Telepharmacy Market Size, Share, Trends, Industry Analysis Report: By Type, Component (Hardware and Software), Delivery Mode, Devices, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 118

- Format: PDF

- Report ID: PM1726

- Base Year: 2024

- Historical Data: 2020-2023

Telepharmacy Market Overview

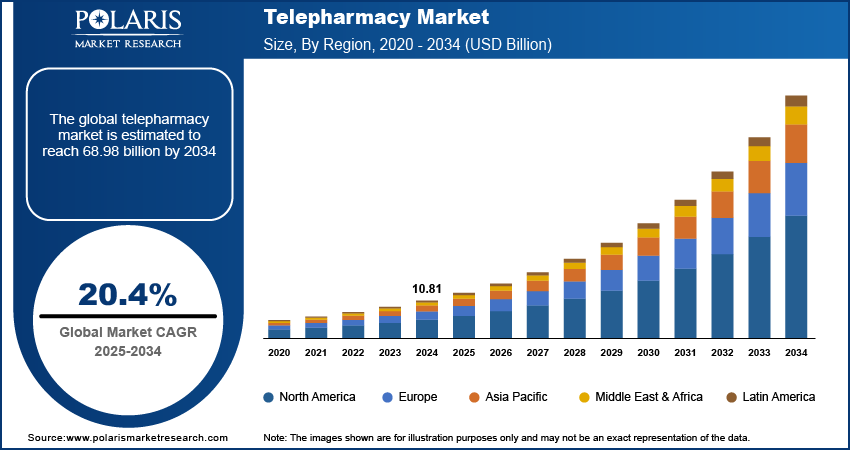

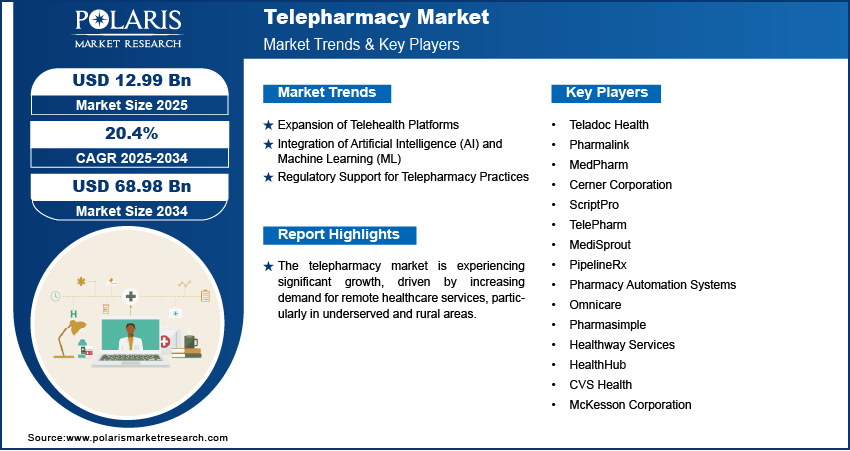

The global telepharmacy market size was valued at USD 10.81 billion in 2024. The market is projected to grow from USD 12.99 billion in 2025 to USD 68.98 billion by 2034, exhibiting a CAGR of 20.4% from 2025 to 2034.

The telepharmacy market refers to the provision of pharmaceutical services through remote communication technologies, enabling pharmacists to offer consultations, medication counseling, and other services to patients in underserved or rural areas. A few of the key factors driving the telepharmacy market growth are the increasing demand for healthcare access in remote locations, advancements in telemedicine, and the growing need for cost-effective healthcare solutions.

Key trends such as the expansion of telehealth platforms, the integration of artificial intelligence (AI) and machine learning (ML) to enhance medication management, and regulatory support in various regions facilitating telepharmacy practices are expected to drive market development in the coming years. Additionally, the rise of chronic disease management, especially in aging populations, has contributed to the growth of telepharmacy services.

