Targeted DNA RNA Sequencing Market Size, Share, Trends, Industry Analysis Report

: By Type (DNA-Based and RNA-Based), Method, Workflow, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 118

- Format: PDF

- Report ID: PM5244

- Base Year: 2024

- Historical Data: 2020-2023

Targeted DNA RNA Sequencing Market Overview

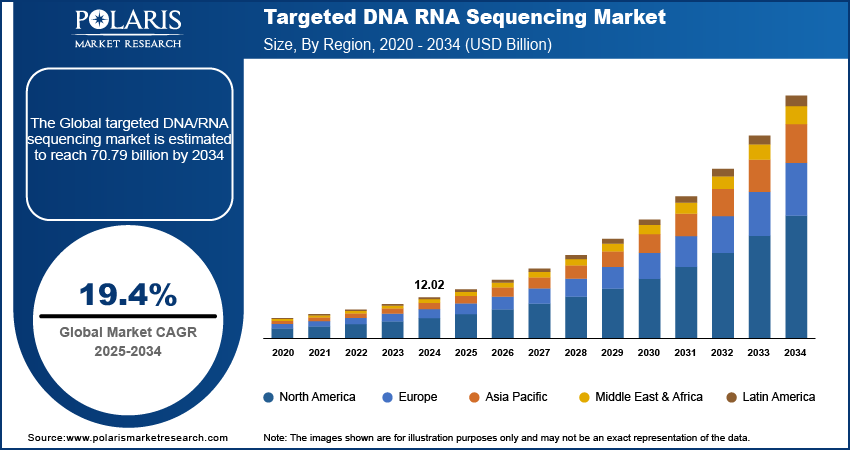

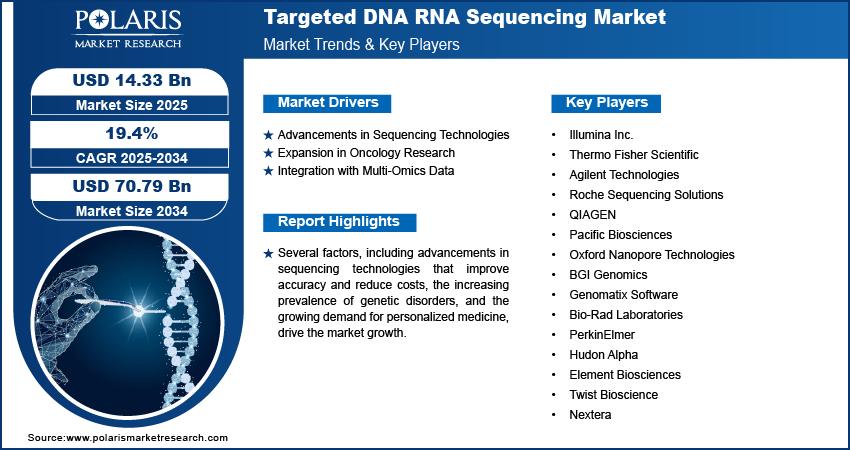

The global targeted DNA RNA sequencing market size was valued at USD 12.02 billion in 2024. The market is projected to grow from USD 14.33 billion in 2025 to USD 70.79 billion by 2034, exhibiting a CAGR of 19.4% during 2025–2034.

The global targeted DNA/RNA sequencing market focuses on sequencing specific regions of DNA or RNA to analyze genetic variations associated with various diseases and conditions.

Several factors, including advancements in sequencing technologies that improve accuracy and reduce costs, the increasing prevalence of genetic disorders, and the growing demand for personalized medicine, drive the market growth. The rising adoption of next-generation sequencing (NGS) technologies, expansion of research in oncology and rare diseases, and the integration of sequencing data with other omics data to enhance diagnostic and therapeutic strategies are expected to emerge as key future trends in the market.

To Understand More About this Research: Request a Free Sample Report

Targeted DNA RNA Sequencing Market Drivers and Trends Analysis

Advancements in Sequencing Technologies

Advancements such as the development of next-generation sequencing (NGS) platforms enhance the speed, accuracy, and cost-effectiveness of sequencing. Companies such as Illumina and Thermo Fisher Scientific introduced high-throughput sequencers that can process millions of DNA/RNA sequences rapidly. According to a 2023 study published in Nature Reviews Genetics, the sequencing cost of a whole human genome has dropped to ∼USD 600, a substantial reduction from $10,000 just a decade ago. This decline in cost is making targeted sequencing more accessible for research and clinical applications. Thus, recent advancements in sequencing technologies are significantly propelling the targeted DNA/RNA sequencing market growth.

