Sustainable Pharmaceutical Packaging Market Size, Share, Trends, Industry Analysis Report: By Material, Packaging Type, Product Type, Process (Recyclable, Reusable, and Biodegradable), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM3245

- Base Year: 2024

- Historical Data: 2020-2023

Sustainable Pharmaceutical Packaging Market Overview

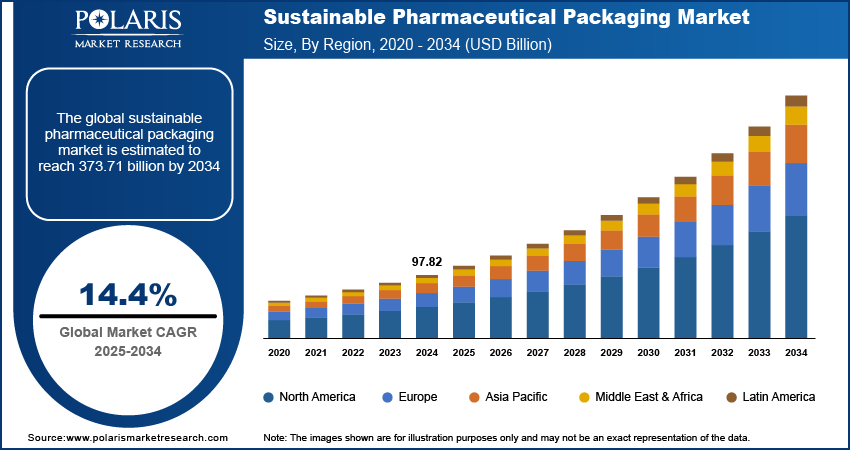

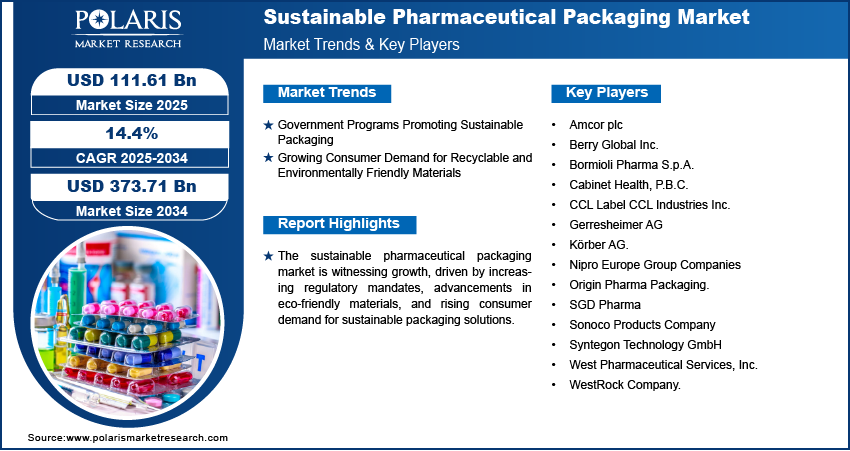

The global sustainable pharmaceutical packaging market was valued at USD 97.82 billion in 2024. The market is expected to grow from USD 111.61 billion in 2025 to USD 373.71 billion by 2034, at a CAGR of 14.4% from 2025 to 2034.

Sustainable pharmaceutical packaging refers to the development and use of eco-friendly packaging materials and designs that minimize environmental impact while assuring product safety and efficacy. The market is driven by the growing focus on reducing packaging size and material usage, as well as advancements in new technologies and innovative solutions. Companies in the pharmaceutical industry are focusing on optimizing packaging design to minimize waste, enhance recyclability, and comply with strict sustainability regulations. For instance, in April 2022, Amcor launched sustainable high shield laminates for pharmaceutical packaging, offering low-carbon, recycle-ready options. These innovations, available in paper-based and polyolefin materials, meet high barrier requirements while supporting recyclability goals without requiring new investments in filling machinery, contributing to the sustainable pharmaceutical packaging market development. The shift towards lightweight materials, biodegradable alternatives, and minimalistic packaging reduces resource consumption and also lowers production costs and carbon emissions. This approach aligns with the industry's broader sustainability goals while maintaining compliance with regulatory standards.

