Term Insurance Market Share, Size, Trends, Industry Analysis Report, By Type (Individual Level Term Life Insurance, Group Level Term Life Insurance), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM4211

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

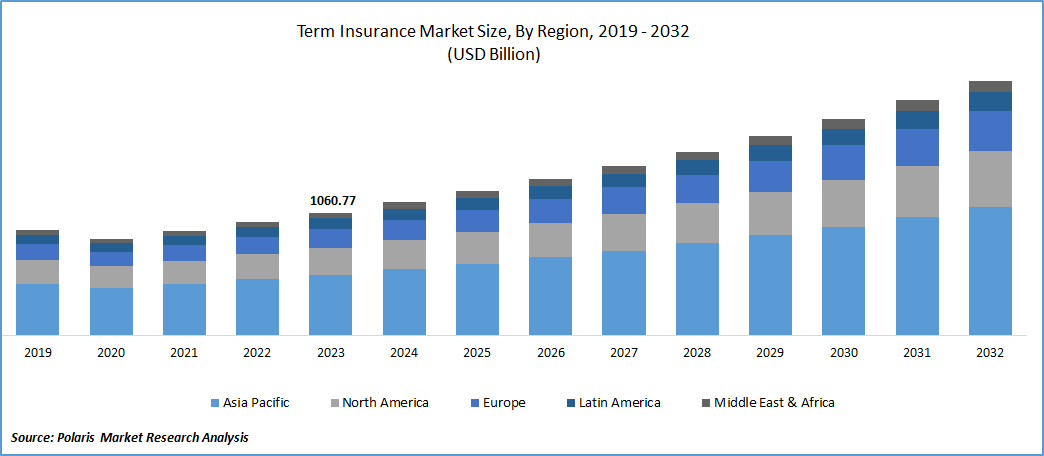

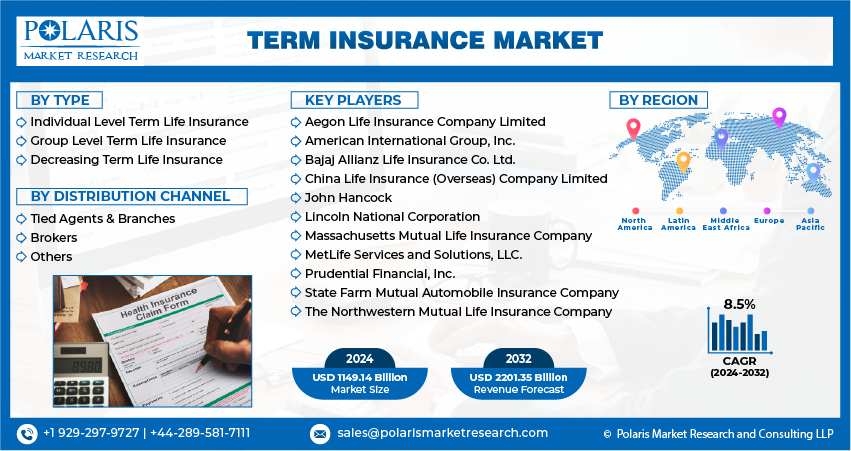

The global term insurance market size and share was valued at USD 1060.77 billion in 2023 and is expected to grow at a CAGR of 8.5% during the forecast period.

Term insurance represents a category of life insurance policies offering coverage for a predetermined period or term. Factors such as cost-effectiveness, heightened awareness, customization, and flexibility are pivotal in fostering the increased adoption of term insurance. Additionally, shifting demographics, a focus on financial security, and evolving trends in the insurance market collectively contribute to the growth of this market.

Insurers can leverage AI to refine large language models (LLMs) for distinct roles and responsibilities within their organizations. These models can be tailored for tasks such as acting as actuaries, underwriters, claims adjusters, and customer service representatives. Nevertheless, considering regulatory considerations and uncertainties about the trustworthiness of AI-generated content and decisions, insurers need to carefully assess the extent to which they delegate tasks to this emerging technology. They should also identify areas where human judgment remains crucial, particularly in terms of quality control oversight.

