Synthetic Rubber Market Share, Size, Trends, Industry Analysis Report, By Product Type (SBR, IIR, EPDM, IR, NBR, & Others), By Application, By Industry Vertical, By Regions, Segments & Forecast, 2023 – 2032

- Published Date:Mar-2023

- Pages: 116

- Format: PDF

- Report ID: PM1530

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

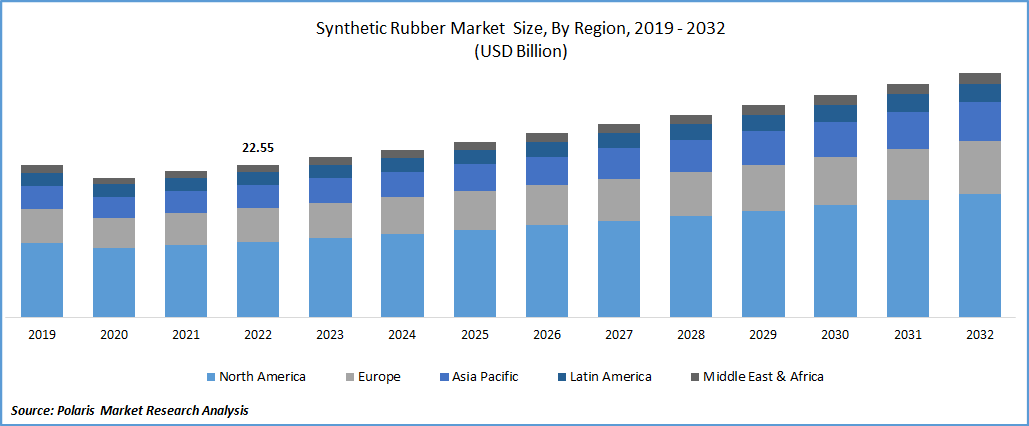

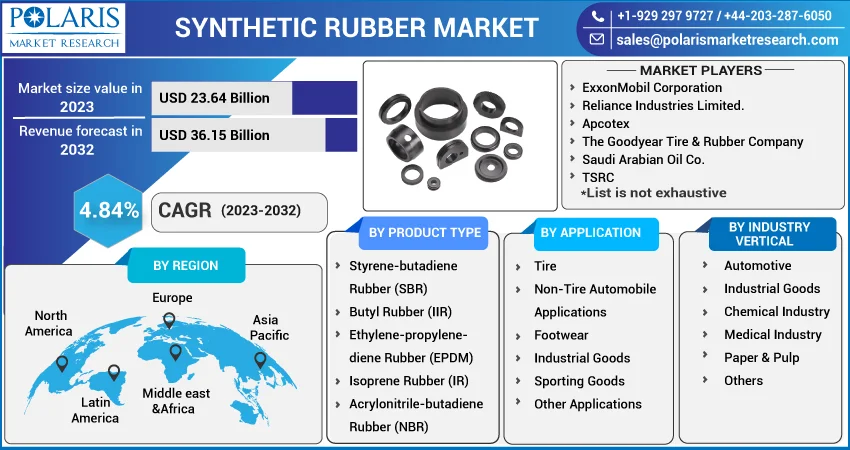

The global synthetic rubber market was valued at USD 22.55 billion in 2022 and is expected to grow at a CAGR of 4.84% during the forecast period. The increasing demand for synthetic rubber from tire and non-tire applications from the automobile industry and newer applications in various end-products primarily drives the market in the forecast period. The regional constraints in the context of natural rubber plantations, coupled with rising prices of natural rubber and insufficient natural rubber to fulfill the global demand for rubber, have given rise to the evolution of synthetic rubber.

The Synthetic Rubber Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Know more about this report: Request for sample pages

Synthetic rubbers are artificially produced materials that mimic natural rubber's desirable properties. The major development of synthetic rubber can be attributed to one factor during the World War II period when the United States was cut off from all of its sources of natural rubber. To meet the country's needs, the government built synthetic rubber plants and sold the plants to industries in the post-war period, which gave a kick-start to commercializing synthetic rubber.

