Temperature Modulation Devices Market Size, Share, Trends, Industry Analysis Report

: By Product (Portable Blood/IV Fluid Warmers, Conductive Patient Warming Systems, Convective Patient Warming Systems, Conductive Patient Cooling Systems, and Other Products & Accessories), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 114

- Format: PDF

- Report ID: PM4077

- Base Year: 2024

- Historical Data: 2020-2023

Temperature Modulation Devices Market Overview

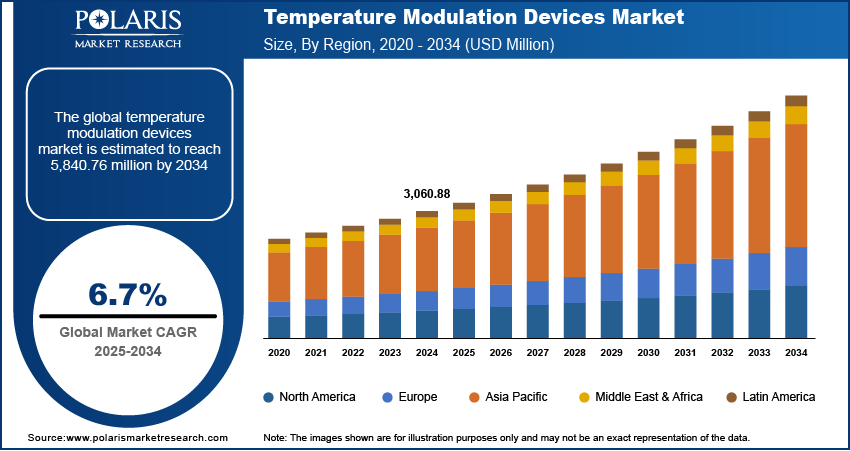

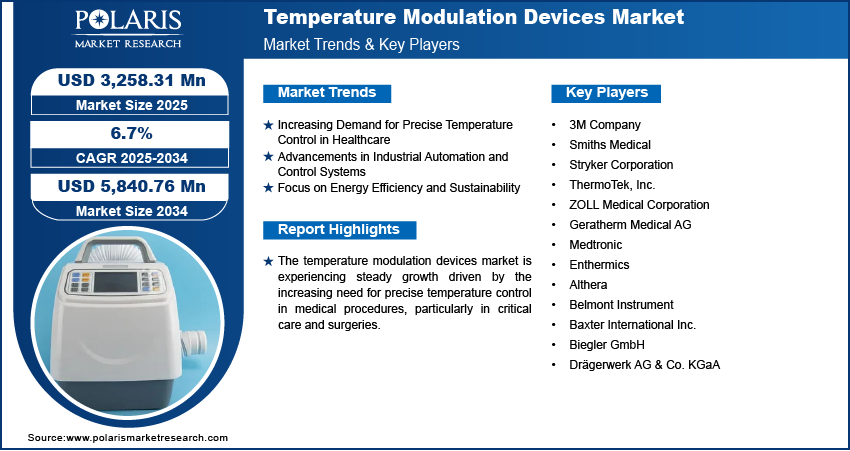

The temperature modulation devices market size was valued at USD 3,060.88 million in 2024. The market is projected to grow from USD 3,258.31 million in 2025 to USD 5,840.76 million by 2034, exhibiting a CAGR of 6.7% during 2025–2034.

The temperature modulation devices market involves in the development and deployment of devices designed to regulate and control temperature variations in various applications. These devices are widely used across sectors such as healthcare, manufacturing, automotive, and electronics.

Key drivers of market growth include the increasing demand for precise temperature control in medical treatments, advancements in industrial automation, and the need for energy-efficient systems in various industries. The temperature modulation devices market trends include the integration of smart technology for better control and monitoring, as well as the growing emphasis on sustainability and energy efficiency in temperature regulation systems.

To Understand More About this Research: Request a Free Sample Report

Temperature Modulation Devices Market Dynamics

Increasing Demand for Precise Temperature Control in Healthcare

The demand for precise temperature modulation is a significant driver in the healthcare sector, especially in medical treatments such as cryotherapy, hyperthermia, and for the preservation of biological materials such as vaccines and organ transplants. Devices that can accurately regulate temperature are essential in maintaining the quality and efficacy of these treatments. According to the World Health Organization (WHO), over 50% of vaccines globally are wasted due to improper temperature control. This highlights the importance of reliable temperature modulation devices in reducing waste and ensuring effectiveness in medical applications. Additionally, the growing use of these devices in therapeutic procedures to treat conditions such as cancer is expected to further increase temperature modulation devices market demand.