Expansion in Oncology Research

Sequencing technologies are being increasingly used to identify genetic mutations and biomarkers that are crucial for cancer diagnosis, treatment, and prognosis. A 2023 report by the American Association for Cancer Research (AACR) highlights that targeted sequencing has led to the identification of over 200 cancer-related genes, which has enhanced the development of targeted therapies and personalized treatment plans. The precision in identifying specific mutations allows for more effective and tailored treatment approaches. Owing to all these advantages, targeted DNA RNA sequencing is highly used in oncology research. Hence, the rising oncology research is expected to drive the demand for targeted sequencing.

Integration with Multi-Omics Data

The integration of targeted DNA/RNA sequencing data with other omics data, such as proteomics and metabolomics, is emerging as a significant trend. This multi-omics approach provides a comprehensive view of the molecular mechanisms underlying diseases and facilitates more accurate diagnostics and treatment strategies. A 2024 article in Cell Systems reported that combining genomic data with proteomic profiles has improved the identification of disease pathways and potential therapeutic targets. The growing emphasis on holistic, multi-dimensional data analysis is pushing the development of more sophisticated data integration tools and algorithms, which is expected to enhance the capabilities and applications of targeted sequencing.

Targeted DNA RNA Sequencing Market Segment Analysis

Targeted DNA RNA Sequencing Market Assessment by Type

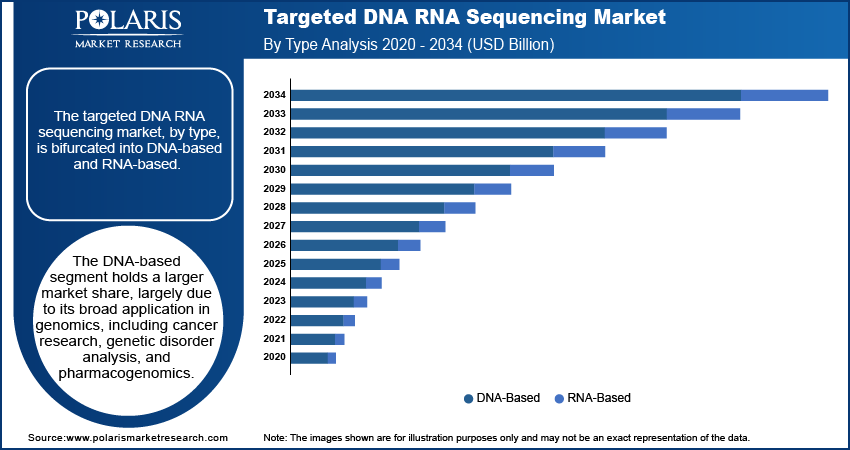

The targeted DNA RNA sequencing market, by type, is bifurcated into DNA-based and RNA-based. The DNA-based segment holds a larger market share, largely due to its broad application in genomics, including cancer research, genetic disorder analysis, and pharmacogenomics. The widespread use of DNA-based sequencing is driven by its ability to provide comprehensive insights into genetic variations and mutations, which are critical for diagnosing and understanding various diseases. The segment benefits from established technologies and significant research investments, which further solidify its dominance in the market.

The RNA-based segment is experiencing a higher growth rate, driven by increasing interest in understanding gene expression and regulation at a more granular level. RNA sequencing provides valuable information on gene activity and is instrumental in fields such as transcriptomics and functional genomics. Recent advancements and reductions in sequencing costs have made RNA-based sequencing more accessible, leading to a surge in research and clinical applications. This growing focus on RNA analysis, particularly in cancer and rare diseases, is contributing to its rapid expansion in the market.

Targeted DNA RNA Sequencing Market Evaluation by Method

The targeted DNA/RNA sequencing market, based on method, is segmented into exome sequencing, enrichment sequencing, amplicon sequencing, and others. The exome sequencing holds the largest market share. The method focuses on sequencing the coding regions of the genome, which are crucial for understanding genetic variations associated with diseases. Exome sequencing is widely adopted due to its ability to efficiently identify mutations and variants in protein-coding genes, making it a preferred choice for genetic research and clinical diagnostics. Its established use in identifying disease-related genetic alterations ensures its continued dominance in the market.

The enrichment sequencing segment is currently registering the highest growth, reflecting its increasing application in targeted research and clinical diagnostics. This method enhances the detection of specific genomic regions by selectively capturing and sequencing them, thus improving the sensitivity and accuracy of the results. The rise in precision medicine and the need for more focused genetic analysis have driven the demand for enrichment sequencing methods. Its ability to tailor the sequencing process to specific genetic targets aligns with the growing emphasis on personalized medicine, contributing to its rapid expansion in the market.

