Sustainable Manufacturing Market Size, Share, Trends, Industry Analysis Report

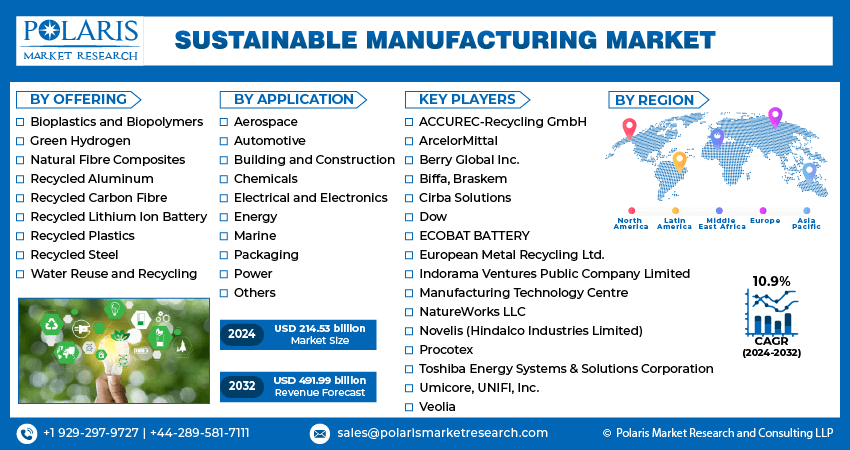

: By Offering, By Application, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 116