Advancements in Industrial Automation and Control Systems

The growing need for temperature control in industrial automation is another key driver of the temperature modulation devices market. As industries move towards automation for greater efficiency, temperature control plays a crucial role in maintaining optimal operational conditions. In industries such as food processing, pharmaceuticals, and electronics manufacturing, precise temperature control ensures product quality and minimizes downtime due to equipment failure.

Focus on Energy Efficiency and Sustainability

The rising focus on energy efficiency and sustainability is driving demand for temperature modulation devices that minimize energy consumption and lower carbon footprints. Governments worldwide are enforcing stricter regulations on energy use and emissions, compelling businesses to adopt energy-efficient solutions. As a result, temperature modulation devices with energy-saving features are gaining popularity, helping industries reduce operational costs while complying with environmental standards. For instance, the widespread adoption of energy-efficient heating, ventilation, and air conditioning (HVAC) systems in commercial and residential buildings aligns with these regulatory measures. According to the U.S. Department of Energy, as of 2022, energy-efficient HVAC systems can cut energy consumption by up to 50% in certain applications, further propelling market growth

Temperature Modulation Devices Market Segment Insights

Temperature Modulation Devices Market Assessment by Product

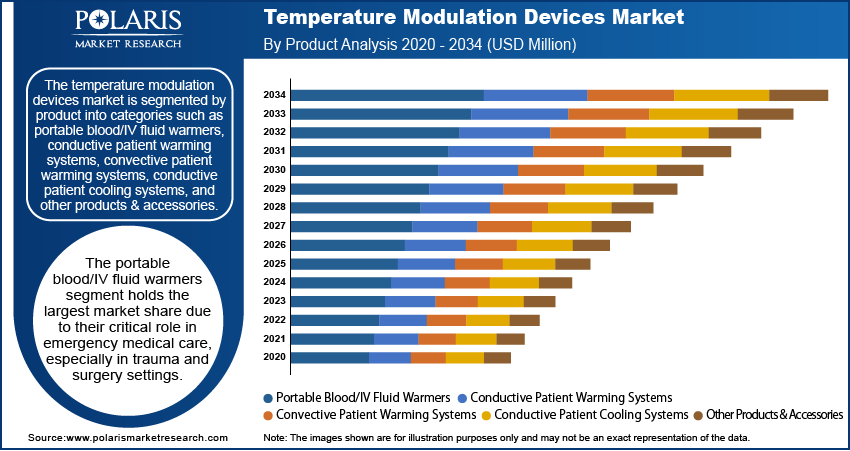

The temperature modulation devices market segmentation, based on product, includes portable blood/IV fluid warmers, conductive patient warming systems, convective patient warming systems, conductive patient cooling systems, and other products & accessories. The portable blood/IV fluid warmers segment holds the largest market share due to its critical role in emergency medical care, especially in trauma and surgery settings. These devices ensure that blood and intravenous fluids are maintained at optimal temperatures, preventing hypothermia and improving patient outcomes. The increasing number of surgical procedures and trauma cases globally is contributing to the steady demand for these warmers, positioning them as a key driver in the market.

The conductive patient warming systems segment is also registering the fastest growth, largely driven by their widespread use in surgical and post-surgical care to maintain patients' core body temperatures. As the emphasis on patient safety and comfort increases, these systems are becoming integral to healthcare protocols. The rise in minimally invasive surgeries and an aging population requiring more frequent medical interventions are also factors propelling the demand for these systems. Other products and accessories, including temperature monitoring devices and cooling accessories, are also witnessing steady growth, although they represent a smaller portion of the overall market compared to the main warming and cooling systems.

Temperature Modulation Devices Market Evaluation by End Use

The temperature modulation devices market is segmented by end use into hospitals and ambulatory surgical centers (ASC). Hospitals hold the largest temperature modulation devices market share due to their extensive use of temperature modulation devices across a wide range of medical applications, including surgery, trauma care, and critical care. Hospitals require these devices to manage the temperature of patients during complex procedures and to ensure proper blood and IV fluid warming, which is essential for maintaining patient stability. The large infrastructure and continuous medical procedures in hospitals ensure that this segment remains dominant in the market.

Ambulatory surgical centers (ASC) are registering the fastest growth in recent years, primarily driven by the increase in outpatient surgeries and the shift towards less invasive procedures. ASCs offer cost-effective alternatives for patients, and as surgical procedures become more common in these settings, the demand for effective temperature management systems is growing. The convenience, lower operational costs, and quick recovery times provided by ASCs contribute to the rising demand for temperature modulation devices in these centers, positioning them as a rapidly expanding segment in the market.