To Understand More About this Research: Request a Free Sample Report

Telepharmacy Market Dynamics

Adoption of Telehealth Platforms

Telehealth platforms enable pharmacists to provide remote consultations, medication delivery services, and patient education. The increasing integration of telemedicine into routine healthcare services has accelerated the adoption of telehealth platforms. According to a report by the American Medical Association, the use of telehealth services in the US surged by over 50% in 2020 due to the COVID-19 pandemic, and it remains a pivotal aspect of healthcare delivery. As telehealth continues to evolve, the scope of telepharmacy is expanding, providing enhanced convenience and access to pharmaceutical services, particularly for rural and underserved populations. Thus, the widespread adoption of telehealth platforms is driving the telepharmacy market development.

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

The integration of AI and ML technologies into telepharmacy systems is revolutionizing medication management and patient care. These technologies can assist in identifying drug interactions, predicting patient compliance, and providing personalized medication recommendations. A 2023 study published in the Journal of Pharmaceutical Health Services Research highlighted that AI-based telepharmacy systems could improve medication adherence by up to 30% as compared to traditional methods. This trend is expected to continue as artificial intelligence and ML technologies improve efficiency, reduce errors, and ensure the safe dispensing of medications remotely.

Regulatory Support for Telepharmacy Practices

Regulatory advancements have played a significant role in the growth of telepharmacy. Governments and regulatory bodies worldwide are increasingly recognizing the importance of telepharmacy services in improving access to healthcare, particularly in rural and remote areas. For instance, in the US, the Drug Enforcement Administration (DEA) extended the temporary allowance for telepharmacy consultations and prescription dispensing during the COVID-19 pandemic, which has since been continued in certain states. A 2022 report from the National Alliance of State Pharmacy Associations (NASPA) revealed that 38 US states have enacted laws to allow telepharmacy services, fostering the telepharmacy market expansion. As regulations continue to evolve, telepharmacy is becoming more integrated into mainstream healthcare systems.

Telepharmacy Market Segment Insights

Telepharmacy Market Evaluation Based on Type

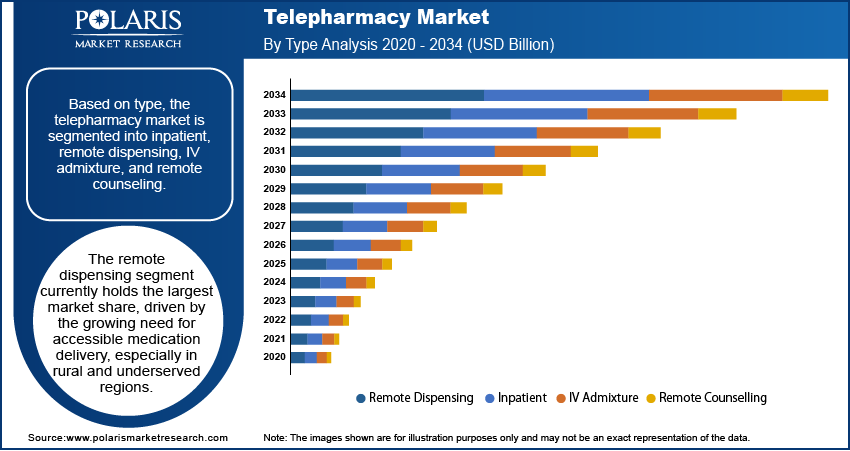

The telepharmacy market, by type, is segmented into inpatient, remote dispensing, IV admixture, and remote counseling. Among these, the remote dispensing segment currently holds the largest market share, driven by the growing need for accessible medication delivery, especially in rural and underserved regions. The convenience of providing prescription medications through remote systems, coupled with advancements in telemedicine, has accelerated the adoption of this model. Additionally, the remote dispensing segment is registering the highest growth, fueled by increasing consumer demand for faster and more efficient pharmaceutical services, particularly during the COVID-19 pandemic and its aftermath.

