Teleradiology Software Market Size, Share, Trends, Industry Analysis Report: By Type (Radiology Information System, Picture Archive and Communication System, and Vendor Neutral Archive), Mode of Delivery, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 134

- Format: PDF

- Report ID: PM5156

- Base Year: 2024

- Historical Data: 2020-2023

Teleradiology Software Market Overview

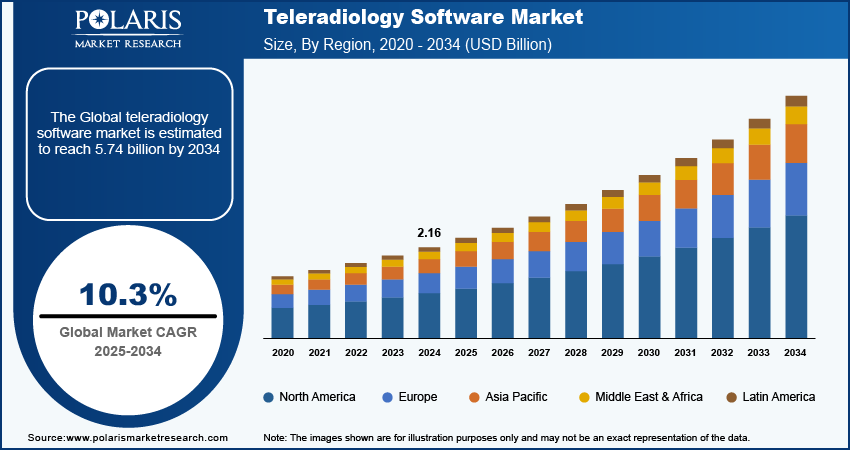

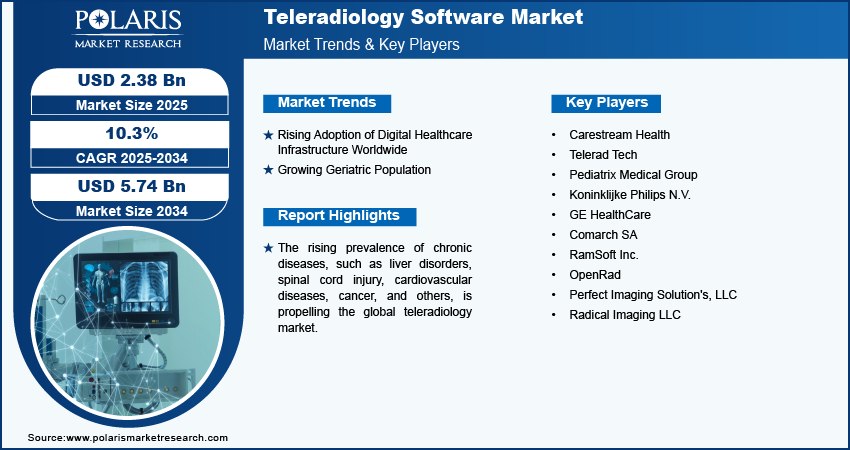

The teleradiology software market size was valued at USD 2.16 billion in 2024. The market is projected to grow from USD 2.38 billion in 2025 to USD 5.74 billion by 2034, exhibiting a CAGR of 10.3% during 2025–2034.

Teleradiology is a transformative aspect of telemedicine that enables the remote transmission and interpretation of radiological images, such as X-rays, CT scans, and MRIs, from one location to another. This technology addresses the growing demand for radiological services, particularly in areas where there is a shortage of qualified radiologists. The core functionality of teleradiology software involves several integrated components such as an image-sending station, secure transmission network, and a receiving station equipped with high-resolution monitors and specialized software for image analysis.

To Understand More About this Research: Request a Free Sample Report

The rising prevalence of chronic diseases is driving the teleradiology software market. As per data published by the National Library of Medicine, approximately one in three of all adults suffer from multiple chronic conditions (MCCs) globally. Chronic disease management often involves multiple healthcare providers, including primary care physicians, specialists, and radiologists. Teleradiology software fosters improved communication and collaboration among these professionals by providing instant access to imaging data. This integrated approach ensures that all providers are aligned in their treatment plans, leading to better patient outcomes.

Many patients suffering from chronic diseases live in rural or underserved areas where access to specialized radiological services is limited. Teleradiology software allows healthcare facilities to connect with radiologists remotely, ensuring that patients receive timely evaluations without needing to travel long distances. This approach enhances accessibility to care, which is crucial for managing chronic conditions effectively.

