Tax Management Market Share, Size, Trends, Industry Analysis Report

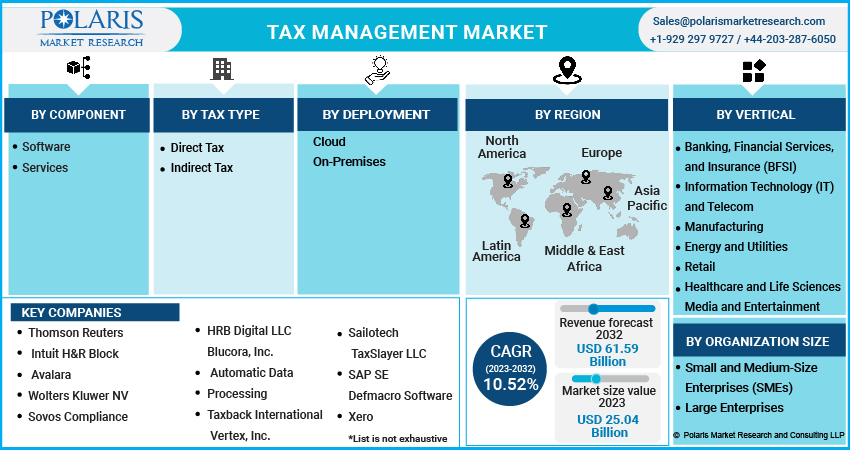

By Component (Software, Services); By Tax Type; By Deployment; By Organization Size; By Vertical; By Region; Segment Forecast, 2023- 2032

- Published Date:Apr-2023

- Pages: 118

- Format: PDF

- Report ID: PM2349

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

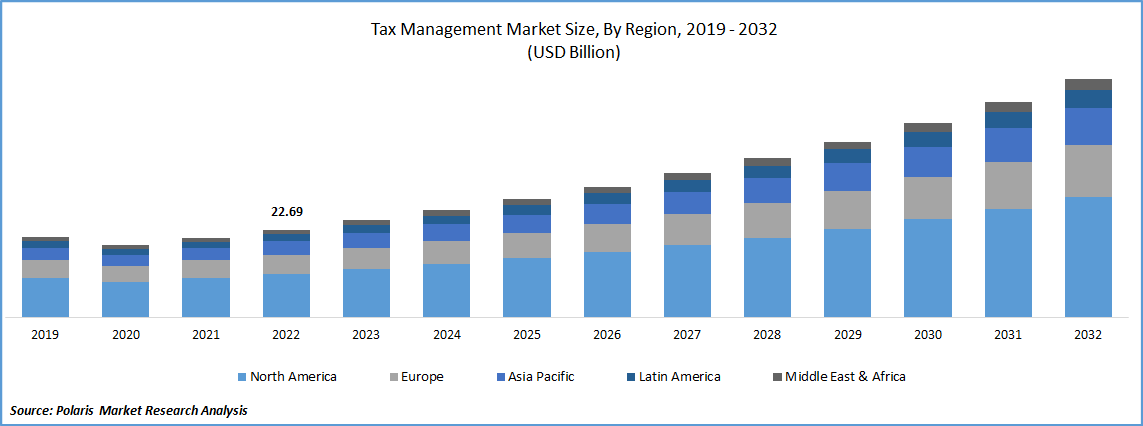

The global tax management market was valued at USD 22.69 billion in 2022 and is expected to grow at a CAGR of 10.52% during the forecast period. The factors such as an increase in compliance requirements, digitization of tax processes, growth in small and medium enterprises, and increased adoption of cloud-based solutions augment the tax management market growth.

The strategy used by taxpayers to abide by tax regulations is known as tax management. Tax management includes all aspects of taxes, including fines, appeals, prosecutions, and tax case settlements. A taxpayer's past, current, and future tax-related activities are examined under a tax management strategy to guarantee compliance and prevent the application of fines and interest. Tax management, as opposed to tax planning, is a requirement for each assessee. As a result, all taxpayers are required to abide by all tax regulations to avoid interest fines.

