Telecom Millimeter Wave Technology Market Size, Share, Trends, Industry Analysis Report: By Frequency (E-Band, V-Band, and Other Frequency Bands), Licensing, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM1450

- Base Year: 2024

- Historical Data: 2020-2023

Telecom Millimeter Wave Technology Market Overview

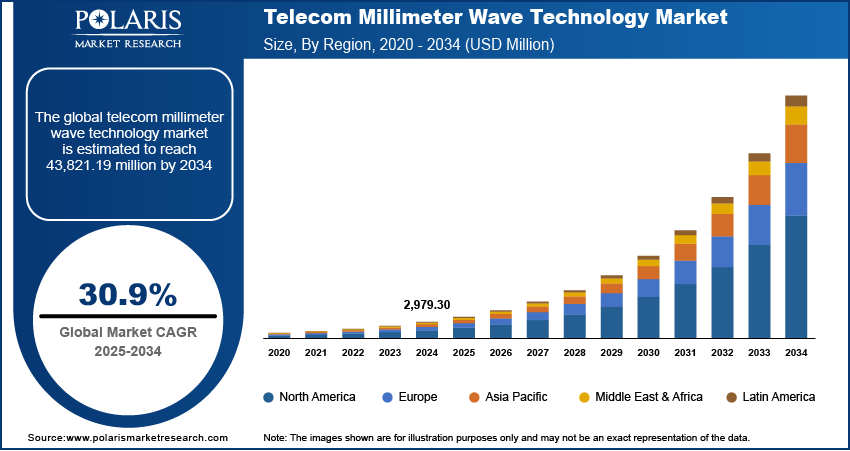

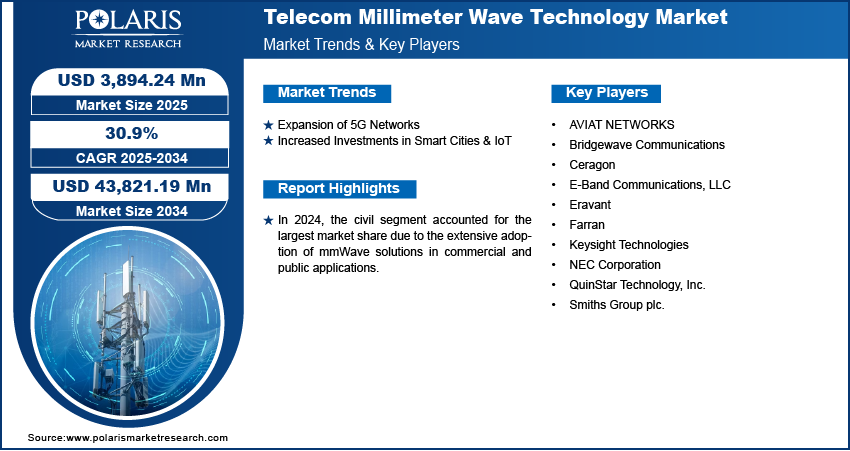

Telecom millimeter wave technology market size was valued at USD 2,979.30 million in 2024 and is expected to reach USD 3,894.24 million by 2025 and 43,821.19 million by 2034, exhibiting a CAGR of 30.9% during the forecast period.

The telecom millimeter wave (mmWave) technology market focuses on the development, deployment, and adoption of millimeter wave technology in telecommunications. Millimeter waves, which operate in the 30 GHz to 300 GHz frequency range, enable high-speed, low-latency wireless communication, making them essential for 5G networks, satellite communication, and high-frequency data transmission.

The surge in high-definition video streaming, cloud computing, and IoT applications fuels the need for high-capacity, low-latency communication networks, which is contributing to the telecom millimeter wave technology market expansion. Additionally, the demand for high-speed broadband connectivity in remote and urban areas is boosting the adoption of mmWave-based FWA solutions, increasing market demand.

To Understand More About this Research: Request a Free Sample Report

The adoption of small cells and high-frequency transmission systems is significantly improving network efficiency in the telecom sector. Small cells help enhance coverage and capacity, especially in urban areas, by efficiently managing high data traffic and reducing network congestion. Additionally, the use of millimeter wave (mmWave) frequencies is transforming satellite communication, enabling high-speed data transmission across various industries. In defense and aviation, mmWave technology supports secure and fast communication, ensuring real-time data exchange for critical operations. In commercial applications, it enhances broadband connectivity, 5G networks, and IoT-based solutions. The growing demand for high-speed, low-latency communication is driving investments in mmWave technology, further accelerating market expansion as telecom providers and enterprises adopt advanced wireless solutions for seamless connectivity.

Telecom Millimeter Wave Technology Market Dynamics

Expansion of 5G Networks

The expansion of 5G networks is a significant driver of telecom millimeter wave technology market, as the deployment of high-speed, low-latency communication infrastructure depends on the millimeter wave (mmWave) spectrum. For instance, according to Ericsson, the rollout of 5G networks is advancing rapidly, with approximately 320 networks now operational worldwide. Excluding mainland China, it's projected that 5G penetration will increase from 45% in 2024 to 85% by 2030, highlighting a significant acceleration in adoption rates during this period. The growing need for enhanced mobile broadband, ultra-reliable low-latency communications (URLLC), and massive machine-type communications (mMTC) has led telecom providers to actively invest in mmWave technology for next-generation connectivity. The high-frequency spectrum enables faster data transmission, reduced congestion, and improved network efficiency, making it essential for 5G network densification. Additionally, governments and regulatory bodies worldwide are actively allocating and auctioning mmWave spectrum, further accelerating market expansion.