The inpatient telepharmacy segment, though smaller in comparison, is experiencing steady growth as hospitals and healthcare institutions seek to improve the efficiency and accessibility of their pharmaceutical services. Remote counseling, while valuable for enhancing patient education and medication management, is also gaining traction but does not currently hold as significant a market shares as remote dispensing. The IV admixture segment, focusing on the preparation and management of intravenous medications, is expected to grow moderately, driven by technological advancements in telehealth platforms and the need for specialized pharmacy services in clinical settings. However, the pace of growth in this segment is slower compared to that of remote dispensing, which remains the dominant driver of market expansion.

Telepharmacy Market Assessment Based on Component

The telepharmacy market, based on component, is segmented into hardware and software. The software segment currently holds the largest market share, driven by the increasing demand for integrated platforms that facilitate the management of telepharmacy services. These software solutions include patient management systems, medication dispensing software, and teleconsultation tools, which are crucial for the effective operation of remote pharmaceutical services. The software segment is also registering the highest growth, fueled by advancements in cloud-based technology, AI, and the rising adoption of telemedicine platforms that require robust software systems for seamless operations and data security.

The hardware segment, while essential for enabling telepharmacy services, holds a smaller market share compared to software but is experiencing steady growth. This segment includes devices such as automated dispensing systems, telecommunication equipment, and monitoring tools, which are increasingly being integrated into telepharmacy operations. As demand for remote dispensing and patient monitoring rises, the need for specialized hardware is also expected to increase. However, the growth in this segment is comparatively moderate, as it is primarily driven by the expansion of telemedicine infrastructure and the integration of technology into healthcare systems. Despite its smaller share, the hardware segment plays a critical role in supporting the functionalities provided by telepharmacy software.

Telepharmacy Market Outlook Based on Delivery Mode

The telepharmacy market is segmented by delivery mode into on-premises, web-based, and cloud-based platforms. The cloud-based segment holds the largest market share and is registering the highest growth due to the increasing demand for flexible, scalable, and cost-effective solutions in telepharmacy. Cloud-based systems offer real-time access to pharmaceutical data, remote consultations, and seamless integration with other healthcare technologies, making them a preferred choice for healthcare providers looking to streamline their services. The growing adoption of cloud-based platforms in healthcare, facilitated by advancements in cloud security and infrastructure, has played a key role in this segment's expansion.

Web-based platforms, though smaller than cloud-based systems, are also witnessing steady growth as they provide easy access to telepharmacy services through standard web browsers, without the need for additional installations. On-premises solutions, which involve installing and maintaining software within an organization's infrastructure, hold a more limited share of the market. Despite this, they continue to be favored by certain healthcare institutions due to their control over data security and internal management. However, the higher operational and maintenance costs of on-premises systems have led to a preference for cloud-based and web-based platforms, which are generally more cost-efficient and provide greater scalability.

Telepharmacy Market Outlook Based on Devices

The telepharmacy market, based on devices, is segmented into computers, smartphones and tablets, and kiosks. The smartphones and tablets segment currently holds the largest market share and is registering the highest growth, driven by the increasing penetration of mobile devices and the demand for on-the-go healthcare services. These devices offer flexibility and convenience for patients and healthcare providers alike, allowing for real-time consultations, prescription refills, and medication management through telepharmacy applications. The rise of mobile health (mHealth) initiatives and the growing preference for mobile-first solutions have been key factors fueling the growth of this segment.

The computers segment continues to hold a significant position in the telepharmacy market, particularly in professional settings where pharmacists utilize desktop computers for medication management, patient consultations, and administrative tasks. However, its growth rate is relatively stable compared to the rapid expansion of mobile devices. The kiosk segment, though smaller in comparison, is gaining traction, especially in high-traffic locations such as pharmacies, clinics, and hospitals, where they provide automated prescription services and basic consultations. Kiosks offer a self-service model that can enhance patient convenience but are still limited in adoption due to the high initial investment and infrastructure requirements. Despite this, the segment is expected to grow as telepharmacy services become more integrated into public healthcare infrastructure.