Also, utilizing a tax management system may help guarantee accurate and current tax computations, which is one of its primary benefits. For companies and people with complicated tax situations or those who need to file multiple tax returns, this is especially crucial. A tax management system can assist in lowering the possibility of mistakes, which, if left unchecked, could incur fines or penalties. Additionally, the system can assist in making sure that all necessary tax forms and paperwork are timely and accurately filed. As a result, the tax management market size is expanding.

The tax management market size and share report detail key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Know more about this report: Request for sample pages

During the projected period, revenue growth in the worldwide tax management market is anticipated primarily driven by rising demand for simple tax record-keeping solutions. Record keeping is a key strategy for most firms when retaining important tax documents, and employing tax software may simplify this process.

In December 2022, Wolters Kluwer’s Tax & Accounting division announced that the cloud-based work-paper management & trial balance solution CCH Axcess Engagement had been completely integrated with its in-proprietary tax management solutions. The three technologies are now accessible on a single, integrated platform for businesses that conduct audits and tax services.

Governments are increasing business compliance requirements, leading to a higher demand for tax management software that automates the tax calculation and filing process. Also, the shift towards digital tax processes has increased the demand for tax management software, making the process more efficient and less prone to errors. Tax laws and regulations are growing in complexity, leading businesses to look for automated solutions to manage their tax processes. Cloud-based solutions offer flexible, scalable, and cost-effective options for businesses, leading to increased adoption of tax management software in the cloud. The growth of SMEs has created a need for affordable and easy-to-use tax management solutions. A cloud-based solution can be used by small, medium, and large-sized enterprises to solve their tax management-related needs.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The demand for tax management software that can handle complicated cross-border tax compliance requirements has arisen due to corporate globalization. Businesses are increasingly using tax management software as they become more aware of its advantages, which include increased accuracy and a lower chance of penalty. This is driving the market demand. The rising usage of cloud-based tax management software results from cloud-based solutions' better flexibility, scalability, and affordability. Increased business investments in technology are driving the expansion of the tax management software market to enhance their tax management procedures.

Report Segmentation

The market is primarily segmented based on component, tax type, deployment, organization size, vertical, and region.

|

By Component |

By Tax Type |

By Deployment |

By Organization Size |

By Vertical |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Services Segment is Expected to Grow at a High CAGR During the Forecast Period

The software segment was leading the market during 2022 and is expected to maintain its dominance during the forecast period. Businesses may prepare and manage audit reports and payments, file tax returns, and handle the massive amounts of financial transaction data created using tax management software. Additionally, the shift towards digital tax processes has increased demand for tax management software, making the process more efficient and less prone to errors.

For instance, In February 2023, eMoney Advisor announced new features to its app that will help financial advisors showcase to their clients the impact of Roth conversion and other strategies on their financial plans. The two functions, which are referred to as "Tax Bracket Report" & "Automated Bracket-Based Roth Conversion," can be used in eMoney's "Decision Center."

The services segment is expected to grow substantially during the forecast period. Various services such as tax planning, compliance, and administration are provided to clients to help them manage their tax-related processes effectively. Due to the rising adoption of tax management software which allows for handling a large amount of transactional data, the requirement for supporting services like integration, deployment, and maintenance is growing in the tax management market.

Indirect Tax Segment is Anticipated to Exhibit Highest Market Share During the Forecast Period

The indirect Tax segment accounted for the highest market share in 2022. Value Added Tax (VAT), Goods and Services Tax, and Excise Duty are included in indirect taxes. According to a Government Economic survey in February 2023, the growth rate of indirect taxes under the new Goods and Services Tax regime has decreased compared to the former system of state and federal indirect taxes.

The direct Tax segment is expected to grow at the fastest CAGR during the forecast period. Direct tax is directly paid to the entity imposing the tax, i.e., the government. Direct taxes give the government and the taxpayer a sense of confidence. The taxpayer and the government are each aware of the required payments and collections, respectively. Vendors provide clear and comprehensive direct tax solutions for shifting market demands. Multiple return types can be filed with direct tax software, offering centralized user management to streamline tax compliance procedures.