Increased Investments in Smart Cities & IoT

Growing investments in smart cities and IoT are boosting the telecom millimeter wave technology market. As the need for ultra-fast and low-latency networks grows, mmWave technology is playing a key role in smart city projects. It helps enable real-time data sharing, smooth connectivity, and better city management. Smart cities use mmWave for autonomous transport, smart grids, security systems, and public safety.

The rise of IoT in industries like automation, healthcare, and smart homes is also increasing demand for high-speed and reliable networks. Governments and companies are heavily investing in 5G-powered smart infrastructure. For example, in September 2023, the US National Science Foundation invested $25 million to improve secure 5G technology, helping to address security challenges in next-generation communication systems.

Telecom Millimeter Wave Technology Market Segment Insights

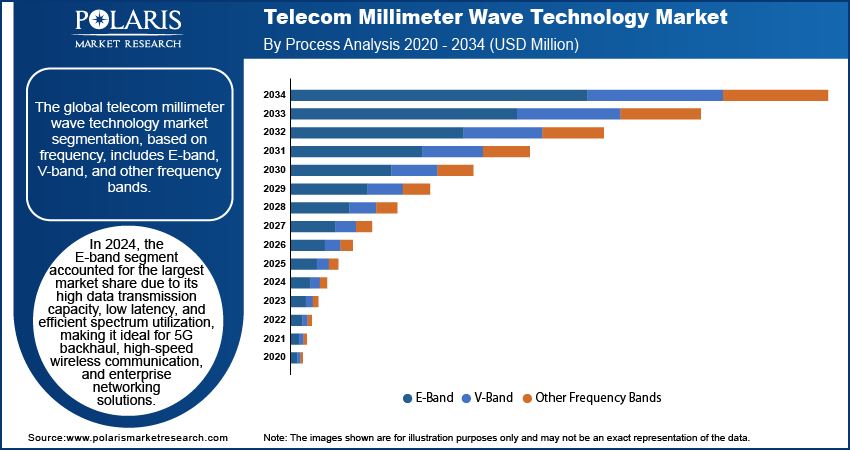

Telecom Millimeter Wave Technology Market Assessment by Frequency

The global telecom millimeter wave technology market segmentation, based on frequency includes E-band, V-band, and other frequency bands. In 2024, the E-band segment accounted for the largest market share due to its high data transmission capacity, low latency, and efficient spectrum utilization, making it ideal for 5G backhaul, high-speed wireless communication, and enterprise networking solutions. The rising deployment of 5G networks and the increasing demand for high-bandwidth applications in industries such as telecommunications, defense, and satellite communications have further driven E-band adoption. Additionally, regulatory approvals and spectrum availability for E-band frequencies (71-76 GHz and 81-86 GHz) have supported market expansion, allowing telecom operators to leverage cost-effective, high-frequency solutions for next-generation connectivity.

Telecom Millimeter Wave Technology Market Evaluation by Application

The telecom millimeter wave technology market is segmented by application into military and civil. In 2024, the civil sector had the biggest share of the telecom millimeter wave (mmWave) technology market. This is because mmWave solutions are widely used in commercial and public applications. The fast rollout of 5G networks in cities, along with the rise of fixed wireless access (FWA) and smart city projects, has helped the market grow. Civil applications use mmWave technology for high-speed data and low-latency communication, which is important for modern digital systems and better connectivity. More private companies are investing in this technology, and governments are supporting its growth with helpful policies. Additionally, advanced components like high-frequency antennas and transceivers are improving network performance, making mmWave technology even more popular in civil applications.

Telecom Millimeter Wave Technology Market Share by Regional Analysis

By region, the study provides telecom millimeter wave technology market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to robust investments in advanced network infrastructure and rapid 5G deployment. For instance, in North America, 5G technology represents 29% of the total wireless cellular connections, demonstrating a robust year-over-year growth of 64%. In 2023 alone, the region added 77 million new 5G connections. Supportive regulatory frameworks are also driving market growth and fueling the widespread adoption of high-speed, low-latency mmWave solutions across commercial and enterprise applications.

Asia Pacific is expected to witness the highest telecom millimeter wave technology market CAGR over the forecast period due to rapid investments in digital infrastructure. Accelerated deployment of 5G and IoT networks and proactive government policies also drive market expansion. For instance, according to Ericsson, it is projected that South East Asia and Oceania to account for approximately 620 million 5G subscriptions by the end of 2028. Additionally, mobile data consumption per smartphone in this region is anticipated to reach around 54 GB per month, reflecting a significant increase in mobile traffic as 5G infrastructure continues to expand and mature. Robust industrial growth and expanding consumer markets in the region are fueling significant demand as operators aggressively upgrade their networks with innovative high-frequency solutions. The widespread adoption of mmWave technology, coupled with strategic R&D initiatives and partnerships, is enhancing network performance while reducing latency and increasing bandwidth, thereby boosting market growth.

