Telepresence Equipment Market Share, Size, Trends, Industry Analysis Report, By Type (Immersive, Personal, Room based, Multi-Codec, Robotic, Others); By Component (Hardware, Software, Services); By Organization Size (Large Enterprises, Small and Medium Sized Businesses); By End-Use; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 113

- Format: PDF

- Report ID: PM2112

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

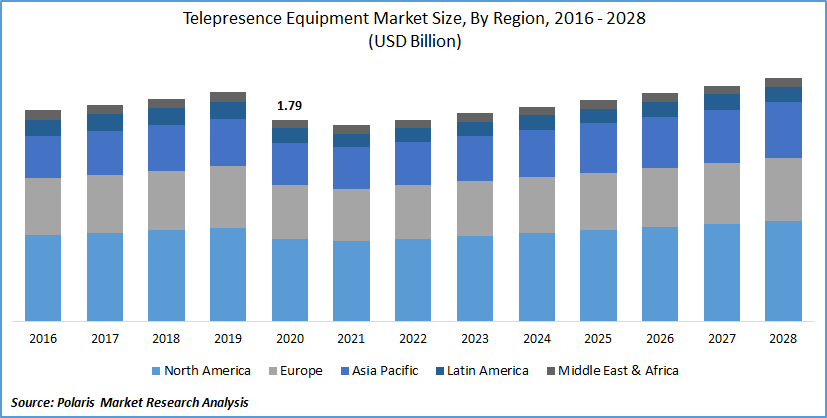

The global telepresence equipment market size was valued at USD 1.79 billion in 2020 and is expected to grow at a CAGR of 3.1% during the forecast period. Telepresence equipment is used for high-quality remote communication through devices such as a microphone, telepresence camera, and display devices. It provides an immersive collaborative experience with high-quality video and audio. The audio and speech quality is free of echo and static breaks while canceling out environmental interferences.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The adoption of telepresence equipment has increased owing to its ability to transmit premium quality video through high-fidelity technology. It provides an immersive experience of being in the same room from a remote location. Adoption of telepresence equipment reduces time and expenses associated with traveling for meetings or presentations. Small and medium-sized businesses are increasingly investing in telepresence equipment for efficient and secure communication, improved customer experience, higher productivity, and employee collaboration.

The greater need for collaboration, high-quality interaction with clients, and effective communication within the workforce by various large and small businesses are driving this market. Increasing adoption of telepresence robots and growing market demand from healthcare and education sectors have resulted in greater adoption. With the increasing trend of remote working, especially during the pandemic, businesses across the globe are turning towards virtual meetings and conferences. The increasing penetration of smart devices, rising digitization, and better customer experiences further supplement the growth of this market.

Know more about this report: request for sample pages

Superior voice and video quality offered by telepresence equipment, reduced technology costs, and the ability to enhance existing business flow have further increased its adoption worldwide. However, the high initial price and lack of standardization limit the growth of the market. The adoption of telepresence equipment increased during the COVID-19 outbreak due to the greater need for work from home due to lockdowns and social distancing regulations. The rising demand for seamless and high-quality communication has encouraged businesses to adopt telepresence equipment.

Healthcare organizations are adopting telepresence equipment to deliver improved services to patients, offer remote therapy, and enable doctor appointments and clinical meetings during the pandemic. This equipment enhances safety and wellness for healthcare workers, patients, and hospitals.

Report Segmentation

The market is primarily segmented on the basis of type, component, organization size, end-use, and region.

|

By Type |

By Component |

By Organization Size |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

The type segment has been divided into personal, immersive, room-based, robotic, multi-codec, and others. The room-based accounted for a major share of the market. Room systems enable transforming any space into a telepresence equipment room to provide an immersive videoconferencing experience. It is used by organizations to improve collaboration, conduct board room meetings, and provide real-time communication.

Insight by Component

The component segment has been sub-segmented into software, hardware, and services. In 2020, the hardware segment accounted for the highest market share owing to the increasing need for high-quality equipment such as display devices, sensors, audio devices, cameras, microphones, and supporting infrastructure. The adoption of technologically advanced hardware equipment has resulted in improved interaction, superior customer experience, and higher productivity.

Insight by Organization Size

The organization size segment has been sub-segmented into large enterprises and small and medium-sized businesses. In 2020, the large enterprise segment accounted for the highest market share due to the massive amount of resources and technological advancements. However, small and medium-sized businesses are increasing investment in telepresence equipment for higher efficiency and improved workflow.

Insight by End-Use

On the basis of the end-use industry, the market is segmented into education, healthcare, commercial, manufacturing, and others. The demand from the healthcare sector is expected to increase during the forecast period. The outbreak of COVID-19 has necessitated the use of telepresence equipment to deliver improved services to patients, offer remote therapy, facilitate doctor appointments, remote observation of patients, and clinical meetings, among others. A massive increase in the use of mobile devices, a greater need for collaboration, and strict healthcare regulations have boosted the growth of this segment.

Regional Outlook

North America held the major share in the global telepresence equipment market in 2020. Businesses are increasingly turning towards this equipment due to the greater need for real-time interaction across different locations. Established technological infrastructure in the region combined with the high adoption of advanced technologies fuels the growth of the market in the region.

North America accounts for a major share of the global market due to various mergers and acquisitions between leading vendors. The industry leaders are expanding and strengthening their presence in the region, leading to market growth.

Competitive Landscape

The leading players in the telepresence equipment market include Array Telepresence, Avaya, Inc., Cisco Systems, Inc., Digital Video Enterprises, HaiVision, Huawei Technologies Co. Ltd., Polycom, Inc., Videonations Limited., Vidyo, Inc., and ZTE Corporation. These companies are taking initiatives to strengthen their market presence by introducing advanced solutions for their customers. These players are also collaborating with other market leaders to expand their offerings and acquire new customers.

Telepresence Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 1.79 billion |

|

Revenue forecast in 2028 |

USD 2.16 billion |

|

CAGR |

3.1% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Type, By Component, By Organization Size, By End-use Industry, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

Array Telepresence, Avaya, Inc., Cisco Systems, Inc., Digital Video Enterprises, HaiVision, Huawei Technologies Co. Ltd., Polycom, Inc., Videonations Limited., Vidyo, Inc., and ZTE Corporation. |