Petrochemical feedstocks are the primary raw materials for the manufacturing of synthetic rubber. Initially, the hydrocarbon mixture is exposed to different natural gases to form liquid latex, further producing monomers. The identical monomers are then bound together to form a polymer; chemical agents are applied to create polymer chains. The last step of the process, known as vulcanization, is characterized by adding specific accelerating agents such as sulfur or polychloroprene to harden the polymer chains into different desired shapes and sizes.

The co-polymerization of different monomers gives rise to other material properties and various synthetic rubber used across industries. Some of the most common varieties of synthetic rubber used across the sectors are butyl rubber (IIR), polybutadiene rubber, styrene-butadiene (SBR) rubber, chloroprene rubber, Ethylene propylene diene monomer rubber (EPDM) rubber, nitrile rubber and more. Besides different synthetic rubbers having various unique properties, some common synthetic rubber properties can be characterized by better abrasion resistance, superior elasticity, heat and aging resistance, flame retardant, and flexibility at low temperatures. With various beneficial properties, synthetic rubbers have been widely used in multiple applications, including automobile tires, drive belts, hoses, seals, floor coverings, medical equipment, conveyor belts and various molded parts.

The rising global vehicle production has been the primary factor for the growth in synthetic rubber demand in the last few years. For instance, the aggregate value for cars and commercial vehicles production in 2021 was 80.14 million, which was 3% higher than the 2020 production number of 77.71 million per the International Organization of Motor Vehicle Manufacturers. The increasing disposable income of middle-class families across developing nations has increased consumer expenditure for improving the standard of living and is one of the major reasons for rising car purchases.

Besides the major synthetic rubber applications in automotive tires, other industry, such as the construction sector, primarily uses rubber for flooring, seals, roofing, and other applications. Medical professionals find synthetic rubber safe for patients sensitive to latex and thus be used for various medical protective equipment. Shoe soles, laptop sleeves, kitchen tools, and multiple items of our daily lives contain some percentage of synthetic rubber.

The sudden covid-19 pandemic has severely affected the demand for synthetic rubber due to the closure of various production units across the industry. During the pandemic, the demand for multiple vehicles was remained insignificant as consumers preferred spending money on their health and essential goods. Moreover, various precautionary measures taken by the government, including lockdown, seriously impact the supply chain of major industries, further dampening production. The declining demand for various end-use industries has lowered the synthetic rubber market during the pandemic period.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The tire industry has remained one of the major driving factors for synthetic rubber market in the last decade. Due to rising disposable income and increasing standard of living, the automobile industry has witnessed a huge demand for various automobiles. For instance, as per the European Automobile Manufacturer's Association (ACEA), world vehicle production has increased by 1.3% from 2020 to 2021, with a value of 79.1 million motor vehicles. Further, global car and commercial vehicle production grew by 0.03% and 4% from 2020 to 2021. The greater use of synthetic rubber in the tire segment of various automobiles has indicated the market's future demand as global automobile production is on a positive growth rate for the coming years.

The increasing carbon and other greenhouse gas emissions from the automobile industry have shifted consumers towards Electric Vehicles adoption in various developing and developed regions. As per International Energy Agency, the number of electric cars across the globe has grown by 200% from 2020 to 6.6 million in 2021. Various key players in the automobile sector are introducing their EV version vehicles to tap the shift from traditional to electric cars. The increasing adoption rate of EV vehicles further raises the demand for synthetic rubber in the tire and other applications and boosts the market in the forecast period.

In addition to the major applications of synthetic rubber in the tire segment of automobiles, it is being used in numerous applications across the industry. Other rubber applications include conveyor belts, footwear, industrial goods, asphalt overlay, tires and adhesives, clutches, cables, pneumatic suspension systems, automobile hoses, mats, plates, rollers, and other technical products. So, with the increased demand for various food and beverage, industrial pieces of machinery and other sectors have a direct demand for synthetic rubber in multiple applications and fuels the market in the years to come.

Report Segmentation

The market is primarily segmented based on product, application, industry vertical and region.

|

By Product Type |

By Application |

By Industry Vertical |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Styrene Butadiene Rubber (SBR) segment accounted for the largest market share in 2022

Styrene Butadiene Rubber (SBR) leads the market segment in the synthetic rubber market. The properties, including high abrasion resistance, high tensile strength, and good aging stability, favor styrene butadiene rubber. The reason can gauge the claim's veracity that 50% of SBR is used to manufacture tires. Further, the growth is also attributed to the applications of SBR in the insulation of wire and cabling, roll coverings, belting, and haul-off pads.