Telecom Millimeter Wave Technology Key Market Players & Competitive Analysis Report

The competitive landscape of the telecom millimeter wave technology market is marked by intense innovation and strategic partnerships among leading industry players. Major telecommunications companies and specialized technology firms are investing significantly in R&D to develop next-generation mmWave solutions, driving market growth. These initiatives aim to meet the increasing demand for ultra-high-speed, low-latency networks essential for 5G, IoT, and smart city applications. To maintain a competitive edge, companies are forming strategic alliances, engaging in mergers and acquisitions, and collaborating on technology standardization efforts, which are reshaping market dynamics. Additionally, continuous advancements in antenna design, transceiver technology, and signal processing are fueling product innovation. With supportive regulatory frameworks and proactive investments in digital infrastructure, the telecom millimeter wave technology industry is experiencing robust growth, creating significant opportunities for players to capture new market share and drive further expansion.

Aviat Networks, Inc. is engaged in providing microwave transport and backhaul solutions, specializing in wireless communication infrastructure. The company was founded in 2007, and is headquartered in Texas, USA. Aviat Networks offers a diverse product portfolio that includes microwave routers, switches, antenna stabilization systems, and network management tools designed to support IP-centric, multi-gigabit data services. The services provided by Aviat encompass network optimization, lifecycle support, and managed network services tailored to meet the needs of public and private telecommunications operators. The company operates across North and South America, Africa, Asia Pacific, Europe, and the Middle East. Moreover, in the realm of telecom millimeter wave technology, Aviat Networks plays a vital role by offering advanced solutions that utilize millimeter wave frequencies for high-capacity wireless communication. Their products are designed to facilitate rapid data transmission over short distances, making them ideal for urban environments and applications requiring high bandwidth.

Keysight Technologies is engaged in providing electronic design automation (EDA) software and test solutions, specializing in measurement technologies for electronic design and testing. The company was founded in 2014 and is headquartered in California, USA. Keysight's product portfolio includes oscilloscopes, signal analyzers, network analyzers, and software for simulation and design verification. The services provided by Keysight encompass consulting, training, and support for engineers across various industries such as telecommunications, aerospace, automotive, and consumer electronics. The company has a global presence with operations in over 100 countries. Furthermore, in the telecom millimeter wave technology, Keysight Technologies offers testing solutions that enable engineers to validate the performance of millimeter wave devices and systems. Their tools are essential for ensuring compliance with industry standards and for optimizing the performance of next-generation wireless networks.

Key Companies in Telecom Millimeter Wave Technology Market

- AVIAT NETWORKS

- Bridgewave Communications

- Ceragon

- E-Band Communications, LLC

- Eravant

- Farran

- Keysight Technologies

- NEC Corporation

- QuinStar Technology, Inc.

- Smiths Group plc.

Telecom Millimeter Wave Technology Market Developments

June 2024: NEC Corporation developed a radio-over-fiber system using a 1-bit fiber communication technique. This technique enables affordable and reliable millimeter-wave communication networks for Beyond 5G and 6G. It allows high-frequency analog signals to be transmitted through a low-cost electrical-to-optical converter, facilitating the creation of compact and cost-effective distributed antenna systems.

June 2024: Deutsche Telekom successfully trialed 5G mmWave frequencies at 26 GHz for industrial applications and is now offering these capabilities commercially to industrial clients.

Telecom Millimeter Wave Technology Market Segmentation

By Frequency Outlook (Revenue USD Million 2020 - 2034)

- E-Band

- V-Band

- Other Frequency Bands

By Licensing Outlook (Revenue USD Million 2020 - 2034)

- Fully licensed

- Light-licensed

- Unlicensed

By Application Outlook (Revenue USD Million 2020 - 2034)

- Military

- Civil

By Regional Outlook (Revenue USD Million 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Telecom Millimeter Wave Technology Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,979.30 million |

|

Market Size Value in 2025 |

USD 3,894.24 million |

|

Revenue Forecast in 2034 |

USD 43,821.19 million |

|

CAGR |

30.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global telecom millimeter wave technology market size was valued at USD 2,979.30 million in 2024 and is projected to grow to USD 43,821.19 million by 2034.

The global market is projected to register a CAGR of 30.9% during the forecast period.

In 2024, North America accounted for the largest market share due to robust investments in advanced network infrastructure and rapid 5G deployment.

Some of the key players in the market are AVIAT NETWORKS; Bridgewave Communications; Ceragon; E-Band Communications, LLC; Eravant; Farran; Keysight Technologies; NEC Corporation; QuinStar Technology, Inc.; and Smiths Group plc.

In 2024, the E-band segment accounted for the largest market share due to its high data transmission capacity, low latency, and efficient spectrum utilization, making it ideal for 5G backhaul, high-speed wireless communication, and enterprise networking solutions

In 2024, the civil segment accounted for the largest market share due to the extensive adoption of mmWave solutions in commercial and public applications.