To Understand More About this Research: Request a Free Sample Report

Another driver shaping the sustainable pharmaceutical packaging market size is the reduction in packaging size and material usage, which helps in minimizing waste generation and optimizing supply chain efficiency. An October 2024 WHO report stated that around 16 billion injections are given each year, but many needles and syringes are not disposed of properly, highlighting the urgent need for sustainable solutions. Manufacturers are adopting lightweight materials, simplified packaging formats, and compact designs to reduce excess material usage and improve logistics. Additionally, the sustainable pharmaceutical packaging market is driven by increasing regulatory pressure to reduce environmental impact and enhance recyclability. Growing consumer awareness and demand for eco-friendly packaging solutions push companies to adopt biodegradable, lightweight, and recyclable materials. Cost-saving benefits from minimalistic packaging and reduced material usage further encourage sustainability efforts. Advances in smart packaging technologies, such as digital tracking and temperature-sensitive labels, enhance efficiency while supporting eco-friendly initiatives. Further, pharmaceutical companies are prioritizing sustainability to strengthen their brand image, improve supply chain efficiency, and meet evolving global sustainability targets and environmental compliance requirements.

Sustainable Pharmaceutical Packaging Market Dynamics

Government Programs Promoting Sustainable Packaging

Regulatory authorities worldwide are implementing policies that mandate the reduction of plastic waste, encourage the use of recyclable and biodegradable materials, and promote extended producer responsibility (EPR). For instance, in January 2025, the FDA released guidance on complying with 21 CFR 211.110 for drug manufacturing, highlighting advanced technologies and in-process testing. The FDA also provided final guidance on the Advanced Manufacturing Technologies Designation Program, which aims to accelerate innovation and improve drug quality and supply. These initiatives push pharmaceutical companies to integrate sustainable practices into their packaging strategies to ensure compliance and avoid potential regulatory penalties. Additionally, government-backed research initiatives and funding programs support innovation in sustainable packaging solutions, accelerating the transition towards environmentally responsible alternatives. These efforts help to achieve eco-friendly packaging goals without compromising product safety or efficacy by establishing strict regulatory frameworks and incentivizing the adoption of eco-friendly materials. Thus, the rising implementation of government programs promoting sustainable pharmaceutical packaging is driving sustainable pharmaceutical packaging market development.

Growing Consumer Demand for Recyclable and Environmentally Friendly Materials

Increasing awareness of environmental sustainability, coupled with concerns about plastic pollution and carbon emissions, has led consumers to favor pharmaceutical brands that prioritize eco-friendly packaging solutions. Companies are responding to this demand by developing packaging made from recyclable, biodegradable, and compostable materials while maintaining product integrity and safety by adopting sustainable pharmaceutical packaging. For instance, in October 2024, Bayer launched eco-friendly PET blister packaging for the healthcare industry, reducing its carbon footprint by 38%, water use by 78%, and land use by 53%. The lightweight design reduces material usage by 18%, replacing PVC and advancing sustainable healthcare packaging. This shift not only improves brand reputation and consumer loyalty but also aligns with corporate sustainability goals, reinforcing the transformation toward sustainable packaging solutions in the pharmaceutical industry.