Teleradiology Software Market Driver Analysis

Growing Geriatric Population

The growing geriatric population worldwide is propelling the global teleradiology software market. According to data published by the United Nations, the number of people aged 65 years and above worldwide is projected to more than double, rising from 761 million in 2021 to 1.6 billion by 2050. Many elderly patients may have mobility issues or live in remote areas where access to healthcare facilities is limited. Teleradiology software enables healthcare providers to deliver radiological services remotely, ensuring that older adults receive timely imaging evaluations without the need for extensive travel. This enhances accessibility and convenience for a population that may struggle to access traditional healthcare settings.

Rising Adoption of Digital Healthcare Infrastructure Worldwide

Digital healthcare infrastructure supports advanced patient management systems that streamline workflows. In this infrastructure, teleradiology software facilitates the scheduling, tracking, and monitoring of imaging procedures for older patients. Moreover, digital healthcare infrastructure makes it easier for healthcare providers to establish teleradiology services in various settings, including rural and underserved areas. Therefore, the rising adoption of digital healthcare infrastructure fuels the global teleradiology software market growth.

Teleradiology Software Market Segment Insights

Teleradiology Software Market Breakdown by Type Insights

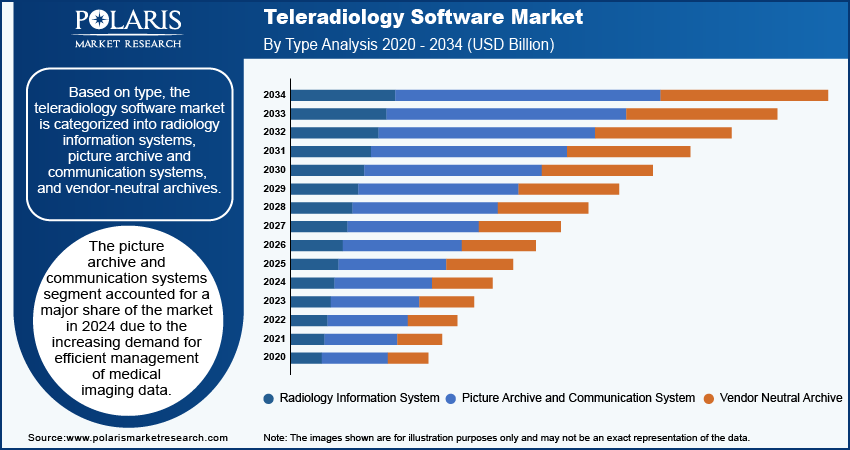

Based on type, the teleradiology software market is categorized into radiology information systems, picture archive and communication systems, and vendor-neutral archives. The picture archive and communication systems segment accounted for a major share of the market in 2024 due to the increasing demand for efficient management of medical imaging data and the need for seamless integration with existing healthcare IT infrastructure. Healthcare facilities faced growing pressure to enhance their operational efficiencies and improve patient outcomes, prompting a shift toward digital solutions that facilitate rapid access to imaging studies. PACS solutions provide healthcare providers with the capability to store, retrieve, and share medical images securely, thereby supporting remote consultations and diagnostic processes. Additionally, the rise in the volume of imaging studies due to an aging population and the prevalence of chronic diseases fueled the demand for these systems.

The vendor-neutral archives segment is expected to grow at a rapid pace during the forecast period, owing to the increasing emphasis on interoperability and data accessibility in healthcare settings. VNAs allow healthcare organizations to store imaging data in a standardized format, making it easier to share and access information across different systems and departments. The ability of VNAs to streamline the storage and retrieval of images while promoting interoperability positions them as a vital component in the future of medical imaging management.

Teleradiology Software Market Breakdown by Mode of Delivery Insights

In terms of mode of delivery, the teleradiology software market is segmented into web-based, cloud-based, and on-premise. The web-based segment held the largest market share in 2024 due to its unparalleled accessibility and ease of use. Healthcare providers increasingly favored web-based solutions as they allow radiologists to access imaging data and perform analyses virtually from any location with internet connectivity. This flexibility enhances remote collaboration and supports telemedicine initiatives, enabling timely diagnoses and improved patient care. Additionally, web-based systems often require less upfront investment and maintenance compared to on-premise alternatives, making them an attractive option for small practices and large healthcare organizations.

The cloud-based segment is projected to grow at a robust pace in the coming years, owing to the growing digital transformation and data management in healthcare. Organizations are increasingly recognizing the advantages of cloud-based solutions, which offer scalability, cost-effectiveness, and robust data security. Furthermore, the cloud's ability to facilitate seamless data sharing across multiple platforms and devices supports the growing need for interoperability among various healthcare systems. The cloud-based delivery mode is expected to position itself as a crucial segment in the evolution of imaging management as the emphasis on collaborative care and integrated health networks intensifies.