Temperature Modulation Devices Market Regional Insights

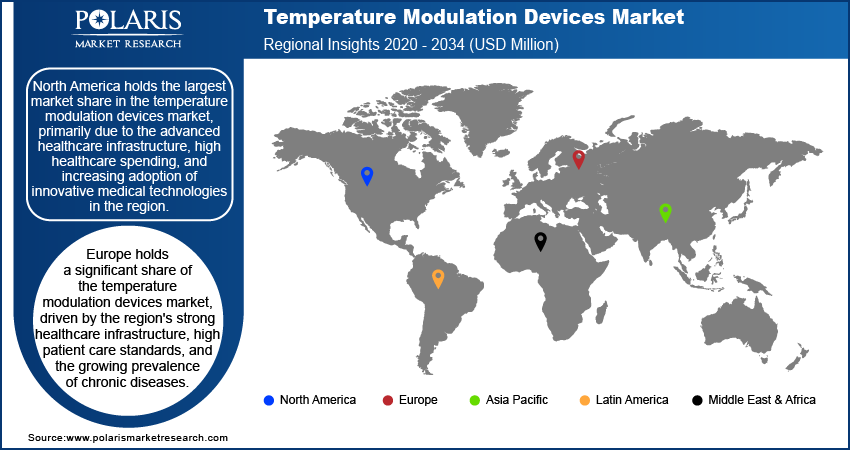

By region, the study provides temperature modulation devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to the advanced healthcare infrastructure, high healthcare spending, and increasing adoption of innovative medical technologies in the region. The presence of key market players, along with a high number of surgical procedures and trauma cases, drives the demand for precise temperature regulation systems in hospitals and ambulatory surgical centers. Additionally, the region benefits from a well-established regulatory framework that supports the adoption of advanced medical devices. Europe follows closely, with strong market growth driven by an aging population and high standards in patient care. Asia Pacific is witnessing rapid growth due to increasing healthcare investments, improved access to medical services, and rising awareness about temperature regulation in medical treatments.

Europe holds a significant share of the temperature modulation devices market, driven by the region's strong healthcare infrastructure, high patient care standards, and the growing prevalence of chronic diseases. Countries such as Germany, the UK, and France are leading in terms of healthcare spending and adoption of advanced medical technologies, which fuels the demand for effective temperature modulation solutions in surgical and critical care. The aging population in Europe also contributes to the rising need for temperature regulation during surgical procedures, as older patients are more likely to undergo surgeries that require precise temperature management. Additionally, stringent regulations and a well-established healthcare system ensure that medical devices meet high safety and quality standards, further supporting market growth.

The temperature modulation devices market in Asia Pacific is experiencing the fastest growth due to rapid economic development, improving healthcare infrastructure, and rising medical needs across emerging economies such as China and India. Increasing awareness of the importance of temperature regulation in healthcare, especially in trauma and surgery cases, is driving demand for these devices. The growing number of surgical procedures, along with a rising middle-class population with greater access to healthcare, is expected to boost temperature modulation devices market expansion. Furthermore, government initiatives to improve healthcare services and invest in modern medical technologies in countries such as Japan, China, and India are expected to contribute to the market growth in the region.

Temperature Modulation Devices Market – Key Players and Competitive Insights

Key players in the temperature modulation devices market include companies such as 3M Company, Smiths Medical, and Stryker Corporation. These companies offer a range of products in the market, including warming and cooling devices used in critical care and surgical settings. ThermoTek, Inc., is also an active player, providing both conductive patient warming systems and portable blood/IV fluid warmers. The company Geratherm Medical AG offers thermal management solutions and is widely recognized in Europe. Medtronic, a global leader in medical technologies, also plays a key role in this market with its advanced systems for temperature control. Additionally, brands such as Enthermics, Althera, and Belmont Instrument are important contributors to the market, focusing on patient warming and cooling technologies.

The competitive dynamics in the temperature modulation devices market are influenced by both technological advancements and the need to adhere to strict regulatory standards. Companies are increasingly integrating smart technology into their products, enabling more precise and automated temperature control during medical procedures. This trend towards connectivity is expected to drive growth, as it allows healthcare providers to monitor patients’ temperature data in real-time, improving clinical outcomes. Moreover, the focus on patient safety and efficiency in medical care is pushing companies to develop more energy-efficient and user-friendly solutions. With increasing healthcare expenditures globally, the market is likely to see intensified competition as companies seek to meet the growing demand for reliable and effective temperature management devices.

3M Company is a multinational corporation that develops a wide range of products, including temperature modulation devices. The company has a strong presence in the medical field, particularly with its patient warming and cooling systems. 3M's products are used in healthcare facilities globally, especially in surgical and critical care settings, where maintaining the right body temperature is crucial. In recent months, 3M has continued to innovate and refine its temperature management solutions, ensuring they meet the growing needs of hospitals and clinics.