Sustainable Pharmaceutical Packaging Market Segment Insights

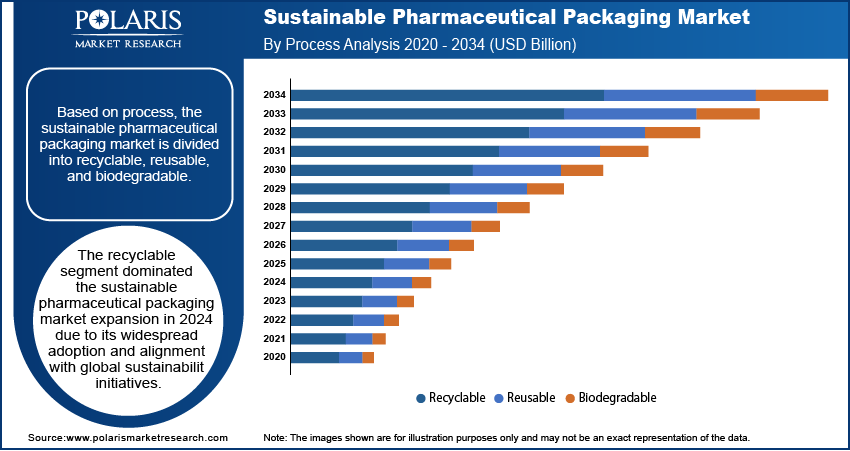

Sustainable Pharmaceutical Packaging Market Assessment by Process Outlook

The global sustainable pharmaceutical packaging market assessment, based on process, includes recyclable, reusable, and biodegradable. The recyclable segment dominated the market in 2024 due to its widespread adoption and alignment with global sustainability initiatives. Pharmaceutical companies are increasingly utilizing recyclable materials, such as polyethylene terephthalate (PET) and high-density polyethylene (HDPE), to reduce environmental impact while maintaining packaging durability and product safety. The recyclability of these materials assures compliance with strict government regulations and supports economic growth by minimizing waste generation. Additionally, advancements in recycling technologies and the establishment of robust recycling infrastructure have facilitated the large-scale adoption of recyclable packaging, making it the preferred choice among pharmaceutical manufacturers.

Sustainable Pharmaceutical Packaging Market Evaluation by Packaging Type Outlook

The global sustainable pharmaceutical packaging market evaluation, based on packaging type, includes primary packaging and secondary packaging. The secondary packaging segment is expected to witness the fastest growth from 2025 to 2034 due to its potential for material optimization and sustainability improvements. Secondary packaging, such as cartons, boxes, and inserts, plays a critical role in product protection and branding while offering opportunities for the use of eco-friendly alternatives such as recycled paperboard and biodegradable materials. The push for minimalistic and lightweight secondary packaging to reduce excess material usage and transportation costs further drives sustainable pharmaceutical packaging market revenue. Additionally, pharmaceutical companies are increasingly focusing on sustainable secondary packaging to enhance supply chain efficiency and meet evolving regulatory and consumer sustainability expectations.