Cloud Segment is Expected to Grow at a High Cagr During the Forecast Period

The cloud-based segment registered the highest growth rate over the study period. Cloud software solutions manage system administration and maintenance, freeing management to concentrate on value-added tasks. The cloud is intended never to go offline and never lose data. This makes it ideal for indirect taxes, which must be determined, held on to, and collected for every transaction. They remove the burden of managing difficult budgets for on-premise deployments from IT staff. They offer better service, greater agility, and higher security while substantially reducing expenses.

In February 2023, KPMG LLP, an audit, tax, and consultancy business, and SentinelOne, an autonomous cybersecurity platform provider, joined forces to speed up investigations into and responses to cyberattacks that target the endpoints, clouds, and identities that make up the modern corporate perimeter.

North America Region is Expected to Lead the Market Growth in 2022

North America region held the largest market share in 2022. The industry is anticipated to be dominated by the US and Canada regarding revenue. This market is highly competitive and consists of both small and large players. Increased regulatory requirements, automation, and the desire for tax efficiency and cost savings drive the market.

Due to the ongoing changes and rules in the local taxation system, the North American market has seen a phenomenal rise in the use of tax software. There are exceptional prospects for software developers and major vendors to invest in tax management software. In January 2023, businesses in the US faced higher federal tax bills due to implementing the 2022 “Inflation Reduction Act” & phasing out a few provisions in the “2017 Tax Cuts & Jobs Act”. The state-level tax reduction is providing some relief in many parts of the US.

The region is anticipated to expand throughout the projection period at a high CAGR. The complexity of tax laws and regulations also drives the need for tax management solutions in North America. Tax management solutions are becoming more widely used as businesses explore ways to simplify their tax procedures and lower their risk of fines and penalties. The North American tax management market has several major participants, including Intuit, H&R Block, Thomson Reuters, and Xero. To accommodate the various demands of their clients, these businesses provide a variety of goods and services.

Competitive Insight

Some of the major players operating in the global market include Thomson Reuters, Intuit H&R Block, Avalara, Wolters Kluwer NV, Sovos Compliance, LLC, HRB Digital LLC, Blucora, Inc., Automatic Data Processing, Taxback International, Vertex, Inc., Sailotech, TaxSlayer LLC, SAP SE, Defmacro Software, Xero, Drake Enterprises, TaxJar, Webgility, SafeSend, EXEMPTAX, Shoeboxed and SAXTAX among others.

Recent Developments

- January 2023: Practice Management Software (PMS) was introduced by the Institute of Chartered Accountants of India to assist the CAs in managing their businesses' practices more effectively through office automation. The program aims to make it simpler to handle projects, papers, accounts, clients, & workers.

- January 2023: ICAI released Practice Management Software for CA firms and practitioners. This software makes the handling of chores, documents, accounts, clients, and employees simpler. It has 15 unsegregated elements for the effortless handling and automation of workflow.

- December 2023: Tax Systems acquired TaxModel to broaden its product suite and expand its international reach. This tactical move corresponds to Tax Systems’ commitment to improving its solutions and expanding globally. TaxModel has been a major contender in the tax conformity sector for approximately a decade and is acknowledged for generating simplified software for tax experts.

Tax Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 25.04 billion |

|

Revenue Forecast in 2032 |

USD 61.59 billion |

|

CAGR |

10.52% from 2023- 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Component, By Tax Type, By Deployment, By Organization Size, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Thomson Reuters, Intuit H&R Block, Avalara, Wolters Kluwer NV, Sovos Compliance, LLC, HRB Digital LLC, Blucora, Inc., Automatic Data Processing, Taxback International, Vertex, Inc., Sailotech, TaxSlayer LLC, SAP SE, Defmacro Software, Xero, Drake Enterprises, TaxJar, Webgility, SafeSend, EXEMPTAX, Shoeboxed and SAXTAX. |

Uncover the dynamics of the tax management sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

FAQ's

The global tax management market size is expected to reach USD 61.59 billion by 2032.

Key players in the tax management market are Thomson Reuters, Intuit H&R Block, Avalara, Wolters Kluwer NV, Sovos Compliance, LLC, HRB Digital LLC, Blucora, Inc., Automatic Data Processing.

North America contribute notably towards the global tax management market.

The global tax management market expected to grow at a CAGR of 10.52% during the forecast period.

The tax management market report covering key segments are component, tax type, deployment, organization size, vertical and region.