Targeted DNA RNA Sequencing Market Breakdown by Workflow

In terms of workflow, the targeted DNA RNA sequencing market is segmented into pre-sequencing, sequencing, and data analysis. The sequencing segment holds the largest market share due to its central role in the sequencing process. This segment encompasses the actual process of reading genetic sequences and is critical for obtaining the data needed for subsequent analysis. The dominance of this segment is supported by the continuous advancements in sequencing technologies, such as next-generation sequencing (NGS), which enhance the accuracy and efficiency of genetic data acquisition. The widespread use and ongoing improvements in sequencing technologies solidify its leading position in the market.

The data analysis segment is experiencing the highest growth, driven by the increasing complexity of genomic data and the rising need for advanced analytical tools. As the volume of sequencing data expands, sophisticated bioinformatics solutions and software are essential for interpreting and integrating this information. The rise in personalized medicine and the integration of multi-omics data are contributing to the heightened demand for robust data analysis solutions. This segment's rapid development reflects the growing importance of effective data interpretation in leveraging the full potential of targeted sequencing technologies.

Targeted DNA RNA Sequencing Market Breakdown by End User

The targeted DNA/RNA sequencing market, by end user, is segmented into academic research, hospitals & clinics, pharma & biotech entities, and others. The academic research segment holds the largest market share, reflecting its extensive use in fundamental and applied genetic research. Academic institutions leverage targeted sequencing technologies to advance understanding of genetic mechanisms, explore disease pathways, and develop new therapeutic approaches. The robust investments in research and the high volume of genomic studies conducted in academic settings contribute to the segment's dominance, supported by continuous funding and grant opportunities.

The pharma & biotech entities segment is experiencing the highest growth, driven by increasing investments in drug development and personalized medicine. Pharmaceutical and biotechnology companies utilize targeted sequencing for drug discovery, biomarker identification, and the development of tailored therapeutic strategies. The segment's rapid expansion is fueled by the need for precise genomic insights to enhance drug efficacy and safety profiles, alongside the growing trend of integrating genomic data into clinical trials and drug development processes.

Targeted DNA RNA Sequencing Market Share by Region

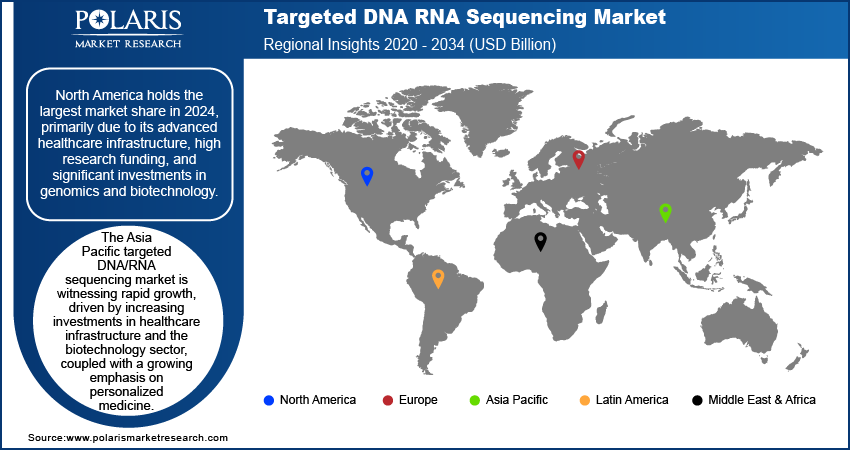

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to its advanced healthcare infrastructure, high research funding, and significant investments in genomics and biotechnology. The region benefits from the presence of leading sequencing technology companies, robust academic and clinical research facilities, and a well-established healthcare system that supports innovative genetic research and personalized medicine. North America's dominance is further supported by its early adoption of advanced sequencing technologies and a strong emphasis on precision medicine.

In Europe, the targeted DNA/RNA sequencing market is experiencing steady growth, driven by significant investments in research and development and a strong focus on precision medicine. The European Union’s Horizon Europe program and various national research initiatives have increased funding for genomic studies, facilitating advancements in sequencing technologies and applications. Countries such as Germany, the UK, and France are at the forefront, with numerous academic institutions and biotech companies engaged in cutting-edge research. Additionally, Europe’s well-established regulatory framework and collaborative research networks contribute to a conducive environment for market expansion.