- Format: PDF

- Report ID: PM5048

- Base Year: 2023

- Historical Data: 2019-2022

Sustainable Manufacturing Market Overview

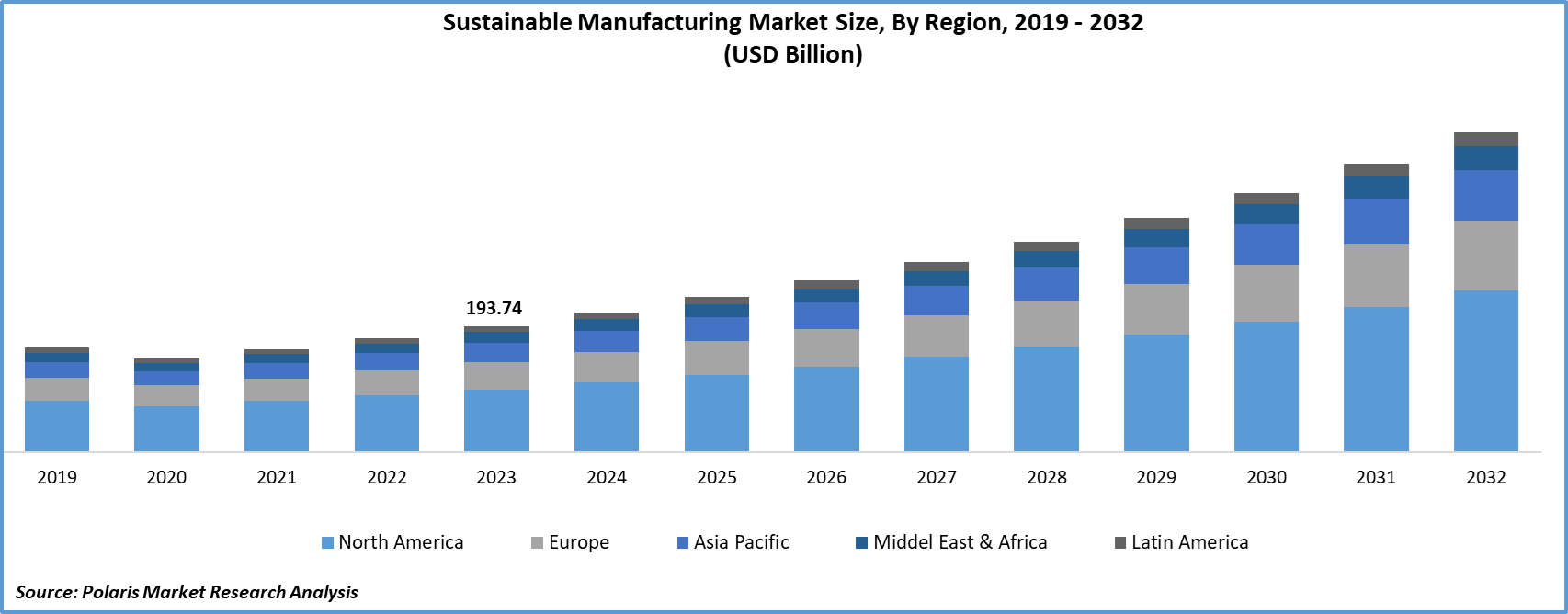

Global sustainable manufacturing market size was valued at USD 193.74 billion in 2023. The market is projected to grow from USD 214.53 billion in 2024 to USD 491.99 billion by 2032, exhibiting a CAGR of 10.9% during the forecast period.

Sustainable manufacturing is a process that involves the development of manufactured goods using economically viable methods that reduce adverse environmental effects and preserve energy and natural resources. The growth of the sustainable manufacturing market is being fueled by the increased awareness and adoption by several companies across various industries. Businesses are recognizing the long-term benefits of sustainability, such as cost savings through resource efficiency, enhanced brand reputation, and compliance with stringent regulations. Thus, businesses are increasingly integrating sustainable practices into their operations.

For instance, Nestlé, a food and beverage company, has emphasized utilizing the potential of food to enhance the well-being of all individuals while also safeguarding the environment for future generations. Nestlé has aimed to reduce its greenhouse gas emissions by 50% and achieve carbon neutrality by 2050. Additionally, Nestlé has decided to procure 20% of its key ingredients through regenerative agriculture methods by 2025. This increased focus and adoption of eco-friendly practices by companies across diverse sectors is driving the global sustainable manufacturing market.

To Understand More About this Research: Request a Free Sample Report

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

The heightened influx of investments in green manufacturing processes is driving the sustainable manufacturing market. Several companies are investing heavily in innovative manufacturing processes to reduce their environmental footprint. For instance, in November 2023, Panasonic announced a substantial investment of around €130 million in a project at its Panasonic Manufacturing UK plant in Cardiff. The company has aimed to renovate the facility to demonstrate its capability to function on renewable energy, underscoring Panasonic's commitment to achieving net-zero emissions and advancing green technologies. Thus, these types of investments from the private sector are accelerating innovations in renewable energy, energy-efficient machinery, and waste-reduction processes, thereby driving the sustainable manufacturing market.

Sustainable Manufacturing Market Drivers and Trends

Growing Focus on Circular Economy

The growing focus on circular economy drives market CAGR for sustainable manufacturing as the world faces an increase in waste generation. The countries are experiencing a substantial increase in waste production from various industries, such as construction, food, and beverage. For instance, in 2021, Ireland experienced a significant surge in waste generation, particularly in key waste streams. Construction and demolition waste saw a 10% increase, while packaging waste increased by 9%. This growth has emphasized the reducing, reusing, recycling, and recovery of materials to minimize waste. Thus, the implementation of the aforementioned circular economy principles is propelling the allocation of funds and promoting innovations in sustainable practices, leading to sustainable manufacturing market growth.

Government Initiatives and Regulations

Government initiatives and regulations are playing a crucial role in driving the growth of the sustainable manufacturing market by creating a framework that encourages and mandates environment-friendly practices. Governments are providing financial incentives such as tax breaks, grants, and subsidies to support businesses in adopting sustainable manufacturing technologies and processes. For instance, the Indian government has implemented several initiatives such as Atmanirbhar Bharat, Make-in-India, Zero Defect Zero Effect, Skilling India, National Mission for Sustainable Agriculture, Digital India, and others to drive economic growth and promote sustainability. These initiatives include stringent environmental regulations that require companies to reduce emissions, manage waste responsibly, and use resources more efficiently. Thus, governments are promoting a competitive environment by setting high standards and providing the necessary support, thereby driving the sustainable manufacturing market.