Medtronic is another key player in the temperature modulation devices market. It offers various temperature modulation solutions as part of its broader medical device portfolio. Medtronic's products include warming and cooling systems that are used during surgical procedures and for critical care patients. The company is known for its advanced technology and commitment to improving patient outcomes.

List of Key Companies in Temperature Modulation Devices Market

- 3M Company

- Smiths Medical

- Stryker Corporation

- ThermoTek, Inc.

- ZOLL Medical Corporation

- Geratherm Medical AG

- Medtronic

- Enthermics

- Althera

- Belmont Instrument

- Baxter International Inc.

- Biegler GmbH

- Drägerwerk AG & Co. KGaA

Temperature Modulation Devices Market Developments

- November 2024: 3M announced the launch of a new patient warming system designed to enhance patient comfort during surgery and recovery.

- September 2024: Medtronic introduced an updated version of its patient warming device, which incorporates new features for better control and ease of use in fast-paced medical environments, aiming to improve efficiency and safety in hospitals.

Temperature Modulation Devices Market Segmentation

By Product Outlook (Revenue-USD Million, 2020–2034)

- Portable Blood/IV Fluid Warmers

- Conductive Patient Warming Systems

- Convective Patient Warming Systems

- Conductive Patient Cooling Systems

- Other Products & Accessories

By Application (Revenue-USD Million, 2020–2034)

- Perioperative Care

- Acute Care

- Chronic Care

- Newborn Care

- Others

By End Use Outlook (Revenue-USD Million, 2020–2034)

- Hospital

- Ambulatory Surgical Centers (ASC)

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Temperature Modulation Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,060.88 Million |

|

Market Size Value in 2025 |

USD 3,258.31 Million |

|

Revenue Forecast by 2034 |

USD 5,840.76 Million |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The temperature modulation devices market has been segmented into detailed segments of product, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth strategy in the temperature modulation devices market focuses on expanding product portfolios through technological advancements and addressing specific healthcare needs. Companies are increasingly incorporating smart technology to enhance device functionality, providing real-time temperature monitoring and improved patient outcomes. Strategic partnerships with healthcare institutions, along with expansion into emerging markets, are key to increasing market reach. Additionally, companies are investing in research and development to create energy-efficient and user-friendly solutions. Marketing strategies emphasize product reliability, patient safety, and the growing demand for temperature regulation in both surgical and critical care environments.

FAQ's

The temperature modulation devices market size was valued at USD 3,060.88 million in 2024 and is projected to grow to USD 5,840.76 million by 2034.

The market is projected to register a CAGR of 6.7% during the forecast period, 2025-2034.

North America had the largest share of the market.

Key players in the temperature modulation devices market include 3M Company; Smiths Medical; Stryker Corporation; ThermoTek, Inc.; ZOLL Medical Corporation; ConvaTec Group; Geratherm Medical AG; Medtronic; Enthermics; Althera; Belmont Instrument; and Atos Medical.

The portable blood/IV fluid warmers segment accounted for the larger share of the market in 2024.

Temperature modulation devices are medical devices used to regulate and control the body temperature of patients during medical procedures or in critical care settings. These devices are designed to either heat or cool the body to maintain optimal temperature levels, which is crucial for patient safety and comfort. They are commonly used in surgery, trauma care, neonatal care, and post-operative recovery. Temperature modulation devices include products such as warming systems for blood and IV fluids, patient warming and cooling blankets, and other specialized equipment designed to prevent hypothermia or hyperthermia during medical treatments.

A few key trends in the market are described below: Integration of Smart Technology: Increasing adoption of connected devices that allow real-time monitoring and control of temperature for enhanced patient safety. Focus on Energy Efficiency: Growing demand for energy-efficient devices to reduce operational costs and meet environmental standards. Personalized Temperature Management: Development of more customizable solutions to address specific patient needs, especially in surgical and critical care settings. Portable and Compact Devices: Rising preference for portable temperature modulation devices, offering flexibility in both emergency care and home healthcare settings.

A new company entering the Temperature Modulation Devices market could focus on developing smart, connected devices that offer real-time monitoring and data integration for improved patient outcomes. Emphasizing energy-efficient, portable, and user-friendly solutions would cater to the growing demand for flexible and cost-effective products in both hospitals and homecare settings. Innovating in non-invasive and personalized temperature management systems could also help differentiate the company, particularly in specialized areas like neonatal and trauma care. Additionally, focusing on emerging markets where healthcare infrastructure is rapidly expanding could provide a competitive edge, as these regions are increasingly adopting advanced medical technologies.

Companies manufacturing, distributing, or purchasing Temperature Modulation Devices and related products, and other consulting firms must buy the report.