The Asia Pacific targeted DNA/RNA sequencing market is witnessing rapid growth, driven by increasing investments in healthcare infrastructure and the biotechnology sector, coupled with a growing emphasis on personalized medicine. Countries such as China and India are emerging as significant players due to their large population base, expanding healthcare needs, and rising research activities. The region benefits from a burgeoning biotech sector, improved research facilities, and government initiatives supporting genomic research. However, the market faces challenges related to diverse healthcare systems, regulatory variations, and varying levels of access to advanced sequencing technologies across different countries in the region. Despite these challenges, the rapid growth in research activities and healthcare investments positions Asia Pacific as a key region for future market expansion.

Targeted DNA RNA Sequencing Market – Key Players and Competitive Analysis Report

Key players in the targeted DNA/RNA sequencing market are Illumina Inc., Thermo Fisher Scientific, Agilent Technologies, Roche Sequencing Solutions, and QIAGEN. Other significant companies are Pacific Biosciences, Oxford Nanopore Technologies, BGI Genomics, Genomatix Software, and Bio-Rad Laboratories. Notable players also include PerkinElmer, Hudon Alpha, Element Biosciences, and Twist Bioscience. Additionally, companies such as Nextera and LGC Biosearch Technologies are actively contributing to market advancements. These companies remain active in the market, providing a range of products and services related to DNA/RNA sequencing technologies.

In terms of competitive analysis, Illumina Inc. and Thermo Fisher Scientific are prominent players due to their extensive product portfolios and strong market presence. They are well-positioned to capitalize on the growing demand for sequencing technologies owing to their advanced platforms and broad customer base. Agilent Technologies and Roche Sequencing Solutions also play significant roles by offering innovative solutions and investing in research to enhance their product offerings. These companies are distinguished by their continuous innovation and robust support networks, which contribute to their strong market positions.

The market dynamics are shaped by intense competition among these players, each striving to develop more accurate and cost-effective sequencing solutions. The competition drives technological advancements, resulting in improved performance and reduced costs of sequencing services. Additionally, the focus on strategic collaborations, partnerships, and acquisitions by these companies enhances their competitive edge and ability to address evolving market needs. Overall, the market is characterized by a high level of innovation and strategic activity, which influences the competitive landscape and shapes future growth trajectories.

Illumina Inc. is a global player in the targeted DNA/RNA sequencing market, known for its comprehensive range of sequencing platforms and reagents. The company focuses on providing high-throughput sequencing solutions that cater to various research and clinical applications.

Thermo Fisher Scientific is another significant player, offering a wide array of sequencing technologies and solutions. The company supports diverse applications in genomics through its sequencing platforms, reagents, and software.

Key Companies in the Targeted DNA RNA Sequencing Market

- Illumina Inc.

- Thermo Fisher Scientific

- Agilent Technologies

- Roche Sequencing Solutions

- QIAGEN

- Pacific Biosciences

- Oxford Nanopore Technologies

- BGI Genomics

- Genomatix Software

- Bio-Rad Laboratories

- PerkinElmer

- Hudon Alpha

- Element Biosciences

- Twist Bioscience

- Nextera

Targeted DNA RNA Sequencing Market Developments

- In August 2024, Thermo Fisher Scientific introduced a new software suite designed to streamline data analysis and improve the interpretation of sequencing results, reflecting its commitment to advancing genomic research and clinical diagnostics.

- In July 2024, Illumina announced the launch of its new sequencing instrument, the NovaSeq 6000, which aims to enhance the efficiency and accuracy of genomic sequencing.

Targeted DNA RNA Sequencing Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- RNA-Based

- DNA-Based

By Method Outlook (Revenue – USD Billion, 2020–2034)

- Exome Sequencing

- Enrichment Sequencing

- Amplicon Sequencing

- Others

By Workflow Outlook (Revenue – USD Billion, 2020–2034)

- Pre-sequencing

- Sequencing

- Data Analysis

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Academic Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Targeted DNA RNA Sequencing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.02 billion |

|

Market Size Value in 2025 |

USD 14.33 billion |

|

Revenue Forecast by 2034 |

USD 70.79 billion |

|

CAGR |

19.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global targeted DNA RNA sequencing market size was valued at USD 12.02 billion in 2024 and is projected to grow to USD 70.79 billion by 2034.

The global market is projected to register a CAGR of 19.4% during the forecast period.

North America accounted for the largest share of the global market in 2024.

A few key players in the targeted DNA/RNA sequencing market are Illumina Inc., Thermo Fisher Scientific, Agilent Technologies, Roche Sequencing Solutions, and QIAGEN. Other significant companies are Pacific Biosciences, Oxford Nanopore Technologies, BGI Genomics, Genomatix Software, and Bio-Rad Laboratories.

The DNA-based sequencing segment accounted for a larger share of the global market.

The exome sequencing segment accounted for the largest share of the global market