Telepharmacy Market Assessment Based on Application

The telepharmacy market is segmented by application into hospitals, small pharmacies, nursing homes, prisons, military bases, and warships. The hospitals segment holds the largest market share and is registering the highest growth, driven by the increasing adoption of telemedicine solutions and the need for efficient medication management systems. Hospitals are incorporating telepharmacy to enhance patient care, particularly in remote or underserved areas, by offering virtual consultations and remote medication dispensing. Additionally, hospitals benefit from the integration of telepharmacy into their broader telehealth and electronic health record (EHR) systems, which facilitates seamless patient care and better coordination of services.

Small pharmacies, while holding a smaller share of the market, are also experiencing growth as they adopt telepharmacy solutions to expand their reach and improve customer service. These pharmacies use telepharmacy platforms to offer consultations, deliver medications, and provide additional services to patients in remote areas or those with limited access to in-person pharmacy services. Other applications, such as nursing homes, prisons, military bases, and warships, also contribute to the market, though these segments typically represent niche areas. The growth in these segments is driven by the need for secure, reliable, and accessible pharmaceutical services in controlled environments where patients may have limited access to on-site pharmacists.

Telepharmacy Market Regional Analysis

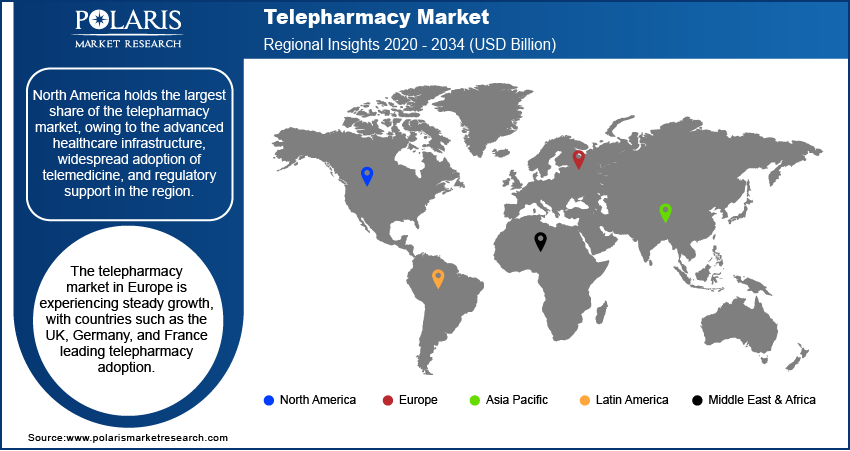

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the telepharmacy market, driven by the advanced healthcare infrastructure, widespread adoption of telemedicine, and regulatory support in the region. The US is a key contributor, with increasing demand for accessible healthcare services in rural areas and remote regions, which is pushing the growth of telepharmacy solutions. Additionally, the integration of telehealth platforms, government initiatives, and the growing preference for cost-effective and efficient healthcare delivery fuel the market expansion in North America. Europe follows closely, with significant adoption in countries like the UK and Germany, while Asia Pacific is emerging as a fast-growing market due to rising healthcare demand and digital healthcare initiatives. Latin America and the Middle East & Africa are witnessing slower adoption, but they are gradually increasing investments in telepharmacy infrastructure to address gaps in healthcare access.

The Europe telepharmacy market is experiencing steady growth, with countries such as the UK, Germany, and France leading adoption. The region benefits from a strong healthcare infrastructure and regulatory support that allows for the integration of telepharmacy services into existing healthcare systems. The European Union has been encouraging the use of telehealth, which includes telepharmacy, to increase access to medical services, especially in rural areas. In the UK, for example, the National Health Service (NHS) has been actively integrating telemedicine solutions, including telepharmacy, to manage medication and provide remote consultations. Despite slower adoption in some Southern and Eastern European countries, the market is expected to grow due to ongoing advancements in digital healthcare initiatives and telemedicine policies.