Sustainable Pharmaceutical Packaging Market Regional Analysis

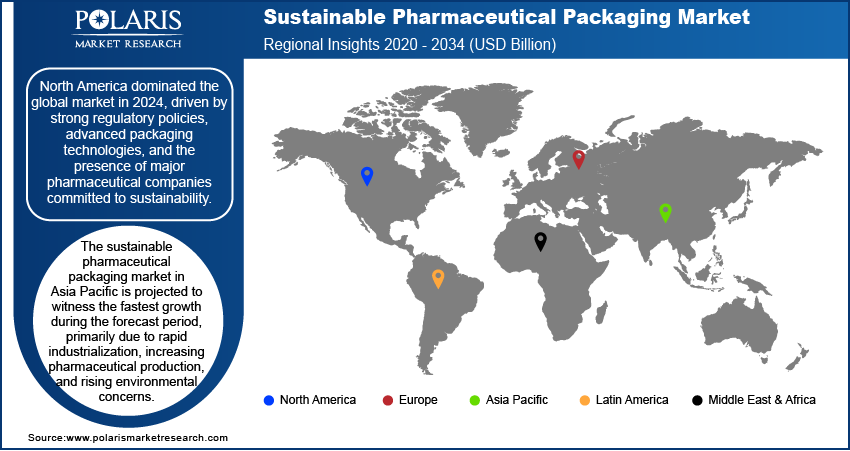

By region, the report provides the sustainable pharmaceutical packaging market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024, driven by strong regulatory policies, advanced packaging technologies, and the presence of major pharmaceutical companies committed to sustainability. Strict environmental regulations and initiatives promoting eco-friendly packaging practices have encouraged pharmaceutical manufacturers in the region to adopt sustainable materials and processes. Additionally, high consumer awareness regarding environmental sustainability has increased the demand for recyclable and biodegradable packaging solutions. For instance, in March 2022, Agilyx joined the Sustainable Medicines Partnership (SMP) to tackle pharmaceutical packaging waste. Leveraging its recycling technology, Agilyx aims to boost closed-loop recycling for hard-to-recycle materials like blister packs, addressing the trillion medicine packets discarded annually and promoting sustainable solutions. This collaboration highlights the region’s focus on innovation and circular economy principles. Thus, the well-established pharmaceutical sector, along with continuous research and development in packaging sustainability, solidifies North America's leadership in the market.

The Asia Pacific sustainable pharmaceutical packaging market is projected to witness the fastest growth during the forecast period, primarily due to rapid industrialization, increasing pharmaceutical production, and rising environmental concerns. Governments in the region are implementing strict regulations to reduce plastic waste and encourage the adoption of sustainable packaging materials. For instance, in August 2021, India introduced the Plastic Waste Management Amendment Rules, 2021, banning identified single-use plastics by 2022. The rules also increased plastic bag thickness to 120 microns, which took effect in December 2022, and implemented Extended Producer Responsibility (EPR) to manage plastic waste sustainably, aligning with global environmental goals. Additionally, growing consumer awareness and demand for eco-friendly pharmaceutical products are driving manufacturers to invest in recyclable, biodegradable, and reusable packaging solutions. The expansion of the healthcare and pharmaceutical industries, particularly in emerging economies like China and India, accelerates the growth of the sustainable pharmaceutical packaging market by increasing the demand for sustainable packaging solutions.

Sustainable Pharmaceutical Packaging Market – Key Players and Competitive Insights

The competitive landscape of the sustainable pharmaceutical packaging market includes global leaders and regional players competing through innovation, strategic alliances, and geographic expansion. Global companies such as Amcor plc, Gerresheimer AG, and Sonoco Products Company leverage advanced R&D, technological expertise, and extensive distribution networks to deliver eco-friendly solutions such as biodegradable materials, recyclable plastics, and smart packaging. Sustainable pharmaceutical packaging market trends highlight rising demand for sustainable practices driven by environmental regulations, consumer awareness, and the pharmaceutical industry’s push for greener alternatives. Global players focus on mergers and acquisitions and partnerships to strengthen their market position, while regional companies cater to localized needs with cost-effective, tailored solutions, particularly in high-growth markets.

Competitive strategies include investing in supply chain sustainability, digital transformation, and innovative packaging designs to meet evolving demands. Technological advancements, such as plant-based materials and reusable packaging, are reshaping the market. Companies are also prioritizing sustainability transformations, aligning with market trends and regulatory requirements. Pricing insights, revenue growth analysis, and competitive intelligence are crucial for identifying opportunities and assuring long-term profitability. In conclusion, the market’s growth is driven by innovation, adaptability, and strategic investments, with major players focusing on market penetration and sustainability to succeed in a competitive global landscape. A few key major players are Amcor Plc; Berry Global Inc; Gerresheimer AG; Nipro Corporation; WestRock Company; Sonoco Products Company; CCL Healthcare; SGD Pharma; West Pharmaceutical Services, Inc.; Bormioli Pharma S.p.A.; Syntegon Technology GmbH; Körber Pharma; Origin Pharma Packaging; and Cabinet Health.

Berry Global Inc. is a manufacturer and marketer of plastic packaging products. Headquartered in Evansville, Indiana, the company operates across over 240 locations worldwide. Berry Global is renowned for its innovative packaging solutions, particularly in the pharmaceutical sector, where it offers a comprehensive range of sustainable products. This includes vials, prescription oval bottles, traditional packer bottles, and ointment jars, all designed to meet rigorous quality standards and sustainability goals. The company's B Circular Range features mono-material, fully recyclable polypropylene packaging, which simplifies recycling processes and reduces environmental impact by using lighter materials that decrease transport emissions. Berry Global's commitment to sustainability is clear in its use of post-consumer recycled (PCR) materials in various packaging solutions. The company supports its customers in achieving ambitious sustainability objectives while maintaining product quality and performance by focusing on circular economy principles.