Term insurance is the purest form of life insurance policy that offers coverage for a predefined period in exchange for a specific premium amount. With a term line insurance plan, the insured person can get comprehensive life coverage at affordable premium rates. In case the insured person dies during the specified term, an assured sum is paid to the nominee. Unlike other insurance policies, term insurance doesn’t have any value other than the guaranteed death benefits and doesn’t feature a saving component.

There are several types of term life insurance, including level term policy, yearly renewable term policy, and decreasing term policy. The premiums of a term life insurance are based on several factors, including the person’s age, health, and life expectancy. Other factors influencing the premium rates include the insurance company’s business expenses and mortality rates for each age. As for the purchase term, these policies can last 10, 15, 20 years, or more. When taking term insurance, a medical examination may be needed in some cases. Besides, some term insurance market key players may inquire about the insurer’s driving record, current medications, family history, and other related information.

To Understand More About this Research, Request a Free Sample Report

Term life insurance provides coverage for a predetermined period, distinguishing it from whole life insurance that requires continuous payments throughout the insured individual's lifetime. Typical durations for term life insurance policies include 10, 20, or 30 years. The growing global adoption of term life insurance is contributing to the expansion of this segment. Term life insurance is favored over permanent policies, with recent data from the American Council of Life Insurers indicating that 48% of the households in the U.S. holding a term life policy, makes it most widely preferred choice compared to cash value policies.

Market growth is substantially driven by the impact of digital transformation. The ongoing digital transformation is playing a crucial role in improving operational efficiency and enhancing the overall customer experience, benefiting both insurers and policyholders. A survey conducted in February 2023 indicated that 60% of consumers consider web-based communication as their primary mode of engagement with insurance companies in the future. The increasing preference for digital interactions among consumers, combined with the proactive adoption of digital transformation technologies by term insurers, is anticipated to be a major catalyst for market expansion.

The term insurance market industry grapples with distinct challenges, and regulatory pressures stand out as a major concern. Regulators on a global scale are advocating for standardized frameworks, compelling term insurance providers to align with risk-based organizational structures and necessitating significant resource allocation and adjustments. The emphasis on consumer-centric governance, aimed at safeguarding policyholders, introduces additional complexities.

Furthermore, the prevalence of cybersecurity threats poses a substantial risk due to the sensitive and personal data handled by term insurance companies. Successfully navigating these evolving regulations and addressing data security concerns is imperative for ensuring the sustained long-term growth of the market.

The market report provides a thorough analysis of the term insurance market, covering all the major aspects stakeholders need to know. It sheds light on the key developments and trends that are anticipated to drive the term insurance market demand over the forecast period. Besides, it maps the qualitative impact of various key factors on market segments and geographies. Furthermore, it examines the key steps taken by industry participants to strengthen their presence in the industry.

Industry Dynamics

Growth Drivers

Technological Advancements

Technological innovations, such as online platforms and mobile apps, have made it easier for people to access and purchase term insurance policies. This convenience can drive market growth.

The term insurance industry is finding a compelling opportunity in the realm of InsurTech. Leveraging cutting-edge technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and big data analytics, InsurTech is streamlining operations, cutting costs, and facilitating more competitive pricing for term insurance products. Furthermore, the impact of InsurTech extends to various aspects, including claims processing, risk assessment, contract drafting, and policy underwriting, thereby significantly enhancing the efficiency of these processes. In the dynamic landscape of insurance, the ascent of InsurTech companies is fundamentally transforming how term insurers operate and deliver services to their customers.

Report Segmentation

The market is primarily segmented based on type, distribution channel, and region.

|

By Type |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Individual segment accounted for the largest market share in 2023

Individual segment accounted for the largest share. Individual-level term insurance is a personalized life insurance product designed to provide coverage for a specific term, typically ranging from 10 to 30 years. What distinguishes it is the determination of premiums based on individual factors such as health, age, and lifestyle. This unique approach tailors the policy to the specific circumstances of the insured person, ensuring they receive the most cost-effective coverage. The segment's growth is propelled by the increasing demand for personalized financial protection and the convenience of customization.