Asia Pacific is witnessing rapid growth in the telepharmacy market, driven by increasing healthcare demands and the growing adoption of digital health solutions. Countries such as India, China, Japan, and Australia are seeing substantial investments in telemedicine and telepharmacy services. In India, the government’s push for digital healthcare through initiatives such as the National Digital Health Mission has spurred telepharmacy adoption, particularly in rural regions where access to healthcare services is limited. China and Japan are also making significant strides, with Japan focusing on telehealth integration in response to an aging population and China leveraging technology to improve healthcare access in rural areas. While challenges such as regulatory frameworks and infrastructure gaps persist in some regions, the overall trend towards digital health is expected to drive growth across the regional market.

Telepharmacy Market – Key Players and Competitive Insights

Key players in the telepharmacy market include companies such as Teladoc Health, Pharmalink, MedPharm, Cerner Corporation, ScriptPro, TelePharm, MediSprout, PipelineRx, Pharmacy Automation Systems, Omnicare, Pharmasimple, Healthway Services, HealthHub, CVS Health, and McKesson Corporation. These companies are actively involved in providing telepharmacy services through a range of solutions, including remote consultations, medication management, prescription dispensing, and pharmacy automation. Many of these companies focus on expanding their technological capabilities, enhancing patient experiences, and integrating telepharmacy into broader healthcare systems, particularly through partnerships with hospitals and healthcare providers.

The competitive landscape of the telepharmacy market is shaped by a combination of large healthcare service providers and specialized telepharmacy technology firms. Key players compete on the basis of technological innovations, customer reach, and service offerings. Companies like Teladoc Health and CVS Health leverage their extensive healthcare networks and brand recognition to expand their telepharmacy services. Meanwhile, firms such as TelePharm and PipelineRx focus on delivering more specialized telepharmacy platforms that cater to specific healthcare settings, such as hospitals and pharmacies. The competitive advantage for these companies often lies in their ability to integrate telepharmacy solutions into broader healthcare delivery systems, improving medication management and patient outcomes.

The market is also seeing growing collaboration and partnerships between telepharmacy providers and healthcare institutions, which is contributing to its expansion. Smaller companies, such as ScriptPro and Omnicare, offer automation and medication management solutions, providing a more cost-effective way for pharmacies to manage remote dispensing. Regulatory changes, including the increased acceptance of telemedicine, are also benefiting companies in the telepharmacy space, as they enable remote consultations and prescription services to be offered more widely. However, as the market grows, competition is expected to intensify, with companies needing to continually innovate to maintain their position, particularly in regions where digital healthcare adoption is accelerating.

Teladoc Health is a prominent player in the telepharmacy market, known for providing telehealth services, including remote consultations and medication management. The company offers a variety of healthcare services via digital platforms, enabling patients to access care and prescriptions remotely. Teladoc Health's telepharmacy solutions are used by hospitals, clinics, and pharmacies to improve access to pharmaceutical services, especially in areas with limited in-person healthcare options.

CVS Health is another significant player in the telepharmacy market, providing pharmacy services along with a broad range of healthcare solutions. Through its network of retail pharmacies, clinics, and digital platforms, CVS Health offers remote consultations and medication delivery services. The company has been integrating telepharmacy into its existing infrastructure, offering patients access to medication counseling and prescriptions through its telehealth services.

List of Key Companies in Telepharmacy Market

- Teladoc Health

- Pharmalink

- MedPharm

- Cerner Corporation

- ScriptPro

- TelePharm

- MediSprout

- PipelineRx

- Pharmacy Automation Systems

- Omnicare

- Pharmasimple

- Healthway Services

- HealthHub

- CVS Health

- McKesson Corporation

Telepharmacy Industry Developments

- In October 2024, Teladoc Health expanded its telepharmacy services through a new partnership with a Johns Hopkins Aramco Healthcare (JHAH), major hospital network, aiming to enhance medication management and support healthcare facilities in rural areas.