Teleradiology Software Market Regional Insights

By region, the study provides the teleradiology software market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to the robust healthcare infrastructure, high adoption rates of advanced imaging technologies, and a growing emphasis on telehealth solutions. Healthcare providers increasingly embraced digital tools to enhance patient care and operational efficiency. The region also benefits from significant investments in healthcare IT, which facilitates the integration of imaging systems into broader health information exchanges. Moreover, regulatory support for telemedicine practices and reimbursement policies that favor remote consultations further propelled the demand for efficient imaging management solutions such as teleradiology software. The need for effective and timely diagnostic services becomes more critical as the population ages and the prevalence of chronic diseases rises, reinforcing North America's leadership in the market.

The Asia Pacific teleradiology software market is expected to record a significant CAGR during the forecast period due to rapid advancements in healthcare technology and increasing healthcare expenditures across several countries. Nations such as China and India are at the forefront of this growth as they invest heavily in expanding their healthcare infrastructures and improving access to diagnostic services. The rising prevalence of lifestyle-related diseases and the growing awareness of the benefits of early diagnosis contribute to the demand for teleradiology software across the region. Furthermore, governments of the region are actively promoting telemedicine initiatives to improve healthcare access in rural and underserved areas, which propels the adoption of teleradiology software. For instance, the Government of India launched eSanjeevani in November 2019 to provide healthcare services to patients in remote regions of the nation.

Teleradiology Software Market Key Players and Competitive Insights

Prominent market players are investing heavily in research and development to expand their offerings, which will drive the teleradiology software market growth in the coming year. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the teleradiology software industry must offer innovative solutions.

The teleradiology software market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Carestream Health; Telerad Tech; Pediatrix Medical Group; Koninklijke Philips N.V.; GE HealthCare; Comarch SA.; RamSoft Inc.; OpenRad; Perfect Imaging Solution's, LLC; and Radical Imaging LLC.

RamSoft Inc. is a prominent player in the field of radiology software solutions, specializing in cloud-based radiology information systems (RIS) and picture archiving and communication systems (PACS). The company has established itself as a prominent provider of teleradiology services, catering to a diverse clientele that includes imaging centers, hospitals, and teleradiology providers. The company's flagship products, PowerServer and OmegaAI, are designed to provide comprehensive, scalable solutions that facilitate efficient image management and reporting.

Pediatrix Medical Group, established in 1979, is a major provider of specialized healthcare services focused on women, infants, and children in the US. The organization has built a reputation for delivering high-quality, evidence-based care across various settings, including hospitals and outpatient clinics. With a workforce of over 8,000 employees and more than 2,600 physicians, Pediatrix operates in 38 states and partners with ∼780 hospitals.

List of Key Companies in Teleradiology Software Market

- Carestream Health

- Telerad Tech

- Pediatrix Medical Group

- Koninklijke Philips N.V.

- GE HealthCare

- Comarch SA

- RamSoft Inc.

- OpenRad

- Perfect Imaging Solution's, LLC

- Radical Imaging LLC

Teleradiology Software Industry Developments

July 2024: RamSoft, a global player in cloud-based RIS/PACS radiology solutions, and RADPAIR, a trailblazer in healthcare technology, announced the integration of AI-driven radiology report generation into the OmegaAI platform to automate the creation of patient-specific reports and streamline clinical output for radiologists.

May 2024: Carestream, a global company that provides medical imaging systems, healthcare IT solutions, and other services, introduced Image Suite MR 10 software to enhance the imaging experience for computed radiography (CR) and digital radiography (DR) imaging systems.

February 2024: The Telerad Group, a global provider of remote radiology services, released its AI-powered RIS-PACS solution RADSpa at Arab Health 2024 for the radiology industry.

Teleradiology Software Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Radiology Information System

- Picture Archive and Communication System

- Vendor Neutral Archive

By Mode of Delivery Outlook (Revenue, USD Billion, 2020–2034)

- Web-Based

- Cloud-Based

- On-Premise

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Teleradiology Software Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.16 billion |

|

Market Size Value in 2025 |

USD 2.38 billion |

|

Revenue Forecast by 2034 |

USD 5.74 billion |

|

CAGR |

10.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global teleradiology software market size was valued at USD 2.16 billion in 2024 and is projected to grow to USD 5.74 billion by 2034

The global market is projected to register a CAGR of 10.3% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Carestream Health; Telerad Tech; Pediatrix Medical Group; Koninklijke Philips N.V.; GE HealthCare; Comarch SA.; RamSoft Inc.; OpenRad; Perfect Imaging Solution's, LLC; and Radical Imaging LLC.

The vendor neutral archive segment is projected for significant growth in the global market during the forecast period.

The web-based segment dominated the market in 2024.