Körber Pharma, part of the Körber Group, is a provider of innovative solutions for the pharmaceutical and biotech industries. The company focuses on improving production and packaging processes to ensure high-quality, efficient, and compliant operations. Körber's expertise spans decades, with a strong presence in developing and implementing advanced technologies such as Manufacturing Execution Systems (MES) like the Werum PAS-X suite, which supports digitalization and automation in pharmaceutical manufacturing. In terms of sustainable pharmaceutical packaging, Körber highlights integrated solutions that improve productivity and also contribute to reducing environmental impact. Körber helps companies transition towards more sustainable practices, such as minimizing waste and optimizing resource usage by leveraging digital technologies and networked industrial processes. The company's approach to Pharma 4.0 involves using data analytics and AI to improve efficiency and compliance, which indirectly supports sustainable production by reducing unnecessary waste and energy consumption.

List of Key Companies in Sustainable Pharmaceutical Packaging Market

- Amcor plc

- Berry Global Inc.

- Bormioli Pharma S.p.A.

- Cabinet Health, P.B.C.

- CCL Label CCL Industries Inc.

- Gerresheimer AG

- Körber AG.

- Nipro Europe Group Companies

- Origin Pharma Packaging.

- SGD Pharma

- Sonoco Products Company

- Syntegon Technology GmbH

- West Pharmaceutical Services, Inc.

- WestRock Company.

Sustainable Pharmaceutical Packaging Industry Developments

February 2025: Amcor launched Recycle-Ready High Shield Medical Laminates for devices such as catheters and wound care, offering high-barrier, low-carbon alternatives to traditional aluminum laminates. These solutions reduce carbon footprints by up to 70% and support the shift toward sustainable medical packaging.

January 2024: Bormioli Pharma and Loop Industries launched a pharmaceutical packaging bottle made with 100% recycled Loop PET resin. This innovation meets EU and US pharmacopeia standards, reduces CO2 emissions, and supports the industry’s shift toward sustainable packaging solutions.

Sustainable Pharmaceutical Packaging Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Plastics

- Paper & Paperboard

- Glass

- Metal

- Others

By Packaging Type Outlook (Revenue, USD Billion, 2020–2034)

- Primary Packaging

- Secondary Packaging

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Plastic Bottles

- Blister

- Labels & Accessories

- Caps & Closures

- Pre-Filled Syringes

- Medical Specialty Bags

- Temp Controlled Packaging

- Pouches & Strip Packs

- Pre-Filled Inhalers

- Vials

- Ampoules

- Medication Tubes

- Jars & Canisters

- Cartridges

- Others

By Process Outlook (Revenue, USD Billion, 2020–2034)

- Recyclable

- Reusable

- Biodegradable

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sustainable Pharmaceutical Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 97.82 billion |

|

Market Size Value in 2025 |

USD 111.61 billion |

|

Revenue Forecast by 2034 |

USD 373.71 billion |

|

CAGR |

14.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global sustainable pharmaceutical packaging market size was valued at USD 97.82 billion in 2024 and is projected to grow to USD 373.71 billion by 2034.

The global market is projected to register a CAGR of 14.4% during the forecast period.

North America dominated the global market in 2024.

Some of the key players in the market are Amcor Plc; Berry Global Inc; Gerresheimer AG; Nipro Corporation; WestRock Company; Sonoco Products Company; CCL Healthcare; SGD Pharma; West Pharmaceutical Services, Inc.; Bormioli Pharma S.p.A.; Syntegon Technology GmbH; Körber Pharma; Origin Pharma Packaging; and Cabinet Health.

The recyclable segment dominated the market in 2024.

The secondary packaging segment is expected to witness the fastest growth during the forecast period.