Sustainable Manufacturing Market Segment Insights

Sustainable Manufacturing Market Breakdown by Offering Insights

The global sustainable manufacturing market segmentation, based on offering, includes bioplastics and biopolymers, green hydrogen, natural fiber composites, recycled aluminum, recycled carbon fiber, recycled lithium-ion batteries, recycled plastics, recycled steel, water reuse, and recycling. The recycled plastics segment accounted for the largest revenue share in the market due to the increasing environmental awareness among consumers and the surge in demand for products made from recycled materials, including plastics. Countries worldwide are witnessing a significant rise in plastic waste generation. For instance, CSIRO reported that India produces approximately 26,000 tonnes of plastic waste daily, totaling nearly 3.46 million tonnes annually. In response, a consortium of Indian and Australian research organizations has developed a roadmap to 2035 aimed at establishing a circular plastics economy in India. The roadmap has provided a comprehensive analysis of the entire plastics value chain and offers systemic policy recommendations. These types of initiatives have encouraged companies to incorporate recycled plastics into their products to meet stringent environmental standards. Consequently, the recycled plastics segment held the dominating revenue share in the sustainable manufacturing market.

Sustainable Manufacturing Application Insights

The global sustainable manufacturing market segmentation, based on application, includes aerospace, automotive, building and construction, chemicals, electrical and electronics, energy, marine, packaging, power, and others. The packaging segment of the market is expected to grow significantly due to the increasing consumer demand for eco-friendly packaging solutions. Consumers are becoming aware of the environmental effects of plastic packaging. Thus, governments are imposing regulatory pressures and policies aimed at reducing plastic waste and are encouraging manufacturers to innovate and implement sustainable packaging products. Further, the increasing need for efficient and sustainable packaging solutions for shipping and logistics is contributing to the growth of the packaging segment in the sustainable manufacturing market.

Sustainable Manufacturing Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

Sustainable Manufacturing Regional Insights

By region, the study provides sustainable manufacturing market insights into North America, Europe, the Asia-Pacific, Latin America, and the Middle East & Africa. North America sustainable manufacturing market held the largest revenue shares due to the growth of the building and construction sector. The region is experiencing a significant increase in construction spending. For instance, according to the U.S. Census Bureau, construction spending in the United States was estimated at USD 2,099.0 billion in April 2024, representing a 10.0% increase compared to the April 2023 estimate of USD 1,907.8 billion. This growth in the sector has increasingly adopted sustainable manufacturing practices to meet the rising demand for green buildings and eco-friendly construction materials. As a result, the building and construction sector's emphasis on sustainability has contributed to North America's leading position in the global market.

Sustainable Manufacturing Market Regional Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

The Asia Pacific sustainable manufacturing market is anticipated to grow significantly due to the presence of a robust automotive industry in the region. Major automotive manufacturing hubs such as China, Japan, India, and South Korea are increasingly adopting sustainable manufacturing practices to meet both global and regional environmental regulations. Furthermore, the push towards electric vehicles (EVs) and hybrid technologies to reduce emissions is prompting automotive manufacturers to invest in sustainable production processes and materials. Thus, the region's strong emphasis on sustainability in automotive production is accelerating the growth of the market in the Asia Pacific.

India's sustainable manufacturing market is also anticipated to grow substantially due to proactive government initiatives and comprehensive policy frameworks aimed at fostering a circular economy. The Indian government has introduced a series of regulations, such as the Plastic Waste Management Rules and the Metals Recycling Policy, to manage and reduce waste across various sectors, thereby supporting sustainable economic development. Further, the formation of 11 committees, including representatives from NITI Aayog and the Ministry of Environment, Forest, and Climate Change (MoEFCC), underscores a focused effort to transition from a linear to a circular economy. These committees are tasked with developing action plans and regulatory measures to address key areas such as municipal solid waste, electronic waste, and tire recycling. As a result of the increased focus of the government on sustainability, the market for sustainable manufacturing in the country is expected to grow over the forecast period.

Sustainable Manufacturing Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the sustainable manufacturing market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, a sustainable manufacturing industry must offer cost-effective solutions.

The sustainable manufacturing market is represented by established market players and innovative startups, all competing to capitalize on the growing demand for eco-friendly production methods. Major companies dominate the market by leveraging extensive experience, technological advancements, and broad distribution networks. Major players in the sustainable manufacturing industry, including ACCUREC-Recycling GmbH; ArcelorMittal; Berry Global Inc.; Biffa, Braskem; Cirba Solutions; Dow; ECOBAT BATTERY; European Metal Recycling Ltd.; Indorama Ventures Public Company Limited; Manufacturing Technology Centre; NatureWorks LLC; Novelis (Hindalco Industries Limited); Procotex, Toshiba Energy Systems & Solutions Corporation; Umicore; UNIFI, Inc.; and Veolia.