- In September 2024, CVS Health announced an initiative to enhance its telepharmacy offerings. They are integrating advanced data analytics to improve medication adherence and optimize patient care across its digital health platforms.

Telepharmacy Market Segmentation

By Type Outlook

- Inpatient

- Remote Dispensing

- IV Admixture

- Remote Counselling

By Component Outlook

- Hardware

- Software

By Delivery Mode Outlook

- On-Premises

- Web-Based

- Cloud-Based

By Devices Outlook

- Computers

- Smartphones

- Tablets

- Kiosk

By Application Outlook

- Hospitals

- Small Pharmacies

- Nursing Home

- Prisons

- Military Base

- War Ships

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Telepharmacy Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.81 billion |

|

Market Size Value in 2025 |

USD 12.99 billion |

|

Revenue Forecast by 2034 |

USD 68.98 billion |

|

CAGR |

20.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The telepharmacy market has been segmented into detailed segments of type, component, delivery mode, devices, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy for the telepharmacy market focuses on expanding accessibility and improving service delivery through technological innovation. Key players are investing in AI, machine learning, and cloud-based platforms to enhance the efficiency of remote consultations and medication management. Companies are forming strategic partnerships with healthcare providers, hospitals, and pharmacies to expand their reach, particularly in underserved regions. Additionally, targeted marketing efforts are aimed at educating both patients and healthcare professionals on the benefits of telepharmacy. As regulations evolve, telepharmacy companies are also leveraging government initiatives to increase adoption and establish a broader customer base.

FAQ's

The telepharmacy market size was valued at USD 10.81 billion in 2024 and is projected to grow to USD 68.98 billion by 2034.

The market is projected to register a CAGR of 20.4% from 2025 to 2034.

North America held the largest market share in 2024.

A few of the key players in the market are Teladoc Health, Pharmalink, MedPharm, Cerner Corporation, ScriptPro, TelePharm, MediSprout, PipelineRx, Pharmacy Automation Systems, Omnicare, Pharmasimple, Healthway Services, HealthHub, CVS Health, and McKesson Corporation.

The remote dispensing segment accounted for the largest telepharmacy market share in 2024.

The software segment accounted for the largest market share in 2024.

Telepharmacy is the provision of pharmaceutical services through remote communication technologies, allowing pharmacists to offer consultations, medication dispensing, and other pharmaceutical care services without the need for in-person interactions. It leverages digital platforms, such as video calls, secure messaging, and automated dispensing systems, to connect pharmacists with patients, especially in rural or underserved areas. Telepharmacy helps improve access to medication management, enhances patient safety by providing expert advice, and allows pharmacies to reach a broader population while reducing the need for patients to travel to physical pharmacy locations.

A few key trends in the telepharmacy market are described below: Growth of Telehealth Platforms: Increasing integration of telepharmacy with telemedicine platforms to expand healthcare access, particularly in rural and underserved areas. Adoption of AI and Machine Learning: Use of AI and machine learning in medication management, drug interaction monitoring, and personalized patient care. Regulatory Support: Expansion of regulatory frameworks allowing for broader adoption of telepharmacy services, especially post-pandemic. Rise in Chronic Disease Management: Increased demand for telepharmacy services driven by the need for managing chronic conditions, especially in aging populations.

A new company entering the telepharmacy market should focus on areas that leverage emerging technologies and address underserved needs. This includes developing AI-driven platforms for personalized medication management, integrating mobile health apps for convenient patient access, and ensuring seamless cloud-based solutions for scalability. Focusing on regulatory compliance and building partnerships with healthcare institutions can facilitate market penetration. Additionally, targeting remote and rural areas where access to healthcare services is limited could offer a competitive advantage, along with offering innovative automated dispensing systems to streamline operations. Providing cost-effective and patient-centric solutions will help differentiate the company in an increasingly competitive market.

Companies manufacturing, distributing, or purchasing telepharmacy and related products, and other consulting firms must buy the report.