenue Forecast by 2034 |

USD 1,219.19 million |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The terminal tractor market has been broadly segmented on the basis of fuel type, application, capacity, technology level. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy: The terminal tractor market growth strategy is focused on technological innovation, particularly in automation and electrification. Companies are investing in research and development to integrate autonomous features and electric drivetrains into their vehicles, meeting the rising demand for environmentally friendly and efficient solutions. Partnerships and collaborations with technology providers are also playing a key role in expanding product offerings and improving fleet management capabilities. Additionally, key players are targeting emerging markets in Asia Pacific and Latin America, where industrialization and logistics infrastructure are rapidly growing. Marketing efforts are centered on highlighting sustainability, cost-efficiency, and the ability to enhance operational performance

FAQ's

? The terminal tractor market size was valued at USD 783.20 million in 2024 and is projected to grow to USD 1,219.19 million by 2034.

? The market is projected to register a CAGR of 4.5% during the forecast period, 2024-2034.

? North America held the largest share of the market in 2024.

? A few key players in the terminal tractor market are Kalmar, Terberg, TICO (Toyota Industries Corporation), Volvo, Konecranes, and Mitsubishi Heavy Industries. Other notable players include Hyster-Yale, Doosan Industrial Vehicle, SANY Group, Liebherr, MANITOU Group, and Caterpillar.

? The diesel segment accounted for the largest share of the market in 2024.

? The container handling segment accounted for the largest share of the market in 2024.

? A terminal tractor is a specialized vehicle designed for moving trailers and cargo containers within a confined area, such as ports, logistics centers, warehouses, and intermodal terminals. These vehicles are typically used to transport containers from docks to storage areas or to load and unload goods from trucks. Terminal tractors are built for high maneuverability, enabling them to operate in tight spaces, and they can handle heavy loads. They are equipped with features like high towing capacity and a short turning radius, making them essential for efficient cargo handling in busy transport hubs.

? A few key trends in the terminal tractor market are described below: Shift Toward Electric Vehicles: Increasing adoption of electric terminal tractors to reduce emissions and operating costs, driven by environmental regulations. Automation and Autonomous Technology: Rising demand for automated and autonomous terminal tractors to improve operational efficiency, reduce labor costs, and enhance safety. Telematics and Connectivity: Integration of telematics and fleet management systems for real-time monitoring, predictive maintenance, and improved productivity. Sustainability Focus: Growing emphasis on eco-friendly solutions, with many companies shifting to alternative fuel sources such as natural gas and hybrid models.

? A new company entering the terminal tractor market must focus on developing electric and automated vehicles to align with the growing demand for sustainable and efficient solutions. Emphasizing the integration of advanced telematics and fleet management systems can provide added value, offering real-time monitoring and predictive maintenance capabilities. Additionally, targeting emerging markets in regions like Asia-Pacific and Latin America, where logistics infrastructure is expanding rapidly, could offer significant growth opportunities. A focus on customization and flexibility in product offerings, tailored to specific industry needs, would also help differentiate the company from competitors. Further, building strong partnerships with key players in the logistics and port sectors could accelerate market penetration.

? Companies manufacturing, distributing, or purchasing terminal tractors and related products, and other consulting firms must buy the report.