Dow Inc. and its subsidiaries provide materials science solutions for packaging, infrastructure, mobility, and consumer applications across various global regions. The company's operations are divided into industrial intermediates and infrastructure, packaging and specialty plastics, and performance materials and coatings segments. The packaging and specialty plastics segment offers aromatics, polyethylene, ethylene, propylene, ethylene vinyl acetate, polyolefin elastomers, and ethylene propylene diene monomer rubbers for various end-markets. In June 2024, Dow introduced its innovative family of REVOLOOP Recycled Plastics Resins, highlighting a significant step in the company's dedication to promoting circularity and waste transformation.

Braskem, a multinational company, operates across various continents, including North America, South America, Europe, and Asia. The company was founded in 2002 through the amalgamation of six companies from the Odebrecht Organization and the Mariani Group. Braskem specializes in producing a wide array of petrochemicals and thermoplastics, such as polypropylene (PP), green polyethylene (biopolymer), polyethylene (PE), and PVC. In July 2023, Braskem announced a 30% boost in the manufacturing capacity of its bio-based ethylene plant, situated in the Petrochemical Complex of Rio Grande do Sul, Brazil. This enhancement, resulting from a USD 87 million investment, was aimed to cater to the increasing global demand for sustainable products.

List of Key Companies in Sustainable Manufacturing Market

- ACCUREC-Recycling GmbH

- ArcelorMittal

- Berry Global Inc.

- Biffa

- Braskem

- Cirba Solutions

- Dow

- ECOBAT BATTERY

- European Metal Recycling Ltd.

- Indorama Ventures Public Company Limited

- Manufacturing Technology Centre

- NatureWorks LLC

- Novelis (Hindalco Industries Limited)

- Procotex

- Toshiba Energy Systems & Solutions Corporation

- Umicore

- UNIFI, Inc.

- Veolia

Sustainable Manufacturing Industry Developments

- April 2024: STILFOLD, based in Stockholm, introduced the MetaFold Academy with a funding of €5 million to advance sustainable manufacturing practices. The MetaFold Academy aimed to revolutionize the industrial education sector in Sweden, Italy, Greece, and Hungary.

- July 2024: The Manufacturing Technology Centre (MTC) made a significant investment in a sustainable additive manufacturing hub aimed at facilitating the creation of net zero products with complete circularity. The newly established hub is equipped with polymer and ceramic additive manufacturing machines specifically tailored for the production of net zero products.

- June 2024: LAPP launched the ETHERLINE FD bioP Cat.5e, marking its first bio-cable in series production. This sustainable variant features a bio-based outer sheath composed of 43% renewable raw materials.

Sustainable Manufacturing Market Segmentation

Sustainable Manufacturing – Offering Outlook

- Bioplastics and Biopolymers

- Green Hydrogen

- Natural Fibre Composites

- Recycled Aluminum

- Recycled Carbon Fibre

- Recycled Lithium Ion Battery

- Recycled Plastics

- Recycled Steel

- Water Reuse and Recycling

Sustainable Manufacturing – Application Outlook

- Aerospace

- Automotive

- Building and Construction

- Chemicals

- Electrical and Electronics

- Energy

- Marine

- Packaging

- Power

- Others

Sustainable Manufacturing – Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sustainable Manufacturing Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 193.74 billion |

|

Market Size Value in 2024 |

USD 214.53 billion |

|

Revenue Forecast in 2032 |

USD 491.99 billion |

|

CAGR |

10.9% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global sustainable manufacturing market size was valued at USD 193.74 billion in 2023 and is projected to grow to USD 491.99 billion by 2032.

The global market is projected to register a CAGR of 10.9% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market ACCUREC-Recycling GmbH; ArcelorMittal; Berry Global Inc.; Biffa; Braskem; Cirba Solutions; Dow; ECOBAT BATTERY; European Metal Recycling Ltd.; Indorama Ventures Public Company Limited; Manufacturing Technology Centre; NatureWorks LLC; Novelis (Hindalco Industries Limited), Procotex, Toshiba Energy Systems & Solutions Corporation; Umicore; UNIFI, Inc.; and Veolia.

The recycled plastics segment held the highest share of the sustainable manufacturing market in 2023.

The packaging category had the highest CAGR in the global market.