Group segment will grow rapidly. This specialized form of life insurance is tailored for members of a specific group, often employees within a company. It features a collective coverage arrangement where premiums and benefits are determined based on the characteristics and needs of the entire group. It results in cost-effective rates for the individual members due to the group's size & shared risk. The segment's expansion is primarily fueled by the cost-efficiency it provides, making it an appealing employee benefit for businesses and organizations. Additionally, the straightforward enrollment process is contributing to the increased adoption of this segment.

By Distribution Channel Analysis

Tied agents segment held the significant market share in 2023

Tied agents segment held the significant market share. Tied agents serve as crucial distribution channels in the market, being exclusively affiliated with a single insurance company. Their significance is on the rise due to their profound product knowledge, personalized customer service, & strong brand association. These agents have client relationships over time, fostering trust & client loyalty. Tied agents play a key role in simplifying the complex insurance scheme, making it insurance accessible & comprehensible, thereby propelling the growth of this segment.

Brokers segment is expected to gain substantial growth rate. Serving as a crucial distribution channel in the market, brokers provide unbiased advice and access to a diverse array of insurance products from multiple providers. Their role in comparing options and identifying tailored coverage solutions has become increasingly popular, particularly as consumers prioritize greater customization and competitive pricing. The growth of brokers as a prominent and trusted distribution channel is fueled by the transparency and choice they offer, aligning with the rising consumer demand for comprehensive coverage.

Regional Insights

Asia Pacific dominated the global market in 2023

Region is driven by its large and diverse population. As demographics age, there is a growing awareness of the significance of life insurance. Additionally, the presence of numerous life insurance companies, coupled with government support and the adoption of digital technologies, is fostering substantial opportunities for new product development and overall industry advancement in the region.

Europe will grow with substantial pace. Regulatory shifts, economic uncertainties, and an aging population have spurred individuals to prioritize financial security, leading to heightened demand for term insurance. Technological advancements and intensified market competition are also key contributors to the sector's expansion. This growth signifies a region that increasingly acknowledges the importance of term insurance as a valuable tool for financial planning and protection.

Key Market Players & Competitive Insights

The term insurance industry is marked by its fragmented structure, with numerous small and niche players operating in it. Serving a diverse customer base across sectors like finance, healthcare, and technology, key market participants are actively pursuing innovation and introducing customized solutions to meet the unique needs of these industries. Moreover, the market remains dynamic, consistently incorporating emerging technologies, and adjusting to evolving demographics and shifting consumer preferences.

Some of the major players operating in the global market include:

- Aegon Life Insurance Company Limited

- American International Group, Inc.

- Bajaj Allianz Life Insurance Co. Ltd.

- China Life Insurance (Overseas) Company Limited

- John Hancock

- Lincoln National Corporation

- Massachusetts Mutual Life Insurance Company

- MetLife Services and Solutions, LLC.

- Prudential Financial, Inc.

- State Farm Mutual Automobile Insurance Company

- The Northwestern Mutual Life Insurance Company

Recent Developments

- In May 2023, New York Life, has unveiled a diverse range of competitively priced term life products. These offerings not only provide enhanced value for clients' protection investments but also promote preparedness for financial uncertainties and opportunities. Specifically designed to cater to the needs of small business owners and individuals.

Term Insurance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1149.14 billion |

|

Revenue forecast in 2032 |

USD 2201.35 billion |

|

CAGR |

8.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions and segmentation. |

Explore the market dynamics of the 2024 Term Insurance Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Research Industry Reports. The analysis of the Term Insurance Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Delve into the intricacies of term insurance in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Bestselling Reports:

Healthcare Data Monetization Market Size, Share Research Report

Medical Device Testing Services Market Size, Share Research Report

Ophthalmic Drugs Market Size, Share Research Report

Post-Consumer Recycled Plastics Market Size, Share Research Report

Connected Medical Devices Market Size, Share Research Report

FAQ's

The Grinding Fluids Market report covering key segments are type, distribution channel, and region.

The global term insurance market size is expected to reach USD 2,201.35 billion by 2032

The global term insurance market is expected to grow at a CAGR of 8.5% during the forecast period.

Asia Pacific regions is leading the global Term Insurance Market.

Technological Advancements key driving factors in Term Insurance Market.