Further, Nitrile Butadiene Rubber (NBR) has been anticipated to witness the fastest growth rate in the forecast period. The major factors for segment growth can be ascribed to its benefits, such as fuel and oil resistance, abrasion resistance, and good temperature properties. It is widely used in various applications, including motor vehicle parts, technical products, oil hoses, mats, plates, rollers, seals, and foodstuffs like milk. The increasing adoption rate for NBR in a wide range of applications is likely the factor for its fastest market growth.

The Tire segment is anticipated to account for a major share of the Synthetic Rubber market

The increasing adoption of synthetic Rubber in the manufacturing of tires can be attributed to various advantages such as better aging and heat resistance, abrasion resistant, excellent electrical insulation material, and others. In addition, the lower availability of natural Rubber due to various factors has also pushed its applications in the tire segment to a greater extent. For instance, as per the USA Tire Manufacturers Association, both passenger and truck tires use 24% and 11% synthetic polymers for their contribution to the life of a tire.

The non-tire automobile application is projected to be the second-largest applicator of synthetic Rubber and will likely witness the fastest growth rate in the forecast period. Due to its significant strength, it is widely used in many automobile parts that reduce vehicle weight and increase fuel efficiency. Applications in the synthetic rubber segment can be seen as hoses for air-conditioning, dashboards, wipers, body seals, vibration-damping pads, and door and window handles.

The Asia-Pacific Region is Projected to accounted for the largest market share in 2022

Major economies such as India, China, Japan, South Korea, Thailand, and Indonesia are the major tire-producing countries of the world. For instance, as per European Automobile Manufacturer's Association (ACEA), the Greater China has accounted for around 33% of world car production in 2021 and 31% of commercial vehicle production in the same period. The greater share of vehicle production and significant manufacturing facilities in countries like India, China, and Japan are the primary factors for the future demand for Synthetic Rubber in the Asia-Pacific region.

Competitive Insight

Some of the prominent key players operating in the Marketspace include ExxonMobil Corporation, Reliance Industries Limited., Apcotex, The Goodyear Tire & Rubber Company, Saudi Arabian Oil Co., TSRC, Kumho Petrochemical, China Petrochemical Corporation, LANXESS, JSR Corporation., ERIKS nv., Mitsui Chemicals America, Inc.

Recent Developments

- November 2022: The Goodyear Tire & Rubber Company has partnered with DriveTLV, an Isreal based mobility incubator, to strengthen the company’s connection within the Israeli mobility ecosystem.

- December 2021: TSRC has relocated the ARLANXEO-TSRC Nantong joint venture to the southern section of NETDA chemical park, China, to bolster the global NBR supply and fulfil the local market demand.

Synthetic Rubber Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 23.64 billion |

|

Revenue forecast in 2032 |

USD 36.15 billion |

|

CAGR |

4.84 % from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Application, By Industry Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

ExxonMobil Corporation, Reliance Industries Limited., Apcotex, The Goodyear Tire & Rubber Company, Saudi Arabian Oil Co., TSRC, Kumho Petrochemical, China Petrochemical Corporation, LANXESS, JSR Corporation., ERIKS nv., Mitsui Chemicals America, Inc. |

Navigate through the intricacies of the 2024 Non-Invasive Prenatal Testing market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2029. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports:

Medical Foods Market Size, Share 2024 Report

Full Dentures Market Size, Share 2024 Report

Disposable Bronchoscope Market Size, Share 2024 Report

Health Information Exchange Market Size, Share 2024 Report

Myasthenia Gravis Disease Treatment Market Size, Share 2024 Report

FAQ's

The global synthetic rubber market size is expected to reach USD 36.15 billion by 2032.

Key players in the synthetic rubber market are ExxonMobil Corporation, Reliance Industries Limited., Apcotex, The Goodyear Tire & Rubber Company, Saudi Arabian Oil Co., TSRC, Kumho Petrochemical, China Petrochemical Corporation, LANXESS.

Asia-Pacific contribute notably towards the global synthetic rubber market.

The global synthetic rubber market expected to grow at a CAGR of 4.84% during the forecast period.

The synthetic rubber market report covering key segments are product, application, industry vertical and region.